KUALA LUMPUR (April 23): While Sapura Energy Bhd has resolved one key condition of its reset plan, analysts maintained their recommendations on the group, as an arduous journey remains to address its balance sheet position.

The planned sale of the group’s 50% stake in SapuraOMV Upstream Sdn Bhd for RM2.27 billion to TotalEnergies Holdings SAS, coupled with RM836.3 million relief on debt obligations, was viewed as fair and expected by analysts on Tuesday.

The RM2.27 billion disposal consideration was deemed aligned with UOB Kay Hian’s minimum valuation assumption of RM2.3 billion, and largely within BIMB Securities’ RM2.5 billion fair value estimate.

“Despite the implied EV/2P (enterprise value-to-proven and probable reserves ratio) of US$5.20 per boe (barrels of oil equivalent), we deem it reasonable, as the deal was concluded when oil prices were lower,” RHB Research also said in a note.

While analysts view the sale as a key condition of Sapura Energy’s debt restructuring plan, enabling the group to pare around 22% of its total borrowings of RM10.98 billion as at end-January and saves RM100 million per year from lower finance costs, the group still has further weaknesses plaguing its balance sheet to address, according to the research houses.

“Moving forward, we think the company needs to recapitalise its debt by at least RM3 billion to RM4 billion, so that its capital structure will be more sustainable,” BIMB said.

Despite the neutral views on the disposal of the 50% stake in SapuraOMV to TotalEnergies, analysts diverge on their outlook on Sapura Energy.

BIMB maintained its ‘buy’ call on Sapura Energy, with an unchanged target price (TP) of six sen, as it expects a favourable outcome from the group’s proposed restructuring scheme amid the current upcycle in oil and gas development projects.

Meanwhile, UOB maintained its ‘sell’ recommendation on Sapura Energy. with a TP of two sen, as it underlines that the group’s ‘biggest hurdle’ remains its weakening earnings generation from other businesses.

“Based on previous management guidance, we estimate that Sapura Energy needs to generate more than RM200 million in Ebitda (earnings before interest, tax, depreciation and amortisation) per quarter to be on track in its reset plans. However, it only generated Ebitda of RM54 million in 3QFY2024 (the third quarter ended Oct 31, 2023), and RM150 million in 4QFY2024,” the research house said.

“Sapura Energy is still working on executing its RM5 billion order book, and its rig utilisation remains poor (albeit improving), as not all of Sapura Energy’s tender rig contracts are of high rates or long contract tenures, unlike other rig types like jack-ups,” it added.

RHB reiterated its ‘sell’ recommendation on Sapura Energy, with an unchanged TP of two sen. The research house noted that upside risks comprise better-than-expected project execution and stronger-than-expected contract flows.

Still long wait till PN17 exit — Jan 25, 2025 at best

That said, UOB recognised the possibility for Sapura Energy’s share price to rise, due to investors engaging in short-term trading play. However, the research house takes the view that monitoring the group’s existing ex-SapuraOMV Ebitda generation in quarterly updates is more important, and there are still downside risks.

“Even if the schemes are successful, ultimately public shareholders have to wait longer, as a potential PN17 (Practice Note 17 status) upliftment can only happen after Jan 25, 2025 at best,” UOB said.

“Hence, we advise a wait-and-see approach as a better position,” UOB added.

Analysts retained their earnings forecasts pending updates to financial models and guidance on Sapura Energy’s future Ebitda generation from its rigs, fabrication, and other offshore businesses.

Sapura Energy not out of the woods, market to closely watch ex-SapuraOMV earnings, debt recapitalisation moves

They maintained their respective Ebitda forecasts for FY2025, with UOB seeing RM480 million, BIMB at RM469 million, and RHB at RM483 million.

The group remained in the red in FY2024, as all segments bled, with a full-year net loss of RM728.4 million on revenue of RM1.1 billion. For the year, financing costs totalled RM805.51 million.

Overall, five out of the six analysts tracking Sapura Energy have a ‘sell’ recommendation, while BIMB is the sole research house recommending clients to buy the shares.

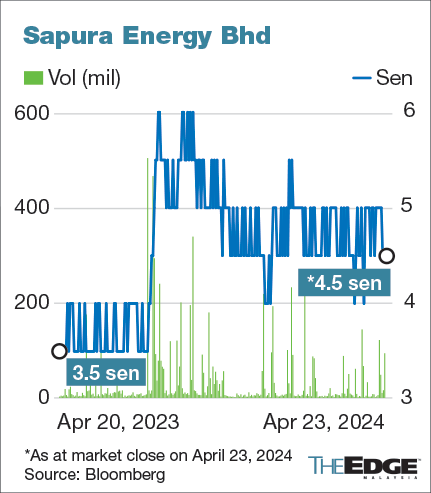

Shares in Sapura Energy ended unchanged at 4.5 sen on Tuesday, valuing the group at RM744.23 million.

Sapura Energy sells entire 50% stake in SapuraOMV for US$705m to TotalEnergies

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport