British American Tobacco Announces a Share Buyback. Here's What Investors Need to Know.

Tobacco and nicotine products company British American Tobacco (NYSE: BTI) recently said it had repurchased 150,000 shares of stock at an average price of about $32. Companies repurchase their stock all the time; once purchased, it's taken out of circulation, which reduces the number of shares outstanding.

Companies repurchase shares for various reasons, often to send a message to the market or shareholders. So, what does British American Tobacco's repurchase potentially say about the stock, and should investors follow suit and buy shares for themselves?

What do share repurchases mean for investors?

Share repurchases are very common. They are one of the primary methods (along with dividends) companies use to share profits with shareholders. Share repurchases decrease the number of shares outstanding, which drives higher earnings per share (EPS). Higher EPS generally translates to a higher share price.

Many companies routinely repurchase shares, regardless of the stock's valuation. However, prudent management teams will consider the stock's valuation to ensure the repurchases are as effective as possible. The lower the share price, the more shares your repurchase will take out of circulation.

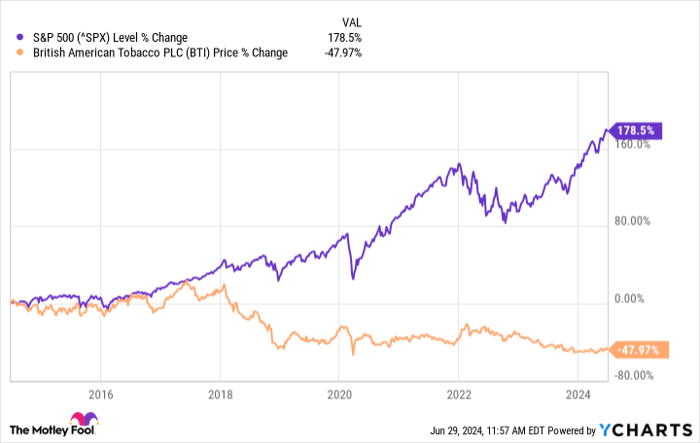

Now seems like a great time for British American Tobacco to repurchase shares. The stock has fallen nearly 50% from a decade ago, a disaster compared to the S&P 500, which has more than doubled during that time.

^SPX

British American Tobacco sold about $2 billion of its stake in Indian conglomerate ITC earlier this year. The repurchases you see are part of management's plan to use some of the proceeds to reduce the share count. Management plans to repurchase stock through the end of 2025.

Why has British American Tobacco performed so poorly?

Some instantly write off British American Tobacco because its stock has performed poorly, but that could be a mistake.

The stock's struggle seems primarily due to an excessively expensive valuation that has taken years to unwind. Smokeable products are British American Tobacco's legacy business. Most people know that smoking rates have been declining for decades due to the harmful nature of the habit. The numbers support this; the company sold 756 billion "sticks" in 2017, but that volume fell to just 555 billion in 2023. It will likely continue falling over time.

British American and other tobacco companies not only raise prices to compensate for selling fewer sticks, but are also selling next-generation products like oral nicotine pouches and electronic cigarettes. These moves are helping generate earnings growth despite smoking declines. Still, it is hard to classify British American Tobacco as a growth business. Analysts believe earnings will grow by an average of just 4% annually over the long term.

For some reason, shares of British American Tobacco traded at 24 times earnings at the start of 2018. The market can do odd things, and it's hard to fathom how this business would warrant such a high valuation. Knowing all this helps put the stock's multiyear slide in context.

Here is why British American Tobacco is an excellent buy right now

Investors willing to look forward and not at the stock's past could be looking at an excellent opportunity. Gone is the bubbly price tag BAT once had; shares trade at a forward P/E of between 6 and 7 today, a reasonable, arguably cheap, value for a company with earnings growth of 4% yearly. Barring more irrational market action, investors could reasonably expect future investment returns to mirror the company's earnings growth.

That alone isn't exciting, but it gets more enjoyable when you factor in the huge dividend, which yields 9.6% today. High dividend yields can be a red flag, but not this one. Tobacco companies are known for dependable cash flows, and British American's dividend payout ratio is only about 50%. Investors should feel confident the dividends will continue flowing to their pockets.

Add it up, and investors are looking at total returns of about 13% to 14% annually, making it a potential market-beater. That's a tremendous turnaround from the stock's years of underperformance.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.