Silhouette of a bull standing on top of a landscape with the sun setting behind it

The answer to the headline: InterContinental Hotels Group (LSE:IHG). Over the last decade, the stock’s up 182%, compared with a 21% increase for the FTSE 100.

This is the result of some strong growth from the underlying business. IHG has increased its revenues at an average of 12% a year and I think there could well be more to come.

Outperformance

It’s not just the last 10 years. Shares in InterContinental Hotels Group have been outperforming the index on a consistent basis.

| InterContinental Hotels Group |

FTSE 100 |

| Year-to-date |

5% |

13% |

| 1 year |

45% |

3% |

| 5 years |

62% |

9% |

| 10 years |

182% |

21% |

IHG has managed impressive revenue growth during that time. But there’s something far more important that explains why the stock’s performed so well.

InterContinental runs a franchise model. That means it doesn’t own the hotels in its network – it takes a fixed percentage of revenues in exchange for its marketing, know-how, and booking system.

There are two main advantages to this. The first is the business is protected from inflation since energy and staff costs are left to individual operators who own the properties.

The other is that it costs almost nothing to add new hotels to its network. This means the company can grow its revenues while using its free cash for shareholder returns.

Can it continue?

With 90% of the cash it generates available to shareholders, IHG has an attractive business model. But the stock isn’t cheap – the market-cap is £13bn for a company generating £650m in free cash.

That means there’s risk for shareholders. The firm’s going to have to keep growing in order to justify is current share price.

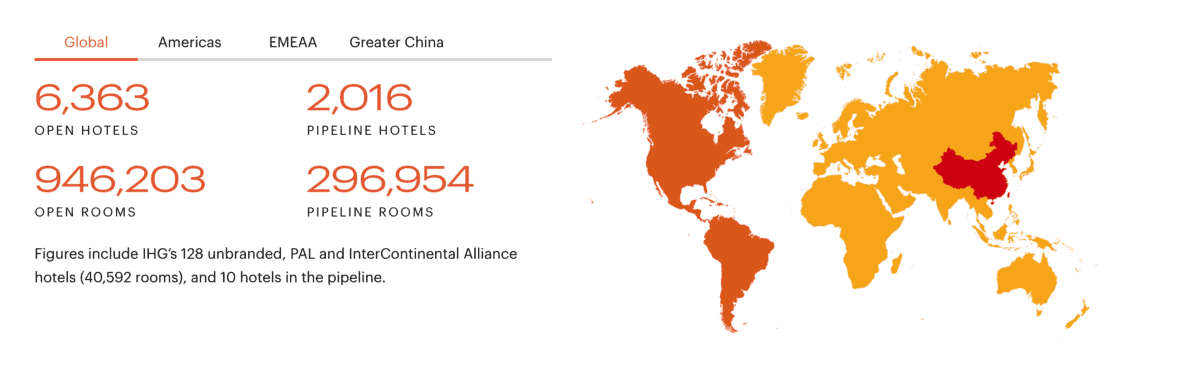

There’s reason to think the company has good growth prospects though. It currently has 2,016 hotels planned with 296,954 rooms in its pipeline.

For context, IHG’s network currently consists of 6,363 hotels with 946,203 rooms. So there’s a lot of scope for further growth to come online.

Source: InterContinental Hotels Group Investor Relations

As a result, I think the stock can keep doing what it’s been doing over the last decade – outperforming the FTSE 100 as the underlying business grows. And a high price tag doesn’t put me off that.

What this means for investors

There are three things to note about InterContinental Hotels Group. First, it’s an unusually good stock that has consistently outperformed the FTSE 100.

Second, the business has scope to keep growing in the way it has done over the last decade. That means it could well turn out to be a great investment, even after a 182% increase in its share price.

Third, the company’s success has been the result of an ability to grow without having to use the cash it generates. That’s a good sign for other businesses that can do the same.

Pound coins for sale — 31 pence?

This seems ridiculous, but we almost never see shares looking this cheap. Yet this Share Advisor pick has a price/book ratio of 0.31. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 31p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 10%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

See the full investment case

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended InterContinental Hotels Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related

-

, Nov. 28 — One of the most anticipated Android releases for 2023 has been the Google Pixel 8 lineup. The Pixel series is often considered the best of what Android has to offer since it brings the true stock Android experience. The Pixel 8 Pro was globally released on ...

See Details:

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

A blank space or an (NR) indicates no readings received. An (e) indicates that the water level has been estimated. An (w) indicates that the conditions were very windy, resulting in an inaccurate reading. Omatjenne Dam does not have abstraction facilities. The dam contents are according to the latest dam ...

See Details:

Namwater Dam Bulletin on Monday 27 November 2023

-

Dhaka, Nov. 27 — Nobel laureate Dr Muhammad Yunus has been appointed chair of the international advisory board of Moscow’s Financial University (under the government of the Russian Federation). On November 23, he joined a high-level strategic meeting with Prof Stanislav Prokofiev, Rector of the Financial University, and his colleagues. ...

See Details:

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

In a pivotal encounter at the International Cricket Council (ICC) Twenty20 World Cup Africa Final Monday, the Cricket Cranes faced Nigeria, knowing that a win could significantly boost their chances of securing one of the coveted tickets to the 2024 T20 World Cup in West Indies and the USA.Nigeria won ...

See Details:

Victory over Nigeria puts Uganda on the brink

-

Capture 1 The Bank Ghana (BoG) Monetary Policy Committee (MPC) has maintained the key policy rate at 30 percent, while introducing additional liquidity management measures to address excess liquidity and reinforce the disinflation process. Announcing the committee’s decision on Monday following its 115th meeting, BoG Governor Dr. Ernest Addison said ...

See Details:

BoG holds policy rate at 30%, tightens liquidity measures

-

Renita Holmes has been displaced four times in the past three years by rising rents With sea levels rising around the globe, Miami, in the US state of Florida, is facing an urgent need to adapt. As property investors turn their gaze inland, away from the exclusive low-lying beach area, ...

See Details:

When sea levels rise, so does your rent

-

Picture2 In a groundbreaking moment, Mrs. Adelaide Siaw Agyepong, CEO-American International School, has achieved yet another milestone by being crowned ‘Icon of Inspiration and Impact for the Year 2023’. The crowning achievement took place in Accra, where Mrs. Siaw Agyepong surpassed contemporaries to clinch this prestigious title at the 5th ...

See Details:

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Sierra Leone prison breaks co-ordinated - minister

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Address the rise of single parenthood

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Unmarried People Under 35 Outnumber Married Ones

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

European interior ministers in Hungary to discuss migration

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone

OTHER NEWS

Despite doing education at the university, Mellon Kenyangi, also known as Mama Bear, did not think of going to class, and teaching students was her dream job.“Since it was not ...

Read more »

213 Sri Lanka Cricket’s Chairman of Selectors, Pramodya Wickramasinghe reported to the Sports Ministry’s Special Investigation Unit( SMSIU) for the Prevention of Sports Offences yesterday for the second day. He ...

Read more »

137 Malindu Dairy (Pvt) Ltd., a leading food production company in Sri Lanka, won the Silver Award in the medium-scale dairy and associated products category at the Industrial Excellence Awards ...

Read more »

Africans Urged to Invest Among themselves, Explore Investment Opportunities in Continent Addis Ababa, November 27/2023(ENA)-The Embassy of Angola in Ethiopia has organized lecture on the “Foreign Investment Opportunities in Angola ...

Read more »

144 The dynamic front row player Mohan Wimalaratne will lead the Police Sports Club Rugby team at the upcoming Nippon Paint Sri Lanka Rugby Major League XV-a-side Rugby Tournament scheduled ...

Read more »

Dozens of people living with disabilities from New Hope Inclusive in Entumbane, Bulawayo on Saturday last week received an early Christmas gift in the form of groceries. The groceries were ...

Read more »

The East African Community (EAC) Summit of Heads of State has admitted the Federal Republic of Somalia to the regional bloc, making it its 8th member country. The decision was ...

Read more »