(Bloomberg) — Brokerage analysts in China are confronting a harsh new reality.

The industry — which employs thousands of people who research and opine about stocks, the economy and markets — is retrenching after years of expansion.

At Guotai Junan Securities Co., a state-owned brokerage based in Shanghai, several senior analysts recently resigned after deciding not to accept pay cuts and stricter performance metrics. One Shenzhen-based brokerage laid off 40% of its analysts during the first quarter and slashed their 2023 bonuses by more than 50%. Other brokerages are reducing meal and travel budgets to contain costs.

The cutbacks, described by people familiar with the matter, come as a prolonged market slump reduces trading commissions and authorities tighten limits around what research analysts are allowed to publish. It’s a stark turnaround from a few years ago, when securities firms were hiring aggressively and offering compensation of 10 million yuan ($1.4 million) or more to star analysts.

“Now with the trading fees cut, the bubble in the research circle will also burst,” said Sun Jianbo, a former chief strategist at China Galaxy Securities Co. who now runs China Vision Capital, an asset manager in Beijing.

Guotai Junan didn’t respond to a request for comment. This account of the industry’s retrenchment is based on conversations with around 20 analysts and former analysts, who asked to remain anonymous or use only their first names discussing a sensitive topic.

Amy, 28, said she lost her job as an analyst covering the new energy sector at a medium-sized brokerage in Shanghai in February. Her former team was cut down to two analysts from seven, she said.

A few weeks later, she settled for a similar job with 40% less pay at a smaller securities firm. “There’s no other way around,” she said. “The only thing that matters now is to stay employed. So my approach is to grab a job first and see what comes next.”

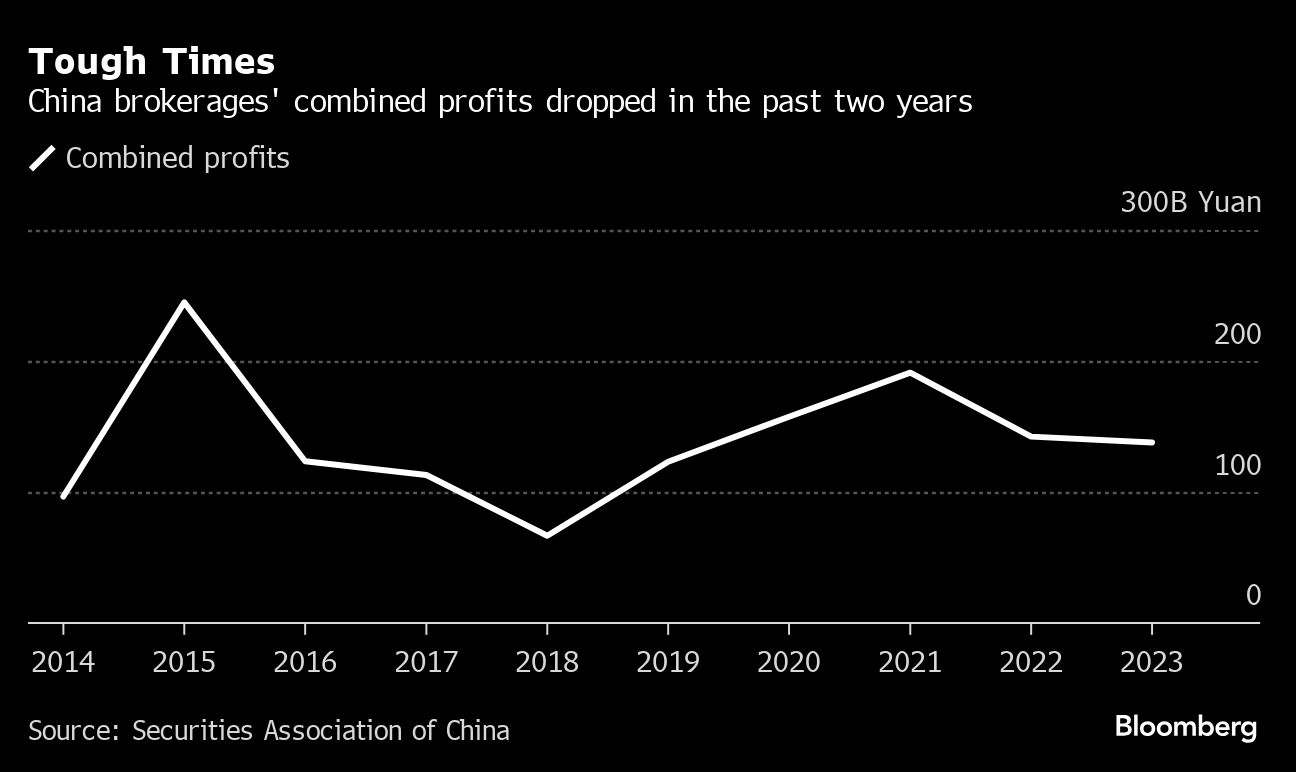

Tough Times | China brokerages’ combined profits dropped in the past two years

Pay Matters

Chinese brokerages have long evaluated their research analysts by the volume of trading commissions — or “soft dollars” — that they generate from fund houses and other investor clients, rather than on the accuracy of their calls. The commissions, or paidian in Chinese, have led brokerages to expand their research teams aggressively and reward analysts generously with competitive pay packages.

The number of sell-side research analysts in the country grew almost 70% over the past decade to more than 4,800 currently, according to data from the China Vision Capital. One of the nation’s largest players, China International Capital Corp., has more than 300 certified analysts, while Citic Securities Co. employs close to 200 research analysts.

Senior analysts that secured top spots at popular research contests like New Fortune could easily earn annual packages of 10 million yuan, according to Brook Zhang, director of headhunting firm Bo Le Associates.

Those with 10 years of experience can get around 800,000 yuan in basic salary, while analysts with 5 years of experience are typically paid around 500,000 yuan, said Zhang, who specializes in hiring financial professionals. Annual bonuses are usually equivalent to around 10 to 12 months basic pay; they can reach 24 months in good years, and be as little as 3 months of pay in bad years.

That tide is now turning, after China proposed late last year to cut trading fees paid by public investment funds, and asked money managers not to use commissions to pay for research from brokerages firms. At the same time, investors have become less keen to put money into mainland China’s stock market following its three-year losing streak, resulting in weaker demand for equity research.

Growth in other segments like proprietary trading and investment banking has also been curbed, prompting brokerages to take an ax to costs. China’s stock-market rescue measures have curtailed short selling and net sales of shares by proprietary trading desks of brokerages. Initial public offering activity in China slowed sharply in the past year, hitting investment banking revenues, and that malaise is expected to continue as Beijing tightens listing rules and beefs up checks on IPO-related malpractices.

Waning Momentum | China’s onshore share sale activity has slowed in recent years

The combined profits at Chinese brokerages dropped more than 20% in 2022, snapping a three-year growth streak, according to data from the Securities Association of China. Profits slid 3% further in 2023.

Few Negative Calls

Analysts in China rarely issue “sell” ratings on stocks. They also have to be increasingly careful about what they say and write in research reports.

Some negative calls have drawn unwanted public attention. Last summer, a state-owned Chinese newspaper criticized Goldman Sachs Group Inc. for taking a bearish view of Chinese banks, after its research analysts recommended selling shares of local lenders.

CICC in late 2023 warned its analysts against making bearish calls or making negative comments about the economy or markets in both private and public discussions. The industry has also been plagued with scandals from racy client parties to win votes at contests.

Money managers say all this has diminished the quality of brokerage research in China. “The market has overflowed with homogeneous and useless research with little insight,” said Sun of China Vision Capital. He said the pressure to bring in commissions has made some analysts lobby their clients for trading business. That makes analysts “more like a public-relations type of job,” Sun added.

Compounding the challenges for brokerages are China’s tighter scrutiny over the financial sector and President Xi Jinping’s signature “common prosperity” campaign, which has hit salaries and triggered belt-tightening across the industry. Global banks have also been cutting China-focused jobs for more than a year, and pay for most senior investment bankers at Wall Street firms in Asia has dropped to the lowest in almost two decades.

Brokerages have stepped up cost-cutting efforts after some scaled back travel perks last year. At least two medium-sized securities firms imposed a cap on total expenses during business trips, meaning teams traveling together will have to split the quota among themselves, said two people familiar with the matter. One of the firms limited their budget for treating clients at 200 yuan ($28) per meal, regardless of the number of attendees.

Read more:

| China Proposes Cuts to Trading Fees, Ending Soft Commissions |

| China Investment Bank Bans Bearish Research, Wealth Displays |

| China Bankers Face Deeper Pay Cuts in ‘Common Prosperity’ Push |

| Is an Analyst Worth $75,000 or $1 Million? How China Decides |

| China Funds Weigh $415,000 Pay Cap in ‘Common Prosperity’ Drive |

Chen Zhiwu, a professor of finance at the University of Hong Kong, said Chinese analysts’ tendency to publish mostly positive views has made their research less credible and useful, endangering their jobs.

“I think these cuts reflect a structural change in the securities business and are hence permanent,” and aren’t transitory responses to the market downturn, he said.

The large pool of analysts will need to shrink to get rid of “redundant research capacity,” said Vision Capital’s Sun. “We’re now just in the early stage and the restructuring going forward will be a rather long and painful process,” he added.

–With assistance from Vicky Wei.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

Recall Just Announced For Popular Cookies Featured In Holiday Gift Baskets

-

Eagles rally past Bills in overtime as Chiefs win

-

Reality bites the green energy agenda

-

Sandigan orders Marcos Sr. pal to pay workers

-

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated

-

The mayor of Paris is making a loud exit from X, calling the platform a 'gigantic global sewer'

-

Rain showers, thunderstorms over Luzon, including Metro Manila — Pagasa

-

'Naruto' live-action film adaptation is in the works

-

NASA Highlights Stingray Nebula

-

Manila's Lagusnilad underpass opens

-

China probes debt-ridden financial giant

-

China's VUCA situation

-

Unraveling the mystery that is diabetes

-

Bangladesh's nuke plant is not going to steal PH investments