PepsiCo (NASDAQ: PEP) recently gave investors some new reasons to feel cautious about the stock. While the company achieved solid sales growth this past year, demand slowed into early 2024, according to management’s early February update. The consumer staples company is also projecting weaker sales trends ahead as its inflation-based price increases end.

That’s unfortunate news for income investors since Pepsi and its 3% dividend yield are so popular with fans of passive income. But there’s another top dividend company that looks more attractive today and pays a hefty yield of nearly 2.5%. Let’s look at some reasons to buy McDonald’s (NYSE: MCD) right now.

Slower is OK

McDonald’s shares fell in the wake of its early February earnings report, yet investors should see that drop as a chance to pick up a quality business at a discount. Sure, comparable-restaurant sales through late December slowed to 3% in the fourth quarter from 9% for the full 2023 year. The core U.S. market notched a mildly disappointing 4% increase compared to 9% in the prior quarter as well.

The chain will bounce back with some big growth avenues it can pursue this year. Its home delivery and drive-thru channels are highly popular, for example, and the chain is planning to stress its value proposition in the coming quarters to boost customer traffic back into positive territory.

Pepsi, on the other hand, seems much more constrained by the tough selling conditions that characterize the snacks, food, and at-home beverage niches. Investors should prefer to own stocks that have more control over their own fate, like McDonald’s does.

Market-leading earnings

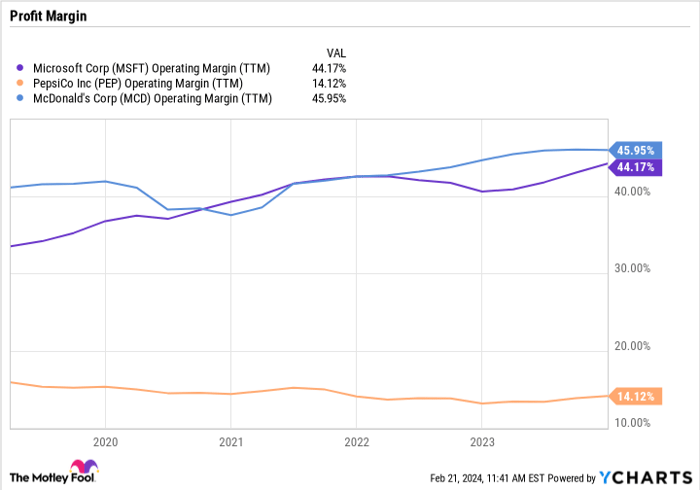

Mickey D’s doesn’t just have some of the highest profit margins in its industry, it is among the most profitable companies in any industry. Compare its nearly 50% operating profit margin with PepsiCo’s 14%, or even with the 44% that Microsoft generates right now, and that’s clear enough.

MSFT operating margin (TTM)

Most of this success can be attributed to the dividend stock’s lucrative selling model that relies on royalties, rent, and franchise fees from its huge global footprint of franchisees.

It also helps that McDonald’s maintains the world’s most valuable fast-food brand, with all the pricing power that this asset delivers. “We remain confident in the resilience of our business amid macro challenges that will persist in 2024,” CEO Chris Kempczinski told investors in mid-February.

Price and value

You’ll pay a premium for McDonald’s over PepsiCo and some other passive-income stocks, to be sure. Its price-to-sales ratio is over 8 compared to Pepsi’s 2.5, in fact. Mickey D’s also pays a more modest yield of 2.4%, while Pepsi is yielding closer to 3%.

Investors have to balance those weaknesses against the stock’s clear operating advantages. McDonald’s has shown it can grow through just about any selling environment. It can boost profit margins during booming consumer-spending periods and when shoppers are feeling price-sensitive. And through it all, the fast-food giant steadily hikes its dividend, as it has for nearly 50 consecutive years. That’s a recipe for market-beating long-term returns for patient income investors.

SPONSORED:

Should you invest $1,000 in McDonald’s right now?

Before you buy stock in McDonald’s, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and McDonald’s wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 20, 2024

Demitri Kalogeropoulos has positions in McDonald’s. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

News Related

-

, Nov. 28 — One of the most anticipated Android releases for 2023 has been the Google Pixel 8 lineup. The Pixel series is often considered the best of what Android has to offer since it brings the true stock Android experience. The Pixel 8 Pro was globally released on ...

See Details:

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

A blank space or an (NR) indicates no readings received. An (e) indicates that the water level has been estimated. An (w) indicates that the conditions were very windy, resulting in an inaccurate reading. Omatjenne Dam does not have abstraction facilities. The dam contents are according to the latest dam ...

See Details:

Namwater Dam Bulletin on Monday 27 November 2023

-

Dhaka, Nov. 27 — Nobel laureate Dr Muhammad Yunus has been appointed chair of the international advisory board of Moscow’s Financial University (under the government of the Russian Federation). On November 23, he joined a high-level strategic meeting with Prof Stanislav Prokofiev, Rector of the Financial University, and his colleagues. ...

See Details:

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

In a pivotal encounter at the International Cricket Council (ICC) Twenty20 World Cup Africa Final Monday, the Cricket Cranes faced Nigeria, knowing that a win could significantly boost their chances of securing one of the coveted tickets to the 2024 T20 World Cup in West Indies and the USA.Nigeria won ...

See Details:

Victory over Nigeria puts Uganda on the brink

-

Capture 1 The Bank Ghana (BoG) Monetary Policy Committee (MPC) has maintained the key policy rate at 30 percent, while introducing additional liquidity management measures to address excess liquidity and reinforce the disinflation process. Announcing the committee’s decision on Monday following its 115th meeting, BoG Governor Dr. Ernest Addison said ...

See Details:

BoG holds policy rate at 30%, tightens liquidity measures

-

Renita Holmes has been displaced four times in the past three years by rising rents With sea levels rising around the globe, Miami, in the US state of Florida, is facing an urgent need to adapt. As property investors turn their gaze inland, away from the exclusive low-lying beach area, ...

See Details:

When sea levels rise, so does your rent

-

Picture2 In a groundbreaking moment, Mrs. Adelaide Siaw Agyepong, CEO-American International School, has achieved yet another milestone by being crowned ‘Icon of Inspiration and Impact for the Year 2023’. The crowning achievement took place in Accra, where Mrs. Siaw Agyepong surpassed contemporaries to clinch this prestigious title at the 5th ...

See Details:

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Sierra Leone prison breaks co-ordinated - minister

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Address the rise of single parenthood

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Unmarried People Under 35 Outnumber Married Ones

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

European interior ministers in Hungary to discuss migration

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone

OTHER NEWS

Despite doing education at the university, Mellon Kenyangi, also known as Mama Bear, did not think of going to class, and teaching students was her dream job.“Since it was not ...

Read more »

213 Sri Lanka Cricket’s Chairman of Selectors, Pramodya Wickramasinghe reported to the Sports Ministry’s Special Investigation Unit( SMSIU) for the Prevention of Sports Offences yesterday for the second day. He ...

Read more »

137 Malindu Dairy (Pvt) Ltd., a leading food production company in Sri Lanka, won the Silver Award in the medium-scale dairy and associated products category at the Industrial Excellence Awards ...

Read more »

Africans Urged to Invest Among themselves, Explore Investment Opportunities in Continent Addis Ababa, November 27/2023(ENA)-The Embassy of Angola in Ethiopia has organized lecture on the “Foreign Investment Opportunities in Angola ...

Read more »

144 The dynamic front row player Mohan Wimalaratne will lead the Police Sports Club Rugby team at the upcoming Nippon Paint Sri Lanka Rugby Major League XV-a-side Rugby Tournament scheduled ...

Read more »

Dozens of people living with disabilities from New Hope Inclusive in Entumbane, Bulawayo on Saturday last week received an early Christmas gift in the form of groceries. The groceries were ...

Read more »

The East African Community (EAC) Summit of Heads of State has admitted the Federal Republic of Somalia to the regional bloc, making it its 8th member country. The decision was ...

Read more »