Local institutions give market a lift amid foreign selling

This article first appeared in Capital, The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

HAVING priced in the ongoing Middle East conflicts, Malaysia’s stock market has been on the rise with local institutions absorbing shares dumped by foreign investors. The FBM KLCI has risen 8% since the beginning of this year. The benchmark closed at 1,569.25 points last Thursday.

Fund managers and analysts say the recent stock market growth was driven primarily by local institutions taking up the space vacated by foreign portfolio investors.

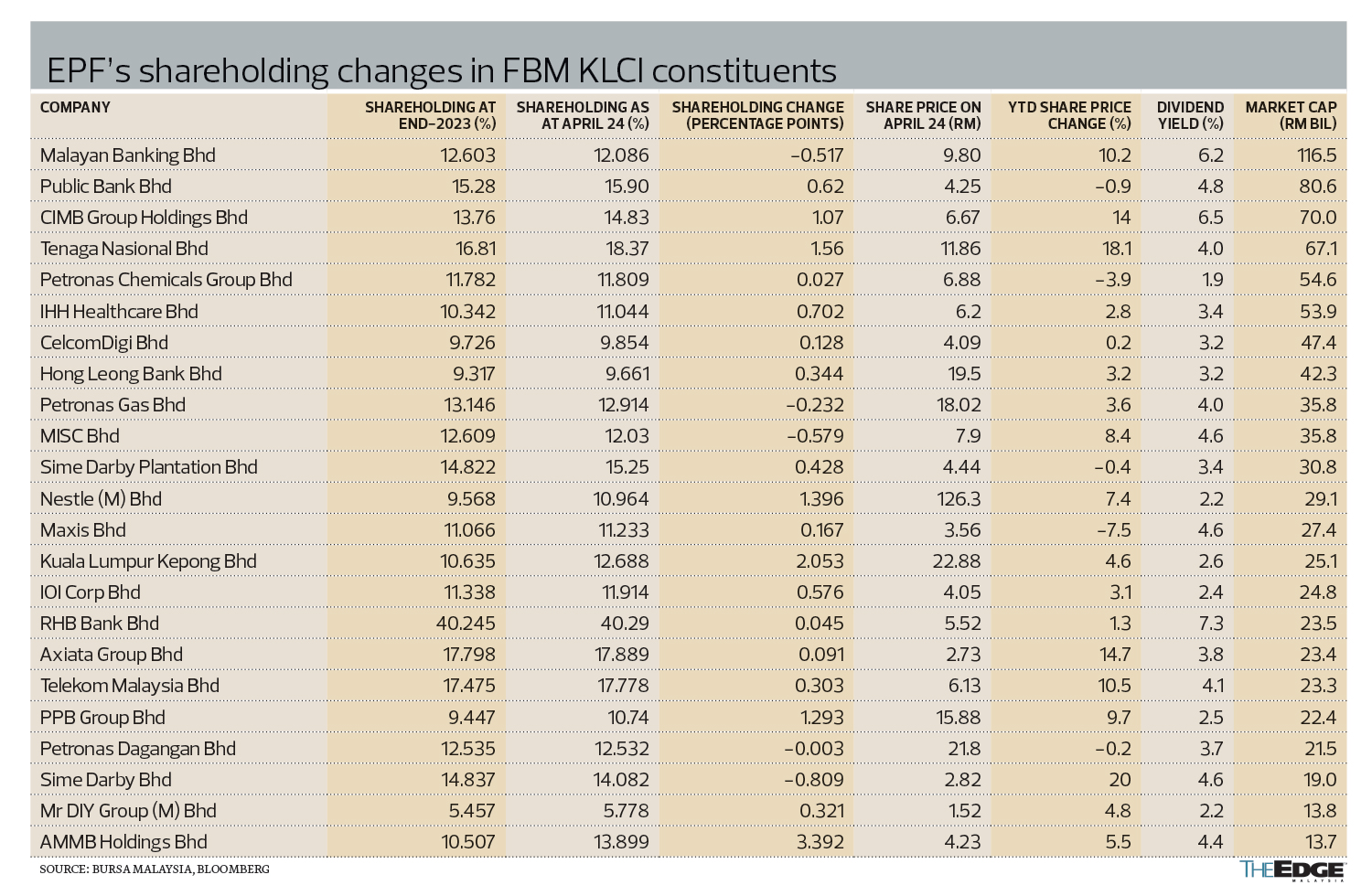

Take the Employees Provident Fund’s (EPF) investment portfolio. The retirement fund has increased its stake in most of the blue chips since the start of the year, except for Malayan Banking Bhd which has fallen by 0.517 percentage points (ppts), Petronas Gas Bhd (-0.232 ppts), MISC Bhd (-0.579 ppts), Petronas Dagangan Bhd (-0.003 ppts) and Sime Darby Bhd (-0.809 ppts).

EPF has accumulated more shares in AMMB Holdings Bhd, up 3.392 ppts to 13.899% from 10.507% as at end-2023. Its shareholding in Kuala Lumpur Kepong Bhd, Tenaga Nasional Bhd, Nestlé (Malaysia) Bhd, PPB Group Bhd and CIMB Group Holdings Bhd increased by 2.053 ppts, 1.56 ppts, 1.396 ppts, 1.293 ppts and 1.07 ppts respectively.

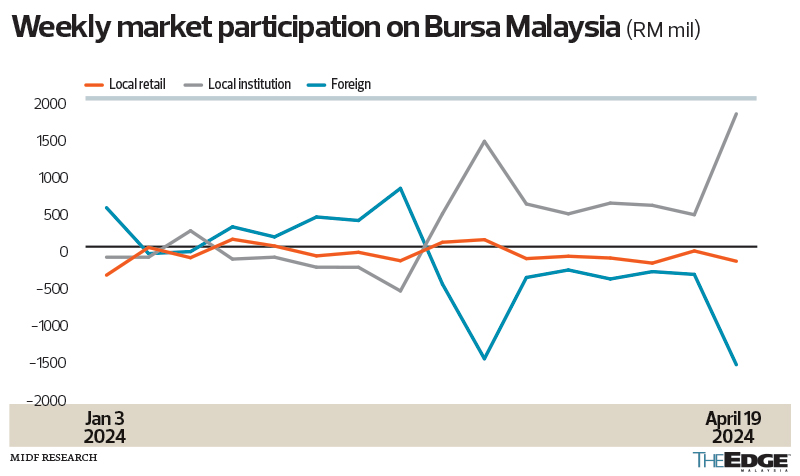

MIDF Research data show local institutions have become net buyers of Malaysian equities in the past two months. For the week ended April 19, net buying was at a six-year high of RM1.79 billion.

In contrast, foreign funds net sold RM1.59 billion worth of local equities during the week in review — the highest weekly net outflow in four years. This is in line with foreign investor sell-off in other Asian bourses.

Retail investors, meanwhile, were net sellers of Malaysian equities for the sixth consecutive week, with net sales amounting to RM195.8 million.

How should investors interpret this diverging trend between local and foreign funds?

Danny Wong, CEO of fund manager Areca Capital Sdn Bhd, is of the view that local institutional funds such as EPF are confident in the local stock market.

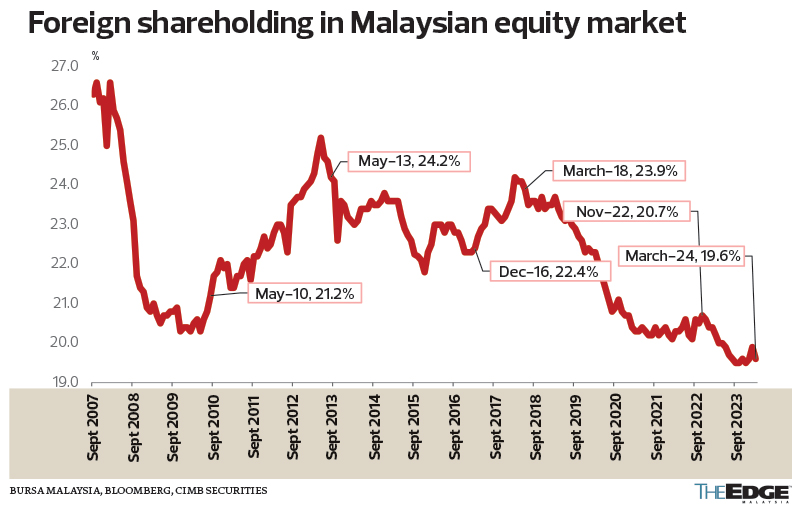

He does not see further significant outflows of foreign funds from Bursa Malaysia as the foreign shareholding is already at a low level. Institutional funds’ net buying position will help support the market.

“Usually for long-term investment funds, they will only do transactions when the volume is there, and they will ‘buy low, sell high’ for the long term. [The net buying position suggests that] local institutional funds see the current level as being low from the mid- to long-term perspective,” Wong tells The Edge.

He says foreign funds are offloading Malaysian equities due to the persistently high inflation and interest rates in the US, resulting in the renewed interest in US dollar-denominated assets.

“It is more to do with the currency risk, which foreign funds don’t like, and not so much about the market itself. To local retail investors, they understand the local stocks’ value and they don’t see currency as a concern,” he explains.

The US dollar has gone from strength to strength against emerging-market currencies this year on growing expectations that US interest rates will stay high. South Korea’s won has fallen 6.3% against the greenback this year, leading the regional declines. The ringgit has depreciated as much as 4.3% this year.

US Federal Reserve chair Jerome Powell has cautioned that elevated inflation may delay the Fed’s rate cuts until later this year. “Recent data have clearly not given us greater confidence that inflation is coming fully under control and instead indicate that it is likely to take longer than expected to achieve that confidence,” he was quoted as saying during a recent panel discussion in the US.

Eastspring Investments Bhd, in its Market Outlook for 2Q2024 report, says: “The expectations for the number of rate cuts by the Fed in 2024 have changed significantly, from initially five rate cuts starting in March to now two, to end the year on a target range of 4.75% to 5%.”

“Given the recent resilient US economic data, the Fed will likely not cut rates too early but will make its decision after seeing a few more months of data. The multi-asset team expects the data-dependent Fed to begin pivoting on clear signs of a threatening recession, a meaningful breakdown in labour market demand, and/or a clear easing of core inflation in a lasting manner toward its target inflation rate of 2%,” it adds.

Nonetheless, Wong believes the Fed will have to reduce its interest rates soon in view of the US economy potentially turning weak later.

“I think the US interest rates have stayed high enough and the US economy may not be as robust as we think. Though the current job market and Consumer Price Index are strong, it is partly because of the geopolitical risk,” he notes.

Foreign shareholding in Malaysian equities fell 0.3 ppts month on month to 19.6% in March, which is close to an all-time low of 19.5% in September-October 2023, according to CIMB Securities’ April 3 note.

Malacca Securities Sdn Bhd head of research Loui Low is of the view that the local market remains on a bullish tone this year, with no major downside risk for now.

“Overall, the market sentiment is being supported by local institutions. As long as the earnings cycle is not declining, I think there will be upside opportunities. I am expecting corporate earnings to improve both on a quarterly and yearly basis,” he says.

Meanwhile, Areca Capital’s Wong says the Middle East conflicts are not of a major concern for now. “As long as the war is contained within that region, I am quite comfortable that it won’t affect us. After a while, investors will accept that there won’t be much impact on this part of the world, and there will even be a trade diversion.”

Although oil prices may spike from the Middle East conflicts, he opines that they are unlikely to rally to the US$140 a barrel level. “The key oil consumers like the US and China will not let the price go higher and they want to maintain the price at US$90 a barrel,” he adds.

Brent crude closed at US$88 per barrel last Thursday.

Despite the ongoing geopolitical developments and interest rate uncertainty, Wong is positive on the local market, with an expectation of a better second half.

“Corporate earnings results for 1Q2024 will be announced soon. I don’t expect to see much improvement and there could be a chance that the earnings season may disappoint, so there could be a situation of selling in May,” he says.

Having said that, he stresses that any weaknesses in stock prices will offer investors the opportunity to accumulate shares.

Wong expects a rotational play from the top-performing sectors — such as property and construction — to laggards like semiconductor, manufacturing, consumer, healthcare, tourism and export-oriented industries.

Bursa’s property index and construction index have gained 17.2% and 14.3% respectively so far this year, outperforming the FBM KLCI’s 8% gain. As the risk premium for FBM KLCI constituents expands, the same could happen to the broader market, Wong believes.

Malacca Securities’ Low sees utility stocks such as Tenaga and YTL Power International Bhd offering some upside. Tenaga and YTL Power have seen their share price rise 18.1% and 60.6% year to date respectively.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.