They might not notice it, but millions of Americans are paying a little more each month for their electricity.

The cause: a seemingly insignificant decision in an arcane corner of Wall Street that rippled out to the real world. A new label for a set of utility bonds spurred a fight with state utility regulators and crept into home electricity bills.

The amplification comes from the rise of passive investing, where money is held in funds that track an index of stocks or bonds. Trillions of dollars are invested in these funds, making the indexes underpinning them more important than ever.

Those indexes are created by private companies and there is little U.S. regulation on how investment securities are categorized to fit them into, or leave them out of, the indexes.

It was just such a decision that has led to some higher power bills. In the summer of 2022, financial-data giant Bloomberg decided that certain bonds sold by utilities would no longer be classified as corporate bonds.

Instead, the bonds—sold by utilities to repair their systems following natural disasters—would be considered asset-backed securities.

The reclassification of these so-called recovery bonds altered their placement in Bloomberg’s widely followed bond indexes. That, in turn, restricted the pool of potential buyers for these bonds since many institutional and individual investors are prohibited from buying asset-backed instruments.

The upshot? The utility companies end up paying more interest on new issuances of this type of debt, a cost that is passed on to customers in the form of higher monthly electricity bills.

While often small on a household level, collectively the pricing changes will run to roughly $3 billion in additional costs over the life of the bonds, according to Joseph Fichera, chief executive of Saber Partners, which advises state governments on these kinds of financial deals. That translates to roughly $150 million annually.

“This unexplained reversal and massive mispricing may be great for Wall Street but is not fair to electricity customers,” said Fichera, who has asked Bloomberg to reconsider the change on behalf of several clients.

Some state electricity regulators say the move is a mistake that forces customers to overpay for debt that’s safer and less complex than what’s typically used in asset-backed offerings. Critics say it ignores regulatory precedence treating the bonds like corporate securities.

“This is against the public interest,” said Andrew Maurey, director of the division of accounting and finance at the Florida Public Service Commission, the state’s utility regulator. He filed a complaint to Bloomberg about the change. It went unanswered, he said.

The utilities’ concerns “appeared to carry little weight in the decision,” said Bob Boada, a former treasurer of Southern California Edison and its parent, Edison International.

