Cover Story: RHB pushes hard for desired growth

This article first appeared in The Edge Malaysia Weekly on May 13, 2024 - May 19, 2024

RHB Bank Bhd’s (KL: RHBBANK) group managing director and group CEO Mohd Rashid Mohamad is in a bright mood when The Edge meets with him at the bank’s headquarters in downtown Kuala Lumpur, showing no signs of wear from the stressful year that the country’s fourth-largest lender has just gone through.

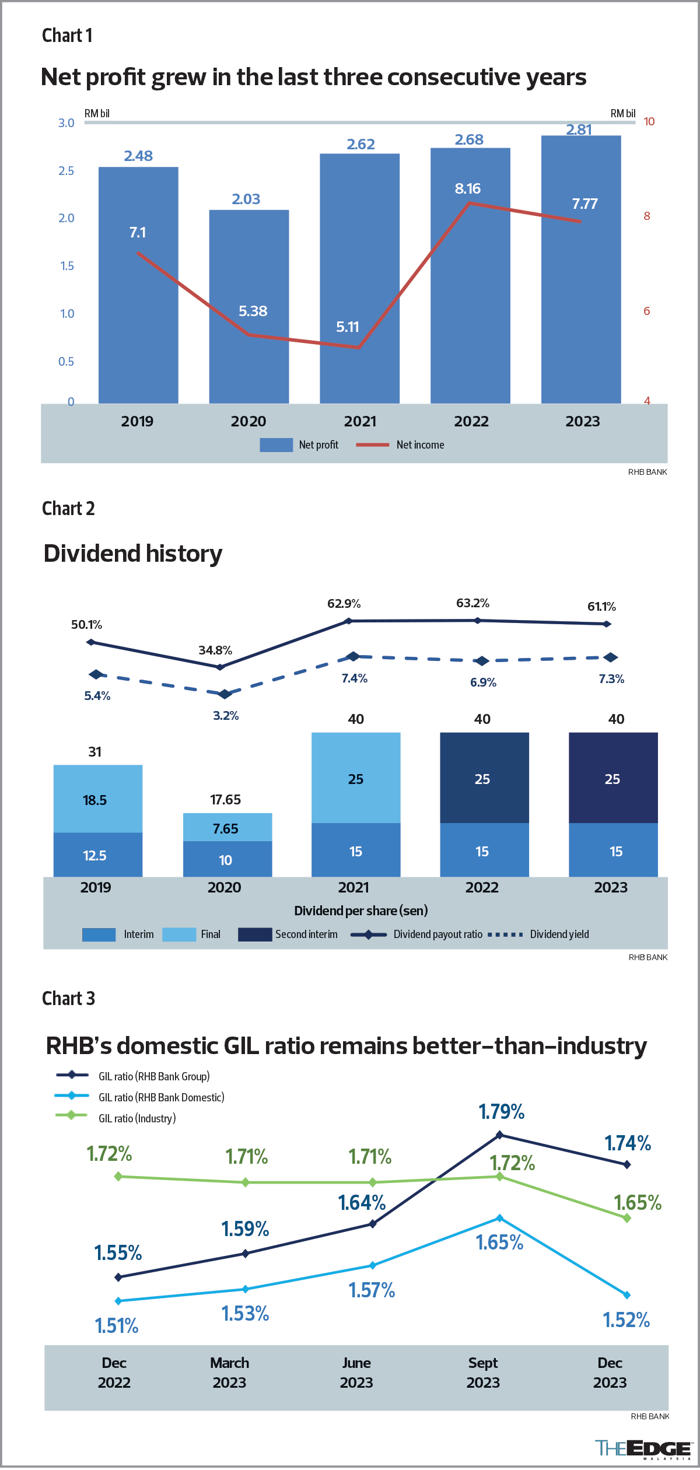

Last year was a particularly tough one for RHB as it strove, along with other banks, to limit a decline in net interest margin (NIM) amid high funding costs as lenders competed fiercely for deposits.

Its NIM — a key measure of profitability that indicates what a bank earns in interest on loans against what it pays out to depositors — dove 42 basis points from a year earlier to 1.82%, far steeper than the banking sector’s 28bps drop to 2.07%.

Be that as it may, RHB managed to notch up a 4.8% increase in net profit to RM2.81 billion for the financial year ended Dec 31, 2023 (FY2023), helped by higher non-interest income (NOII) and lower provisions, thus continuing a three-year growth streak.

“If you ask me, 2023 was a good learning period for us,” Rashid, who took on the top job in April 2022, tells The Edge. “Despite all the challenges, we came out better than the year before.”

