Sale of crown jewel alone won’t revive Sapura Energy

This article first appeared in The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

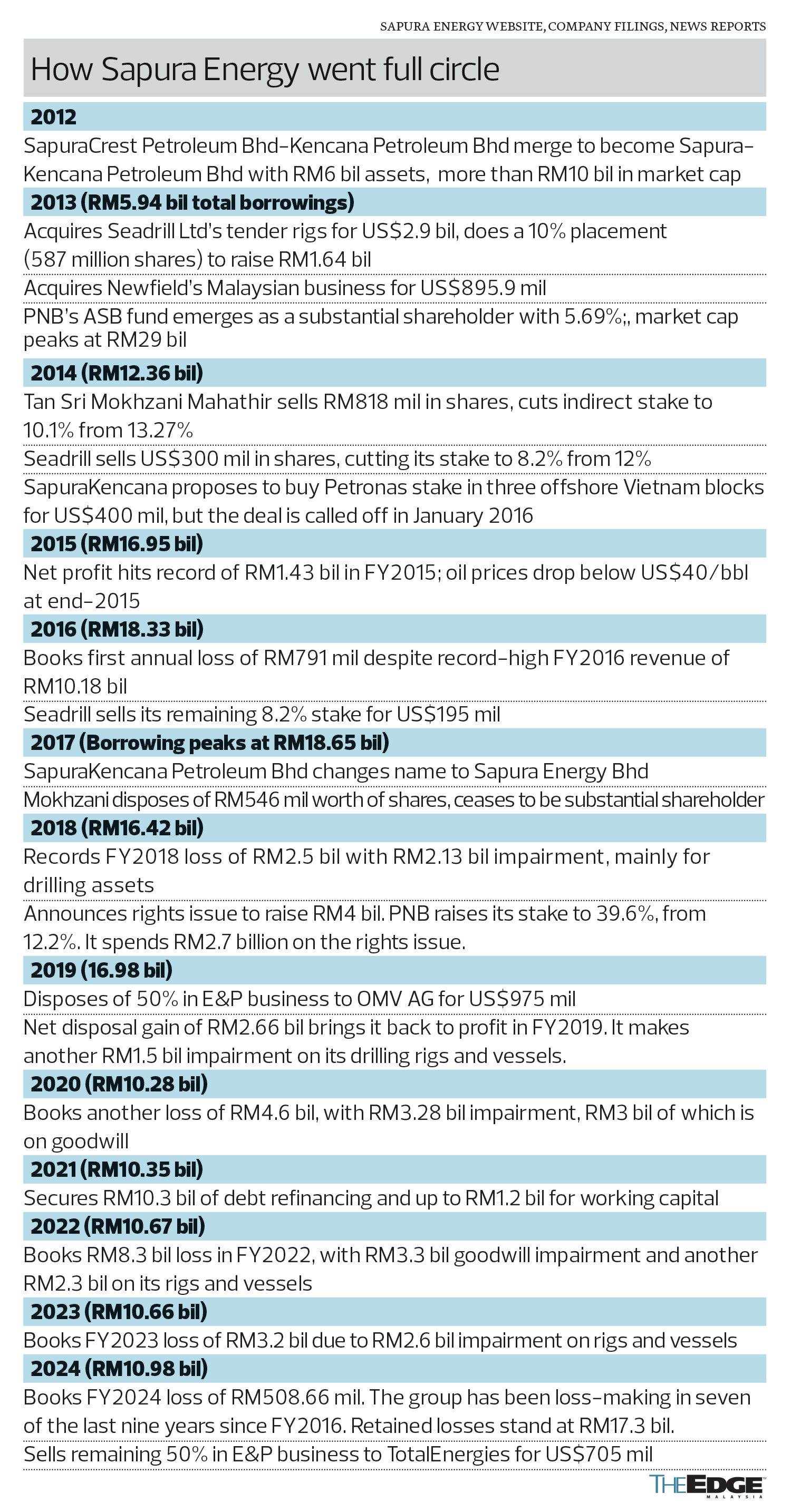

THE long-awaited sale of Sapura Energy Bhd’s remaining 50% stake in its exploration and production (E&P) unit — SapuraOMV Upstream Sdn Bhd — has finally come to pass. However, its largest shareholder, Permodalan Nasional Bhd (PNB), cannot breathe a sigh of relief yet.

Last week, the company announced that TotalEnergies Holdings SAS is buying the stake in SapuraOMV for US$705.3 million (RM3.4 billion).

The proposed divestment will see US$530.3 million satisfied in cash and the remaining US$175 million in the form of relief on debt obligations related to a financing facility extended by a unit of OMV AG to SapuraOMV.

In ringgit terms, it works out to RM2.5 billion in cash, which is a whopping sum, and RM836.3 million in relief on debt obligations.

In its announcement to Bursa Malaysia, Sapura Energy said the proposed divestment would result in a net gain on disposal of about RM793 million. Notably, the cash proceeds from the sale would be used to pare down its borrowings and any unsecured creditor claims deemed important.

In January, TotalEnergies signed an agreement to acquire OMV’s 50% stake in SapuraOMV for US$903 million, including the transfer of a US$350 million loan granted by OMV to SapuraOMV. OMV bought the stake from Sapura Energy for US$975 million in 2019. Sapura Energy had undertaken the sale to revive its financial health, in addition to making a massive rights issue.

Nevertheless, the asset sale and cash call did not do much to turn things around five years ago.

The latest sale of the remaining 50% in its crown jewel is unlikely to lift the beleaguered oil and gas company out of debt too.

Sapura Energy has borrowings of RM10.62 billion. The divestment will trim its debts by 22% to RM8.17 billion, which is still a massive amount.

The saving grace is that its finance costs will drop as a result of lower borrowings.

Fresh round of recapitalisation inevitable

BIMB Research estimates that Sapura Energy would need RM3 billion to RM4 billion for recapitalisation.

This raises the question of whether PNB would have to once again extend a lifeline to the group as it did in 2018.

PNB controls a 40.7% stake in the company, while former controlling shareholder Sapura Holdings Sdn Bhd holds a 9.18% stake. Sapura Holdings is the investment vehicle of Tan Sri Shahril Shamsudin, co-founder and former CEO of the listed entity.

In September 2018, Sapura Energy announced a RM4 billion rights issue to clean up its balance sheet, which had borrowings of some RM16 billion.

At that time, PNB was only a 12.16% shareholder. It committed to taking up any unsubscribed rights shares and also fully subscribed for Sapura Energy’s Islamic redeemable convertible preference shares (RCPS-i). The group raised RM3 billion via the rights issue of shares at 30 sen apiece, and RM1 billion via a two-for-five renounceable rights issue of new RCPS-i at 41 sen each.

In total, PNB pumped in RM2.67 billion to give Sapura Energy a lifeline. Its stake is valued at RM336.6 million based on last Friday’s closing price of 4.5 sen.

“I don’t think it (PNB injecting capital) is on the cards for now, but let us just wait for the company’s announcement on its final restructuring plan,” says an analyst when contacted.

Debts aside, UOB Kay Hian Research points out that the biggest challenge for Sapura Energy after the sale of its E&P unit is the weaker earnings generation of its remaining business.

Sapura Energy is still working on executing its RM5 billion order book, and rig utilisation, while improving, remains poor as not all of its tender rig contracts have high rates or long contract tenures, unlike other rig types like jackups, UOB KayHian comments.

Based on previous guidance by management, the research outfit estimates that Sapura Energy needs to generate quarterly earnings before interest, taxes, depreciation and amortisation (Ebitda) of more than RM200 million in order to be on track with its reset plans.

However, UOB KayHian notes that the company generated Ebitda of only RM54 million in the third quarter ended Oct 31, 2023 (3QFY2024) and loss before interest, taxes, depreciation and amortisation of RM150 million in 4QFY2024.

Some might wonder if the company will sell more assets to pare down its debts further. However, analysts do not think that is on the cards at this juncture.

Following the sale of its E&P unit, Sapura Energy’s assets will consist of fabrication yards, vessels, accommodation boats and barges, and its tender rig business.

In addition, the company still has exploration assets — the SB331 and SB332 production sharing contracts that were awarded to its subsidiary Sapura Energy Ventures in 2019.

According to UOB KayHian, Petronas had extended the concessions by three years to allow Sapura Energy to complete its minimum work commitments by Nov 19, 2024, where a failure to do so would incur a penalty.

The company fell into Practice Note 17 status on March 31, 2022, when its shareholders’ equity on a consolidated basis was less than 50% of its share capital.

Time is ticking for Sapura Energy as the deadline for its regularisation plan submission is May 31 — just five weeks from now.

The deadline has been extended twice. Will it be extended further? More importantly, will a white knight emerge if PNB does not step in again?

Sale of crown jewel alone won’t revive Sapura Energy

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.