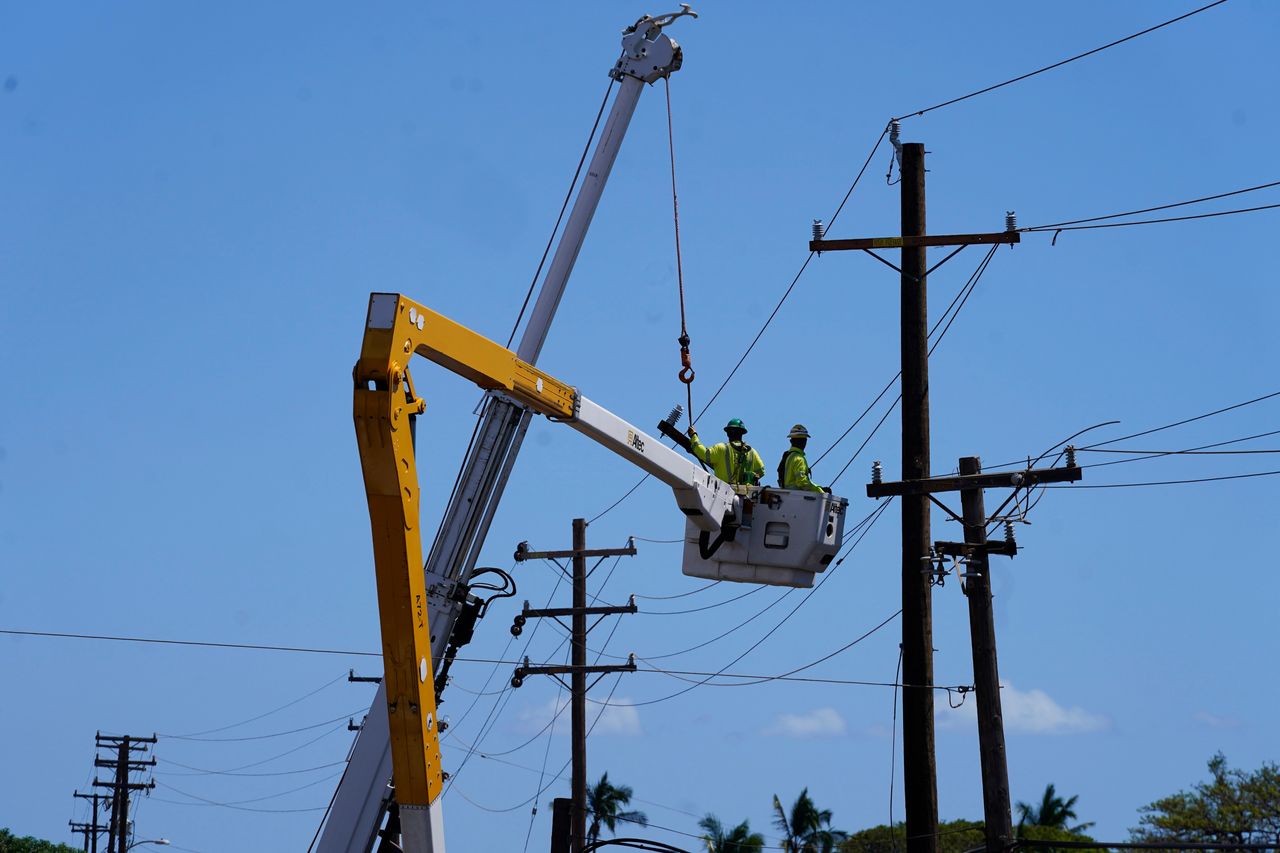

These types of bonds have been growing rapidly. There are about $31 billion in recovery bonds outstanding in 2024, according to Saber Partners. That’s up from roughly $8.5 billion in 2016, according to a Duke Energy Florida filing. Hawaiian Electric could soon offer billions of dollars of them to help it rebuild after last year’s Maui wildfires.

A Bloomberg spokesman said the decision “was made through a robust governance process, public consultation and reflected broad market feedback, and we strongly believe it serves the public interest with a more accurate and transparent market.”“We stand by the decision,” he added.

Best known for its news service and data terminals, Bloomberg is especially important to the recovery bonds because it is a leading index provider for corporate debt. (Editors of The Wall Street Journal help select the components of a stock market index, the Dow Jones Industrial Average, of 30 large “blue chip” stocks listed in the U.S.)

Bloomberg receives fees from firms, such as asset-management companies, large banks and pension funds, which use the indexes as benchmarks or to create investment securities.

Some advocates have already called for more regulation of the index firms and the Securities and Exchange Commission has sought public comment on whether to do so.

The recovery bond fight started after a May 2022 bond offering from California’s PG&E. Bloomberg said it reconsidered the recovery bonds due to their rising popularity and investor calls to do so.

Since the reclassification, recovery bonds have come with higher borrowing costs than other triple-A-rated corporate securities, according to a Journal review of transaction data. The review took into account the difference, or spread, between different bond issues and comparable U.S. Treasurys.

For example, Southern California Edison in 2021 issued bonds structured as corporate securities to finance wildfire cleanup. At the time, a roughly 20-year slug of the securities yielded about 0.6 percentage point more than a 20-year U.S. Treasury, according to Federal Reserve data. Other top-rated corporate bonds were trading at slightly narrower spreads to Treasurys.

When the utility, which serves five million customers in Los Angeles, sold another approximately 20-year bond in April 2023, after Bloomberg’s change, the bonds’ spread to Treasurys had jumped to about 1.2 percentage points. The spreads for top-rated corporate bonds were essentially unchanged.

One of the biggest effects appeared to be at PG&E, which went to market twice in the middle of 2022, both before and after Bloomberg announced it was considering the change.

In the May offering that started the fight, PG&E got a spread of about 1.60 percentage points above corresponding U.S. Treasury rates, while triple-A-rated corporate bonds issued by Johnson & Johnson were trading at a spread of 0.88 percentage point. On a similar offering in July, the utility’s borrowing costs shot up to 1.95 percentage points above Treasurys, while the spread of Johnson & Johnson bonds to Treasurys narrowed to 0.69 percentage point.

Write to Andrew Ackerman at [email protected]

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB