(SPOT.ph) April could be the official start of the summer season in the Philippines but for individual taxpayers (and accountants!), vacation leaves are only filed once they have processed their annual income tax return for the previous year. While private and government employees typically don’t need to file these returns themselves, those who are self-employed, mixed-income earners, and practicing professionals are mandated to process their annual ITRs on their own using the forms 1700, 1701A, and 1701 forms and pay corresponding tax dues.

Overwhelmed already? Whether you’re a first-time entrepreneur, a freelancer, a mixed-income earner, or a professional practitioner with no bookkeeper to help you, you can use this updated comprehensive guide to navigating annual income tax return filing under the existing tax laws. Soon, you’ll be breezing through the usually complicated process and booking that much-deserved holiday trip come summertime.

Understanding the Annual Income Tax Return for Filipino Taxpayers

The Income Tax Return (ITR) is an actual tax obligation you pay annually every 15th day of April of the succeeding year. It provides a summary of all your income (or loss) you have made in the past year. As a responsible citizen, your tax compliance signifies your professional integrity and intention to contribute to nation-building efforts.

While it’s understandable that you might not directly feel the impact of your contributions to the national treasury, you surely don’t want to miss out on some perks of filing your ITRs regularly. Among them includes:

- Access to home financing, car, and bank loans. Let’s face it: in the Philippines, you’re not a legit income earner unless you can provide legal documents for the processing of financial transactions. In fact, the first base, which is creating a bank account, could also trigger background checks and financial records to establish the legitimacy of your bread-and-butter a.k.a. source of income. Without a duly signed ITR stamped by the bank or the Bureau of Internal Revenue (BIR) itself, you might have a hard time accessing loans for your #homegoals and dream car.

- Travel Goals. Are you eyeing those envy-inducing travels of Instagram influencers? Well, you’ll probably need proof of income in the form of a stamped ITR to present to the immigration prior to flying internationally. Some people were asked for such a document and were offloaded when they couldn’t provide one. It’s better to be prepared than miss your flight and vacation altogether.

- Proof of Business Legitimacy. If you’re practicing your profession as a doctor, lawyer, engineer, or any vocation where you are your own boss (e.g. with a clinic or a firm), you need to establish your reputation and legitimacy, which can result in business expansion and larger clientele. Through the tax certifications you post on your building and even your own official receipts (OR), you can rest assured that you’re miles away from being locked down for non-compliance (hello, Oplan Kandado program) and incurring hefty penalties.

- Bragging Rights. Nothing says “responsible citizen” better than being an active taxpayer. Not only you can sleep soundly at night but you’ll also get to promote your gigs, businesses, or contracts without the fear of being tagged as an individual with questionable wealth. Bonus: You’ll also have the moral right to criticize government spending and misgivings because you’re a legitimate taxpayer who contributes to nation-building.

Types of Forms for Filing Annual Income Tax Return (ITR)

Thanks to the Tax Reform Laws (TRAIN), the filing process for annual income tax returns has been made easier for individual taxpayers. Here are 3 types of forms that you can access via eBIRforms, a software dedicated to tax filing for specifically mandated taxpayers:

- Form 1700. Use this form if your main source of income is your employment. Unlike a regularly employed individual, you’re required to file ITR through this form if and only if you have two or more job employments and are earning from each. Using this form, you’ll have to sum up all your employment income for the past year and deduct all payroll taxes that have been withheld by your employers. Take note that you can’t qualify for substituted filing (meaning, your employer will file on your behalf) because you’ve got more than one employer and that would complicate the process if you don’t file your ITR yourself.

- Form 1701. This is applicable to you if you’re an employee AND are currently earning income from your business or side hustles (e.g. freelancing, consultancy gigs, etc.). Also, if you’ve chosen the Graduated Tax rate with an Itemized Deduction Method, you’ll be required to use this form to fill out fields pertaining to specific income deductions.

- Form 1701A. This form is reserved for those individuals whose income derives from their businesses or professional practice. It is actually a new form that you can use if you have opted for the Optional Standard Deduction Method (OSD) or have chosen the 8% standard income tax rate in the past year.

How to File Annual Income Tax Return

Depending on your taxpayer type and chosen taxation method, your ITR filing can be straightforward or a bit detailed. But don’t worry; with the introduction of the Ease of Paying Taxes Law, you can rest assured that it no longer reeks of red tape and complicated processes.

- For Individuals Earning Less than P250,000 Per Year. You’ll be exempted from paying income taxes if you fall under this threshold. Still, while you’re not required to pay any cent, you need to file zero tax due and that’s it.

- For Individuals with More Than P250,000 Annual Income. Either you choose the 3% percentage tax with an income tax due, or opt for the 8% Gross Receipt Tax that cancels the percentage tax. However, these options aren’t for everybody. More on this computation in the next section.

Computation of Tax Dues

Before you hit that “Fill Up” button on your eBIRForms, you must check first if your Certificate of Registration (COR) indicated that you availed an 8% Income Tax Rate of the Graduated Income Tax Rate. This will determine which fields and deductions are applicable for calculating your tax dues.

-

If you’re on the 8% Income Tax Rate and a taxpayer whose income is solely derived from your business or profession, your tax dues will be computed as:

Tax Due = 0.08 x (Gross Income/Sales – P250,000)

-

If you’re a mixed-income earner whose income comes from combined employment and business, here’s how your tax due is computed:

Tax Due = 0.08 x Gross Sales + Tax Due on Employment Compensation

Take note that the P250,000 deduction won’t apply for mixed-income earners, as this is already deducted from the tax due on their employment compensation. Hence, the said deduction no longer applies to business income.

- If you’re on the Graduated Income Tax Rate, check your COR first whether you’ve opted for the Itemized Deduction or Optional Standard Deduction (OSD).

Don’t be confused, though. Here’s how these two options work: OSD allows you to claim a deduction of 40% from your gross sales or receipts for the quarter, while Itemized Deduction requires you to specify and deduct all the ordinary and necessary expenses from your gross income. These expenses must be attributed to the development, management, and operation of your business like travel and salaries; meaning NO personal expenses must be included. Take note that neither of these options is available for you if you opt for the 8% IT rate:

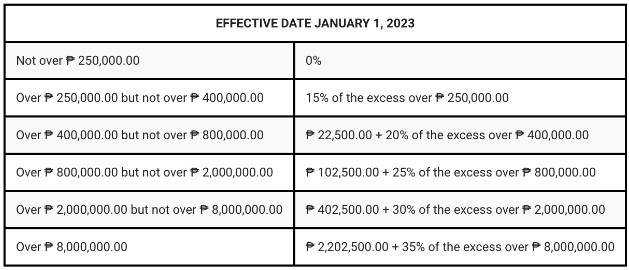

computation of tax dues

Manual Tax Filing

If you’re mandated to file manually (e.g. if you’re a person with a disability, senior, etc.), you should process your annual income tax return by manually printing the 1700 form series from eBIRForms or filling up the specific forms at BIR.

- Download, fill out, and print 3 copies of the required BIR Form.

- If you have a tax due to pay, go to your Revenue District Office (RDO)’s accredited bank where you are registered. Present your accomplished BIR form along with other requirements.

- Keep your own copy of your validated and duly stamped BIR form to serve as your proof for accomplishing the filing of ITR.

Electronic BIR Forms (eBIRForms)

Meanwhile, the BIR has already adopted seamless tax filing and payment channels to ensure convenience for taxpayers. No more long lines, just a few clicks and you’re all set.

- Go to the BIR website and click “eServices.”

- Download the offline eBIRForms package.

- Access the package. Select the required tax return.

- Fill up the required form and save a copy of the finalized tax return.

- Submit the accomplished form to the eBIRForms system.

- BIR will email to confirm receipt of your income tax return.

- Pay your tax dues through the nearest AAB of your RDO.

Deadline for Annual Income Tax Return Filing

You need to submit and file your ITR on or before April 15. In the event that the date falls on a holiday or a weekend, it may likely be moved. Still, it’s best to file and pay your dues before this date to avoid incurring huge penalties (P1,000 for late filing + surcharge if with tax dues). The good thing is you can initiate filing as early as January 1 to avoid delays, especially if you’re using eBIRForms software.

News Related-

Recall Just Announced For Popular Cookies Featured In Holiday Gift Baskets

-

Eagles rally past Bills in overtime as Chiefs win

-

Reality bites the green energy agenda

-

Sandigan orders Marcos Sr. pal to pay workers

-

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated

-

The mayor of Paris is making a loud exit from X, calling the platform a 'gigantic global sewer'

-

Rain showers, thunderstorms over Luzon, including Metro Manila — Pagasa

-

'Naruto' live-action film adaptation is in the works

-

NASA Highlights Stingray Nebula

-

Manila's Lagusnilad underpass opens

-

China probes debt-ridden financial giant

-

China's VUCA situation

-

Unraveling the mystery that is diabetes

-

Bangladesh's nuke plant is not going to steal PH investments