This Forecasting Tool Is Sending Its Strongest Warning Since the Great Recession. It Could Signal a Big Move in the Stock Market.

Many economists forecast a recession in 2023 as scorching inflation and rapidly rising interest rates threatened to choke the economy, but that downturn never materialized. In fact, the U.S. economy expanded 2.5% in 2023, an acceleration from 1.9% in 2022.

However, consumer spending and business investments slowed in the first quarter of 2024, such that U.S. economic growth slowed to 1.6%, much lower than the 2.5% growth analysts anticipated. Admittedly, many pundits still believe the U.S. will avoid a downturn. But stubborn inflation, elevated interest rates, and rising consumer debt undoubtedly pose a risk, and a few economic indicators are currently sounding a recession alarm.

For instance, the Treasury yield curve has been inverted since late 2022. The three-month Treasury bill currently pays a higher interest rate than the 10-year Treasury note, and the exact same inversion has preceded every recession since 1969 with zero false positives.

Additionally, the Conference Board Leading Economic Index (LEI) has fallen 13.1% from its record high in December 2021. The index hasn’t declined that sharply since the Great Recession, and it could portend a decline in the S&P 500 (SNPINDEX: ^GSPC). Here’s what investors should know.

The Conference Board Leading Economic Index has fallen sharply from its record high

The Conference Board Leading Economic Index is a predictive indicator that anticipates turning points in the business cycle. The index incorporates 10 economic variables into a single number each month. Sequentially higher numbers suggest the economy is strengthening, and sequentially lower numbers suggest the economy is weakening. The 10 variables are listed below.

- Average weekly hours worked by production workers in manufacturing

- Average weekly initial claims for unemployment

- New consumer goods and materials orders placed by manufacturers

- New orders placed by customers of manufacturing firms

- New nondefense capital goods orders (excluding aircraft) placed by manufacturers

- Building permits for new private housing units

- Changes in the S&P 500 index

- Changes in a proprietary credit index comprising six financial indicators

- Interest rate spread between the 10-year Treasury and the federal funds rate

- Average consumer expectations for business and economic conditions

The Conference Board LEI has been a relatively reliable recession forecasting tool since 1969. Whenever the LEI has declined at least 5% from its peak, a recession has generally followed within 21 months. There have only been two exceptions to that rule.

The first exception was the July 1981 recession. The LEI had yet to recover from the January 1980 recession, meaning it never had a chance to decline 5% from its peak. The second exception is the current situation. The Conference Board LEI last peaked in December 2021, which was 28 months ago and counting.

The chart below shows (1) each month the Conference Board LEI hit a record high before subsequently falling 5%, (2) the start date of each recession since 1969, and (3) the time that elapsed between the LEI’s peak and the onset of a recession.

Data Source: National Bureau of Economic Research. The Conference Board, Trading Economics.

The Conference Board LEI last peaked at 117.8 in December 2021, and it has since declined 13.1% to 102.4. The index has not fallen so sharply from its peak since the Great Recession. Also noteworthy, 28 months has elapsed since the Conference Board LEI last peaked, but the U.S. economy has continued to expand. Never before has the index been at least 5% below its high for so long without a recession.

In short, the Conference Board LEI is sounding its most severe recession warning since the financial crisis. Of course, the alarm could be a false positive. But should a recession occur, history says the S&P 500 would decline sharply.

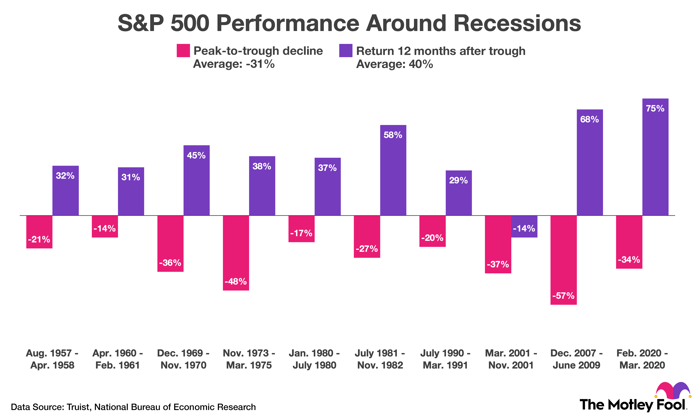

The S&P 500 has declined by an average of 31% during recessions

The S&P 500 was created in March 1957, and the index is widely regarded as the best benchmark for the overall U.S. stock market.

The chart below shows (1) the S&P 500’s peak-to-trough decline during past recessions and (2) the S&P 500’s return during the 12-month period following its recessionary trough.

A chart showing the S&P 500’s peak-to-trough decline during past recession, as well as the S&P 500’s return during the 12-month period following the trough.

As shown above, the S&P 500 has declined by an average of 31% during recessions. While that figure is unsettling, there is a silver lining for investors: The index has normally rebounded quickly. The S&P 500 has returned an average of 40% during the 12-month period following its recessionary trough.

Readers may be wondering: Should I sell my stocks now and buy them back after the recession? I would answer that question with an emphatic “no!” for two reasons. First, while the Conference Board LEI is sounding a recession alarm, no forecasting tool is perfect and there is no guarantee a downturn will occur. Second, even if a recession does occur, investors who sold their stocks would probably miss out on big gains because predicting the rebound is impossible.

Here’s the bottom line: Investors should be cautious in the current economic environment, but not so cautious as to exit the stock market.

SPONSORED:

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,959!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.