(Bloomberg) — London-based asset manager Ashmore Group PLC is reducing its exposure to Indian equities and has made China the #1 pick in its emerging-markets fund, arguing that India’s stock market is overhyped and overcrowded while China’s is set for a rebound.

With $6.5 billion invested in emerging equities, the fund has allocated 26% of its EM equity fund to China, while reducing India to less than half that, according to Edward Evans, a London-based EM equities portfolio manager. He cites a divergence in valuations as the main reason for the decision.

“The risk-reward balance is arguably stronger for China and less so for India,” Evans said. “India demonstrates fantastic economic growth with great policy stability and it’s often quite a fertile ground for stock selection. But that said, one cannot be agnostic to price, not least in fast-growing emerging markets, since you do not want to pay up front for those future returns.”

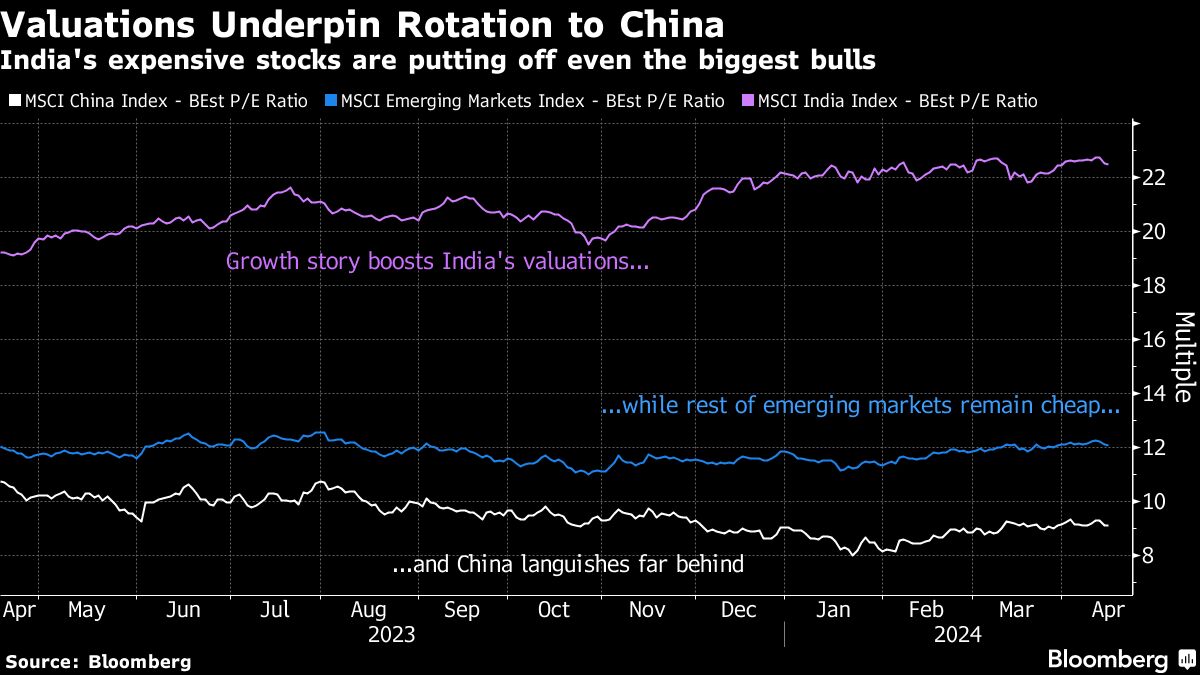

Ashmore’s bet goes against market consensus. Almost half of 390 Bloomberg MLIV Pulse survey respondents between April 8-12 selected India as the best investment compared to Japan and China, which was least favored among the three. Indian equities currently trade at a whopping 23 times next year’s expected earnings, exceeding even US multiples, and compared with nine for China, according to data compiled by Bloomberg based on MSCI Inc.’s indexes.

Valuations Underpin Rotation to China | India’s expensive stocks are putting off even the biggest bulls

Read: Overpriced India Lures Investors Tired of China Risk: MLIV Pulse

Ashmore has also previously been overweight India, but has booked profits as many companies reached valuations at “extremes” that “ultimately don’t look sustainable,” Evans said. “We are a quality-growth investor, but we are not agnostic to valuation, or to price, and that led us to take profits.”

He also cited a risk in India that authorities could look to dampen more speculative investing behavior, especially in the domestic market, making the policy narrative less supportive.

In China, the risks are well known, ranging from geopolitical tensions and a trade showdown with the US, to a property sector crisis and growth that’s cooling from the world-beating levels the economy enjoyed over past decades. The main gauge of Chinese equities has tumbled about 40% from its peak three years ago, and is down 19% in the past year, compared with a 33% gain for the benchmark MSCI India index.

China’s economic growth is expected to trail India’s for at least the next two years, according to economists’ forecasts on Bloomberg.

Still, Evans sees tentative signs of recovery in China, including pickups in factory activity and exports. He points to Caixin manufacturing PMI data, which indicated a fifth straight month of expansion in March, with official government data also showing a rebound. Exports have also increased amid rising global demand for technology goods.

Read: Goldman, Morgan Stanley Boost China’s 2024 Growth Outlook

Evans said Chinese companies’ shares will also benefit from tight cost management, share buybacks and increasing dividends. Those measures are putting a floor under valuations and offer “a rich potential and a shining opportunity,” he said.

Companies in industries such as the supply chain behind AI and electric-vehicle renewables are likely to be drivers of future performance, he said. The balance sheet for the Chinese consumer is still strong and there’s also opportunity in consumer-focused shares, especially in services, he said.

Ashmore’s pure EM equity fund has gained 5% on average annually over the past five years, a paltry return compared with that enjoyed by investors in US stocks, but still double the average return of peers in emerging markets. The fund has performed in parallel with the average so far in 2024, according to data compiled by Bloomberg.

–With assistance from Srinivasan Sivabalan.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB