This article first appeared in Capital, The Edge Malaysia Weekly on February 5, 2024 – February 11, 2024

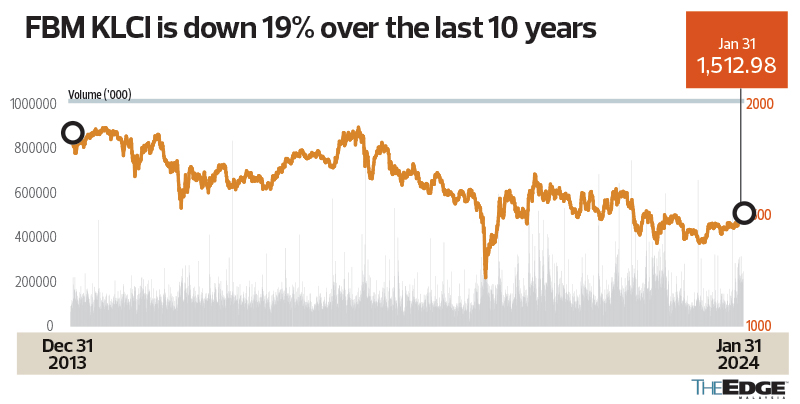

FOLLOWING the woes brought about by the sell-off in the shares of 16 small-capitalisation counters on Bursa Malaysia in mid-January, the tide seems to have turned, favouring counters with larger market capitalisation. This can be seen in the performance of the benchmark index, the FBM KLCI, which gained more than 4% or 58 points in the first month of this year, making it the best performer in the region.

The FBM KLCI, which comprises the top 30 companies on Bursa’s Main Market based on market capitalisation, rose above the 1,500 level to the highest point since August last year.

From its recent low in June 2023, the index had gained more than 9% as at Jan 31 this year, but it is still far from the definition of a bull market — a 20% increase from the recent low.

While this should be a moment to be celebrated, historical data shows that the benchmark index usually loses its momentum after a spectacular rally.

For instance, last year, the FBM KLCI surged above 1,500 points in the early part of the year before falling 7.3% from its peak in March to below the 1,400 level in early April. This was also seen in 2022, when the benchmark index peaked above the 1,600 level in March before falling 12.8% in July to 1,400 points.

Since 2014, the FBM KLCI has closed lower every year except in 2017 and 2020.

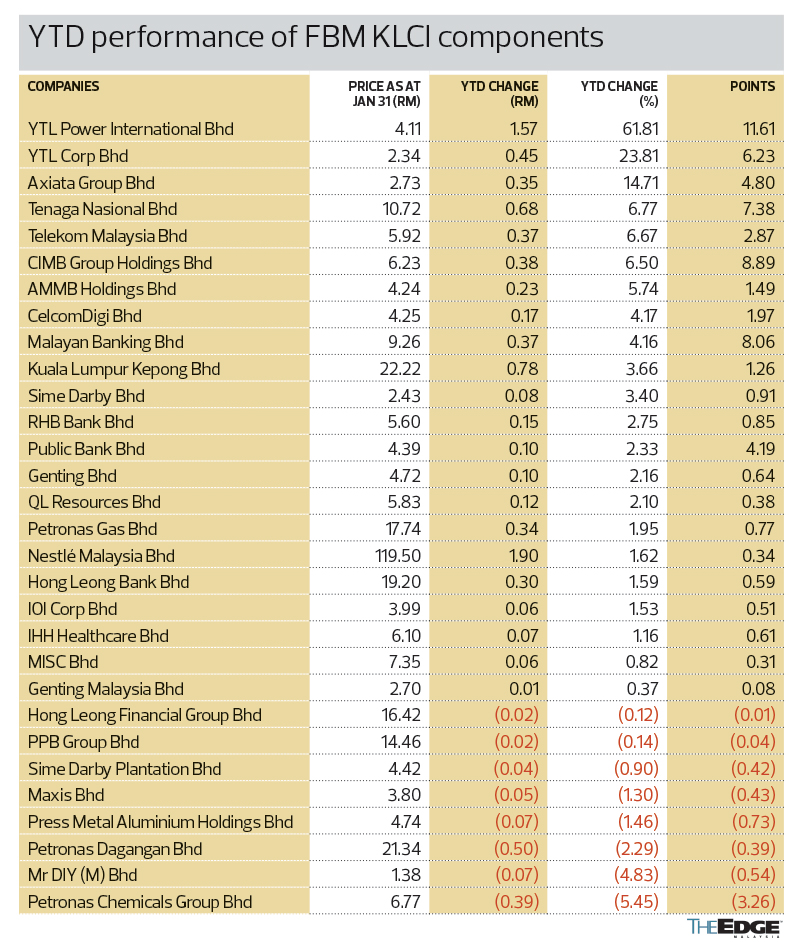

It is worth noting that the recent rally in the index was mainly driven by a handful of companies, namely YTL Power International Bhd, CIMB Group Holdings Bhd, Malayan Banking Bhd, Tenaga Nasional Bhd, YTL Corp Bhd and Axiata Group Bhd.

YTL Power and YTL Corp, which became constituents of the FBM KLCI late last year, saw their respective share prices gain 62% and 24% this year alone. But their spectacular gain has only collectively contributed 17.8 points to the benchmark index so far this year.

Holding the highest weightage in the FBM KLCI is Maybank, which saw its share price gain 4.2% this year to RM9.26 apiece on Jan 31, adding 8.06 points to the index’s performance. This was followed by CIMB Group, which gained more than 6.5% and added 8.9 points to the market barometer. Meanwhile, Tenaga surged 6.77%, contributing 7.4 points to the index.

In other words, the performance of the FBM KLCI was heavily influenced by the share price movements in Maybank, CIMB Group and Tenaga due to their weightage contribution to the index.

Overall, 22 companies out of the 30 on the FBM KLCI were in the green this year as at Jan 31, while the rest — namely PPB Group Bhd, Hong Leong Financial Group Bhd, Press Metal Aluminium Holdings Bhd, Maxis Bhd, Petronas Dagangan Bhd, Mr DIY Group (M) Bhd, Sime Darby Plantation Bhd and Petronas Chemicals Group Bhd — were in the red.

However, a slowdown may be on the cards, as suggested by Inter-Pacific Research Sdn Bhd, which says the current rally is “approaching overbought” scenario.

“This could keep further near-term gains more modest with the hurdles now at the 1,520-1,525 levels, while the supports are at the 1,508-1,510 levels and at 1,500 points respectively,” it says in a Jan 30 note to clients.

The research house points out that in comparison to the gains in the benchmark index, the broader market was more subdued with mild profit-taking emerging, sending both the FBM ACE and FBM Small Cap indices lower.

Nonetheless, Inter-Pacific Research expects the buying interest in selective heavyweights on Bursa to remain, giving the FBM KLCI near-term impetus to make further headway and putting behind it the market vagaries that had dented its performance in 2023.

“Much of the buying will continue to be sentiment-driven as there remains little improvement to Bursa’s fundamentals for the time being, and this is also allowing the FBM KLCI to outperform its Asean peers thus far in 2024.

“It is also allowing for the key index to play catch-up from its laggard position over the past two years with the prospects for further improvement in the country’s economic outlook later this year,” it says.

Another research house points out that profit-taking activities could be on the horizon should the FBM KLCI go near the 1,528-1,550 levels ahead of the release of major US and China economic data.

“We reiterate our optimism that the FBM KLCI’s rebound from 1,446 (Jan 2 low) may continue after closing at a 17-month high of 1,515.4. Nevertheless, the index could face profit-taking hurdles (having surged 36.2 points in the last six consecutive session) near the 1,528-1,550 levels,” Hong Leong Investment Bank Research said on Jan 30.

Resurgence still has legs

Danny Wong, CEO of fund management company Areca Capital Sdn Bhd, reckons that there is still upside in the local stock market, driven by economic growth, expectations of rate cuts by the US Federal Reserve and steady improvement in China’s economy.

“The recent rally in the market has been mainly driven by several sectors, including construction and property, on the back of recent announcements of mega infrastructure projects. It was not a broad-based rally, as such we think that there is more upside in the market,” he tells The Edge.

Wong suggests that the market will see a gradual increase as there are companies’ share prices that have yet to recover from the Covid-19 pandemic. “Last year was supposed to be a recovery year for the local stock market, but the rapid increase in the Fed rate curbed it. Any interest rate cut in the US will be a boon for markets in the developing economies as most of their currencies and stock markets are trading at undemanding valuations and below their historical mean averages.”

Last Wednesday, the Fed left its benchmark interest rate unchanged at a 23-year high of 5.25% to 5.5%. The US central bank has maintained its rate since July last year, a sign that its aggressive rate hike campaign may have come to an end as inflationary pressure fades.

However, in a news conference last Wednesday following the January meeting, Fed chair Jerome Powell pushed back against the idea that it could start reducing rates as early as March this year.

Foreign investors have already been making their way to Asean stock markets, with Malaysia and Indonesia seeing net inflows of RM644 million and RM1.75 billion respectively this year. However, this has yet to reverse the total foreign net outflow from the Malaysian stock market last year, which totalled RM2.34 billion.

According to a MIDF Research report, foreign investors returned as net buyers on Bursa, contributing to a net foreign inflow of RM267.7 million for the week of Jan 19 to 25.

The top three sectors with the highest net foreign inflows were financial services (RM112.2 million), utilities (RM97.3 million) and property (RM86.6 million).

The top three sectors with the highest net foreign outflows were consumer products and services (RM39.6 million), industrial products and services (RM38 million) and healthcare (RM21.2 million).

According to CIMB Bank Research, YTL Power remained the most heavily bought stock by foreign institutional investors, followed by YTL Corp and CIMB Group.

The top three net sells by foreign investors were RHB Bank Bhd, Press Metal and Malaysia Airports Holdings Bhd.

Meanwhile, local institutional investors’ top net sells were IJM Corp Bhd, YTL Power and Sime Darby Bhd, while their key net buys included RHB Bank, Malaysia Airports and Press Metal. Local retail investors’ top net sells were YTL Power, YTL Corp and Malaysian Resources Corp Bhd.

Still value in small caps, but focus on fundamentals, say analysts

The recent selldown of 16 small-cap counters on Bursa Malaysia provides a lesson to investors not to be caught in euphoria.

While it may have a negative short-term effect on market sentiment, market observers and analysts say, it is the US Federal Reserve decision that will determine market trends in the coming months.

Former investment banker and investor Ian Yoong says while investor sentiment may have been dented — mainly in the retail segment — the damage is containable. He says that the episode where a number of small caps inexplicably tanked over just a few days, after rising substantially, reinforces the lesson for investors to look into a company’s fundamentals before making investment decisions.

“It is a good lesson and also a learning opportunity,” he tells The Edge.

About a fortnight ago, a cluster of small-cap stocks, including a few related to prominent investor Datuk Dr Yu Kuan Chon, experienced a severe selldown, prompting several brokerages to tighten their rules for margin financing.

The counters shared many similar traits, one being that they soared to dizzying heights for months, even though there was no visible improvement in their business fundamentals. Some were even loss-making companies.

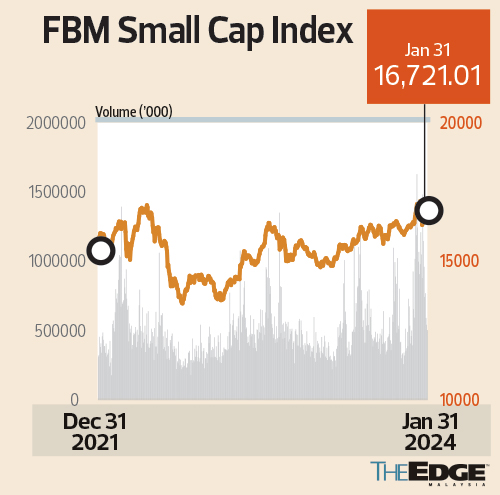

Small-cap companies generally had a fantastic run in 2023, as evidenced by the FBM Small Cap Index’s near 10% increase compared to the 1.3% dip in the benchmark FBM KLCI.

Notwithstanding the recent bloodbath in those select small caps, the FBM Small Cap Index has gained 2.25% in the past month.

The overall market sentiment has been hit since the beginning of 2022, when the Fed embarked on an aggressive monetary policy to fight persistent inflation. But, since July last year when the Fed decided to pause its rate hike, the local stock market has started to become more active. It started 2024 on a livelier note, but the small cap sell-off has spooked the market somewhat with investors asking if there is more to come.

Yoong believes cautious sentiment aside, it is an opportunity for investors to look at small caps as there are undervalued stocks.

“Investors should be more vigilant and not depend on speculation when making decisions. They should be looking at the shareholders’ structure and these companies’ financial performance in the past,” he adds.

Looking past the episode, Areca Capital Sdn Bhd CEO Danny Wong says that the overall market trend remains intact, with the recovery theme expected to continue this year.

“The recent sell-off mainly involved small-cap counters that saw their share price move higher than the fundamentals and, as such, they are also vulnerable to short-sellers,” he explains.

Wong reckons that the recent sell-off in these counters is a “one-off” event and a lesson for retail investors.

“We believe that the overall stock market will do better this year on the back of the US Fed cutting interest rates, China’s economic focus and a better political landscape in Malaysia,” Wong adds.

Nonetheless, he warns investors to be vigilant over the recent rally in some property and construction stocks following announcements on mega infrastructure projects.

RHB Research suggests that the recent market sell-off among small-cap counters on Bursa Malaysia should not deter investor confidence in looking for good fundamental stocks.

In a strategy note last Tuesday, the research house said that investors will continue to have a tendency to eye the more attractively priced space in the small- to mid-cap space as opposed to the expensive large caps.

“While the small- to mid-cap space is often preferred for higher growth prospects, a balanced pick, combined with value- and growth-focused stocks, would be appropriate in the current environment.”

As such, RHB called for a focus on earnings quality, margin preservation, cash flow and yield generation as they would be paramount, especially againstthe backdrop of tense geopolitical conflict, cost escalation and demand uncertainty.

“Optimism about a stronger corporate earnings outlook on a low base in 2023 may continue to lend support to trading activities. We believe laggard plays on bottoming-out stocks will likely be another major theme realised on potential cyclical recovery and sector rotation,” the research house added.

“I believe some may have run ahead of fundamentals as some of the project implementation is not certain yet at this juncture,” he points out.

The stock exchange operator has attributed the recent stock selldown to margin calls. Last week, at a press conference, Bursa Malaysia Bhd CEO Datuk Muhamad Umar Swift pointed out that the selldown of the counters was triggered by their shareholders’ inability to meet margin calls. But he assured that the stock market remains “orderly” and that the local stock market operator does not view the episode as posing a systemic threat to the market.

“Volatility is the life of the secondary market, right? The counters involved were some 0.18% of the total market. Yes, we do see the changes. We do track it. We are concerned. But it doesn’t pose a systemic threat,” he told the press after the group’s financial results media briefing last Wednesday.

“There will always be what we like to call ‘animal spirits’ in the market. That is what makes the market triumph. The key is to make sure the market is orderly, that there is no misconduct, and that is something we take great detail (of) after we work with the Securities Commission on it,” said Muhamad Umar.

Chairman Tan Sri Abdul Wahid Omar also assured that Bursa Malaysia has active surveillance in place to ensure compliance with its Listing Requirements.

“Some of the volumes are very much triggered by the forced sale of the stocks, where some of these stocks, which were pledged with financiers, were unable to meet their margin calls, and that has triggered the downtrend and the high volume,” said Abdul Wahid. “The role of an exchange would be to ensure that the market continues to operate in a fair and orderly way, and that remains the case.” — By Intan Farhana Zainul

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport