Lloyds’ share price is up 20% in a year so have investors missed out? Here’s what the charts say

Smart young brown businesswoman working from home on a laptop

In the last 12 months, FTSE 100 stalwart Lloyds‘ (LSE: LLOY) share price has put on a show. During that time it’s risen from 45.3p to 54.3p, a 20% jump.

As a shareholder, this strong performance comes as a pleasant change. The stock hasn’t budged for years. And when it did, it often retreated. So to see the bank finally gain some momentum is nice.

But where does it go from here? If it keeps surging, it’ll have the 60p mark in its sights. So have investors who were still considering the stock missed out?

Price-to-book

There are a few ways to answer that. One is to value a bank is by looking at its price-to-book (P/B) ratio.

As the chart below highlights, Lloyds’ current P/B is 0.85. That’s higher than some of its Footsie peers. For example, Barclays‘ P/B is 0.53 while Standard Chartered’s is 0.55. Over the last 12 months, the lowest Lloyds has been is 0.65.

Nevertheless, its current P/B is below the benchmark value of 1. As such, I reckon the stock still looks good value, despite its recent rise.

Return on equity

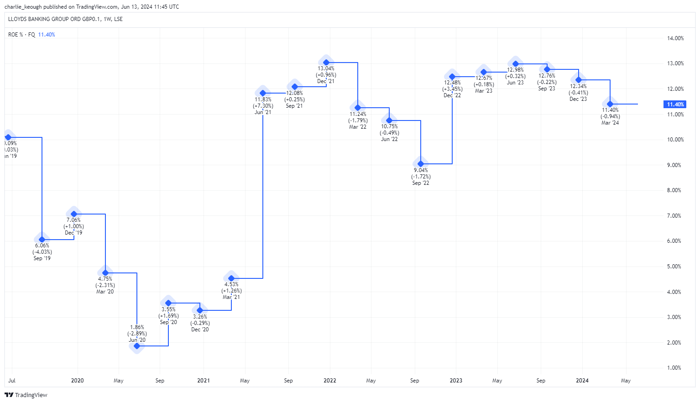

There are other ways I can see if Lloyds is still a smart investment. For example, I can look at its profitability. One way to explore this is by looking at the firm’s return on equity. As seen below, it currently sits at 11.4%.

Created with TradingView

That’s been trending lower since June 2023. However, it’s higher than the current average of its peers on the Footsie, which is 9.9%.

What next?

But where do we go from here? Well, I’m optimistic we’ll keep seeing the Lloyds share price rise in the times ahead. Analysts seem to agree too. Its 12-month target price is 59.3p. That’s an 8.8% premium from today.

Its price-to-earnings (P/E) ratio is just 7.3, which is cheap for a business of Lloyds’ quality, in my opinion. The Footsie average is 11, while Its forward P/E is 8.6.

What’s more, I like owning Lloyds shares as they provide passive income. The stock yields 5.1% covered over two times by trailing earnings. That’s above the average Footsie yield of 3.6% and with the income I’ve received, I’ve simply reinvested it back into buying more cheap shares.

Issues along the way

That’s not to say I don’t see its share price meandering up and down along the way. Lloyds faces multiple issues.

For example, the bank generates all of its revenues from the UK. That means, unlike some of its competitors, it’s heavily reliant on the domestic economy to perform. I’m expecting further uncertainty surrounding the economy’s performance in the months to come, given issues such as interest rate cuts and the general election. So investors could see Lloyds produce large amounts of volatility in the near term.

Long-term buy

But Lloyds looks undervalued to me today. As such, if I had the cash, I’d add to my position. I’m not expecting a smooth journey. Nonetheless, I’m hopeful we’ll continue to see the stock rise in the years to come.

Like buying £1 for 31p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

See the full investment case

More reading

Charlie Keough has positions in Barclays Plc and Lloyds Banking Group Plc. The Motley Fool UK has recommended Barclays Plc, Lloyds Banking Group Plc, and Standard Chartered Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.