Two more major mortgage lenders have announced they are upping rates this week, in a blow to homeowners hoping for lower mortgage bills.

TSB has increased rates across its two-year, three year and five-year fixed rate deals by up to 35 basis points.

These changes will impact products aimed at first-time buyers, home movers and anyone remortgaging.

From April 26 Halifax upped mortgage rates by 20 basis points for the same groups.

Upping rates: TSB and Halifax are the latest big mortgage lenders to announce rate hikes with more expected to follow suit.

This could mean some of the cheapest two-year fixed rates on the market will disappear.

Halifax currently offers a market-leading two-year fix of 4.6 per cent with a £1,099 fee to home buyers with at least a 40 per cent deposit and a top 4.65 per cent rate for someone buying with a 25 per cent deposit.

The moves by TSB and Halifax follows HSBC, Barclays and NatWest, which all announced rate hikes earlier this week.

The main reason fixed rate mortgages going up is swap rates, according to Nicholas Mendes, mortgage technical manager at John Charcol.

Swap rates show what lenders think the future holds for interest rates, and this governs their pricing.

Since 25 March two-year swaps have risen from 4.36 per cent to 4.56 per cent, while five-year swaps have risen from 3.81 per cent to 4.06 per cent.

Nicholas Mendes of John Charcol says lenders are changing their rates due to uncertainty about the future of the markets

‘Typically, there’s a delay of up to two weeks between shifts in swap rates and corresponding changes in mortgage rates,’ says Mendes.

‘Recent hikes in mortgage rates have mirrored rises in gilt yields, spurred by market revisions in the anticipated timing and magnitude of interest rate cuts by central banks, including reactions to forecasts about the Federal Reserve.

‘Lenders in recent days have been quick to adjust their pricing in line with competitors to avoid being an outlier and impact on service levels.

‘Also, swaps are influenced by market sentiment, until we see a bank rate reduction, we will likely see further periods of changes.’

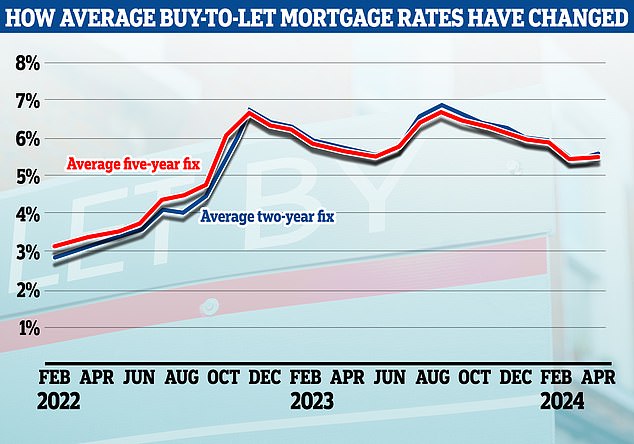

Buy-to-let takes a hit

Landlords are on the receiving end of rate hikes this week with hikes announced by both TSB and BM Solutions – a buy-to-let arm of Lloyds Banking Group.

TSB increased its two-year and five-year buy to let fixed rate deals by up to 45 basis points.

It has also withdrawn its two-year tracker deals aimed at both buy-to-let buyers and those remortgaging.

These included its best buy 5.74 per cent tracker rate with a £994 fee at 60 per cent loan to value. This is base rate (5.25 per cent) plus 0.49 per cent.

Trackers follow the Bank of England’s base rate, plus or minus a set percentage.

For example, someone could be paying base rate plus 0.75 per cent on top with a tracker. With the base rate at 5.25 per cent, they’d pay 6 per cent at present.

But if the base rate was cut to 4.5 per cent, for example, their rate would fall to 5.25 per cent.

The main benefit of tracker deals is that they typically don’t come with early repayment charges.

BM Solutions also announced that it will be increasing its tracker rates by 20 basis points this week.

Chris Sykes, associate director of mortgage broker Private Finance, says it’s not all doom and gloom for landlords despite mortgage rates edging up

But the lender is also upping rates across its fixed rate deals by 20 basis points.

This could see the lowest five-year fix on the market also disappear overnight. BM Solutions currently offers landlords buying with a 25 per cent deposit a five-year fix at 4.19 per cent.

However, while rates are on the rise, it’s not all bad news for landlords, according to Chris Sykes, technical director at broker Private Finance.

‘Some prospective landlords may be eyeing the market with optimism,’ says Sykes.

‘Rents have risen and in some areas housing prices have become reasonable which increases rental yields.

‘One could say in 2022, sellers held the upper hand; 2023 favoured buyers. Now, in 2024, we find ourselves in a balanced market.

‘Additionally, several lenders have eased buy-to-let stress rates recently, which makes it easier to only require a minimum of 25 per cent deposit in many cases and possibly increase the amount of mortgage you can get.

‘This will leave landlords with more cash and liquidity to put towards renovations for investment property or potentially buy more properties.

‘It is still a tougher market than before for landlords that require a mortgage, but has improved gradually.’

News Related-

Pedestrian in his 70s dies after being struck by a lorry in Co Laois

-

Vermont shooting updates: Burlington police reveal suspect’s eerie reaction to arrest

-

Grace Dent says her ‘heart is broken’ as she exits I’m A Celebrity early

-

Stromer’s ST3 Urban E-Bike Goes Fancy With Minimalist Design, Modern Tech

-

Under-pressure Justice Minister announces review of the use of force for gardaí

-

My appearance has changed because of ageing, says Jennifer Lawrence

-

Man allegedly stabbed in the head during row in Co Wexford direct provision centre

-

Children escape without injury after petrol bomb allegedly thrown at house in Cork City

-

Wexford gardai investigating assault as man is bitten in the face during Main Street altercation

-

Child minder’s husband handed eight year sentence for abusing two children

-

The full list of the best London restaurants, cafes and takeaways revealed at the Good Food Awards

-

Mazda CEO Says EVs 'Not Taking Off' In The U.S.—Except Teslas

-

Leitrim locals set up checkpoint to deter asylum seekers

-

Ask A Doctor: Can You Get Shingles More Than Once?