Larry Summers – Ting Shen/Bloomberg

Investors are racing to buy British debt as traders ramp up bets that the Bank of England will start cutting interest rates before the US Federal Reserve. Official data showed the US rose by more than expected in March in a blow to US rate cut hopes.

Stock markets fell and global borrowing costs jumped on the back of the figures as traders reappraised their rate cut predictions.

Traders now believe the Fed will only cut interest rates twice instead of three times this year, with the first reduction pushed back from September to November.

The figures were released just hours after the UK sold £5bn in short-term gilts, with demand outstripping supply almost four times over.

This is the strongest demand for UK debt since April 2020, when recession fears saw investors plough billions of pounds into gilts during the first pandemic lockdown.

Imogen Bachra, a rates strategist at Natwest, said the recent strong demand for short-term debt was driven by expectation that the UK will cut rates before the Fed.

She said: “Investors that think that the Bank could cut before the Fed and more than the market is currently pricing.”

Traders now believe the Bank of England will begin cutting rates from 5.25pc in August, three months before the Fed and a month after the European Central Bank.

Speculation is growing that the US will have to keep interest rates higher for longer after figures showed consumer prices rose by 3.5pc in March compared to a year earlier.

Inflation accelerated from 3.2pc the previous month and was greater than the 3.4pc predicted by analysts.

The data adds to evidence that the US economy has cooled less than policymakers would like in the face of 23-year-high borrowing costs.

The monthly inflation measure remained flat at 0.4pc in March, defying expectations of a slight easing to 0.3pc.

Former US Treasury Secretary Larry Summers said the surprise jump in headline inflation rate raised the prospect of another increase in borrowing costs by America’s central bank.

He told Bloomberg TV: “You have to take seriously the possibility that the next rate move will be upwards rather than downwards.”

Markets plunged in response to the inflation figures, with the benchmark S&P 500 down 1pc and the tech-heavy Nasdaq suffering a 1.1pc fall.

In the UK, the FTSE 100 pared most of its earlier gains, ending the day up 0.3pc at 7,961.

Megum Muhic, a rates strategist at RBC Capital Markets, said investors no longer believed the UK had an inflation problem.

While the rate of price rises in the UK is only marginally different to the US – at 3.4pc – inflation here has been falling faster than expected and is forecast to fall below the Bank’s 2pc target within months, reflecting a big drop in energy bills.

Mr Muhic said: “The UK market had for a long time been trading with a narrative where people thought that the UK had this idiosyncratic, sticky inflation problem. It was seen as a bit of an outlier.

“Now, it’s starting to see inflation coming in below expectations, whereas in places like the US, inflation has come in above expectations.”

Some observers believe the Bank is unlikely to cut before the Fed, given it will leave Britain exposed to potential capital outflows if a rates gulf emerges with other economies.

However, strategists and fund managers at Jupiter Asset Management, Pictet Asset Management and Candriam have all said markets are underpricing the chances of the Bank of England cutting sooner and deeper than its major counterparts.

Fed chairman Jerome Powell has already warned that the central bank risks being forced to delay its first cut to interest rates because of stubborn inflation and strong economic growth.

06:13 PM BST

French deficit to widen further as pressure mounts on Macron

Thanks for joining us today. We’ll be back tomorrow to cover the latest markets news, but I’ll leave you with the latest update from our deputy economics editor Tim Wallace:

Emmanuel Macron is poised to borrow more money than expected this year as the French budget deficit is expected to hit 5.1pc of GDP, up from previous forecasts of 4.4pc.

Governments across much of the developed world are under pressure to reduce borrowing in the wake of the pandemic and cost of living crisis, but France is struggling to achieve this. Last year the deficit came in at 5.5pc, also above target.

Bruno Le Maire, the French finance minister, has said savings of another €10bn (£8.6bn) will be required this year and €20bn in 2025 in order to get borrowing below 3pc by 2027 and balance the books by 2032.

The French president has sought to rule out tax rises to plug the gap, but is coming under pressure from parts of his own party to impose a levy on the rich to replenish the state coffers.

06:00 PM BST

Meta launches new AI chip in bid to break reliance on Nvidia

Meta and Google have unveiled new artificial intelligence (AI) microchips as the technology giants seek to ease their reliance on Nvidia, the chipmaker that has become one of the world’s biggest companies on the back of the AI boom. James Titcomb has the details:

On Wednesday, Meta unveiled a new generation of its AI accelerator chip, which is used to power the company’s algorithms that decide what adverts and posts to place in users’ feeds on Facebook and Instagram.

It came a day after Google unveiled an updated version of its TPU, which is seen as an alternative to Nvidia’s in-demand AI chips.

Both are spending huge sums with Nvidia, which has risen to a $2 trillion (£1.6 trillion) valuation in recent months amid frantic demand for its processors.

05:41 PM BST

Private equity bidders circle The Lawyer publisher Centaur Media

Shares in the publisher of The Lawyer magazine surged by as much as 40pc after bosses confirmed it had received a takeover approach from a Dutch private equity firm.

Centaur Media said it had received a “highly preliminary expression of interest” from Waterland Private Equity Investments over a potential all-share deal.

Shares in the London-listed company, which also owns Marketing Week, jumped as much as 40pc before falling back to a rise of 28pc, giving it a market value of around £75m.

Under UK takeover rules, Waterland, which invests in small and medium-sized businesses across Europe, has until May 8 to either table a firm bid for Centaur or say it does not intend to make an offer.

Bosses told shareholders there could be no certainty that an offer would be made nor as to the terms of any offer.

The company added:

The board remains confident in the company’s growth strategy and its ability to maintain a competitive edge within the markets it operates.

04:54 PM BST

Footsie closes up

The FTSE 100 closed up 0.3pc today. Tesco led the risers, rising 3.3pc, followed by HSBC, up 2.9pc. The biggest faller was Ocado, down 3.4pc, followed by Anglo American, down 2.1pc.

Meanwhile, the mid-cap FTSE 250 rose 0.2pc. The biggest riser was OSB (OneSavings Bank), up 5pc, followed by insurance company Lancashire Holdings, up 4.5pc. The biggest faller was self storage company Safestore Holdings, down 2.9pc, followed by iron ore pellet exporter Ferrexpo, down 2.9pc.

04:45 PM BST

Vistry to build 1,000 homes in government-backed deal

Vistry, the housebuilder formerly known as Bovis, is to deliver 1,000 homes on behalf of housing and regeneration quango Homes England.

The company told investors it would build 750 on the site of Birmingham City Hospital (which is being replaced with a new hospital around a mile away). A further 250 homes will be built in Hardingstone in Northamptonshire.

Shares in Vistry rose this morning before before being pushed downwards by new US inflation figures, which suggest there will be less appetite for interest rate cuts.

04:32 PM BST

US shares drop and dollar gains after US inflation data

American shares tumbled, US Tresury yields rose and the dollar jumped after data showing US consumer prices rose more than expected in March cast further doubt on whether the Federal Reserve will start to cut interest rates in June.

Markets are now pricing in roughly a one in four chance the Federal Reserve will cut rates in June, compared to around a 50pc chance before the data.

That sent the benchmark yield on 10-year US Treasury bonds up 12 basis points to 4.493pc.

The dollar rose sharply, up 1.02pc against the pound.

04:21 PM BST

Direct Line poaches Aviva finance chief amid cost-saving overhaul

Direct Line has hired the finance chief of Aviva’s UK insurance arm weeks after unveiling a new £100m cost-cutting plan. Adam Mawardi reports:

The British insurer on Wednesday announced that Jane Poole will join as an executive in October.

Ms Poole is currently chief financial officer of Aviva’s UK and Ireland general insurance business, a position she has held since 2021.

Her arrival comes as Direct Line, which owns Churchill Insurance, is under pressure to overhaul the business after fending off a £3bn takeover bid from Belgian rival Ageas.

The Brussels-based suitor last month walked away from its takeover attempt having had two offers rejected by Direct Line’s board.

Ms Poole will join Adam Winslow at Direct Line, the former head of Aviva’s UK and Ireland general insurance division who took over as the company’s chief executive in March.

It was just weeks ago that Mr Winslow announced plans to reduce costs across the business by around £100m by the end of 2025.

The FTSE 250 company hopes to cut costs by increasing automation and modernising IT systems, although has declined to say whether the overhaul will include layoffs.

Direct Line’s operational losses soared from £6.4m to £189.5m last year, which the insurer blamed on volatile market conditions hitting its motor insurance division.

However, the company posted a pre-tax profit of £277.4m in 2023 after selling its brokered commercial business to rival RSA Insurance.

04:04 PM BST

Slash benefits to get more men into work, IMF urges

Cutting benefits and taxes could help solve the global worklessness crisis by encouraging more men into jobs, the International Monetary Fund (IMF) has said. Tim Wallace reports:

More training and childcare support would help more women into work, while higher pension ages can keep more older people in jobs.

It comes amid fears Britain is being held back by the 9.25 million adults of working age who are economically inactive – those who are neither in work nor looking for work.

Of these, 2.7 million are long-term sick, 2.6 million are students, 1.6 million are looking after their home or family, and 1.1 million have taken early retirement.

In the UK, the employment rate of women aged between 16 and 64 has risen from around 55pc half a century ago to 72pc now.

By contrast the share of men in work has fallen from 89pc to 78pc over the same period.

Without radical action to boost productivity the world faces a dire slump in economic growth, the global watchdog warned.

Read the full story…

04:02 PM BST

American operator of Ted Baker a forerunner to take over British stores

Ted Baker’s US licensing partner is a forerunner to take over the brand’s UK business after it collapsed into administration, according to a report.

Sky News understands that OSL, which was given the rights to run Ted Baker’s US retail business more a year ago, is a likely contender to take over the running of the brand in Britain.

OSL runs Ted Baker’s New York’s head office, an Atlanta warehouse, and over 80 shops and concessions in the US.

The Ted baker store at London Bridge – Jonathan Brady/PA

03:55 PM BST

Speedy Hire loses out from softer demand from builders

Sales at Speedy Hire fell 5pc during the year to the end of March after a warm winter cut demand for heaters and demand from builders was subdued.

The company told investors that revenue would come in at about £420m when it files its accounts. It said profits would be “towards the lower end of the board’s expectations”.

However, it said there was a positive outlook for the business considering some recent contract wins.

03:49 PM BST

Churchill China profits rise after it cuts agency staff

The Stoke on Trent manufacturer of china used by restaurants, hotels and pubs, Churchill China, has reported rising profits despite a financial crunch being felt by major pub and restaurant groups.

Revenue dipped 0.2pc to £82.3m in 2023, with over half coming from exports.

The company said that profits had been helped by a reduction in agency staff in its factory and that permanent employees were more productive. As a result, it said, it had been able to cut factory staff by 136. Profit before tax rose by £1.2m to £10.8m.

03:38 PM BST

MyProtein owner losses half amid artificial intelligence push

THG, the online retailer behind brands such as MyProtein and Cult Beauty, said its revenue started growing again in the last three months of 2023 as it halved its losses over the year.

The business said annual revenue was down 8.7pc to £2 billion, but returned to growth in the final quarter.

Meanwhile its pre-tax loss went from £549.7m to £252m.

Matthew Moulding, chief executive, said:

In 2023, we made material progress against our strategic priorities, delivering significant profit growth following the support for our consumers through the cost-of-living crisis in 2022.

Having completed our recent infrastructure investment programme, the group is now delivering operating leverage.

Our fulfilment network is becoming increasingly optimised through a combination of robotics automation, AI and the onboarding of new Ingenuity clients utilising existing capacity.

It was a turbulent year for THG.

Last April the business announced that it had been approached by private equity giant Apollo, which was interested in perhaps taking the group private.

But a little under a month later the firms announced that their talks had ended without a deal being reached.

Shares in THG had soared when the interest from Apollo was announced, but crashed back down to their previous levels after it was withdrawn. The board said Apollo had not adequately valued THG.

03:17 PM BST

Traders look to European Central Bank meeting after US inflation blow

Rate-setters at the European Central Bank are tomorrow expected to hold interest rates at 22-year-high.

After the unexpectedly high US inflation figure in March, the Frankfurt-based central bank could be the first major institution to lower borrowing costs after two years of soaring inflation.

Jan Felix Gloeckner, Senior Investment Specialist at £650bn asset manager Insight Investment, said:

“The growing economic divergence between the US and Europe is starting to impact expectations for central bank policy, with a building consensus that the European Central Bank will cut in June, even as Fed cuts are pushed later into the year. Given that backdrop, this week’s meeting could well prove an important milestone in setting expectations – as the ECB is preparing the ground for a June rate cut, markets will be looking for any hints on the pace of cuts and the potential landing zone.”

02:50 PM BST

Hopes of FTSE 100 breaching record dashed amid disappointing US inflation

The UK’s blue-chip stock index this morning appeared within touching distance of surpassing an all-time high past 8,000, as rising oil prices boosted heavyweights like Shell and BP.

Yet it pared all of its gains after inflation in the US came in hotter than expected in March, delaying hopes of lower interest rates in the world’s largest economy.

The sticky inflation figure across the pond slightly tempered expectations for interest rate cuts in the UK too, although traders still believe the Bank of England will cut at least three times this year.

02:35 PM BST

Traders pare back bets on US rate cuts after higher-than-expected inflation

Traders are now expecting that the Federal Reserve will deliver only two interest rate cuts rather than three this year after US inflation figures for March came in hotter than expected.

They believe the Fed will refrain from reducing borrowing costs from a 23-year high until in November rather than September as previously predicted.

The benchmark US interest rate stands at a range of 5.25pc to 5.5pc.

01:37 PM BST

US inflation comes in above expectations in blow to rate cut hopes

Inflation in the world’s largest economy rose by 3.5pc in the year to March, slightly above expectations of 3.4pc. It marks an increase from 3.2pc the previous month.

The higher-than-expected figure comes amid growing evidence that the US economy has still not cooled as much as policymakers would like despite 23-year-high borrowing costs.

The monthly measure remained flat at 0.4pc in March, defying expectations of a slight easing to 0.3pc.

01:32 PM BST

Switzerland looks to toughen banking regulations after Credit Suisse collapse

The Swiss government has made a range of proposals for how to tighten banking rules for UBS and three other systemically important lenders to avoid another Credit Suisse-style crisis.

It plans to bolster the financial regulator’s powers, ramp up requirements for how much capital banks need to hold and boost cooperation between authorities.

It comes after the shotgun marriage of Credit Suisse and UBS in March last year.

12:15 PM BST

China’s largest carmaker received £2.9bn in state subsidies to dominate EV market, study says

Chinese manufacturer BYD received at least £2.9bn in direct state aid amid a push by Beijing to dominate clean technologies.

This is the conclusion of a study by the Kiel Institute for the World Economy, which comes amid growing trade tensions between China and Brussels.

BYD overtook Tesla as the world’s best-selling electric vehicle maker at the start of the year.

11:56 AM BST

Outlook improving for unloved British equities, says Barclays

The fortunes for shunned UK-listed stocks are poised to improve amid rising oil prices and a fading overhang from Brexit, analysts at Barclays have said in a note to clients.

Emmanuel Cau, Barclays Head of European Equity Strategy, said that while UK equities had missed out in the AI-fuelled rally since November, the market was starting to catch up.

Mr Cau said: “The steady rise of oil/commodities means UK earnings per share momentum should improve and provide some backstop to depressed valuations.”

He added: “UK co-ordination with the EU appears to be improving across both major parties, with elections looming, which could unwind some of the risk premium placed on UK markets. With multiples looking depressed, inbound M&A, and buybacks are seeing a pick-up, which could help valuations.”

10:44 AM BST

Stocks in Welsh microchip firm soar by nearly a third

Shares in a Welsh microchip company that supplies Apple have surged by almost a third as it predicted a turnaround in demand for semiconductors after a sharp downturn last year.

Senior technology reporter Matthew Field has the latest:

IQE’s stock climbed by 32pc in trading on Wednesday to around 26p as it predicted that an “unprecedented cyclical downturn” in microchip demand was coming to an end.

The pandemic and supply chain disruption caused technology companies to stock up on microchips, but this has been followed by a glut of supply. Americo Lemos, IQE’s chief executive, said: “Buoyed by ongoing industry recovery, IQE is well positioned.”

The Cardiff-headquartered company manufactures semiconductor wafers used for creating microchips for cameras, cars and 5G technology.

IQE’s shares fell last year as it was forced to implement cost-cutting measures amid a downturn in the semiconductor industry, including cutting 10pc of its workforce.

Elsewhere, TSMC, the Taiwanese semiconductor manufacturing giant, reported quarterly revenues of $18.5bn in the first three months of the year, towards the top of analysts’ estimates.

The Taiwanese company has enjoyed accelerating revenue growth on the back of demand for cutting edge processors to power artificial intelligence technologies.

09:55 AM BST

China suffers debt downgrade in latest blow to economy

China has suffered a downgrade in the latest blow to its economy, after agency Fitch cut its outlook to negative over concerns about rising debt levels.

Fitch said the world’s second-largest economy was likely to keep amassing debt in an attempt to pull itself out of a property-driven slump.

The rating agency noted: “Fiscal policy is increasingly likely to play an important role in supporting growth in the coming years which could keep debt on a steady upward trend.”

It comes after China’s public debt has soared in recent years, as the Government has tried to push up growth rates by pumping money into the economy.

It recently announced new stimulus measures like financial support to help families and businesses upgrade appliances or machinery while suggesting more would follow.

China criticised Fitch’s downgrade, saying it failed to reflect that its interventions would help spur growth and stabilise the debt burden.

China

09:25 AM BST

BMW boasts surge in electric vehicle sales as rivals struggle

The German carmaker sold 28pc more EVs in the first three months of the year, in sharp contrast to a broader slowdown in demand for battery-powered cars.

Deliveries of models such as i4, iX1 and i7 surged by 41pc, offering a glimpse of hope for the battered European EV market.

Other manufacturers like Tesla have seen global sales plummet at the start of the year, blaming high interest rates and Red Sea shipping disruption.

09:07 AM BST

China hits out at ‘discriminatory’ and ‘protectionist’ Brussels amid deepening trade war

The world’s second-largest economy has rebuked the European Union over measures against its companies amid rising trade tensions.

It comes after Brussels announced it would launch a probe into Chinese wind turbine makers receiving state subsidies.

It follows a similar investigation into cheap Chinese electric vehicles pouring into the continent.

Mao Ning, a foreign ministry spokesperson, said: “China is highly concerned about the discriminatory measures taken by the European Union against Chinese companies and even industries.”

He added: “The outside world is worried about the rising tendency of protectionism in the EU.”

He urged the bloc to abide by World Trade Organization rules and market principles.

The EU’s probe is the latest development as Brussels and the US seek to protect their homegrown industries from a flood of cheap clean technology imports from China.

08:50 AM BST

Former Rolls-Royce boss to chair air traffic provider after flight chaos

Warren East, who headed up Rolls-Royce for seven years, has been appointed non-executive chair of the UK’s air traffic provider.

Mr East’s appointment comes after a system failure last August unleashed flight chaos affecting more than 700,000 passengers.

He is replacing Paul Golby, who helmed NATS for a decade and led it through Covid.

Mr East stepped down as Rolls-Royce chief executive in 2022.

08:29 AM BST

The FTSE 100 opens 0.6pc higher as it nears previous high

The blue-chip stock index of the largest UK-listed firms rose in the first minutes of trading, boosted by heavyweights like oil giants Shell and BP and bank HSBC.

The FTSE 100 is nearing its previous record just past 8,000 a year ago, reaching 7,986.01 upon opening before retreating slightly this morning.

08:20 AM BST

Tesco’s profits up by nearly 160pc

Our retail editor, Hannah Boland, has a longer take on Tesco’s soaring profits here.

She highlights:

Tesco profits rose by almost 160pc last year as Britain’s biggest supermarket said inflationary pressures have “lessened substantially”.

Bosses said Tesco had benefitted from price rises falling “gradually across the year”, in the latest sign that inflation across the broader economy is turning a corner.

Tesco chief executive Ken Murphy said: “Inflationary pressures have lessened substantially, however we are conscious that things are still difficult for many customers, so we have worked hard to reduce prices and have now been the cheapest full-line grocer for well over a year.”

08:05 AM BST

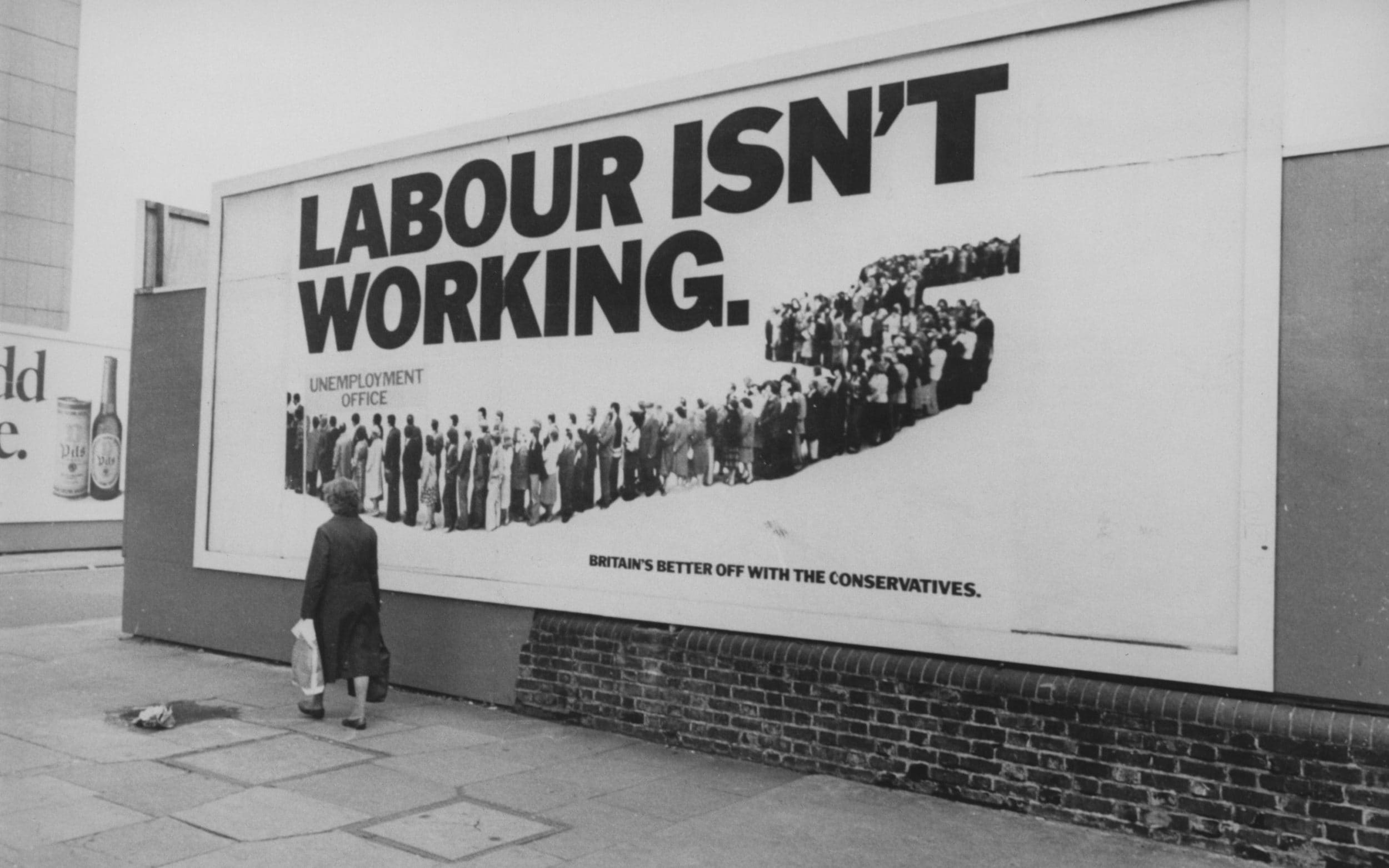

Thatcher’s advertising agency posts 10pc drop in profits

M&C Saatchi has become the latest advertiser to report a plunge in profits in 2023, as clients cut back on spending to weather the recession.

The agency behind the “Labour isn’t working” ad, which was credited with putting Margaret Thatcher in power, suffered a 7pc hit to revenues.

It blamed “macroeconomic uncertainty” but insisted it had a promising first quarter in 2024.

Large billboard with text ‘Labour isn’t working’

07:53 AM BST

Energy crisis will leave lasting scars on German industry, warns leading chief executive

The boss of one of Germany’s largest energy companies has warned that the country’s struggling industry is unlikely to recover fully from the crisis sparked by the war in Ukraine.

Markus Krebber, chief executive of RWE, said structurally higher gas prices since the invasion had left Europe’s largest economy disadvantaged, in a story first reported by the Financial Times.

He said: “Gas prices in continental Europe, especially in Germany, are structurally higher now, because we, in the end, depend on LNG imports. The German industry has a disadvantage.”

07:45 AM BST

Unite slams Tesco’s profits amid cost of living crisis

One of the UK’s largest trade unions has criticised Tesco’s gleaming results this morning and accused the chain of profiteering.

Unite general secretary Sharon Graham said:

“Tesco is raking in mountains of cash while families struggle to put food on the table because of sky-high prices. Many companies have used the cost-of-living crisis to grab excessive profits.

“There is an epidemic of profiteering in our economy – the government has been missing in action and failed to curb it.”

07:42 AM BST

Tesco reports bumper profits amid falling grocery inflation

The UK’s largest supermarket chain posted pre-tax profits of £2.3bn in the year to February, nearly tripling from £882m.

The grocery giant said price pressures had eased “substantially” and its many price reductions had helped lift sales by 4.4pc from the previous year.

Tesco said it has cut the prices of more than 4,000 products over the year with average reductions of 12pc.

Tesco

07:31 AM BST

Good morning!

5 things to start your day

1) Biggest North Sea oil find in decades to be drilled for first time | Sites expected to produce 500m barrels of oil despite net zero crackdown

2) Cyber attacks risk triggering bank runs, warns IMF | Research shows the number of malicious attacks has doubled since the pandemic

3) Baby boomers are coping best with higher bills, FCA survey finds | Older Britons are more likely to own homes outright and have inflation linked income

4) Why Mohammed bin Salman has been forced to rein in his dreams of a mirror city | Plans for a gleaming skyscraper utopia in the Saudi desert have lost their shine

5) Jeremy Warner: Failures in the Bank’s forecasting are about to be thrown into sharp relief | Sound monetary policy must be based above all on sound judgement

What happened overnight

In Wall Street, the S&P 500 edged up by 0.1pc, to 5,209.91, after barely budging the day before. The Dow Jones Industrial Average slipped less than 0.1pc, to 38,883.67, while the Nasdaq Composite rose 0.3pc, to 16,306.64.

Treasury yields eased in the bond market ahead of Wednesday’s highly anticipated update on inflation at the US consumer level. The yield on benchmark 10-year US Treasury bonds dipped to 4.35pc from 4.42pc late on Monday.

Hong Kong stocks rose at the open on Wednesday, the Hang Seng Index adding 0.58pc, or 97.95 points, to 16,926.02.

The Shanghai Composite Index dipped 0.08pc, or 2.58 points, to 3,045.96, meanwhile the Shenzhen Composite Index on China’s second exchange gave up 0.23pc, or 3.97 points, to 1,746.83.

In Tokyo, stocks also opened lower with investors expected to take a wait-and-see stance ahead of the release of US inflation data.

The benchmark Nikkei 225 index dropped 0.34pc, or 133.84 points, to 39,639.29 while the broader Topix index slipped 0.31pc, or 8.61 points, to 2,746.08.

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report