BERLIN—Germany is considering scaling back plans to step up government scrutiny of Chinese investments, the latest example of how a country deeply intertwined with—and increasingly conflicted about—China is pulling its punches as others get tougher on Beijing.

People familiar with the plan said a decision to defang a planned foreign investment-screening law had become likelier because of fears that it could hurt Berlin’s parallel efforts to re-energize Germany’s stagnating economy.

The backtracking could raise concerns among Western allies that Beijing is whittling down Western support for increasingly aggressive U.S. and European Union efforts to rein in China’s global influence. After hosting German Chancellor Olaf Scholz in Beijing this month, Chinese leader Xi Jinping is preparing to visit France, Hungary and Serbia in May.

The diplomatic rapprochement comes despite mounting alarm in Germany about the extent of Chinese espionage. This week alone, German prosecutors detained four alleged spies for China as a result of two separate intelligence investigations.

“We are seeing a rise in clandestine interference in politics, companies and scientific institutions,” Sinan Selen, deputy head of Germany’s domestic intelligence agency, said at a conference on China’s growing security threat in Berlin this week. “Companies are no longer just facing industrial espionage from unfair competitors, but the full power of the [Chinese] state.”

After Scholz’s election in 2021, Berlin started pushing back against Chinese influence, marking a departure from years of friendly policies under former Chancellor Angela Merkel, who saw China become Germany’s largest trading partner.

As part of this pivot, the government tightened export controls for sensitive technologies, capped state guarantees on German foreign investments and exports, and banned a number of Chinese investments in the country on security grounds.

Last summer, the government unveiled Germany’s first China strategy document, which called the country a “partner, competitor and systemic rival” and urged Germany to “derisk” by reducing its dependence on the Chinese market and imported components and raw materials.

Around the same time, Berlin started work on a new investment-screening bill.

The plan, described last summer in an economics ministry paper seen by The Wall Street Journal, proposed giving the government new powers to screen foreign investments for security risks and to extend its purview to new types of investments. While China was only obliquely mentioned, officials and analysts said it was the implicit target.

New investment types that could come under scrutiny included greenfield investments—which go into creating new businesses rather than acquiring existing ones—in “quantum technology, sophisticated semiconductors, artificial intelligence and critical infrastructure,” the paper said.

The ministry also suggested adding a catchall provision allowing the screening of cooperation projects between German research institutions and foreign partners in critical areas.

Now, people familiar with the discussions say that while no final decision was made, both ideas will likely be dropped. Some officials said the government might not draft a new bill but rather amend the broader rules that currently define the government’s investment-screening powers—a more commonplace exercise.

While less ambitious, the officials said this approach would likely still give the government new powers, for example, to scrutinize certain internal corporate restructurings or the transfer of patents to foreign investors.

A German government spokesman declined to comment on the deliberations but said “investment screening is designed to avoid risks to security and public order in Germany. At the same time, it is important to remain open to foreign investments.”

A spokesman for the economics ministry, which is shepherding work on the legislation, said that while current screening rules were effective, “recent experience has shown that [they] should be reformed to reflect the changing security situation…This work is currently under way.”

The change of mind comes despite intense fretting in Berlin—and in German boardrooms—about increasing Chinese competition that is beginning to rival even Germany’s most advanced engineering goods, from cars to industrial machines, often bolstered by subsidies from Beijing.

German security officials say China has intensified its spying efforts against the country, especially those aimed at extracting know-how in areas such as advanced chipmaking and military technology that are shielded by strict export controls.

Members of a suspected spying cell detained this week had transferred to China a high-powered laser without authorization and collected sensitive scientific information that could be used to build engines for military vessels, the prosecutors said.

In its latest annual report, Germany’s Federal Office for the Protection of the Constitution, the country’s domestic intelligence agency, named China as Germany’s “biggest economic and scientific espionage threat.”

One central argument driving Berlin’s pared-back approach is mounting concern in the chancellery that a new investment-screening law could be seen by foreign companies and governments as a discouragement to invest in Germany, these officials said.

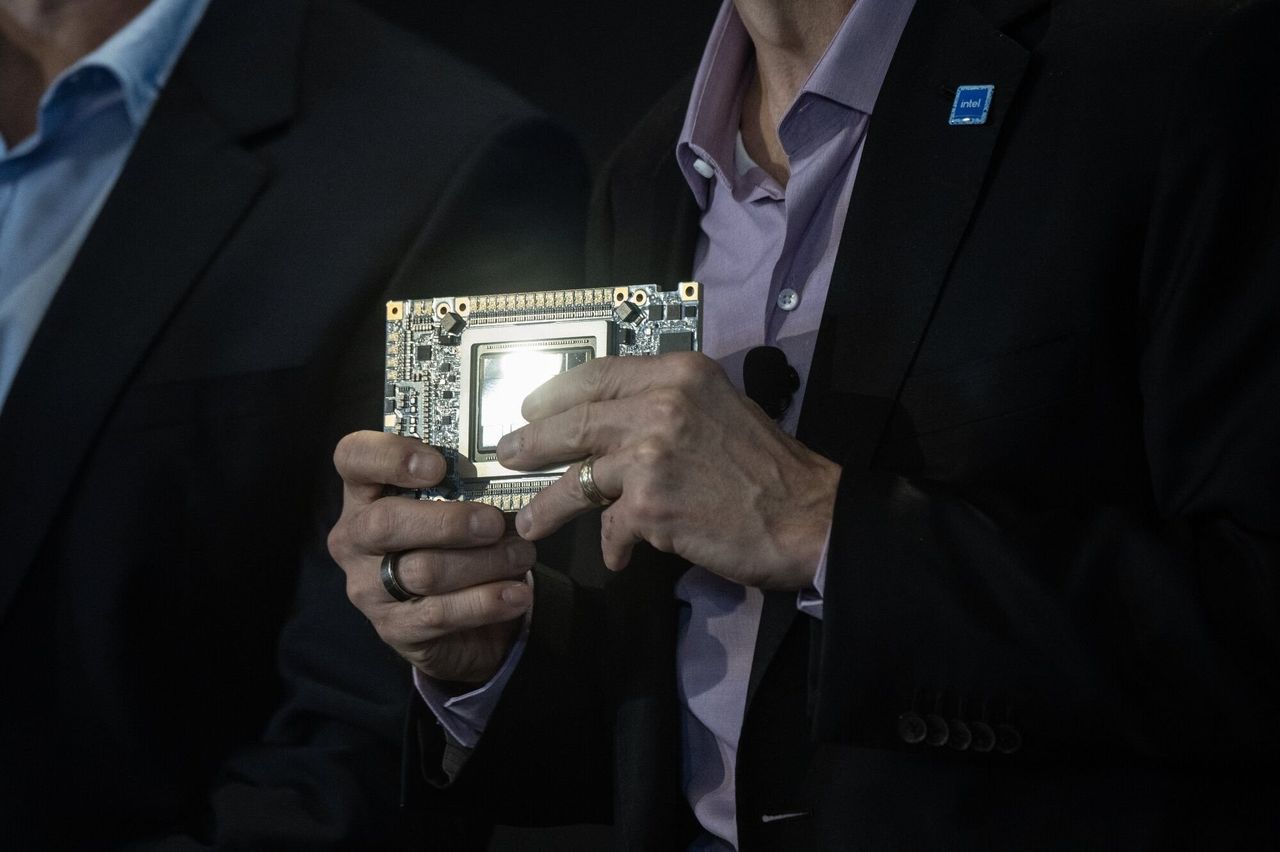

Berlin is planning a high-profile conference this fall to woo international investors, officials said. Scholz’s government has also pledged more than €15 billion, equivalent to around $16.1 billion, in incentives to draw investments from chip makers such as Intel and Taiwan Semiconductor Manufacturing.

Economists say greenfield investments are generally beneficial and welcomed by governments since they can bring capital, jobs and in some cases technical know-how.

Chinese greenfield investments in Europe are rising fast and now make up a growing proportion of total Chinese foreign direct investment, which, as a whole, has fallen in past years. In 2022, Chinese greenfield investments in Europe overtook M&A investments for the first time, according to a report by consulting firms Rhodium Group and the Mercator Institute for China Studies.

“It can be difficult to make an argument that greenfield investment presents risk,” said Gregor Sebastian, a senior analyst focused on China-EU economic relations at Rhodium Group. “It depends on how narrow or broad your definition of national security is.”

Examples of greenfield investments that pose direct security risks are rare. Last year, local officials in North Dakota stopped the sale of farmlands near Grand Forks Air Force Base to a Chinese company that had planned to build a corn-milling plant there after the Pentagon expressed concern about the spying risks.

Under a broader definition of national security, however, even a heavily subsidized Chinese battery plant, for instance, could increase European dependency if it priced local producers out of the market, Sebastian said.

Separate from its work on a new investment-screening law, German officials said Berlin remains skeptical about an EU proposal to screen outbound investments by European companies because of the extra red tape it would create for business.

Berlin’s fading ambitions on confronting China could put it at odds with the European Commission, which has intensified its economic pressure on Beijing and is going after subsidized Chinese companies by threatening to prevent them from bidding on European government contracts and is considering tariffs on imports of Chinese electric vehicles.

Write to Bertrand Benoit at [email protected]

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB