Confused between old and new tax regimes for FY25? We have it sorted for you

With the new financial year kicking in, the debate between opting for old and new tax regimes is back.

For those with fewer investments to claim, the new regime offers advantages, while the old regime is more favorable for taxpayers eligible for deductions such as HRA and home loan.

So, if you are confused between the two regimes, it is better to work out the tax payable before opting for one. The initial phase of tax planning involves assessing how much tax savings you have already done under old tax regime.

This is a crucial step often overlooked amidst life’s routine activities such as deduction available on home loan, education loan, life and health insurance, with little regard for their tax implications. Subsequently, it’s essential to determine the available room for further tax-saving investments. Understanding the remaining space within the Rs 1.5 lakh bracket, HRA and home loan deduction that you can avail to take informed decisions on additional investments.

The third step entails exploring suitable investment avenues aligned with individual life goals and risk tolerance. Selecting options meticulously ensures a balanced approach to tax planning.

The above mentioned deductions are offered under old tax regime whereas the new regime has a very few deductions like employers contribution under NPS. However, there is no tax on income up to Rs 7 lakh under new tax regime. Opting for the new regime means accepting lower tax rates without the option to claim deductions, ideal for those prioritizing increased disposable income and those who have not big ticket deductions available such as home loans and HRA.

Hence, taxpayers now have more flexibility, as those preferring not to invest in tax-saving instruments can choose the new regime, while those aiming for comprehensive tax planning and wealth creation may opt for the old regime. Salaried individuals should inform their employers if selecting the old tax regime to ensure proper TDS planning. Importantly, taxpayers can switch tax regimes when filing their income tax returns.

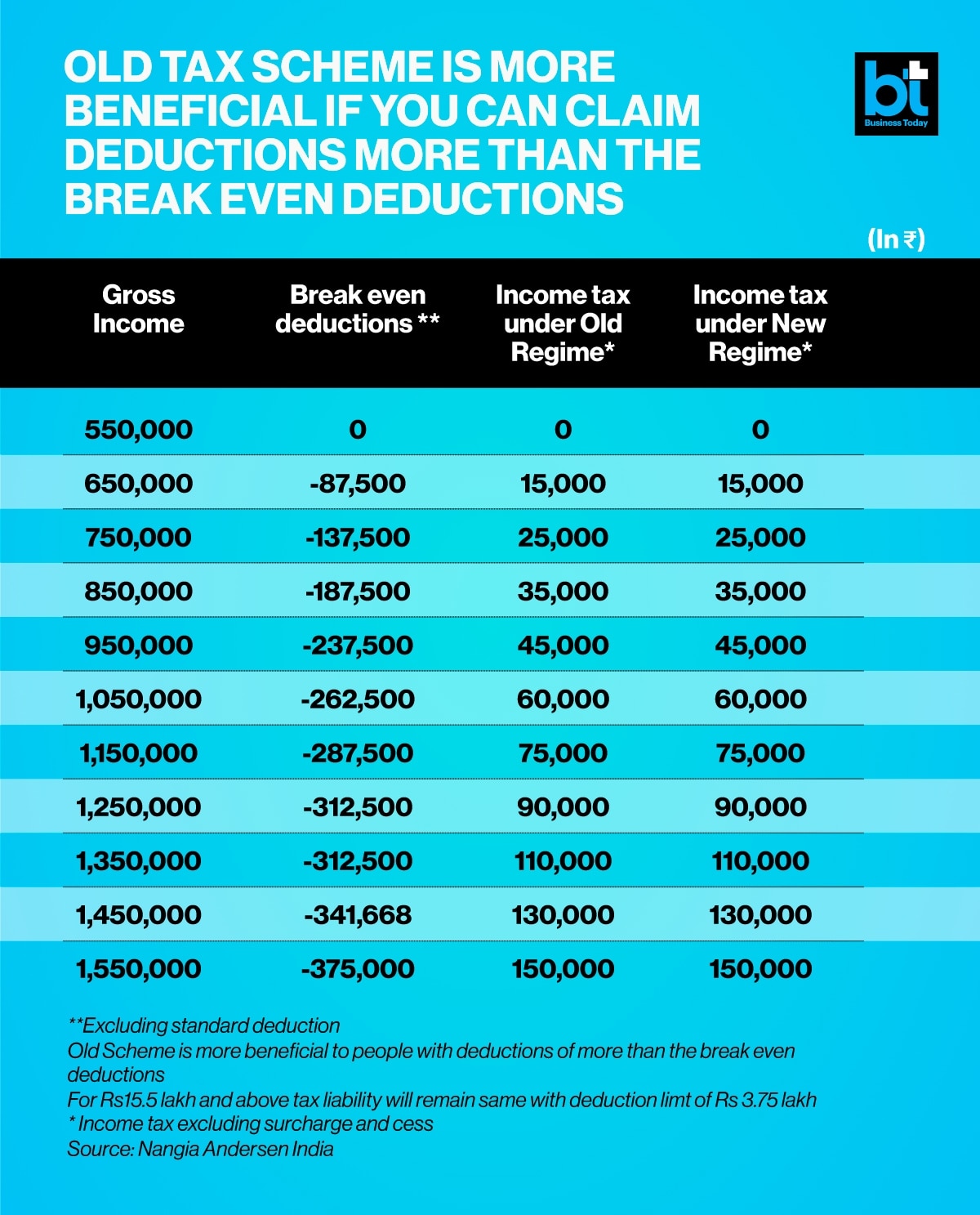

Break-even limits

To simplify this decision-making process, we’ve calculated breakeven deduction limits for various income brackets. This will help you determine which regime suits you best. If your deductions fall below a specific threshold, then new tax regime is better otherwise if you have higher deductions old tax regime is better for you.

For example, if your eligible deductions total Rs 2,37,500 (excluding the standard deduction of Rs 50,000), your tax liability will be identical under both regimes if your gross income is Rs 9.50 lakh. Beyond this threshold, the old regime becomes more advantageous.

Similarly, considering a deduction of Rs 3.75 lakh (excluding the standard deduction of Rs 50,000), the tax liability is the same for a gross income of Rs 15.5 lakh and above. Below this income level, different breakeven deductions apply.

Neeraj Agarwala, Partner at Nangia Andersen India, explained that the break-even deduction is Rs 3,75,000 for a gross income of up to Rs 5 crore.

Beyond this, the reduced surcharge of 25% in the new tax regime makes it more beneficial.

Watch Live TV in English

Watch Live TV in Hindi

News Related

-

Anyone who’s purchased gift baskets to hand out to loved ones this holiday season might need to find a backup present after the latest food recall that involves festive cookies. Gift basket company Wine Country Gift Baskets just announced that it is voluntarily recalling all gift baskets that feature Acorn Baking ...

See Details:

Recall Just Announced For Popular Cookies Featured In Holiday Gift Baskets

-

LOS ANGELES: Quarterback Jalen Hurts ran in an overtime touchdown to give the Philadelphia Eagles a 37-34 NFL win over the Buffalo Bills Sunday (Monday in Manila) and move them to 10-1 on the season. The Eagles, who lost the Super Bowl to Kansas City last season, trailed at half-time ...

See Details:

Eagles rally past Bills in overtime as Chiefs win

-

Yen Makabenta First word WHILE UN Secretary-General Antonio Guterres and other promoters of the climate emergency are preparing to convene the 28th conference of the parties (COP28) of the UN Framework Convention on Climate Change (UNFCCC) in the United Arab Emirates, starting on November 30 and stretching to December 12, ...

See Details:

Reality bites the green energy agenda

-

Sandigan orders Marcos Sr. pal to pay workers The Sandiganbayan has ordered the enforcement of a July 2023 ruling ordering a Marcos Sr. associate to pay a lumber company’s workers P2.1 million in damages as well as return 60 percent of their company’s shares and pay all unpaid benefits. The ...

See Details:

Sandigan orders Marcos Sr. pal to pay workers

-

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated MANILA, Philippines – More than 18,000 families have fled to evacuation centers across flood-affected regions in the country due to the impact of the shear line and low pressure area. Department of Social Welfare and Development (DSWD) gave ...

See Details:

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated

-

-

MANILA, Philippines: The entire Luzon, including Metro Manila, is expected to experience isolated rain showers and thunderstorms as the northeast monsoon (“amihan”) and easterlies will be affecting the country over the next 24 hours, the state-run weather agency said on Tuesday. Weather specialist Patrick del Mundo of the Philippine Atmospheric ...

See Details:

Rain showers, thunderstorms over Luzon, including Metro Manila — Pagasa

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

'Naruto' live-action film adaptation is in the works

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

NASA Highlights Stingray Nebula

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Manila's Lagusnilad underpass opens

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

China probes debt-ridden financial giant

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

China's VUCA situation

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Unraveling the mystery that is diabetes

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Bangladesh's nuke plant is not going to steal PH investments

OTHER NEWS

ALIW Awards Foundation Inc. President Alice H. Reyes has released the names of finalists for the 2023 Aliw Awards to be presented on Dec. 11, 2023, at the Manila Hotel ...

Read more »

WhatsApp Web gains the feature of single-view photos and videos (Photo: Unsplash) The WhatsApp Web, the desktop version of the popular messaging app from Meta, has received an update allowing ...

Read more »

Young athletes’ time to shine in Siklab Awards MANILA, Philippines — The future heroes of Philippine sports will be honored during the third Siklab Youth Sports Awards on Dec. 4 ...

Read more »

Graphics by Jannielyn Ann Bigtas A local government official said Monday that five to 10 barangays in Northern Samar are still isolated following the massive flooding in the area last ...

Read more »

DyipPay app lets you pay jeepney fare, book tricycles “Barya lang po sa umaga.” Everyone who rides jeepneys knows this rule: it may not be an actual law, but it’s ...

Read more »

Updated In-Season Tournament Bracket ahead of pool play finale Tuesday will mark the last day of pool play for the inaugural NBA In-Season Tournament. From there, six first-place teams and ...

Read more »

PCG forms teams for maritime emergency response MANILA, Philippines — Recent incidents of fishermen lost in the waters off Southern Tagalog have prompted the Philippine Coast Guard (PCG) to form ...

Read more »