5 charts that show why Americans are currently in a better place ‘both economically and psychologically’

After years of high inflation and a looming recession that never quite happened, Americans are suddenly much more optimistic about the economy.

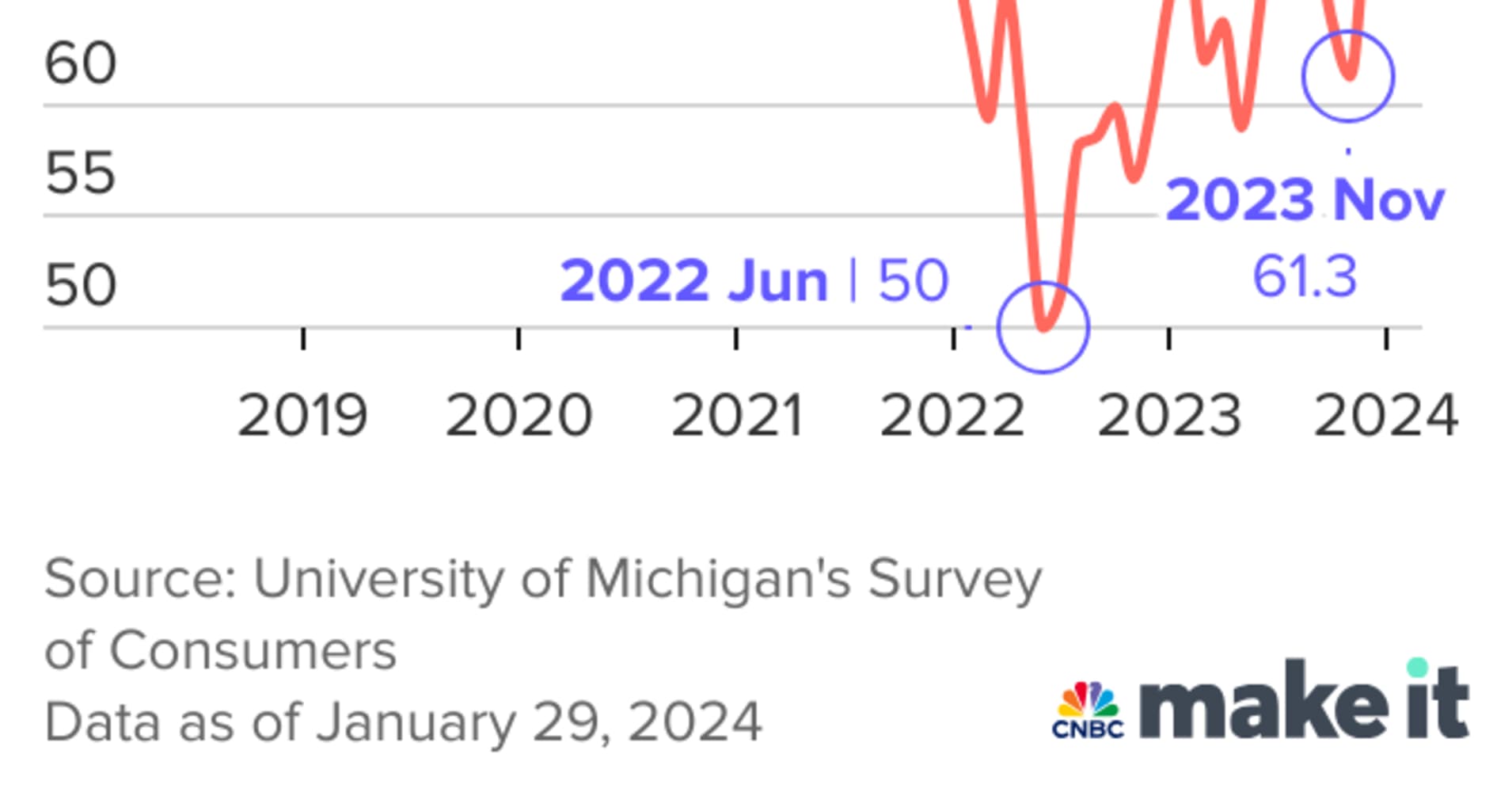

Positive sentiment about the economy has surged by 29% since the beginning of December — the largest two-month increase since 1991, according to the closely watched University of Michigan Surveys of Consumers.

This confidence is echoed by other recent metrics, including a survey by Morgan Stanley showing that consumer sentiment hit a five-month high in January.

Similarly, the percentage of American adults who expect their finances to be the same or better a year from now is 76.5%, the highest level since September 2021, according to a New York Federal Reserve study published Feb. 12.

So what’s changed in the last few months? Economists who spoke to CNBC Make It say it’s likely the cumulative effect of wage growth, low unemployment and slowing inflation. Some say stock market performance is a factor, too.

“If you look at where we are today and where we were four years ago at the start of the Covid pandemic, we are in a much better place both economically and psychologically,” says Robert Johnson, professor of finance at Creighton University’s Heider College of Business.

Here’s a closer look at what’s influencing the recent surge in optimism among many Americans.

Slowing inflation and wage growth

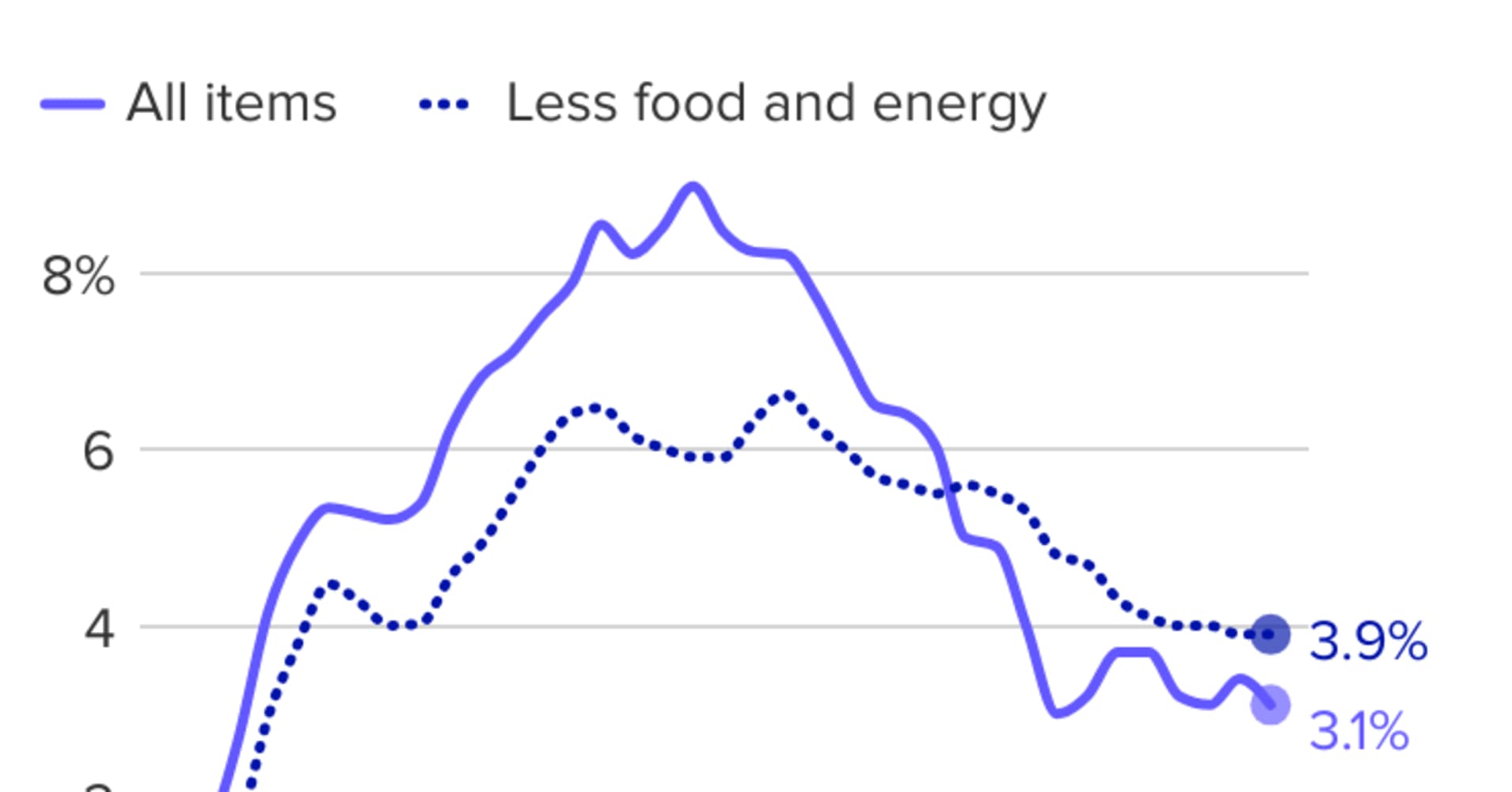

Inflation soared by nearly 18% in the last three years, according to the consumer price index, which measures the price of everyday items Americans typically purchase.

While inflation is still above the Fed’s target of 2%, it has leveled off to a year-over-year rate of 3.1% as of January, which is a significant climbdown from its June 2022 peak of 9.1%.

“Consumer sentiment was low in 2022 and early 2023, despite good economic growth and a very strong labor market, because inflation was high,” says Gus Faucher, chief economist at PNC Financial Services Group.

“But with slowing inflation and strong wage growth, adjusted-for-inflation incomes are increasing, giving consumers more buying power,” he says.

Since 2022, wage growth has helped soften the blow of higher consumer prices. Wages increased 5% in January 2024, a three-month moving average of nominal wage growth for individuals, as measured by the Atlanta Fed’s Wage Growth Tracker. Before the pandemic, the rate of wage growth was closer to 3.5%.

Americans who benefitted the most from those wage gains were middle-income and lower-income households, write economists from the U.S. Department of the Treasury.