He is optimistic of chalking up even better earnings in FY2024, as competition in the fixed deposit space appears to have eased — “you hardly see FD rates of 4% and above in the market now, they’ve all come down” — and the bank continues with efforts to actively manage costs and liabilities.

Notably, last year, RHB undertook active liability management through foreign exchange swaps to help fund ringgit-based loans, the positive effects of which were reflected as forex gains under NOII in its books. It will continue to do so in FY2024, albeit less aggressively and when there is opportunity, Rashid says.

The TWP24 scorecard

Yet, despite the improved earnings outlook, Rashid admits that RHB may not meet some of the financial targets set out under its three-year strategic plan — codenamed Together We Progress 24 (TWP24) — that concludes this year.

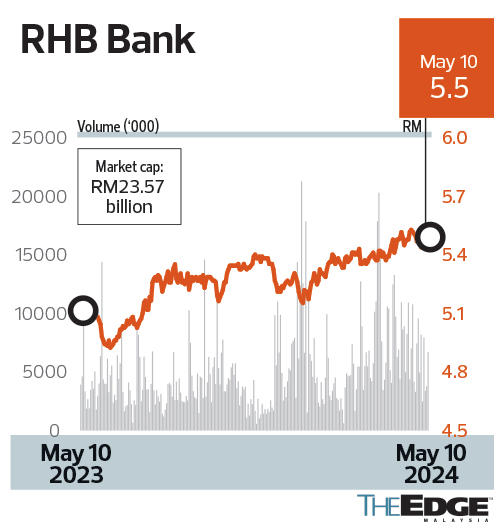

Under TWP24, it had aimed to achieve a return on equity (ROE) of 11.5% and cost-to-income ratio (CIR) of no more than 44.5% by end-FY2024.

Last year, its ROE stood at 9.5% — falling short of an internal ROE target of at least 10% for the year, which has been carried over to this year — while CIR came in at 47.5% (see Chart 4 next page). In FY2022, ROE was at 9.6% and CIR 44.2%. The last time its ROE exceeded 10% was in FY2019 (10.3%).

“[TWP24 targets relating to] customer experience, I’m very confident of achieving. But, some of the financial metrics, we may not be able to achieve. When we were developing TWP24 in 2022, we didn’t expect [such] elevation in cost of funding,” Rashid explains.

Nevertheless, he is pushing his team to get the bank’s ROE to as close as possible to the official TWP24 target of 11.5%. “I still have close to eight months before we close TWP24. I’ve given the team a stretch target. We will strive to narrow the gap or at least do better than last year,” he says.

On the non-financial front, Rashid is particularly pleased with the bank’s progress on prioritising customer experience. This was reflected in its improved net promoter score, a gauge of customer service, which saw it ranked No 2 among lenders last year versus No 4 prior to 2022. It had been aiming for the No 3 spot under TWP24.

Though optimistic about the bank’s prospects, Rashid maintains a sliver of cautiousness, as there are still uncertainties in the market in relation to how soon the US will start cutting interest rates, and by what quantum, and whether the war in the Middle East will spread — all of which could have an impact on the industry.

In addition, the fortunes of some of the Asean countries in which RHB operates are dependent on China, whose growth has slowed considerably compared with previous years. RHB saw an elevation in overseas provisions last year, particularly in Thailand and Cambodia, mainly for hospitality-linked sectors and small and medium enterprises (SMEs).

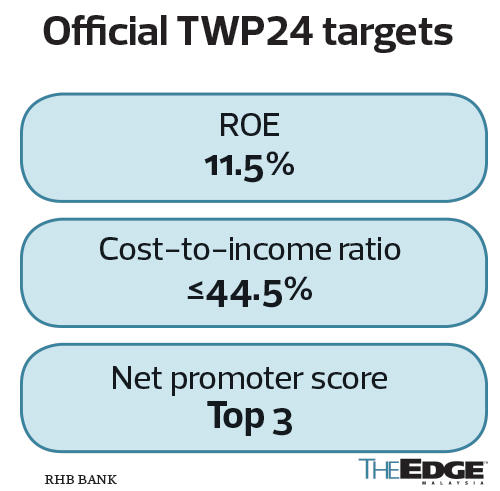

Nevertheless, he is confident of the group’s ability to stay within a targeted gross impaired loan (GIL) ratio of less than 1.75% this year. Last year, the ratio was 1.74%.

Meanwhile, RHB is targeting a NIM of between 1.8% and 1.9% this year on the assumption that Bank Negara Malaysia will maintain the overnight policy rate at 3%.

Rashid is encouraged that RHB’s exclusive partnership with the Ministry of Higher Education in relation to 20 public universities, inked in 2022, will enable it to onboard one million students over a five-year period, which will help enhance its CASA (current account savings account) deposits — a cheaper source of funds for banks. As a start, last year, the bank onboarded 600,000 students, which led to a “substantial” increase in deposits, he says.

Charting the next three-year plan

With TWP24 coming to an end, RHB’s management has already started developing the next three-year strategic plan. “The target is to unveil it as early as the first quarter of next year,” says Rashid.

Sharing insights, he says hyper-personalisation — a term that refers to the need to have a deep understanding of customers’ needs, preferences and behaviour to serve them better — will be a key focus.

“We’ll continue to focus on the affluent and mass affluent market. This year, we have started looking at Islamic wealth management. We see opportunities for us in that space, [making use of] technology and innovation,” Rashid says, adding that artificial intelligence is another element that RHB will increasingly incorporate beyond 2024.

The bank only recently appointed Mohd Najman Isa, an equity portfolio manager formerly based in Hong Kong, as the new CEO and chief investment officer of RHB Islamic International Asset Management.

Meanwhile, the SME business, highly competitive as it is, will remain an important focus for RHB. The bank will zero in on SMEs particularly in Penang, Johor, Sabah and Sarawak, says Rashid. RHB’s market share of SME loans in the industry (excluding development financial institutions) fell marginally to 9.2% at the end of last year, from 9.3% the year before. Last year, its SME loan growth slowed to 4.9% from 7.9%.

Singapore focus and M&A

On the overseas front, RHB continues to count on Singapore the most for growth. It has four branches in the city state, as well as two ATM e-lobby sites, and employs 678 people.

RHB Singapore’s profit before tax fell 47.7% year on year, however, to S$50.5 million in FY2023, but Rashid expects an improved performance this year.

He says Singapore contributes between 10% and 12% from the loans perspective. Loan growth there last year was 17.5% (or 10.8% in Singapore currency). “This year, we have slightly higher expectations from the growth perspective and contribution perspective.”

If Singapore can deliver, it will help substantially with RHB’s aspiration to achieve a group loan growth stretch target of 7% this year, he adds. The official group loan growth target is 4.5%.

The corporate and commercial segments make up around 80% of total Singapore loans.

Apart from Singapore, RHB has commercial banking branches in Cambodia (13), Laos (three), Thailand (three) and Brunei (one). It also operates stockbroking businesses in Cambodia, Thailand and Indonesia. In February, the group exited Vietnam when it sold RHB Securities Vietnam Co Ltd to a subsidiary of Public Bank Bhd (KL:PBBANK) for VND374 billion (RM72.55 million) in cash.

Meanwhile, Rashid stresses that the bank’s next three-year plan will be based on organic growth. There are no plans for M&A.

“We will need to continue to improve our fundamentals and strengthen the group’s performance before we can consider possibilities. Otherwise, it’s not fair for the shareholders,” he says.

Bloomberg data shows that nine analysts have a “hold” call on the stock, while four have a “buy” rating and three are calling a “sell”. The average 12-month target price was RM5.96. The stock has gained 5.5% so far this year to close at RM5.50 last Friday (May 10) for a market value of RM23.57 billion. Its highest close this year was RM5.53, on April 23.

“Valuations are about fair. They should do better this year on the back of NIM recovery, sustained NOII and lower credit cost. But, there’s nothing exciting about the group to prompt a ‘buy’,” says a senior banking analyst, who has a “hold” call.

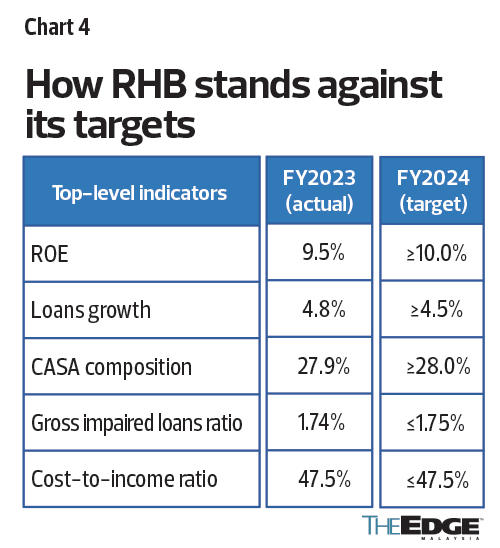

Nevertheless, better dividends will be something investors will be looking for from the group, whose total dividend per share in each of the last three years was 40 sen. An analyst says RHB recently said it would strive to maintain a cash dividend payout policy of at least 30%.

Rashid says: “We don’t have a dividend policy, but a dividend payout guidance of 30% to 50%. Our intention is to reward our shareholders with consistent dividend payouts while optimising capital utilisation for better returns. We have continuously provided a payout ratio above 50% and an attractive dividend yield between 6% and 7% in the last three years.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.