O&G stocks perform on better earnings prospects

This article first appeared in The Edge Malaysia Weekly on April 22, 2024 – April 28, 2024

OIL and gas (O&G) stocks have been gaining traction over the past few months, premised on better earnings prospects, and more recently, on the likelihood of oil prices escalating due to the conflict in the Middle East.

Earlier this month, on April 2, the Bursa Malaysia Energy Index hit a three-year high of 980.73 points, having gained more than 24% since early December last year. At the time of writing, the index was testing the 970-point level, rising after Israel’s air strikes on the Iranian cities of Isfahan and Tabriz.

The strikes were in retaliation to Iran’s drone strikes on Israel on April 13, which came about after an attack on Iran’s consulate in Damascus on April 1. While the prospects of war have strengthened oil prices, market watchers say the rally in the Bursa Malaysia Energy Index and the shares of many publicly traded O&G companies has been brought about by the imminent announcement of financial results.

“The issues in the Middle East may have some impact but if you ask me, the O&G players will be announcing their results for the first quarter [ended March 31] next month … I believe the rally in many of the companies’ share prices is a result of this,” says a player from the offshore support vessel (OSV) segment.

“From what I gather, the financial results are likely to be good compared with those of the first quarter of last year.”

Meanwhile, the CEO of a publicly traded hook-up and commissioning outfit says, “Traditionally, the first quarter of the year is slow due to the monsoon season, but this year, the bounce-back was very fast and it has set the stage for a good year, the entire 2024 could be a good year … by mid next month, when the [companies’] financials start trickling in, we will see if the rally [in share prices] is justified.”

O&G stocks perform on better earnings prospects

One seasoned market player says because of the weak ringgit, foreigners may be drawn to O&G stocks, many of which are cheap, having been battered for so long.

To recap, Brent crude traded at US$145 per barrel in mid-July 2008 but tumbled to US$26 in February 2016, and after a number of short-lived rallies, it fell again to US$20 in April 2020. With such low oil prices, many players were hammered down and never really recovered with banks and financial institutions shying away from the sector.

Over the past year, however, Brent crude has averaged about US$82 per barrel, which, according to O&G executives is “a very comfortable level” and could, in turn, result in better earnings.

The Iran-Israel impact

The offshore support services executive says the troubles in the Middle East have thus far not had any major impact on oil prices other than a knee-jerk reaction in mid-April when prices temporarily shot above US$90 per barrel. Last Friday at midday, Brent crude was at about US$88 per barrel, after a 4% gain to US$90.54 per barrel when news of the Israeli air strikes first came out.

Similarly, shipping costs for both refined petroleum products and crude oil have not shown any increase. Last Friday at midday, the Baltic Exchange Clean Tanker Index, which tracks the cost of carriage of refined petroleum products, shed about 27% from its 52-week high of 1,411 points in late January to current levels or about 1,021 points and was largely unchanged post-Israel’s attacks on Iran. Meanwhile, the Baltic Exchange Dirty Tanker Index, which is a gauge for the cost of carriage of crude oil, in mid-January slipped almost 27% from early January highs of 1,552 points, and fell an additional six points to 1,128 points at lunch time last Friday, post-Israel’s attacks.

For perspective, Brent crude was briefly above the US$90 per barrel band after the Iranian drone attacks but had dropped to just below the US$86 per barrel band last Thursday and gained marginally last Friday.

Some say Brent crude at US$100 per barrel is on the cards but there are those who say otherwise.

In mid-April, after Iran’s drone strikes, JPMorgan in a report highlighted that “with bellicose rhetoric coming from both sides, markets might continue to place a sizeable premium on the price of oil in the immediate term. Yet, beyond the short-term spike induced by geopolitics, our base case for oil remains as US$90 Brent through May and US$85 in 2H2024”.

UOB in its Commodities Strategy report in mid-April maintains its forecast for Brent crude oil at US$90 per barrel by 4Q2024, but maintains that the outlook “remains highly uncertain”.

O&G performers on Bursa

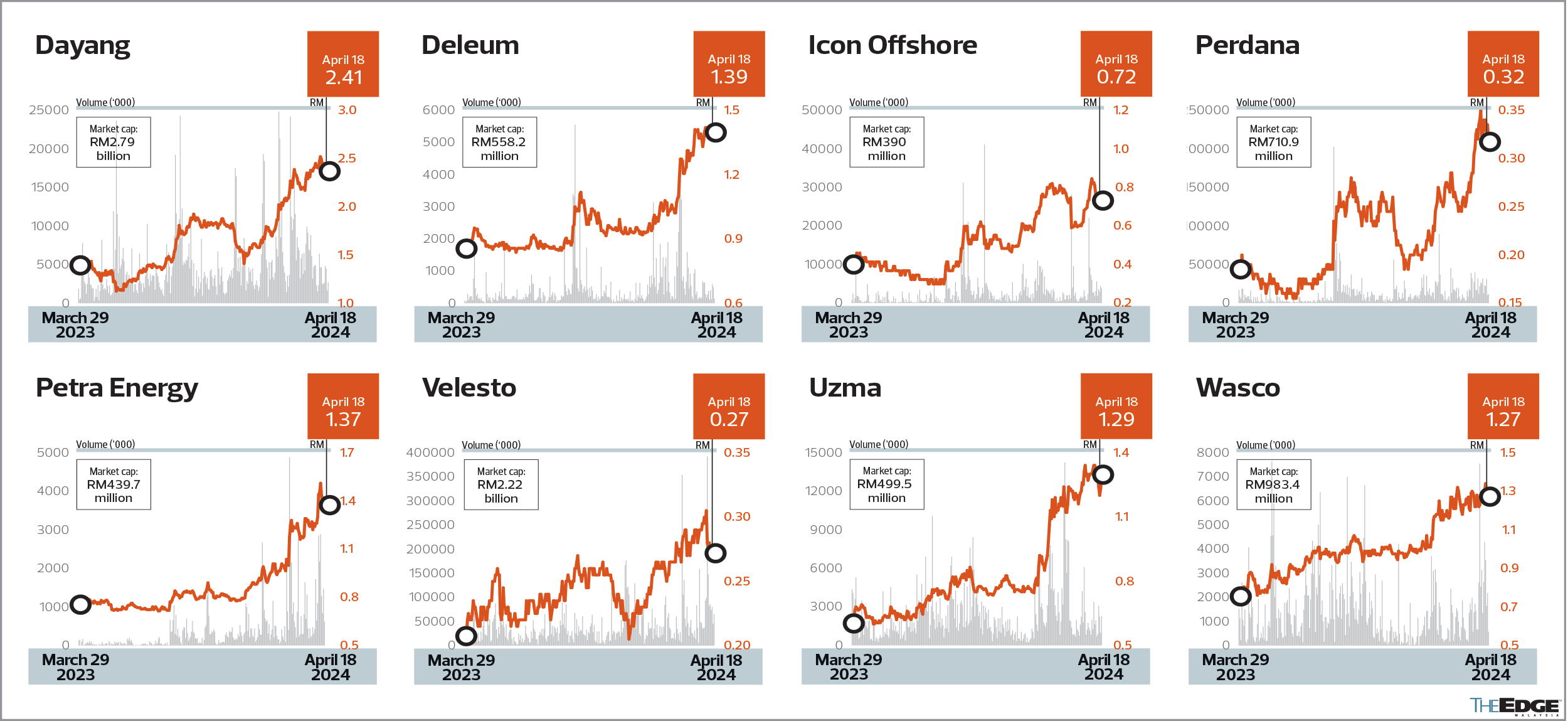

Some of the stellar O&G performers on Bursa Malaysia include Petra Energy Bhd, Wasco Bhd, Perdana Petroleum Bhd, Velesto Energy Bhd, Deleum Bhd, Dayang Enterprise Holdings Bhd, Uzma Bhd and Icon Offshore Bhd.

It is also noteworthy that not all O&G stocks have performed as those that are financially weak have remained in the doldrums.

Most of the companies mentioned above have done better in terms of profitability in the latest full financial year compared with the year before, with the exception of Icon Offshore, which showed a lower net profit but remained in the black.

Petra Energy’s shares have gained about 55% year to date (YTD) and ended trading last Thursday at RM1.37. The stock hit its 52-week high of RM1.54 in intra day trading.

While there was market talk of Wasco looking to divest its 27% stake in Petra Energy, this has been dismissed by executives familiar with Wasco.

The market value of Wasco’s shareholding in Petra Energy as at last Thursday’s close was put at close to RM119 million.

To its credit, Petra Energy has a strong balance sheet and its management has paid out good dividends over the years. At its close last Thursday, its dividend yield was more than 5%. This company is perhaps one of the few O&G players in a strong net cash position, owing to its prudent management, which prefers to remain low key.

Petra Energy is involved in exploration, development and production, and hook-up and commissioning, and has a fabrication yard, among others.

Wasco’s stock has gained 27% YTD and closed last Thursday at RM1.27, falling from its 52-week high of RM1.36 in intraday trading on April 12.

Other than specialised pipe coating, corrosion protection, and engineering and fabrication services, Wasco also has an agro engineering services division focused on renewable energy, among others.

Interestingly, Wasco is part of the Tan family empire, which controls developer IGB Bhd, IGB Real Estate Investment Trust (REIT) and IGB Commercial REIT.

OSV player Perdana’s shares have gained about 60% YTD, finishing last Thursday at 32 sen. The stock hit its 52-week high of 36.5 sen in intraday trade on April 4.

Perdana has been in the news lately for a number of contract awards, both from its 63.67% parent Dayang as well as external parties.

Dayang, which is a maintenance, hook-up and commissioning player and via Perdana charters marine vessels, is among the largest O&G companies in terms of market capitalisation. At its close of RM2.41 last Thursday, Dayang’s market capitalisation stood at RM2.79 billion. YTD, Dayang’s shares have gained more than 52%.

Miri-based Dayang is 24.22% controlled by Naim Holdings Bhd, a Sarawak-based property developer.

Deleum’s shares have gained close to 50% YTD and finished last Thursday at RM1.39, after hitting a 52-week high of RM1.44 in intraday trade on March 18.

Interestingly enough, O&G services outfit Deleum — one of the few in a net cash position — made an important foray into Indonesia seeking to acquire a 70% stake in valves company OSA Industries Indonesia for US$7 million (RM33.1 million).

OSV player Icon Offshore’s shares have strengthened more than 23% YTD, buoyed by an acquisition of a 50.22% in the company by businessman Lim Han Weng and his family.

The Lims — who control floating, production, storage and offloading vessel player Yinson Bhd — bought the block in Icon Offshore from government-linked private equity outfit Ekuity Nasional Bhd or Ekuinas.

Permodalan Nasional Bhd-controlled Velesto’s stock has gained more than 17% YTD, and ended trading last Thursday at 27 sen. The oil rig owner-operator’s shares hit a 52-week high of 31.5 sen in intraday trading on Feb 28.

Velesto, in its financial year ended December 2023, registered a net profit of RM99.53 million on revenue of RM1.21 billion. It recently paid out dividends of 0.25 sen per share its first payout in a decade.

Meanwhile, Uzma’s stock has shot up 72% YTD, finishing last Thursday at RM1.29. Uzma’s shares hit a 52-week high of RM1.37 on March 21.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.