The S&P 500 (SNPINDEX: ^GSPC) bull market is now official by all standards, and the index has soared by a whopping 42% from its low point in October 2022.

That doesn’t mean that the best is already behind us, though. There’s still plenty of room for growth, and by investing now, you can take full advantage of those gains. Bull markets are fantastic wealth-building opportunities, and getting in early could help you make a lot of money over time.

It’s crucial, though, to have the right strategy. The good news is that building wealth in the new bull market doesn’t have to be difficult, and whether you’re new to investing or simply want a no-fuss approach, there are three simple steps to help maximize your earnings.

Gold bull and bear figurines set atop a newspaper showing financial information.

1. Invest in an S&P 500 ETF

Exchange-traded funds (ETFs) are baskets of securities bundled together into a single investment. When you invest in just one share of an ETF, you’ll instantly own a stake in all the stocks included in that fund. This can take much of the guesswork out of what to buy while building a well-diversified portfolio at the same time.

An S&P 500 ETF is a fund that tracks the S&P 500, and it includes all the stocks within the index itself — or around 500 stocks from the largest and strongest companies in the U.S. There are many S&P 500 ETFs to choose from, but a few of the most popular include the Vanguard S&P 500 ETF (NYSEMKT: VOO), the iShares Core S&P 500 ETF (NYSEMKT: IVV), and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY).

While there are never any guarantees when investing, the S&P 500 is about as surefire as it gets. The index itself has a decadeslong history of earning positive total returns, and it’s managed to recover from every downturn it’s ever faced.

In fact, research shows that it’s actually harder to lose money in the S&P 500 than to make money. Analysts at Crestmont Research examined the S&P 500’s long-term performance and found that every single 20-year period ended in positive total returns. In other words, if you’d invested in an S&P 500 ETF at any point in history and simply held it for 20 years, you’d have made money.

Everyone’s investing preferences are different, so an S&P 500 ETF won’t be right for every investor. But if you’re looking for a safer, more reliable, and low-effort investment, it could be a fantastic fit for your portfolio.

2. Take advantage of dollar-cost averaging

Although stocks are thriving right now, it can still be a daunting time to invest. Nobody knows whether another downturn is looming or how long this bull market might last, and it can be tempting to hold off on investing until the perfect moment.

However, there is never a perfect time to buy, because the market will always be unpredictable to a degree in the short term. And if you wait too long to invest, you’ll miss out on valuable time to grow your savings.

A safer (and often less stressful) approach is called dollar-cost averaging. This strategy involves investing a set amount at regular intervals throughout the year, rather than investing a large amount at once. There will be times when you buy at peak prices, but you’ll end up investing when stocks are trading at a discount, too. Over time, those highs and lows should average out.

Dollar-cost averaging makes it easier to take the emotion out of your investing decisions, and it can also save you money over time. Timing the market accurately is next to impossible, and if your timing is off, you could potentially lose a lot of money. With dollar-cost averaging, you won’t need to worry as much about what the market will do over the coming weeks or months.

3. Keep a long-term outlook

Again, stocks are often volatile in the short term — even during a bull market. But by investing consistently and keeping your money in the market for at least several years (or ideally, decades), you can earn more than you might think while still protecting your portfolio.

When you invest for the long term, there’s never necessarily a bad time to buy. If stock prices drop immediately after you invest, your portfolio may take a hit. But good investments will recover from downturns, and you should go on to see positive long-term returns.

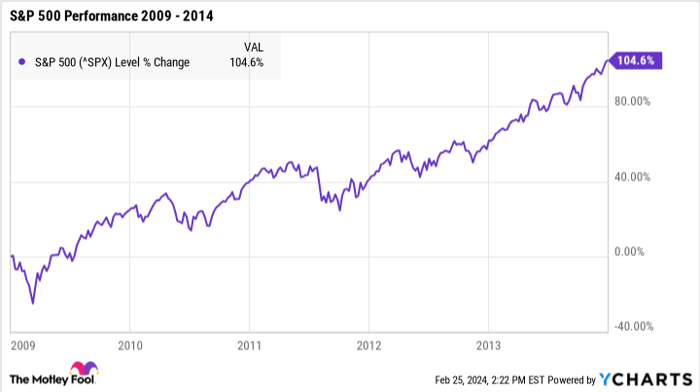

For example, say you invested in an S&P 500 ETF in January 2009. The market had already fallen substantially during the Great Recession, but it still had one more big drop before the S&P 500 bottomed out in March 2009.

^SPX

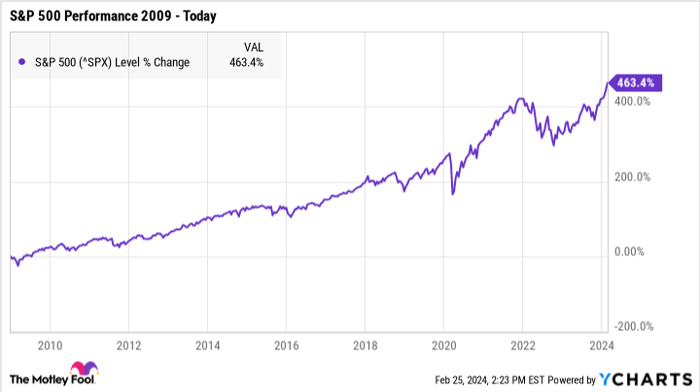

At the time, that may have seemed like an awful moment to invest. But if you stuck it out and stayed invested, you’d have earned returns of nearly 105% — more than doubling your money — within five years. By today, you’d have seen total returns of more than 463%.

^SPX

Of course, past performance doesn’t predict future returns, so there are no guarantees that the market will continue earning positive total returns over time. But considering the market has a perfect track record of rebounding from even the worst downturns, investing in the S&P 500 is a pretty safe bet.

As stock prices continue to soar, now is a fantastic time to invest. By choosing your investments carefully, investing consistently, and keeping a long-term outlook, you’ll be on your way toward generating life-changing wealth in the stock market.

SPONSORED:

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Katie Brockman has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

News Related-

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

Namwater Dam Bulletin on Monday 27 November 2023

-

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

Victory over Nigeria puts Uganda on the brink

-

BoG holds policy rate at 30%, tightens liquidity measures

-

When sea levels rise, so does your rent

-

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Sierra Leone prison breaks co-ordinated - minister

-

Address the rise of single parenthood

-

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Unmarried People Under 35 Outnumber Married Ones

-

European interior ministers in Hungary to discuss migration

-

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone