This article first appeared in The Edge Malaysia Weekly on November 20, 2023 – November 26, 2023

SHELL, the country’s second largest oil and gas (O&G) producer, intends to keep its “very, very strong” presence in this market, which represents one of nine core countries in the oil major’s portfolio, says country chair Siti Hurrairah Sulaiman, who took the role in December last year.

Shell is “absolutely prepared” to go into the country’s deep water exploration “as long as these projects are commercially viable and carbon-competitive”, she says, citing the availability of technologies that have allowed more such projects to take off in Malaysia in recent years.

“Being a core country is an important statement because it means we are gaining our shareholders’ confidence to continue to invest in Malaysia,” says Siti Hurrairah, 51, who is also senior vice-president of Shell’s upstream business in the country. “Our recent projects are a demonstration of how we have performed as Shell Malaysia upstream and, hence, the ability for us to sustain the status of a core country … Malaysia stays as a very strong portfolio as far as Shell Group’s upstream portfolio is concerned.”

The last few years have seen the exit of several western exploration and production (E&P) players such as Newfield Exploration Co in 2017, ExxonMobil in 2019 and Repsol in 2021. This year, Austrian O&G outfit OMV is looking for suitors for its 50% stake in its E&P joint venture with Malaysia’s Sapura Energy Bhd as part of its Asia-Pacific exit.

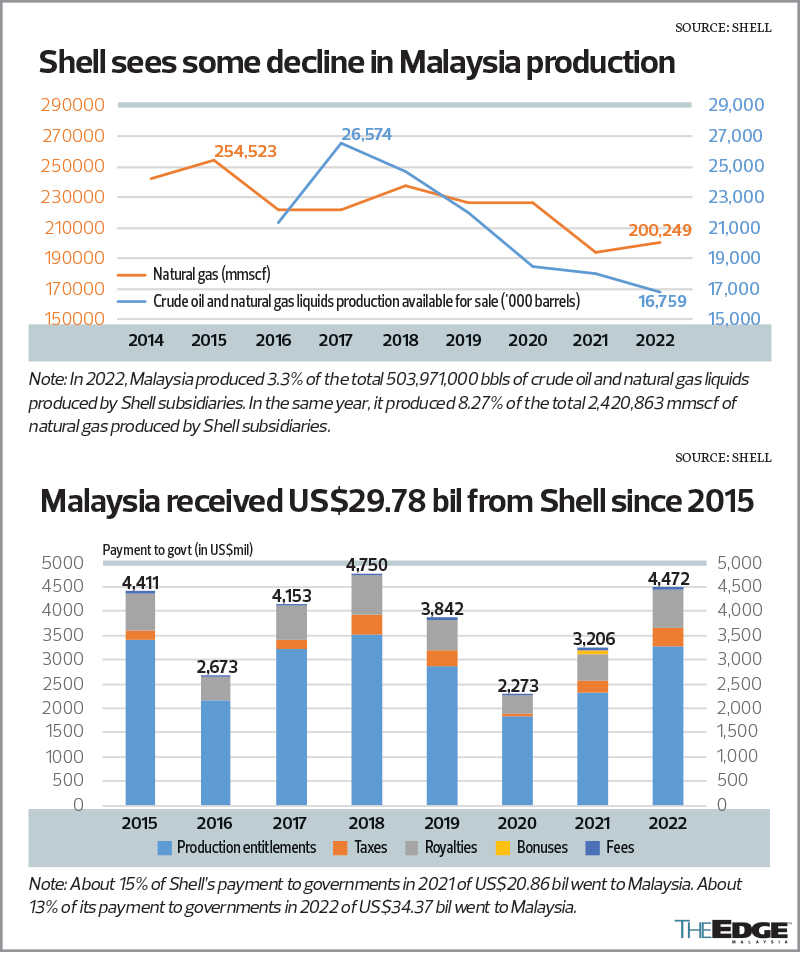

In 2022, Shell’s natural gas production in Malaysia represented 8.27% of the oil major’s total natural gas production while its production of crude oil and natural gas liquids in the country contributed 3.3% of the group’s total in the same period.

That year, Shell paid US$4.47 billion to the Malaysian government for production entitlement, taxes, royalties and fees. This constituted a sizeable 13% of the group’s total payments to 25 governments in 2022 of about US$34.37 billion.

That said, local production has declined over the years, with gas production seeing its recent peak in 2015 while crude oil and liquids production reached a high in 2017. In March, Shell also disposed of two non-operated production sharing agreements (PSCs) in the Baram Delta to Petroleum Sarawak Bhd (Petros).

Siti Hurrairah notes the decline was in line with Shell’s global strategy in 2021 to reduce production towards net zero emissions. Within the Shell Group, the slew of asset disposals globally reportedly helped Shell meet its 2030 output targets “eight years early” in 2023. “Two years on, we realised that the decline rate at the global level is far more than what it should be.”

She points to the complex Rosmari-Marjoram project, with a sour gas portfolio and depth of 140m, which is expected to go online in 2026. “A couple of years ago, we were not able to do that because it was too expensive. Give [the industry] another five years, the costs [for ultra-deep water exploration] could come back to a very balanced view. That was exactly how [the industry] saw offshore back in the 1970s — not everybody wanted to play in the offshore space because it is expensive. Now everybody goes offshore.”

The subsurface also “never fails to surprise us”, she adds, citing a sweet gas find several years ago when it was thought such reservoirs were depleted.

In August, Shell achieved first oil at the Timi sweet gas and oil project, which operates at a depth of 145m. This is Malaysia’s deepest fixed platform to date. The sweet gas field was discovered in 2018. Both Timi and Rosmari-Marjoram are located within Block SK318, 200km off Miri, Sarawak.

An accompanying onshore gas plant in Bintulu for Rosmari-Marjoram will be Shell’s largest onshore project in Sarawak since the construction of Bintulu Crude Oil Terminal (BCOT) and Bintulu Integrated Facility (BIF) in the late 1970s.

“This (Rosmari-Marjoram) is going to be part of the Sarawak Integrated Sour Gas Corridor Development … [for future sour gas discoveries] we know we have this hub to leverage, in the context of future developments,” Siti Hurrairah says.

Petros, SMJ ‘two important key stakeholders’

Shell has no upstream presence in the peninsula, but commands a very strong position with 19 PSCs in Sabah and Sarawak, where it first set foot more than a century ago. This comprises 13 operatorships (seven in Sarawak and six in Sabah), as well as six PSCs on non-operated basis (two in Sarawak and four in Sabah).

The changing industry landscape is seeing more hands-on participation by the two state governments under the strengthening of the Malaysia Agreement 1963, with Sarawak’s efforts led by Petros, while Sabah’s O&G ambition is spearheaded by SMJ Sdn Bhd.

Petros and SMJ “are two important key stakeholders for Shell”, says Siti Hurrairah. “We are partnering with Petros in one of our PSCs (Block SK437), and we also engage with them on other O&G-related matters. SMJ is the same. We do have a lot of engagements and good relationships with both.

“Are [the dynamics] different from 20 years ago? Yes, they are new, they are given the mandate by the states on a number of aspects related to O&G … they will continue to evolve, and we welcome that because it is great to see companies really driving the development of local capabilities so they are able to play more and more in the O&G industry in Malaysia,” she says.

Siti Hurrairah, a Shell scholar who has built her career within the group, is Shell Malaysia’s first woman country head.

In both the upstream and downstream segments, efforts are being made to decarbonise, including rooftop solar installations in 287 retail sites and renewable energy for offshore platforms Timi (solar-wind hybrid) and Rosmari-Marjoram (solar).

Shell is also evaluating the commercial viability of carbon capture and storage in Malaysia, alongside Petroliam Nasional Bhd.

Nationwide, the group operates 950 retail fuel stations, close to 200 electric vehicle charging points, and over 800 Shell Select stores, with plans to hit 80 Shell Café sites by year end as part of efforts to grow the non-fuel retail products segment.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport

-

Big market marred by poor upkeep