Low unemployment

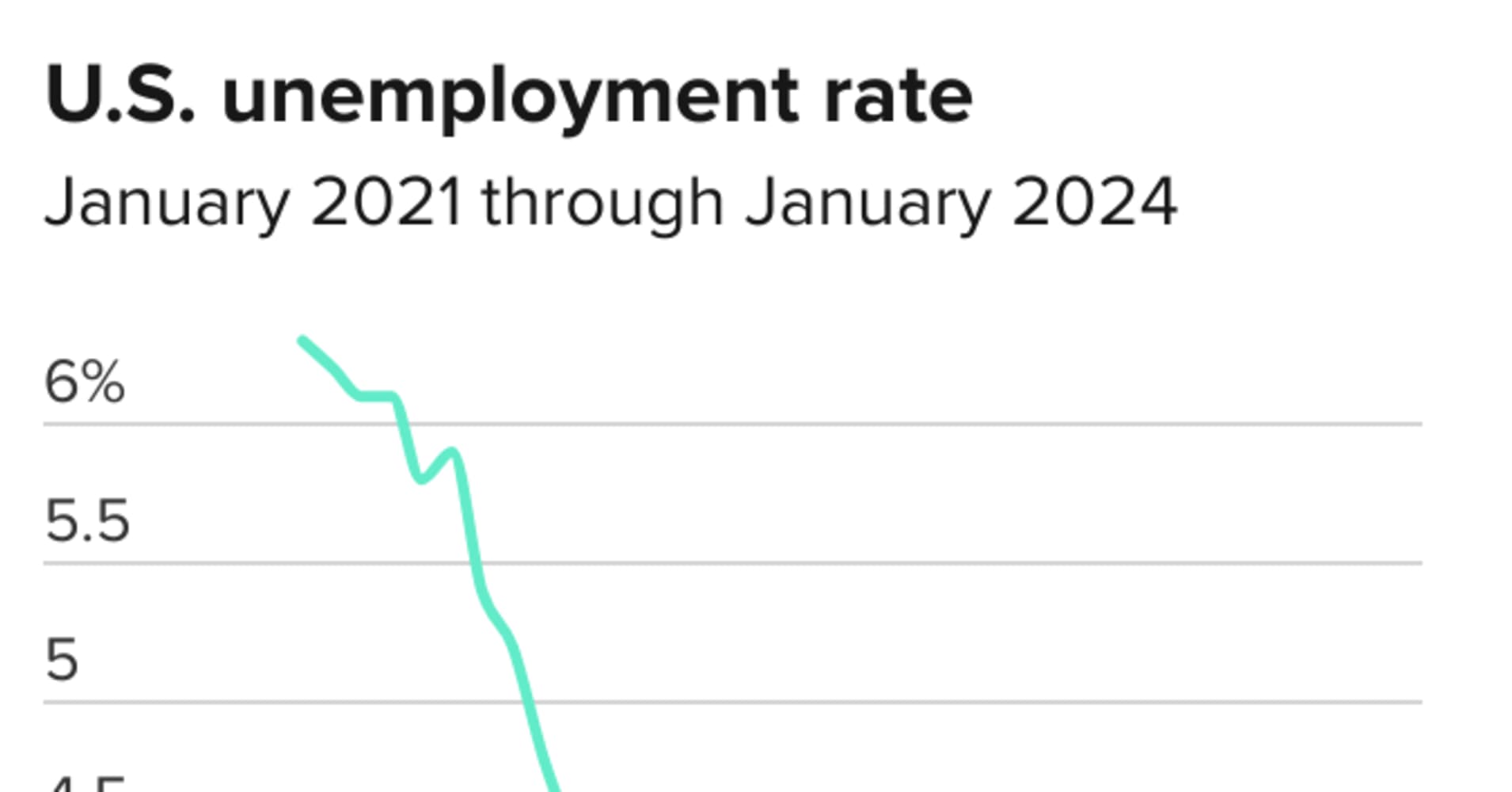

In 2022, the Federal Reserve implemented a series of benchmark interest rate hikes to combat inflation. Since rate hikes increase the cost of borrowing, they tend to slow the economy, and can even tip it into a recession. In turn, this would typically result in higher unemployment numbers.

So far, that hasn’t happened. While unemployment ticked up slightly in recent months, it has hovered near 3.6% for the past two years — a historically low rate.

“Many people were conditioned to expect a recession and we have not experienced one — it has buoyed consumer confidence,” says Johnson.

Stock market performance

The S&P 500 index gained 25% in 2023, a remarkable turnaround after posting losses of nearly 20% in 2022.

“Perhaps one of the biggest influences in shaping consumer sentiment is the wealth effect due to the tremendous performance of the stock market,” says Johnson.

The wealth effect is a theory in behavioral economics that suggests consumers spend more and exhibit greater confidence when their wealth increases, even if their income does not, says Johnson.

Considering 58% of Americans owned stocks as of 2022, they might be feeling more confident about their economic prospects.

However, not all economists say stock market performance is a main factor in improved consumer sentiment.

The effects could be a secondary factor, but “I’m not sure that’s what’s driving the consumer confidence in this case,” Jonathan Ernest, assistant professor of economics at Case Western Reserve University, tells CNBC Make It.

Wage growth, slowing inflation and low unemployment are the main factors for improved optimism among Americans, Ernest says.

Consumer sentiment could change

It’s worth noting that while consumer sentiment has improved, it’s only in relation to the pessimism of the previous few years. The Michigan Consumer Sentiment reading is still about 20 percentage points below pre-pandemic levels, for example.

And while progress has been made in taming inflation, at 3.1%, the inflation rate is still well above the Fed’s stated target of 2%.

Inflation numbers were higher than expected in January. As a result, Fed rate cuts are expected to be pushed off later into 2024, rather than in March, as some observers had believed.

With news of higher-than-expected inflation, the stock market took a tumble last week, too. This largely reflects uncertainty about the economy and continued high interest rates that could trigger a recession.

For that reason, expect “sentiment to adjust accordingly in the coming weeks,” says Erin Sykes, chief economist at Nest Seekers International.

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport