This article first appeared in The Edge Malaysia Weekly on April 15, 2024 – April 21, 2024

NINJA Logistics Sdn Bhd (Ninja Van Malaysia) was one of the private venture-backed start-ups that burst onto the last-mile delivery scene and disrupted the long-standing business model of incumbent delivery companies with technologies that deliver products faster, cheaper and more efficiently than before. Today, it has emerged as Malaysia’s largest last-mile delivery company by retail points. It has 5,500 retail stores and 200 hubs across the country.

According to CEO Lin Zheng, the number of parcels Ninja Van Malaysia handles has continued to increase since its inception in 2015. It crossed another milestone last September when it delivered its 300 millionth parcel, up from 10 million in March 2019 and one million in December 2017.

Companies Commission of Malaysia (SSM) data shows that Ninja Van Malaysia’s revenue exceeded previous years’ figures, to total RM862.65 million for the financial year ended June 30, 2023 (FY2023), an increase of 21.9% from RM707.76 million in FY2022.

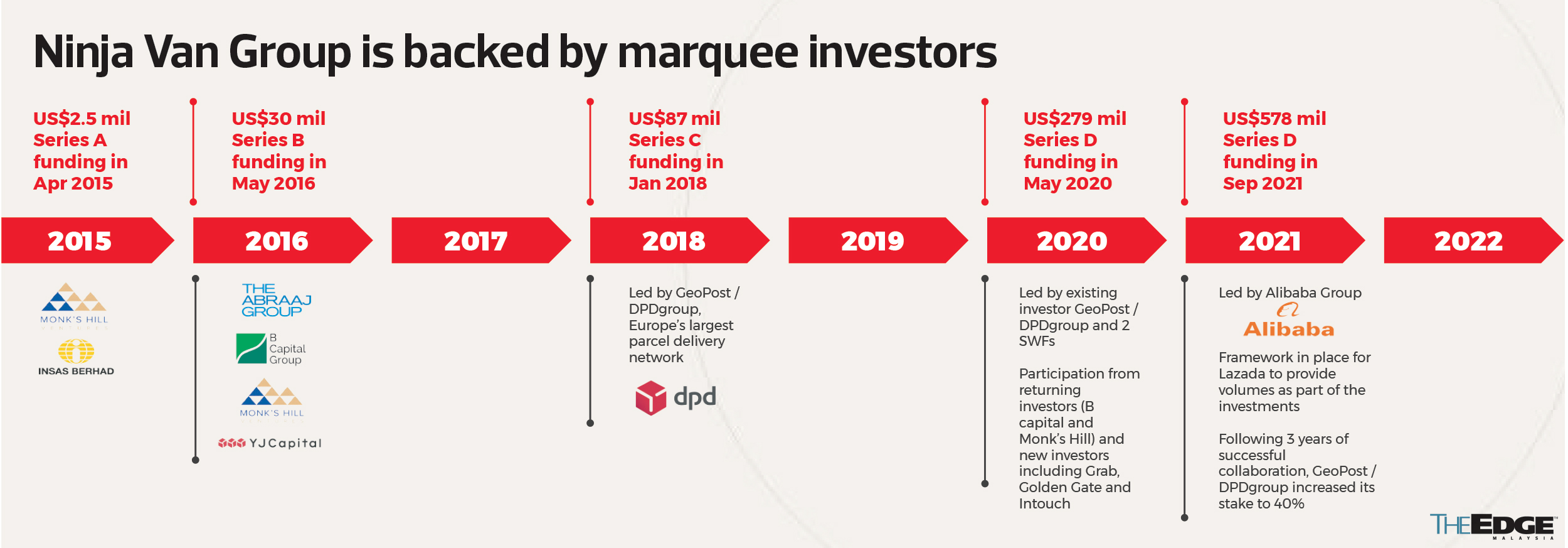

Ninja Van Malaysia’s Singapore-based parent company Ninja Logistics Pte Ltd (Ninja Van Group) has raised US$976.5 million in the 10 years since its establishment. Investors include Singapore-based tech venture capital firm Monk’s Hill Ventures, Insas Bhd, DPDgroup (Europe’s largest parcel delivery network), China’s Alibaba Group Holding Ltd, B Capital Group Management LP and ride-hailing firm Grab Holdings Inc.

Ninja Van Group was founded in 2014 by three Singaporeans — its CEO Lai Chang Wen, chief technology officer Shaun Chong and chief product officer Tan Boxian.

“Logistics is a capital-intensive business. Additional funds are required to fund our expansion in trucks, warehouses and equipment, as well as into other markets. That’s when we need more investors to help fund our expansion over the years. Today, we operate in six countries — Singapore, Malaysia, Indonesia, Vietnam, the Philippines and Thailand,” Lin tells The Edge in an interview.

Lin, 36, was promoted from chief operating officer to CEO of Ninja Van Malaysia in January, replacing Adzim Halim who moved to parent company Ninja Van Group as group chief international officer. The average age of top executives at Ninja Van Malaysia is 37.

“Our vision is to connect Southeast Asia, one delivery at a time. Today, we connect the region with our coverage in the six countries, and also connect Southeast Asia with the world through our investors like DPDgroup,” he says.

“While Ninja Van Group has separate teams operating in each of these countries, not all countries have the same products although most do have variants. It depends on the maturity and customer segments that we are in. That’s how we decide to expand our business in each market. [Within the network] Ninja Van Malaysia probably has one of the most complete logistics ecosystems.”

It operates a 260,000 sq ft sorting facility in Shah Alam and a fleet of more than 7,000 vehicles. It employs about 10,000 people.

Ninja Van Malaysia reported its first annual profit in FY2020 since entering the market in 2015 as the Covid-19 pandemic forced consumers to stay home and shop online, causing the demand for same-day and next-day deliveries to escalate. It recorded a net profit of RM2.61 million in FY2020 and RM23.82 million in FY2021. However, it swung to a net loss of RM22.17 million in FY2022 amid a heated price war and as e-commerce user growth slowed after the pandemic. Its net loss widened to RM83.4 million in FY2023.

In a March report, Bloomberg quoted Ninja Van Group CEO Lai as saying it has put plans for a stock market debut on the back burner as it focuses on improving its profitability before going ahead with an initial public offering (IPO). The group expects to reach positive earnings before interest, taxes, depreciation and amortisation in 12 months, he reportedly said.

Lin says in line with the group’s expectations, Ninja Van Malaysia is also eyeing a return to profit in the next 12 to 18 months, driven by better optimisation and an expansion in its product range.

“In the past two years, we have invested in the network and systems, and we are seeing improved efficiencies. We are focused on [our turnaround]. [IPO] will come after that, given that the market for IPOs is also not great at the moment. So I don’t think it is a primary goal for us at the moment,” he says.

Asked which market Ninja Van Group will list in, Lin says: “We have a few options on the table, but that is something still up for consideration. As a group, we have not determined [which exchange to list on] yet.”

Company differentiates itself with a focus on ecosystem

Over the course of the last decade, the e-commerce boom has seen the entry of a new breed of players in Malaysia’s last-mile delivery industry that are tech-savvy and backed by private equity funds, such as Hong Kong-based Lalamove, Indonesia’s J&T Express and Ninja Van Malaysia.

Intensifying competition has resulted in some casualties in recent years. For example, incumbent Nationwide Express Holdings Bhd and start-up Pgeon Delivery ceased operations, while CJ Century Logistics Holdings Bhd disposed of its loss-making courier business.

Major last-mile delivery companies are also finding it harder to make a profit in Malaysia. GDEX Bhd, whose shareholders include Singapore Post Group and Japan’s Yamato Group, saw its net loss double to RM34.8 million in the financial year ended Dec 31, 2023 (FY2023) from RM17.27 million in FY2022.

National post and parcel service provider Pos Malaysia Bhd’s loss before tax (LBT) in the postal segment, which includes the courier business, widened to RM153.61 million in the financial year ended Dec 31, 2023 (FY2023) from RM130.38 million in FY2022 on lower revenue. Revenue in the postal segment dropped 12% year on year to RM1.09 billion in FY2023, which Pos Malaysia attributed to the intense competition when other major players, especially international courier companies, continued to pursue penetration strategies to capture higher market share in the courier business. In addition, major e-commerce players increasingly shifted to their insourced delivery capabilities, it said.

In late 2020, the Malaysian Communications and Multimedia Commission (MCMC) announced a moratorium of two years on the issuance of new courier service licences. The moratorium ended on Sept 15, 2022.

According to Lin, the market remains competitive despite the moratorium.

“During the moratorium, there were new players that bought existing licensees [to operate] and expanded. After the moratorium, the industry continued to attract new entrants. As such, we don’t really see a decline in competition.”

MCMC’s 2022 annual report shows that there were 121 courier licences as at end-December 2022.

Lin, however, is of the view that measuring competition based on the number of players can be misleading, citing the last-mile delivery industry in Thailand, which has fewer licensed operators in the market than Malaysia, but more intense price competition.

“Actually, we are seeing the same type of [intense price] competition in all the [six] markets [that Ninja Van Group operates in]. Lower price drives more volume, but at the same time, lower price means you have to serve in a more economical way. Even if you look at China, the competition there is fiercer than in Malaysia,” he adds.

On the local last-mile delivery market being saturated, Lin says: “It really is what the product differentiation of each player is and finding their niche. I feel the market is quite big where everyone can focus on their own areas, and within their own areas, they can find optimisation and scale to achieve their goals.

“Thus, I wouldn’t categorically say the market is too competitive [because] it depends on what you are looking at and how you structure your sales operations and so on to achieve the intended target for the segments you are in.”

On Ninja Van Malaysia’s part, it differentiates itself from competition through its ecosystem, according to Lin.

“The focus becomes more on what value you can provide to the customers rather than just the price. We not only offer last-mile delivery services, but fulfilment, warehousing and distribution services and digital tools so that we can be a one-stop shop. If you provide just one part of the services, customers will only think about price. If you look at the whole ecosystem [such as] what other values you can bring to them, then they will start to see what value the company can provide them, rather than what the price is,” he says, concurring that relentless price-cutting is turning the market into a “race to the bottom”.

“Tech-wise, we are definitely a pioneer in the market. The competition now is how we stay ahead, how we continuously differentiate and develop more services. For sure, tech helped us to benefit during Covid-19.”

It was reported that Ninja Van Group is now considering further fundraising to expand its business. However, private equity firms are reportedly less flush with cash amid inflation and rising interest rates.

To this, Lin says: “We understand that external factors such as inflation and rising interest rates can impact the broader economic landscape. However, Ninja Van Malaysia continues to focus on its strength and we remain committed to our mission of providing seamless and hassle-free logistics solutions to shippers and shoppers alike. We trust that by providing comprehensive solutions beyond last mile, we can engage customers and partners across the value chain, delivering not just packages but also innovation that redefines Malaysia’s logistics landscape.”

He points out that this year is about getting Ninja Van Malaysia’s ecosystem to work together.

“This means getting our customers to use our full suite of services and with that, they grow, we grow together. We definitely can still add more products. For us, it is about listening to our customers and what their requirements are. From there, we see if we can do anything better or we can find a partner that can service them. But I think this will probably be the suite of services that we have for now.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport