(Bloomberg) — The Federal Reserve is stuck in a mode of forecasting and public communication that looks increasingly limited, especially as the economy keeps delivering surprises.

The issue is not the forecasts themselves, though they’ve frequently been wrong. Rather, it’s that the focus on a central projection — such as three interest-rate cuts in 2024 — in an economy still undergoing post-pandemic tremors fails to communicate much about the plausible range of outcomes. The outlook for rates presented just last month now appears outdated amid a fresh wave of inflation.

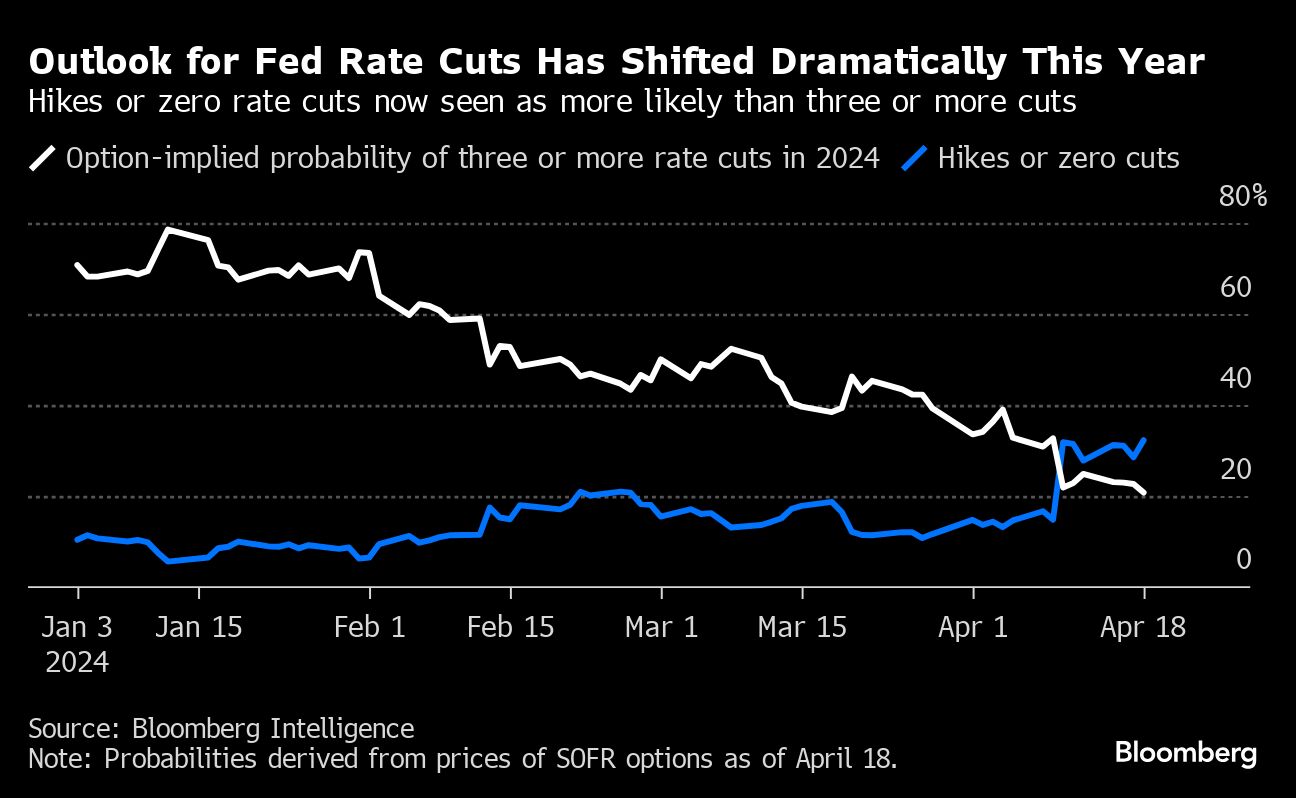

Outlook for Fed Rate Cuts Has Shifted Dramatically This Year | Hikes or zero rate cuts now seen as more likely than three or more cuts

An alternative method starting to gain steam is called scenario analysis, which involves emphasizing a range of credible risks to the baseline and how a central bank might respond. It’s a tactic that becomes especially useful in times of high economic uncertainty.

“The Fed urgently needs to incorporate scenario analysis into its public communications,” said Dartmouth College professor Andrew Levin, who was a top adviser to former Fed Chair Ben Bernanke. Levin describes it as “stress tests for monetary policy.”

Bernanke himself is currently making a similar case across the Atlantic. He recommended the Bank of England adopt such an approach in a report published this month for the UK central bank. It wouldn’t be the first to do so: Sweden’s Riksbank, for example, already uses scenarios to think about alternative policy paths.

Publishing both central and alternative scenarios means “the public will be able to draw sharper inferences about the reaction function and thus better anticipate future policy actions,” Bernanke wrote in his review of the BOE’s forecasting methods.

A sizzling economy continues to surprise Fed officials. From December to March, they revised up their outlook for growth in 2024 by a substantial 0.7 percentage point and projected three rate cuts this year, according to their median estimate.

Higher-than-expected inflation data quickly rendered that call obsolete, at least in financial markets: Investors have dialed back the number of cuts expected this year, while options markets say the probability of one cut or less is about a coin toss.

US Inflation Has Accelerated on a Short-Term Basis | Fed’s preferred core PCE inflation gauge hit a bump in the first quarter

The projections represent a compilation of the views of 19 policymakers about the likely trajectory for growth, unemployment, inflation and interest rates. By design and intention, the Fed trains the eyes of investors and analysts on the median estimates. But at times like the present, when the economy is highly unpredictable, the full range of views acquires more importance.

In March, for example, nine of 19 officials wrote down two rate cuts or fewer for 2024, a view that has suddenly become more plausible with the arrival of the latest inflation figures. Fed Chair Jerome Powell’s constant refrain is that what the central bank ultimately decides on rates will depend on the data, though he has leaned into the rate-cut narrative this year.

Without a sense of how officials might revise their path for rates in a “hot economy” scenario, “any shift in these outlooks creates more volatility,” said Ira Jersey, chief US interest-rate strategist at Bloomberg Intelligence. “Understanding how the Fed is handicapping such potential outcomes could provide valuable information,” he said.

Fed staff economists do run scenarios for policymakers. But they are model-driven, don’t reflect an agreed-upon anticipated reaction of the rate-setting committee and are irrelevant for communications purposes since they are made public only with a five-year lag.

Historical Record

There are several ways Fed officials could begin to communicate the risk of alternative paths. The New York Fed already asks Wall Street dealers to assign probabilities for different outcomes of the year-end policy rate. If policymakers did the same, investors would have likely seen a greater-than-zero chance of no rate cuts in 2024.

“From their perspective, it may be tidier to communicate about baseline outcomes. The question is, ‘What is the most helpful thing to do?’” said Kris Dawsey, the head of economic research at the investment firm D.E. Shaw Group. “There is a sense that it is costly to change the way they communicate on the rate path too abruptly.”

After what has been a volatile couple of years for the economy, Dawsey’s analysis shows that economic forecasts collected from market participants and published by the New York Fed also show a tighter range of outcomes than the historical record suggests, going back to World War II.

Dawsey said in his own view, another year of economic growth above 3% is slightly less than a coin toss, based on historical patterns. That’s a risk that both investors and central bankers have to take on board and talk about.

The information value of the Fed’s quarterly projections is something officials have been concerned about for years. Treasury Secretary Janet Yellen, when she was Fed vice chair in 2012, tried to get the committee to agree on publishing a consensus forecast. That effort was unsuccessful.

Read More on the Fed’s Shift:

|

Fed Resets Clock on Cuts and Questions If Rates Are High Enough Rents Are Fed’s ‘Biggest Stumbling Block’ in Taming US Inflation Inflation’s Stubborn Start to 2024 Blamed Partly on Powell Pivot Powell Signals Rate-Cut Delay After Run of Inflation Surprises |

“There is no getting away from the fact that policymakers are laying out a single policy path and they need a modal outlook,” said Ellen Meade, a Duke University professor and former Fed board staff member. Once they have that, “scenarios can be good for discussing with the public about the fact that the modal path is not 100% or set in stone and what the most prominent risks are.”

At least some current Fed officials do seem amenable to that kind of approach. Cleveland Fed President Loretta Mester, who has in the past served on the central bank’s subcommittee for communications, calls herself “a fan” of scenario analysis. Her Minneapolis counterpart Neel Kashkari published an essay last year outlining two competing economic outlooks and their hypothetical implications for interest rates.

The Fed tends to move slowly when it comes to innovations in public communications practices. But Bernanke’s BOE review could spur more thinking on how to talk more about rate-path probabilities and alternative scenarios, said JPMorgan Chase & Co.’s chief US economist Michael Feroli.

And the timing may also be fortuitous: Fed officials later this year will launch another policy framework review after undertaking the first of its kind at the central bank in 2019 and 2020.

“I think it will come back to these shores,” Feroli said.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB