Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), the conglomerate led by legendary investor Warren Buffett, has been relatively cautious in its stock market investments lately. The company sold more stocks than it bought in 2023, resulting in its public stock portfolio shrinking by 16% over the past year in terms of its total number of disclosed holdings. Another bearish signal is the company’s rapidly rising cash pile. Late last year, Berkshire’s cash position reached a record high of $157 billion.

While some may see these moves as a sign of missed opportunities in light of the otherworldly performance of artificial intelligence (AI) and weight loss stocks in 2023, Berkshire’s bearishness in a full-fledged bull market is curious nonetheless. Here are three reasons Berkshire’s contrarian positioning may have a solid rationale behind it.

Warren Buffett speaking to a reporter.

Three reasons that may underlie Berkshire’s bearishness

Reason No. 1: Historically, the stock market tends to produce lower returns in the year following a presidential election, especially if the incumbent party loses. This trend is believed to be the result of investors taking a more cautious approach to a new administration’s economic policies.

While presidential priorities rarely have an immediate impact on the broader economy, certain measures by the executive branch can affect corporate profits and business development strategies significantly.

For instance, President Obama’s administration effectively blocked Pfizer and Botox maker Allergan from merging in 2016 — a move that wasn’t beneficial to shareholders of either company at the time. Berkshire may be taking some money off the table in anticipation of the uncertainty this upcoming election cycle is sure to create in the markets.

Reason No. 2: The trajectory of inflation and interest rates remains an open question. The U.S. economy has remained oddly resilient in the face of red-hot inflation and interest rate hikes from the Federal Reserve. But its resiliency will undoubtedly be tested if inflation fails to cool off soon.

After all, the core Consumer Price Index, which strips out volatile food and energy costs, rose faster than expected in January. Sticky inflation may force regulators to delay lowering rates until mid-summer or perhaps later.

The next inflation reading, due out on March 12, could thus prove to be a key inflection point for U.S. stocks. If inflation starts to cool in response to the Fed’s aggressive rate hikes, stocks may climb even higher.

However, the exact opposite scenario may play out if inflation comes in on the high side yet again in the Labor Department’s next report. Given Buffett’s well-known aversion to risk, it wouldn’t be out of character if Berkshire is indeed preparing its stock portfolio for the bear-case scenario on inflation and interest rates.

Reason No. 3: U.S. stocks, on balance, are expensive — at least on paper. Keeping with this theme, the benchmark S&P 500 recently broke through the 5,000 level for the first time in history, fueled by excitement over the AI revolution and the obesity drug bonanza.

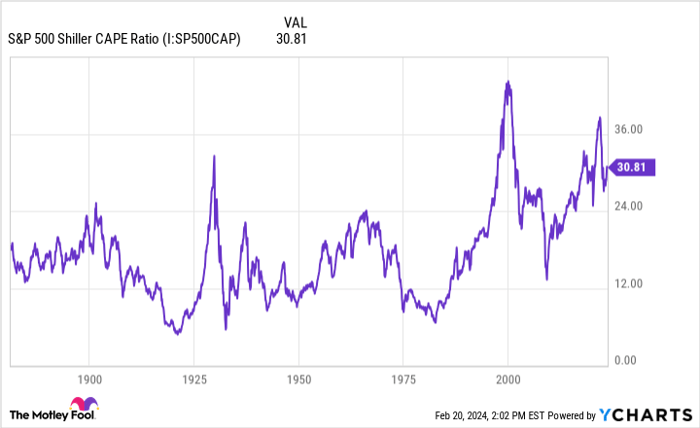

As a direct result, most of the index’s largest holdings are also trading at elevated valuations right now. A commonly used valuation metric for the index, known as the cyclically adjusted price-to-earnings ratio (CAPE), underscores this point.

This metric, popularized by Nobel laureate Robert Shiller, measures the price of a stock or index relative to its average earnings over the past 10 years, adjusted for inflation. The CAPE provides a longer-term perspective on valuation compared to the traditional price-to-earnings ratio.

As of now, the S&P 500’s CAPE ratio is currently trading at more than 90% above its historical average. Moreover, the index isn’t far off from its peak levels on this key metric before the dot-com bubble burst in 2000 (see graph below).

S&P 500 Shiller CAPE Ratio

Now, it is important to bear in mind that no valuation metric is 100% accurate when it comes to predicting market-level movements, and although the CAPE has been better than most at forecasting future returns, its track record is still mediocre at best.

Still, the U.S. market’s hefty premium probably doesn’t appeal to dyed-in-the-wool value investors like Buffett.

Key takeaways

These three factors may explain why Berkshire Hathaway is holding back on buying more stocks and keeping a large cash reserve. Of course, this does not mean that the holding company is completely pessimistic about the future, or that it will not find attractive investment opportunities in the future.

However, the current market environment also isn’t ideal for value investing in the strictest sense. Speaking to this point, this market is heavily dependent on sentiment and momentum — not necessarily fundamentals.

This does not imply that the market will crash or that stocks will slow down as the year goes on. Stocks have technically been “expensive” — based on the CAPE — for the better part of the past two decades, and that fact hasn’t stopped many large-caps from reaching new all-time highs lately.

For value investors, though, it might be smart to follow Buffett’s advice and be “fearful when others are greedy, and greedy when others are fearful.” After all, there are not many super attractive deals in this market, especially among large-cap stocks.

SPONSORED:

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 20, 2024

George Budwell has positions in Pfizer. The Motley Fool has positions in and recommends Berkshire Hathaway and Pfizer. The Motley Fool has a disclosure policy.

News Related-

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

Namwater Dam Bulletin on Monday 27 November 2023

-

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

Victory over Nigeria puts Uganda on the brink

-

BoG holds policy rate at 30%, tightens liquidity measures

-

When sea levels rise, so does your rent

-

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Sierra Leone prison breaks co-ordinated - minister

-

Address the rise of single parenthood

-

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Unmarried People Under 35 Outnumber Married Ones

-

European interior ministers in Hungary to discuss migration

-

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone