This article first appeared in The Edge Malaysia Weekly on April 8, 2024 – April 14, 2024

THE last few years have seen multiple challenges that tested the financial resilience of companies, from Covid-19 to the post-pandemic commodity and inflation shocks, which in turn spurred interest rate hikes that indirectly skewed global currency exchange trends.

The surprising good news from this unprecedented series of events is that there is a notable improvement in the balance sheets of Malaysian public listed companies (PLCs), judging by their debt and cash positions (net gearing or net cash), according to data compiled by The Edge and Asia Analytica.

But a higher net gearing level or lower net cash does not necessarily equate to poor performance or management of a company. Companies may choose to leverage or take on borrowings to fund capital-intensive expansion programmes such as building new factories.

Other times, shareholders prefer companies to reinvest excess cash into projects with higher yielding returns — or dividend out the funds so that the shareholders can reinvest elsewhere.

Nonetheless, companies with less debt or higher cash piles have a bigger financial buffer, which will be useful to tide them over during the bad times, as seen during the pandemic.

Cover Story: More PLCs have stronger balance sheets than before pandemic

The compiled data show that nearly half (47.6%) of the 870 Malaysian PLCs that remain listed since 2019 have improved their balance sheets compared to pre-pandemic levels (going by lower net gearing levels or higher net cash, taking into account lease liabilities and short-term investments).

This compares with 34.9% that had higher net gearing or lower net cash, and 17.5% of companies whose balance sheet position remained unchanged as measured by these two metrics, suggesting that the effects of the pandemic are well behind most of them.

At the start of 2024, more companies had lower net gearing/higher net cash on a year-on-year basis (363 companies, compared with 339 at the start of 2023). Similarly, fewer saw a y-o-y increase in net gearing or reduction in net cash (319 companies in 2023, versus 351).

Across the wider economy, Bank Negara Malaysia data show that total credit to businesses rose at a slower pace of 3.8% y-o-y to RM1.349 trillion in 2023, compared with the faster 7.6% y-o-y increase in total deposits by business enterprises (to RM848.73 billion).

That said, at least 12 PLCs were forced to delist due to unsuccessful regularisation plans in the 2020-2023 period. A quick check on Bursa Malaysia shows at least four — Dolomite Corp Bhd, Top Builders Capital Bhd, Scomi Group Bhd and China Automobile Parts Holdings Ltd — were delisted last year alone.

A divergence can also be seen: While 129 companies reduced their net gearing/improved their net cash position for two consecutive years in 2022 and 2023, a total of 137 recorded the reverse in the same period.

The screening saw 37 companies turn net cash in 2023 (having more cash than borrowings) from the year before, bringing the total number of net-cash companies to 466. Conversely, 30 companies turned net debt in the same period.

The trend suggests firms are better prepared to face uncertainties in the global economic and financial environment that could have adverse knock-on effects on the Malaysian economy in 2024, says Sunway University Business School professor of economics Dr Yeah Kim Leng.

The firms could also be ‘waiting for the storm to pass’ before committing their cash reserves to capacity expansion, upgrading or investment in new ventures, he says.

“However, the financial trends are heterogeneous as reflected by the similar number of firms which are accumulating cash and reducing gearing and firms which have lower net cash positions and higher gearing,” he adds.

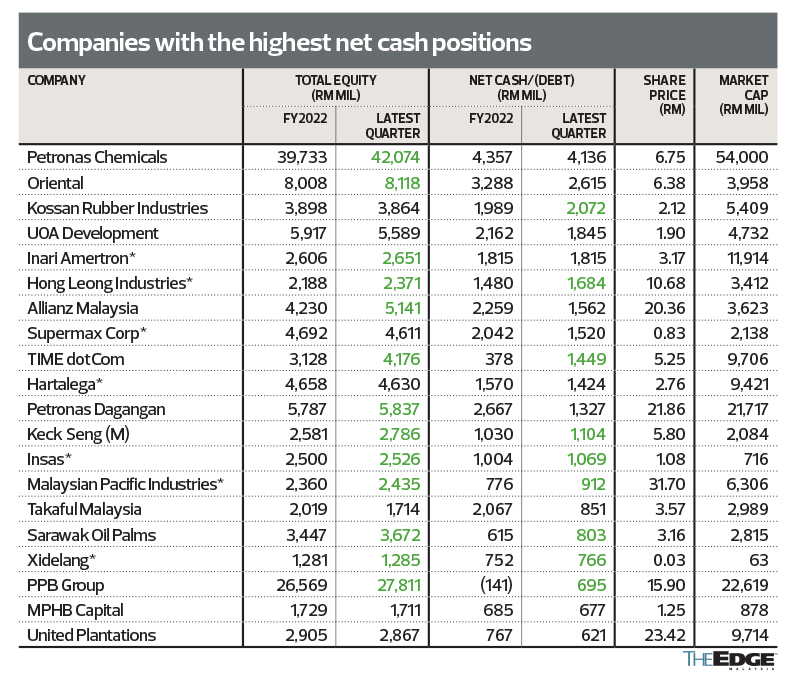

Cash-rich companies

The trend of improved balance sheet position is reflected in the valuation of the companies, as more of those with a bigger market capitalisation saw y-o-y improvement in 2023.

This is led by those with a market capitalisation above RM10 billion (50% of them saw y-o-y improvement in balance sheet), followed by those valued between RM1 billion and RM10 billion (37%), RM100 million to RM1 billion (34.8%), and below RM100 million (29.2%).

Petronas Chemicals Group Bhd leads the pack with the highest net cash of RM4.14 billion as at end-2023. Yet, this is the company’s smallest net cash pile in at least five years, compared with its recent peak of RM12.54 billion during the petrochemical price boom in financial year (FY) 2021, and RM9.47 billion in FY2019.

This is followed by Oriental Holdings Bhd with net cash of RM2.61 billion, compared with its market capitalisation of RM3.9 billion.

The Boon Siew Group-linked conglomerate, which has operations across the plantation, automotive, hospitality, plastic products and healthcare segments, raised its total borrowings and lease liabilities to RM2.76 billion as at end-2023 from RM1.88 billion the year before, against cash and short-term investments of RM5.37 billion.

Other notable net cash companies include glovemakers Kossan Rubber Industries Bhd (RM2.07 billion versus RM5.41 billion market cap as at April 4), Supermax Corp Bhd (RM1.52 billion versus market cap of RM2.15 billion) and Hartalega Holdings Bhd (RM1.4 billion versus RM9.48 billion market cap), UOA Development Bhd (RM1.85 billion versus RM4.73 billion market cap) and Inari Amertron Bhd (RM1.81 billion).

By segment, those with the highest net cash include electrical and electronics (E&E)-related companies, as well as glovemakers and plantation companies, all of which benefited from industry upturn in different years through 2020 to 2022.

It’s a different story for each sector, according to analysts contacted by The Edge.

The big glovemakers “will continue to conserve their cash as the industry has not fully recovered” despite stabilising prices and returning orders, says BIMB Securities analyst Nursuhaiza Hashim.

“The industry remains cautious due to oversupply from Chinese players who are operating at over 90% capacity at present. Overall, the current market situation has not returned to pre-Covid levels,” she says in an email reply.

For E&E players, it is normal practice to have a cash buffer in hand, which is useful for the expansions ahead, says Trident Analytics founder Peter Lim Tze Cheng.

The coming industry boom last seen in 2021 “will be much stronger” and expected to last until 2027, with artificial intelligence or AI not only raising demand for graphics processing units (GPUs, such as those produced by Nvidia) but also chips across the industry, he says.

Similarly, plantation companies are anticipated to soon utilise the cash pile boosted during the Russia-Ukraine crisis for replanting, upgrading of infrastructure, downstream expansion and potentially further acquisitions, according to CIMB Group head of Malaysia research Ivy Ng.

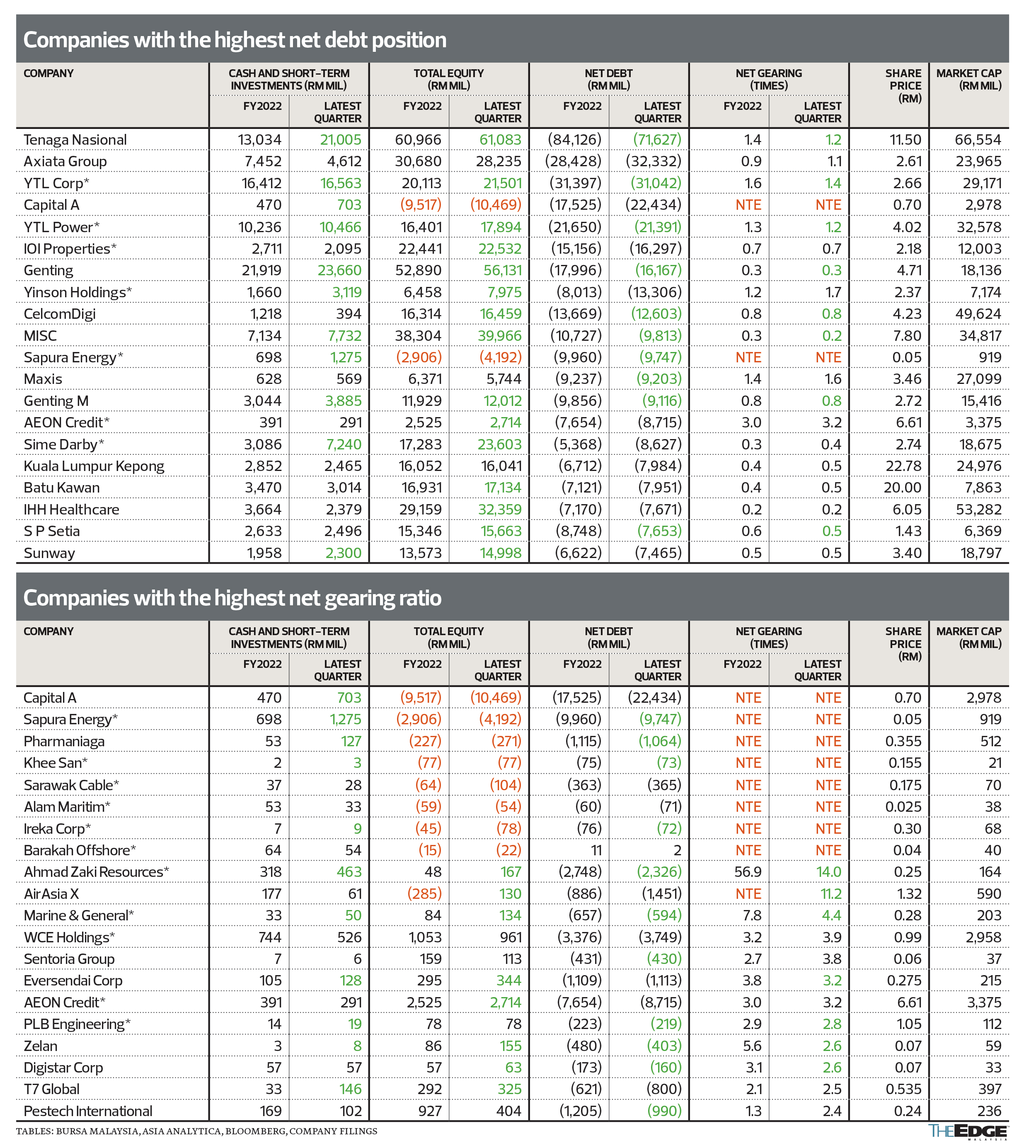

Biggest borrowers

From a net debt perspective, the biggest borrowers are in capital-intensive businesses such as power generation, oil and gas (O&G), telecommunications, property and construction, and highways.

Those with the highest borrowings (in ringgit terms) are led by Tenaga Nasional Bhd (RM71.6 billion, net gearing of 1.2 times), Axiata Group Bhd (RM32.3 billion, 1.1 times), YTL Corp Bhd (RM31 billion, 1.4 times), Capital A Bhd (RM22.4 billion including lease liabilities, negative total equity) and YTL Power International Bhd (RM21.39 billion, 1.2 times).

Notably, the two YTL counters are seeing a downward trend in net gearing, thanks to recent years of strong profits from the Singapore power generation business that boosted equity positions through retained earnings. For YTL Corp, an improvement in the earnings of 78.58% indirect-owned Malayan Cement Bhd also helped, coupled with a rebound in tourism activities that lifted earnings in its hospitality segment.

Axiata, affected by elevated borrowing costs, has continued to restructure by exiting non-performing regional markets, with the latest being Myanmar and Nepal. It still operates in Indonesia, Sri Lanka, Bangladesh, Cambodia, Pakistan, Laos and the Philippines.

Capital A is currently in the midst of seeking Bursa Securities approval for a restructuring, where it plans to spin off a brand management business in the US, and dispose of its aviation business to sister company AirAsia X Bhd to improve its equity position and exit the Practice Note 17 status.

Other notable borrowers are property outfit IOI Properties Group Bhd (RM16.3 billion, 0.7 times net gearing), Genting Bhd (16.2 billion, 0.3 times), floating O&G asset operator Yinson Holdings Bhd (RM13.3 billion, 1.7 times), CelcomDigi Bhd (RM12.6 billion, 0.8 times), MISC Bhd (RM9.8 billion, 0.2 times) and Sapura Energy Bhd (RM9.86 billion, negative total equity).

Yinson geared up to fund its project execution needs for three floating production storage and offloading (FPSO) vessels (the Anna Nery, Maria Quitéria and Agogo). The group, which has a charter order book for nine floating offshore vessels, also raised RM283 million through a private placement of 3.96% of its enlarged share capital to fund its renewable energy venture, having announced its fourth solar plant with 97MWp (megawatt peak) capacity in Peru that is expected to begin operations in the third quarter this year.

Another round of quarterly loss by Sapura Energy (RM728 million in the fourth quarter of last financial year ended Jan 31, 2024 (FY2024) suggests more time is needed for a turnaround. Support from its undisclosed white knight and creditors is crucial for the restructuring of the upstream O&G player, which has current borrowings of RM10.98 billion and RM5.5 billion in trade and other payables. It incurred RM805 million on finance costs in FY2024, up from RM622 million the year before.

Losses, expansion drive gearing

Among the most indebted companies, a handful experienced a spike in their net gearing ratios as ballooning accumulated losses ate into equity. They include construction group Ahmad Zaki Resources Bhd (AZRB, net gearing of 14 times), vessel operator Marine & General Bhd (4.4 times), affordable housing developer Sentoria Group Bhd (3.8 times) and structural steel specialist Eversendai Corp Bhd (3.2 times).

Other highly geared companies include AirAsia X Bhd (11 times, taking into account lease liabilities), and highway concessionaire WCE Holdings Bhd (3.9 times, in line with the progress of the West Coast Expressway).

AZRB, which this month secured a RM316 million upgrading and renovation works contract for Istana Abu Bakar in Pahang, booked a RM192 million gain on disposal last year following the sale of its liability-laden loss-making plantation business.

Eversendai founder Tan Sri A K Nathan in a recent interview alluded to progress in its debt restructuring and receivables collection from a related-party project, which will add to its financial health on top of the recent RM5.4 billion contract wins in the Middle East and India that will keep it busy for the next two years.

Among those that have geared up the most compared with 2022 levels are construction outfit Reneuco Bhd (net gearing of 1.2 times from net cash in 2022), whose debt nearly tripled to RM301 million last quarter following the consolidation of debts in a recently acquired subsidiary, which has a 29.1MW hydro project in Sabah. The quarter before that, Reneuco impaired RM132 million worth of receivables.

Similarly, Pestech International Bhd’s net gearing rose to 2.4 times as losses accumulated.

More companies have geared up to expand as well.

Sunway Construction Bhd (SunCon) turned from net cash a year ago to a net gearing position of 0.5 times at end-2023. Analysts say this is to support progress of its Indian highway projects, and construction works for 100MW of the fourth cycle of the Large Scale Solar (LSS4) projects, in line with a rise in the group’s order book to nearly RM6 billion (including a recent RM747 million data centre construction contract). The counter is one of the construction industry’s favourites among analysts alongside Gamuda Bhd (0.3 times gearing).

Aside from companies like SunCon or Yinson whose gearing rose due to expansion, other sizeable companies that saw a rise in net gearing for similar reasons include Lotte Chemical Titan Holding Bhd.

Despite losses in the last two years, retained earnings of over RM3.4 billion served as a cushion while the group geared up, raising RM6.35 billion in debt, of which RM5.54 billion was earmarked for its 51%-owned, US$3.95 billion new ethylene cracker plant in Indonesia capable of naphtha cracking at a capacity of one million tonnes per annum.

Also noteworthy is cocoa products manufacturer Guan Chong Bhd. Its borrowings nearly doubled to RM2.18 billion in the past year, lifting net gearing to 1.2 times, from 0.7 times, due to higher working capital requirements amid skyrocketing cocoa prices.

Another notable mention is Press Metal Bhd’s 23.39%-associate PMB Technology Bhd (net gearing rose to 0.8 times, from 0.5 times), which raised borrowings for working capital and Phase 3 construction of its metallic silicon plant in Bintulu, Sarawak.

Sector-wise, companies that have geared up are largely construction companies with market cap below RM1 billion, such as Binastra Corp Bhd (which remains in net cash position), and Vestland Bhd. Notably, domestic construction contract awards to listed contractors have risen from RM18.57 billion in 2022 to RM21.81 billion in 2023, according to data compiled by HLIB Research. In the first quarter this year, domestic awards stood at RM6.96 billion, the research house’s compilation shows.

The trend in corporate balance sheets shows companies have respectable cash balances that would allow them to budget for higher capital expenditure, says Bank Islam chief economist Dr Mohd Afzanizam Abdul Rashid.

“The higher interest rate environment may have contributed to such conditions as firms become selective as they need to impute a higher internal rate of return (IRR) whenever they do their investment appraisal.

“In a way, it is good to know that companies have become disciplined in their financial management. So, it is about how firms would unlock their value by utilising their cash in order to improve productivity and contribute positively to their earnings,” Afzanizam says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport