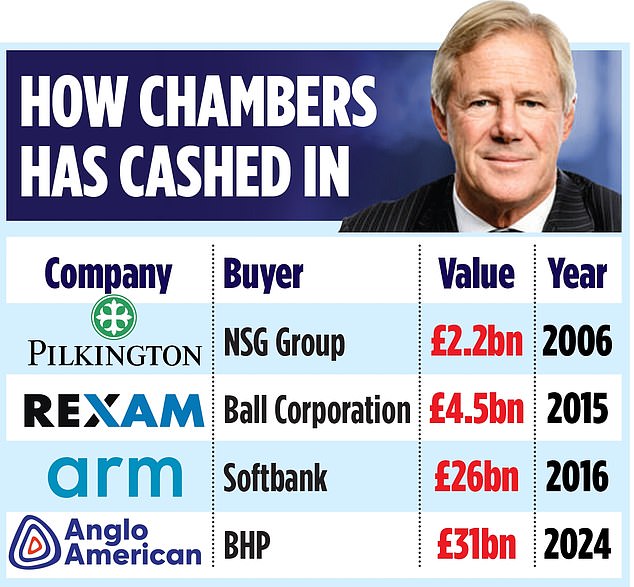

City grandee Stuart Chambers is under fire as yet another British business he leads is at risk of being sold off to a foreign predator.

Mining giant Anglo American was this weekend forced to defend the record of Chambers, its chairman, after it received a £31 billion bid from rival BHP.

Chambers – who has presided over the sale of a string of blue chip companies – rejected BHP’s all-share offer to create the world’s biggest copper miner.

He said the bid was ‘opportunistic’ and significantly undervalued the London-listed company.

But critics point out that Chambers, 67, has a track record of selling other household name companies when he was at the helm. He also has close ties with Sir Nigel Rudd, who was nicknamed Sir Sell Off after presiding over the sale of a seires of flagship British firms.

Driving force: Stuart Chambers has presided over the sale of a string of blue chip companies

City experts say Anglo, which also owns the De Beers diamond group and the Woodsmith mine in north Yorkshire, is firmly ‘in play’ as other rivals could also swoop with a bid. Most controversially, Chambers oversaw the £26 billion sale of home-grown chip designer Arm Holdings to Japanese investment company Softbank in 2016.

Arm went on to snub London for a listing on the New York stock exchange where it is now valued at over £80 billion.

Chambers was chairman of FTSE 100 drinks can-maker Rexam when it was bought by US rival Ball Corporation in 2015.

He was also chief executive of glass manufacturer Pilkington, one of Britain’s most emblematic companies, when it was bought in 2005 by Japan’s Nippon Sheet Glass. He went on to run that company. Chambers’s chairman at Pilkington was Rudd, who oversaw the disposal of companies including retailer Boots, defence giant Meggitt and engineer Invensys to foreign owners.

A senior City advisor told the Mail on Sunday that Chambers still deeply regrets the Arm sale, which highlighted the London stock market’s growing inability to attract and retain top companies. However, an Anglo insider insisted Chambers ‘wasn’t remotely embarrassed’ by the Arm sale and claimed his critics were driving ‘in the rear view mirror’.

‘The chair doesn’t single-handedly make these decisions, it’s for the board and then shareholders to decide,’ the source said.

‘It’s just not reality that one individual controls events.’ Analysts say Sydney-based BHP will have to come back with a higher offer to win over Anglo’s shareholders. Under City takeover rules BHP has until May 22 to make a firm offer for Anglo or walk away.

The rush of British firms to the exit has accelerated this year with Darktrace on Friday agreeing a £4.2 billion sale to a US suitor in the latest blow to London.

Jeremy Hunt will hold a summit next month at the Chancellor’s weekend residence, Dorneywood, aimed at stemming the exodus.

ALEX BRUMMER: Open season on British businesses

The London stock market is having a torrid time.

America’s biggest corporations and private equity funds see easy pickings and are swooping on undervalued companies, some of them badly run, allowing valuable technology, patents and brands to move overseas. It has also become difficult to attract the most desirable floats to the City.

The careless explanation is Brexit. Yet the biggest money spinners for the City, including foreign exchange, derivatives and investment banking advisory services, have prospered since the UK left the European Union.

Until the late 1990s more than one-third of the equity in British-quoted firms were held in the pension funds of our biggest corporations.

Changes in regulation and the abolition of tax benefits for payment of dividends saw retirement money flee overseas for better returns.

As a result, less than five per cent of UK shares are held by funds with strong commitment to Britain.

This has made it open season on British businesses.

News Related

-

Asylum seekers travel in an inflatable boat across the English Channel, bound for Dover on the south coast of England (Photo: Ben Stansall/AFP) Up to 40 Conservative MPs are poised to rebel over Rishi Sunak’s Rwanda deportation policy as they question ministers’ commitment to the scheme. A major row is ...

See Details:

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

In the saltmarsh fringing where the Ballyboe River dissolves into Trawbreaga Bay, a little egret wears its plumage like a windblown stole. Our car swoops across the 10 arches of Malin bridge and we park along the village green. Malin is almost as far north as you can get on ...

See Details:

Country diary: A tale of three churches

-

Photograph: Chris Ratcliffe/EPA Hampton Court is an enduring monument to the power of Henry VIII, a pleasure palace down the Thames from Westminster and the City of London. On Monday it was the scene of power projection of a different kind, as Rishi Sunak pitched for investment from some of ...

See Details:

Sunak woos business elite with royal welcome – but they seek certainty

-

-

Tottenham interested in move to sign “fearless” £20m defender in January Tottenham Hotspur have joined the race to bring an overseas defender to the Premier League in January, according to a fresh report. Postecoglou’s centre-back options The Lilywhites currently have Micky Van De Ven, Ashley Phillips, Cristian Romero and Eric ...

See Details:

Tottenham interested in move to sign “fearless” £20m defender in January

-

A £100m campaign urging households and businesses to use less water will be funded from customers’ bills, Ofwat has said. Bill payers to stump up cost of £100m water usage campaign The regulator’s chief executive David Black told MPs that if the measures worked it would be cheaper than building ...

See Details:

Bill payers to stump up cost of £100m water usage campaign

-

FILE PHOTO: Soccer Football – FIFA Women’s World Cup Australia and New Zealand 2023 – Group B – Canada Training – Olympic Park, Melbourne, Australia – July 24, 2023 Canada’s Christine Sinclair during training REUTERS/Hannah Mckay/File Photo (Reuters) – BC Place in Vancouver, British Columbia, will be renamed “Christine Sinclair ...

See Details:

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

Hamilton heads for hibernation with a word of warning

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

This exercise is critical for golfers. 4 tips to doing it right

-

Michael van Gerwen is hunting down a fourth World Championship title (Picture: Getty Images) Michael van Gerwen is Phil Taylor’s tip to lift the World Darts Championship trophy for a fourth time in January, expecting a backlash from the recent defeat in the Players Championship Finals. The 2024 World Championship ...

See Details:

One in three households with children 'will struggle to afford Christmas'

-

OTHER NEWS

Kobbie Mainoo made his first start for Man Utd at Everton (Photo: Getty) The Football Association are reportedly confident that Manchester United starlet Kobbie Mainoo will choose to represent England ...

Read more »

Michael Smith will begin the defence of his world title on the opening night (Picture: Getty Images) The 2024 World Darts Championship is less than three weeks away and the ...

Read more »

For the first time a long haul commercial aircraft is flying across the Atlantic using 100% sustainable aviation fuel (SAF). A long haul commercial flight is flying to the US ...

Read more »

The King has met business and finance leaders from across the world at a Buckingham Palace reception to mark the conclusion of the UK’s Global Investment Summit. Charles was introduced ...

Read more »

After Ohio State’s 30-24 loss to Michigan Saturday, many college football fans were wondering where Lou Holtz was. In his postgame interview after the Buckeyes beat Notre Dame 17-14 in ...

Read more »

Darius Slay wouldn’t have minded being penalized on controversial no-call No matter which team you were rooting for on Sunday, we can all agree that the officiating job performed by ...

Read more »

New England Patriots quarterback Mac Jones (10) Quarterback Mac Jones remains committed to finding success with the New England Patriots even though his future is up in the air following ...

Read more »