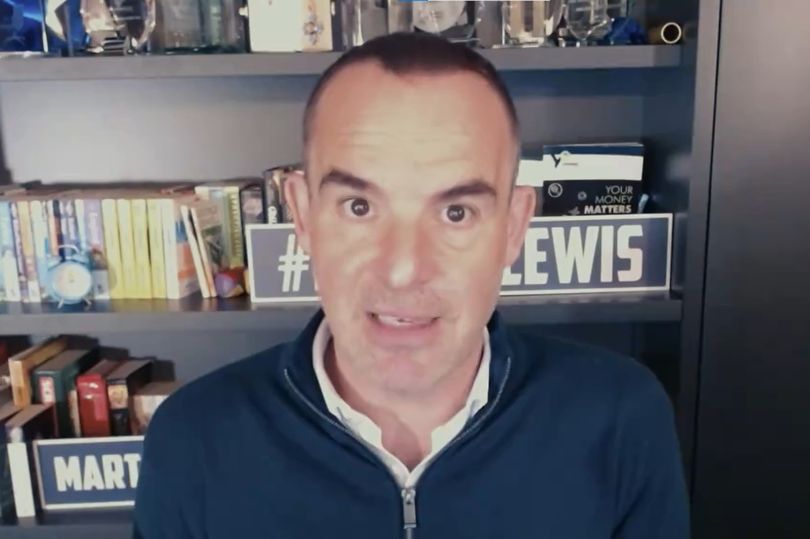

Martin Lewis explains inheritance tax in a handy video

Martin Lewis has shed light on the complexities of inheritance tax, a levy imposed on assets such as property, money, and possessions left behind by someone who has passed away – including who does, and does not, have to pay.

The topic has been hotly debated in recent times, with numerous calls for its abolition. However, no changes have been implemented so far. Given the intricate rules and stipulations, it can be challenging to determine who is or isn’t required to pay inheritance tax. Fortunately, Money Saving Expert founder Martin Lewis clarified everything people need to know earlier this year.

In a video posted on Twitter, Mr Lewis stated: “This is a tax there are so many misunderstandings about. Most people, when they die, their estates will not pay inheritance tax. This is primarily a tax that only affects the most affluent households.”

He outlined five crucial rules about inheritance tax, the first being that anything left to a marital or civil partner is exempt. However, this doesn’t apply to cohabiting couples, even if they’ve been together for 20 years and have 184 kids, as Mr Lewis pointed out, as per the Liverpool Echo.

The second rule states that there is no inheritance tax to be paid on the first £325,000 of an estate’s worth – consequently, if the total assets amount to less than this, there’s no tax liability. This threshold increases to £500,000 if the family home is left to children or grandchildren, including those who are adopted, fostered or stepchildren. However, this increment does not apply if the estate exceeds a value of £2m.

Mr Lewis elaborated: “Number four. It’s not just that you can leave anything to your married or civil partner and it’s exempt, you can also leave them any of your unused inheritance tax allowance”.

To illustrate this point, he expounded: “You leave everything to your wife and she is going to leave everything to your offspring. So she has a £500,000 allowance. She also gets your £500,000 allowance, so in total she can now leave £1m of assets without paying inheritance tax on it. That is a very large amount which covers what the vast majority of households in the UK are worth, hence why very few pay inheritance tax”.

For the fifth and final rule, Mr Lewis addressed the “four, five, six, seven percent of people who may well be eligible to pay inheritance tax”, highlighting that numerous strategies exist to lessen the amount due. He added: “If you give someone a give from your annual income it is not eligible for inheritance tax. “There are also a range of allowances you can give people and, as long as you live seven years after you give anybody anything, it’s not due inheritance tax”.

In wrapping up, Mr Lewis said: “If you’ve gone through all of those and your estate is so big it is going to be charged, the rate is 40%.”

News Related

-

Anyone who’s purchased gift baskets to hand out to loved ones this holiday season might need to find a backup present after the latest food recall that involves festive cookies. Gift basket company Wine Country Gift Baskets just announced that it is voluntarily recalling all gift baskets that feature Acorn Baking ...

See Details:

Recall Just Announced For Popular Cookies Featured In Holiday Gift Baskets

-

LOS ANGELES: Quarterback Jalen Hurts ran in an overtime touchdown to give the Philadelphia Eagles a 37-34 NFL win over the Buffalo Bills Sunday (Monday in Manila) and move them to 10-1 on the season. The Eagles, who lost the Super Bowl to Kansas City last season, trailed at half-time ...

See Details:

Eagles rally past Bills in overtime as Chiefs win

-

Yen Makabenta First word WHILE UN Secretary-General Antonio Guterres and other promoters of the climate emergency are preparing to convene the 28th conference of the parties (COP28) of the UN Framework Convention on Climate Change (UNFCCC) in the United Arab Emirates, starting on November 30 and stretching to December 12, ...

See Details:

Reality bites the green energy agenda

-

Sandigan orders Marcos Sr. pal to pay workers The Sandiganbayan has ordered the enforcement of a July 2023 ruling ordering a Marcos Sr. associate to pay a lumber company’s workers P2.1 million in damages as well as return 60 percent of their company’s shares and pay all unpaid benefits. The ...

See Details:

Sandigan orders Marcos Sr. pal to pay workers

-

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated MANILA, Philippines – More than 18,000 families have fled to evacuation centers across flood-affected regions in the country due to the impact of the shear line and low pressure area. Department of Social Welfare and Development (DSWD) gave ...

See Details:

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated

-

-

MANILA, Philippines: The entire Luzon, including Metro Manila, is expected to experience isolated rain showers and thunderstorms as the northeast monsoon (“amihan”) and easterlies will be affecting the country over the next 24 hours, the state-run weather agency said on Tuesday. Weather specialist Patrick del Mundo of the Philippine Atmospheric ...

See Details:

Rain showers, thunderstorms over Luzon, including Metro Manila — Pagasa

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

'Naruto' live-action film adaptation is in the works

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

NASA Highlights Stingray Nebula

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Manila's Lagusnilad underpass opens

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

China probes debt-ridden financial giant

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

China's VUCA situation

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Unraveling the mystery that is diabetes

-

Attention, Naruto fans! You can soon watch the famous anime’s live-action adaptation as it finally has a confirmed writer. According to a Variety report, the beloved manga and anime series is set to head to big screens for its live-action adaptation under Lionsgate. It will be written by Tasha Hao, ...

See Details:

Bangladesh's nuke plant is not going to steal PH investments

OTHER NEWS

ALIW Awards Foundation Inc. President Alice H. Reyes has released the names of finalists for the 2023 Aliw Awards to be presented on Dec. 11, 2023, at the Manila Hotel ...

Read more »

WhatsApp Web gains the feature of single-view photos and videos (Photo: Unsplash) The WhatsApp Web, the desktop version of the popular messaging app from Meta, has received an update allowing ...

Read more »

Young athletes’ time to shine in Siklab Awards MANILA, Philippines — The future heroes of Philippine sports will be honored during the third Siklab Youth Sports Awards on Dec. 4 ...

Read more »

Graphics by Jannielyn Ann Bigtas A local government official said Monday that five to 10 barangays in Northern Samar are still isolated following the massive flooding in the area last ...

Read more »

DyipPay app lets you pay jeepney fare, book tricycles “Barya lang po sa umaga.” Everyone who rides jeepneys knows this rule: it may not be an actual law, but it’s ...

Read more »

Updated In-Season Tournament Bracket ahead of pool play finale Tuesday will mark the last day of pool play for the inaugural NBA In-Season Tournament. From there, six first-place teams and ...

Read more »

PCG forms teams for maritime emergency response MANILA, Philippines — Recent incidents of fishermen lost in the waters off Southern Tagalog have prompted the Philippine Coast Guard (PCG) to form ...

Read more »