ETF chart stocks

Are you a Canadian looking to create a practical investment program that generates reliable passive income streams? Investing in a diversified portfolio of high-quality TSX dividend stocks with established track records could be an option. Small regular investments in a curated portfolio of financially strong dividend payers could transform a $500 monthly investment into a $266 annual passive income stream during the remainder of 2024, setting you well on a path towards attaining long-term retirement income goals. Â

Speaking of retirement planning in Canada, your goals may include preserving capital and building a low-to medium-risk core portfolio that generates recurring income, each month, while appreciating in capital value â preferably.

Canadian dividend Exchange-Traded Funds (ETFs) offer curated portfolios that suit various income investing strategies, and the iShares Core MSCI Canadian Quality Dividend Index ETF (TSX:XDIV) is one of the best income-investing examples that turn small regular investments into diversified retirement portfolios which generate reliable passive income streams.

iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV): A core investment holding for passive income

The iShares Core MSCI Canadian Quality Dividend Index ETF is a growing medium-risk-rated investment fund that has accumulated more than $1.1 billion in assets under management (AUM) since its inception in 2017. Managed by BlackRock, the low-cost ETF provides access to a curated portfolio of 17 Canadian dividend stocks with above-average dividend yields and steady or increasing regular dividend payouts. It provides instant diversification to new investors and has quickly become a formidable high-dividend yield ETF to hold in core portfolios.

The XDIV ETF invests in high-quality Canadian dividend stocks with strong financial performance, solid balance sheets, and stable annual earnings that pay increasing or stable dividends. Its dynamic portfolio pays monthly dividends of $0.13 per share, currently yielding a little above 6% annually.

Its largest holdings currently include Suncor Energy at 10.4%, followed by Pembina Pipeline stock at 9.7%, and the Royal Bank of Canada (RBC) stock, which comprises 9% of the XDIV ETF portfolio. Around this time last year, the portfolioâÂÂs $823 million in AUM was allocated 9.3% in Manulife Financial Corp stock, and 9.2% in each of Sun Life Financial stock and RBC stock as top holdings. ÃÂ

Diversification has improved over the past 12 months as financial sector stocks, which used to dominate the ETF with a 51.8% portfolio weight a year ago, gave up some space to other sectors. Financials comprise 41.5% of the ETF today, followed by energy stocks at 24.1% and utilities at 17.1%.

Invest in a low-cost ETF for growth and high-yield passive income

The XDIV is a low-cost ETF with a management expense ratio (MER) of 0.11%. Investors should expect to pay about $1.10 per every $1,000 invested in the ETF, or just $0.55 on each $500 investment, every year. The ETFâÂÂs low-cost profile minimizes investment expensesâ drag on wealth and income growth.

Most of the ETFâÂÂs holdings pay dividends quarterly. However, the ETF pays monthly dividends to its investors. The fund transforms quarterly dividends into monthly passive income streams â a key service that smoothens portfolio cash flow streams at a significantly low cost.

Besides providing regular and growing dividends to investors, the XDIV ETF has been a source of capital gains too. Shares have steadily gained in value since inception to provide capital appreciation to investors.

Historically, the ETF has generated total returns averaging 8.9% per annum since its inception. Thatâs enough to double investorsâ capital in just over eight short years â the Rule of 72 estimates.

How to invest $500 each month to create $266 in annual dividend income

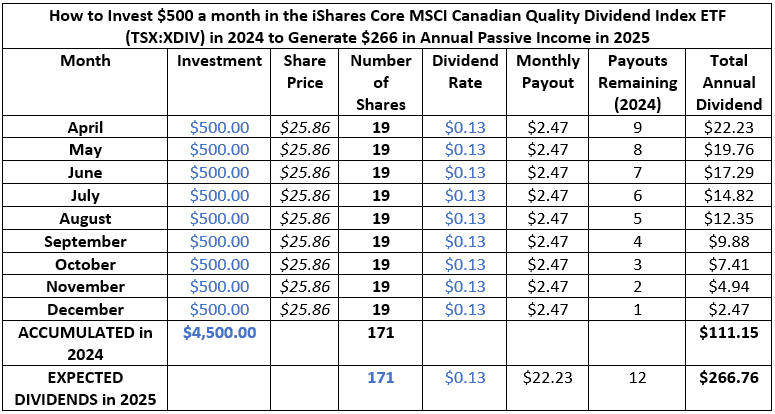

To create a passive income stream of $266 annually during the remainder of 2024, invest approximately $500 before the dividend record dates for each month in the XDIV ETF to buy 19 shares every month, starting right now.

Before you know it, you could have built a $4,500 position by December that may generate $111 in dividends this year and more than $266 passive income next year, as shown in the table below.

How to invest 0 a month in 2024 and earn 6 in passive income annually.

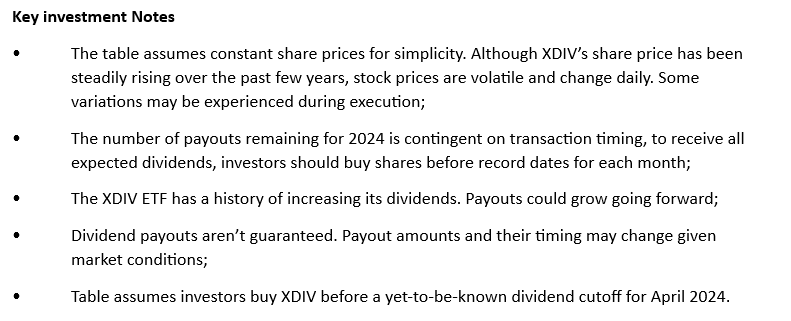

Passive income investment notes: XDIV ETF

Repeat the monthly investment program every year to build a large dividend portfolio that generates regular income every month.

The XDIV ETF is eligible for investment as a core holding in a registered or privately held portfolio. Investors may also add growth stocks around the core holding to diversify and build a formidable retirement fortress.

Should you invest $1,000 in Ishares Core Msci Canadian Quality Dividend Index Etf right now?

Before you buy stock in Ishares Core Msci Canadian Quality Dividend Index Etf, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now⦠and Ishares Core Msci Canadian Quality Dividend Index Etf wasnâÂÂt one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 … if you invested $1,000 in the âÂÂeBay of Latin Americaâ at the time of our recommendation, youâÂÂd have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month â one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Pembina Pipeline. The Motley Fool has a disclosure policy.

News Related-

The best Walmart Cyber Monday deals 2023

-

Jordan Poole took time to showboat and got his shot blocked into the stratosphere

-

The Top Canadian REITs to Buy in November 2023

-

OpenAI’s board might have been dysfunctional–but they made the right choice. Their defeat shows that in the battle between AI profits and ethics, it’s no contest

-

Russia-Ukraine Drone Warfare Rages With Dozens Headed for Moscow, Amid Deadly Winter Storm

-

Trump tells appeals court that threats to judge and clerk in NY civil fraud trial do not justify gag order

-

Can Anyone Take Paxlovid for Covid? Doctors Explain.

-

Google this week will begin deleting inactive accounts. Here's how to save yours.

-

How John Tortorella's Culture Extends from the Philadelphia Flyers to the AHL Phantoms

-

Tri-Cities' hatcheries report best Coho return in years

-

Wild release Dean Evason of head coaching duties

-

Air New Zealand’s Cyber Monday Sale Has the 'Lowest Fares of 2023' to Auckland, Sydney, and More

-

NDP tells Liberals to sweeten the deal if pharmacare legislation is delayed

-

'1,000 contacts with a club': Tiger Woods breaks down his typical tournament prep to college kids in fascinating video