Young black man looking at phone while on the London Overground

There’s more to successful income investing than choosing stocks with the biggest dividend yields. Buying FTSE 100 and FTSE 250 stocks with enormous yields for this year could do little for creating a long-term second income if dividends slump beyond this.

More important to me is finding companies that can pay a healthy dividend today and steadily grow it over time. This is why it can be a good idea to invest in stocks that have:

- Impressive records of earnings growth, helped by things like diversified revenue streams and competitive advantages (or economic moats, an essential quality sought by Warren Buffett)

- Robust balance sheets (this can include strong cash flows and low debt levels)

- Long histories of dividend hikes and sustainable payout ratios

- Resilience to broader economic conditions

With all of this in mind, let me talk you through a FTSE 250 dividend share I think could help me build a brilliant passive income over the next decade: Chemring Group (LSE:CHG).

Defence giant

Purchasing stocks that provide defence technologies could be a shrewd move as the world embarks on a new era of rapid rearmament. Fresh International Institute for Strategic Studies (IISS) data shows that global defence expenditure soared 9% in 2023 to a record $2.2trn. And the body expects the figure to rise again this year.

Countermeasures manufacturer Chemring is already thriving in this period of renewed Western arms spending. In the 12 months to October 2023, its order intake rose 37% year on year, to £756m. This uptick bodes well for dividends in the current financial year as well: almost 80% of expected revenues for fiscal 2024 are now covered.

Chemring’s share price has rocketed on the back of this demand upswing. But at current prices of 349p, it still carries exceptional value: a forward price-to-earnings growth (PEG) ratio of 0.4 sits well below the accepted value watermark of one.

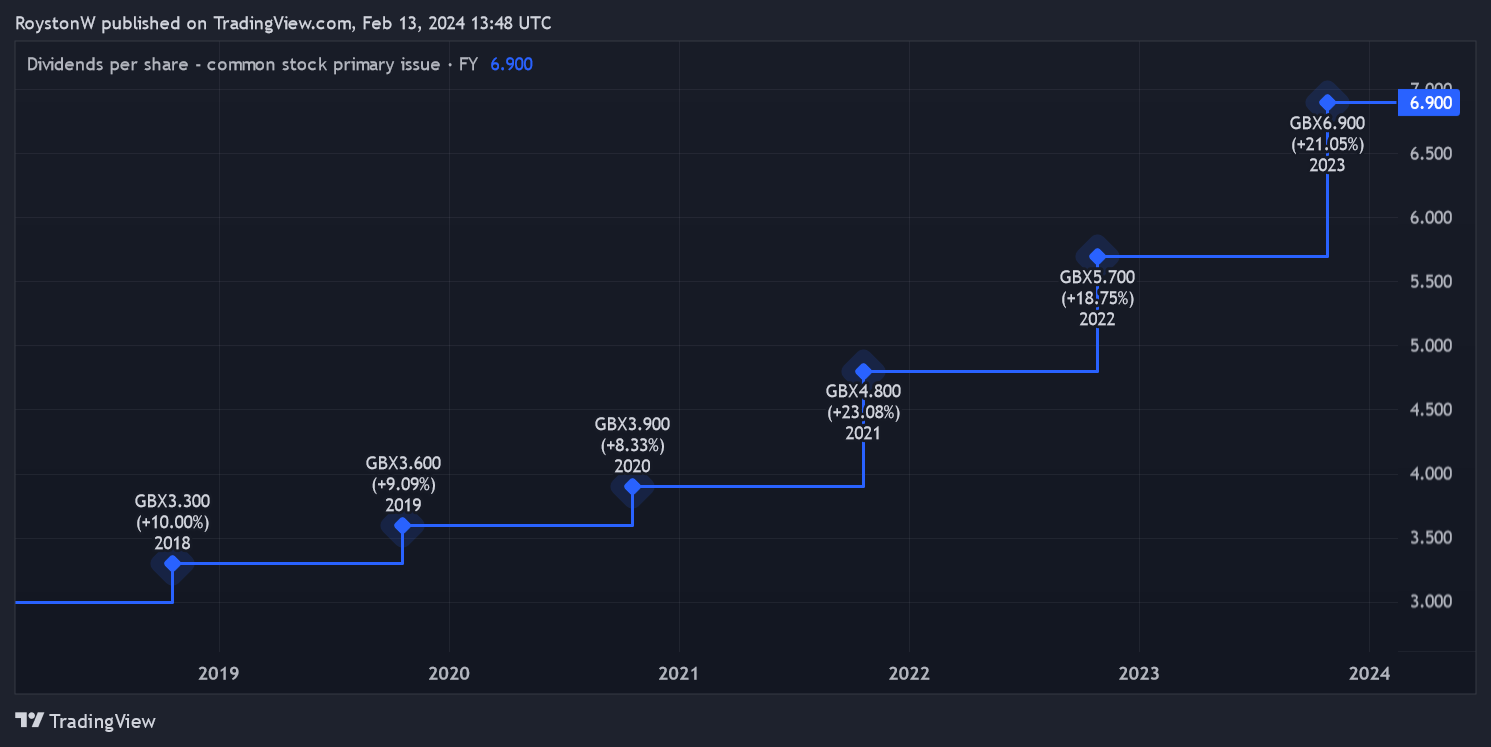

I’m not put off by the FTSE 250 company’s modest 2.2% dividend yield for this year. I believe the potential for rapid dividend growth — supported by its healthy cash flows and focus on the stable defence sector — makes it a great income stock to own today.

Chemring has grown shareholder dividends rapidly since 2017. Chart created with TradingView

A top dividend stock

It’s important to remember that dividends are never guaranteed. And even Chemring has been known to deliver disappointing dividends in the past. In 2016, for example, the business cut the dividend in response to project delays.

But the company is in better financial health to withstand any such dangers today. Its net debt to underlying EBITDA stood below 0.2 as of October. And the defence market outlook is far stronger now than it was during the mid-2010s.

I think Chemring shares could be an excellent way to make a passive income over the next decade. So I’ll be looking to add it to my own portfolio when I next have cash to invest.

Like buying £1 for 51p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this recent ‘Best Buy Now’ has a price/book ratio of 0.51. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 51p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 8.5%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

See the full investment case

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report