- After markets opened on Friday shares in NYCB fell some 24 percent

- It came after the bank revealed additional losses and new leadership

- Kevin O’Leary wrote in a column for DailyMail.com that it would fail in months

Shares in New York Community Bank fell 24 percent on Friday morning after the ailing lender announced new leadership and reported an additional $2.4 billion loss.

The bank, with 420 branches and hundreds of thousands of customers, has faced a crisis in recent months after the quality of its commercial real estate loans soured and ratings agencies downgraded its credit status to junk.

Companies are giving up on offices and downtown retail spaces – after Covid normalized working from home and catalyzed the decline of downtown shopping.

That left the owners of commercial buildings unable to pay lenders like New York Community Bank (NYCB). Some 16 percent of its loans are for commercial real estate acquisition, development and construction.

Two weeks ago, Shark Tank star Kevin O’Leary wrote in a column for DailyMail.com that small, regional banks are ‘dinosaurs’ – and predicted that ‘NYCB will be wiped out in three months.’

New York Community Bank has been facing a crisis over souring commercial real estate loans

Shark Tank star recently predicted the bank would be wiped out altogether within months

‘If your bank is in the news, be concerned,’ O’Leary wrote.

On Thursday, the Long Island-based bank made the news again after it amended its fourth-quarter results to report losses 10 times higher than it had previously, citing the $2.4 billion charge which it associated with pre-2007 purchases.

The bank’s share price first fell at the end of January – after it cut its dividend and posted a surprise loss.

On the last day of the month it plummeted 38 percent from $10.38 to $5.47. Since then it continued to edge down before last night’s big decline. Losses since January are now up to about 64 percent.

On Thursday, the bank also announced that its executive chairman Alessandro DiNello would take on the role of president and CEO, effective immediately.

NYCB also noted that it had found ‘material weaknesses’ in the processes it uses to evaluate the risks associated with loans.

Also hurting NYCB is that it is a major lender to New York apartment landlords, many of whom have suffered earnings hits on multifamily residences after New York toughened rent controls in 2019.

‘Without a doubt, the situation feels a bit uncertain at NYCB right now,’ Piper Sandler analyst Mark Fitzgibbon wrote in a note to clients.

‘We fear that there could be additional issues that get raised as a new team takes the reins,’ he added.

Covid normalized working from home and catalyzed the decline of downtown shopping

Pictured is the Chrysler Building in New York – office buildings are facing increasing vacancies

But in statement on Thursday, DiNello made assurances the bank would weather the storm.

‘It is my mandate as President and CEO, alongside our Board, to continue our transformation into a larger, more diversified commercial bank,’ he said.

‘While we’ve faced recent challenges, we are confident in the direction of our bank and our ability to deliver for our customers, employees and shareholders in the long-term.’

The bank also revealed in that statement that its presiding director of the board would be replaced by Marshall Lux.

But like Kevin O’Leary, experts and industry bodies are not quite so optimistic about the future for regional lenders.

Some $929 billion of outstanding commercial mortgages held by lenders and investors will mature in 2024, or 20 percent of the $4.7 trillion total outstanding debt, according to recent data from the Mortgage Bankers Association.

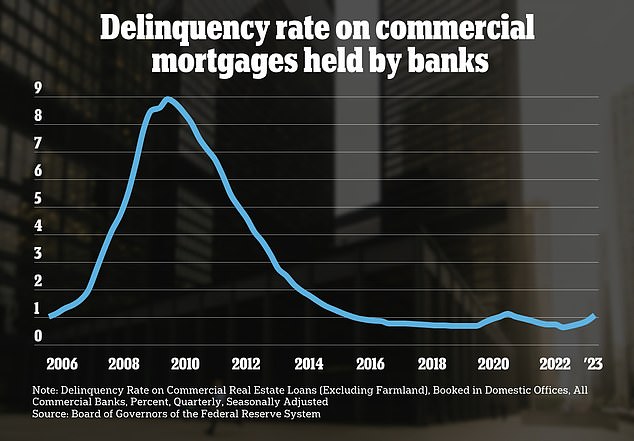

The delinquency rate on commercial mortgages, a leading indicator for defaults, ticked up last year, but so far is well below the level seen in the Great Recession, when it approached 10%

And about 14 percent of all commercial real estate loans, and 44 percent of office loans, appear to be ‘underwater,’ with current property values that are less than the outstanding loan balances, according to a recent working paper for the National Bureau of Economic Research.

‘If nothing changes – if interest rates remain elevated and property values do not improve – we do view defaults at the rate of the Great Recession, and in fact even higher, as quite a possibility,’ one of the co-authors, Columbia Business School professor Tomasz Piskorski, recently told DailyMail.com.

Piskorski said that he and his co-authors view a commercial mortgage default rate of 10 percent or more as ‘quite likely’ given the current share of underwater loans.

‘This is the icing on the cake that can really create a problem for quite a few banks, mainly smaller and mid-sized banks.’

Read more

News Related

-

, Nov. 28 — One of the most anticipated Android releases for 2023 has been the Google Pixel 8 lineup. The Pixel series is often considered the best of what Android has to offer since it brings the true stock Android experience. The Pixel 8 Pro was globally released on ...

See Details:

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

A blank space or an (NR) indicates no readings received. An (e) indicates that the water level has been estimated. An (w) indicates that the conditions were very windy, resulting in an inaccurate reading. Omatjenne Dam does not have abstraction facilities. The dam contents are according to the latest dam ...

See Details:

Namwater Dam Bulletin on Monday 27 November 2023

-

Dhaka, Nov. 27 — Nobel laureate Dr Muhammad Yunus has been appointed chair of the international advisory board of Moscow’s Financial University (under the government of the Russian Federation). On November 23, he joined a high-level strategic meeting with Prof Stanislav Prokofiev, Rector of the Financial University, and his colleagues. ...

See Details:

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

In a pivotal encounter at the International Cricket Council (ICC) Twenty20 World Cup Africa Final Monday, the Cricket Cranes faced Nigeria, knowing that a win could significantly boost their chances of securing one of the coveted tickets to the 2024 T20 World Cup in West Indies and the USA.Nigeria won ...

See Details:

Victory over Nigeria puts Uganda on the brink

-

Capture 1 The Bank Ghana (BoG) Monetary Policy Committee (MPC) has maintained the key policy rate at 30 percent, while introducing additional liquidity management measures to address excess liquidity and reinforce the disinflation process. Announcing the committee’s decision on Monday following its 115th meeting, BoG Governor Dr. Ernest Addison said ...

See Details:

BoG holds policy rate at 30%, tightens liquidity measures

-

Renita Holmes has been displaced four times in the past three years by rising rents With sea levels rising around the globe, Miami, in the US state of Florida, is facing an urgent need to adapt. As property investors turn their gaze inland, away from the exclusive low-lying beach area, ...

See Details:

When sea levels rise, so does your rent

-

Picture2 In a groundbreaking moment, Mrs. Adelaide Siaw Agyepong, CEO-American International School, has achieved yet another milestone by being crowned ‘Icon of Inspiration and Impact for the Year 2023’. The crowning achievement took place in Accra, where Mrs. Siaw Agyepong surpassed contemporaries to clinch this prestigious title at the 5th ...

See Details:

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Sierra Leone prison breaks co-ordinated - minister

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Address the rise of single parenthood

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Unmarried People Under 35 Outnumber Married Ones

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

European interior ministers in Hungary to discuss migration

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone

OTHER NEWS

Despite doing education at the university, Mellon Kenyangi, also known as Mama Bear, did not think of going to class, and teaching students was her dream job.“Since it was not ...

Read more »

213 Sri Lanka Cricket’s Chairman of Selectors, Pramodya Wickramasinghe reported to the Sports Ministry’s Special Investigation Unit( SMSIU) for the Prevention of Sports Offences yesterday for the second day. He ...

Read more »

137 Malindu Dairy (Pvt) Ltd., a leading food production company in Sri Lanka, won the Silver Award in the medium-scale dairy and associated products category at the Industrial Excellence Awards ...

Read more »

Africans Urged to Invest Among themselves, Explore Investment Opportunities in Continent Addis Ababa, November 27/2023(ENA)-The Embassy of Angola in Ethiopia has organized lecture on the “Foreign Investment Opportunities in Angola ...

Read more »

144 The dynamic front row player Mohan Wimalaratne will lead the Police Sports Club Rugby team at the upcoming Nippon Paint Sri Lanka Rugby Major League XV-a-side Rugby Tournament scheduled ...

Read more »

Dozens of people living with disabilities from New Hope Inclusive in Entumbane, Bulawayo on Saturday last week received an early Christmas gift in the form of groceries. The groceries were ...

Read more »

The East African Community (EAC) Summit of Heads of State has admitted the Federal Republic of Somalia to the regional bloc, making it its 8th member country. The decision was ...

Read more »