Signage at a job fair at Brunswick Community College in Bolivia, North Carolina, US, on Thursday, April 11, 2024.

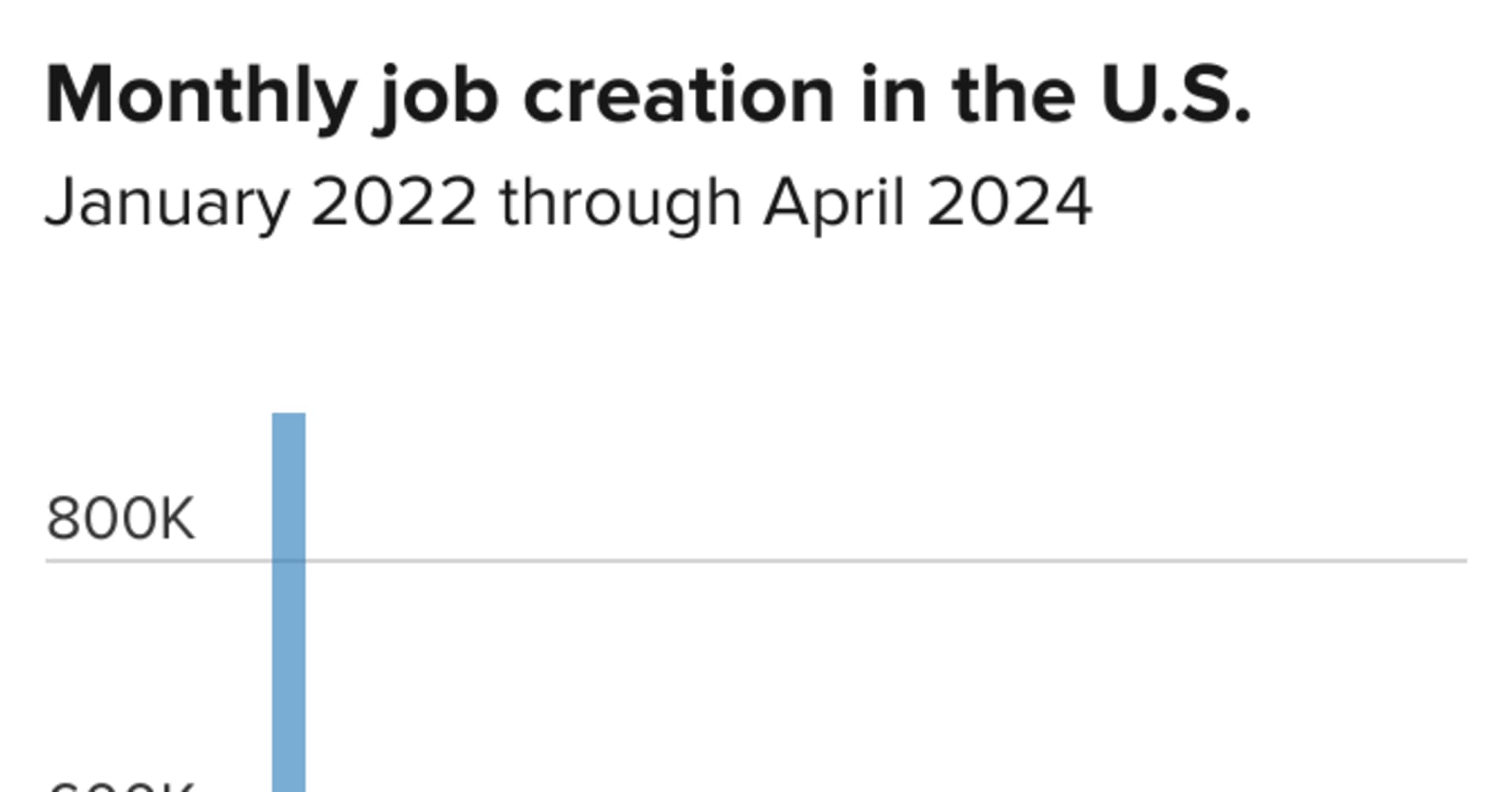

The U.S. economy added fewer jobs than expected in April while the unemployment rate rose, reversing a trend of robust job growth that had kept the Federal Reserve cautious as it looks for signals on when it can start cutting interest rates.

Nonfarm payrolls increased by 175,000 on the month, below the 240,000 estimate from the Dow Jones consensus, the Labor Department’s Bureau of Labor Statistics reported Friday. The unemployment rate ticked higher to 3.9% against expectations it would hold steady at 3.8%.

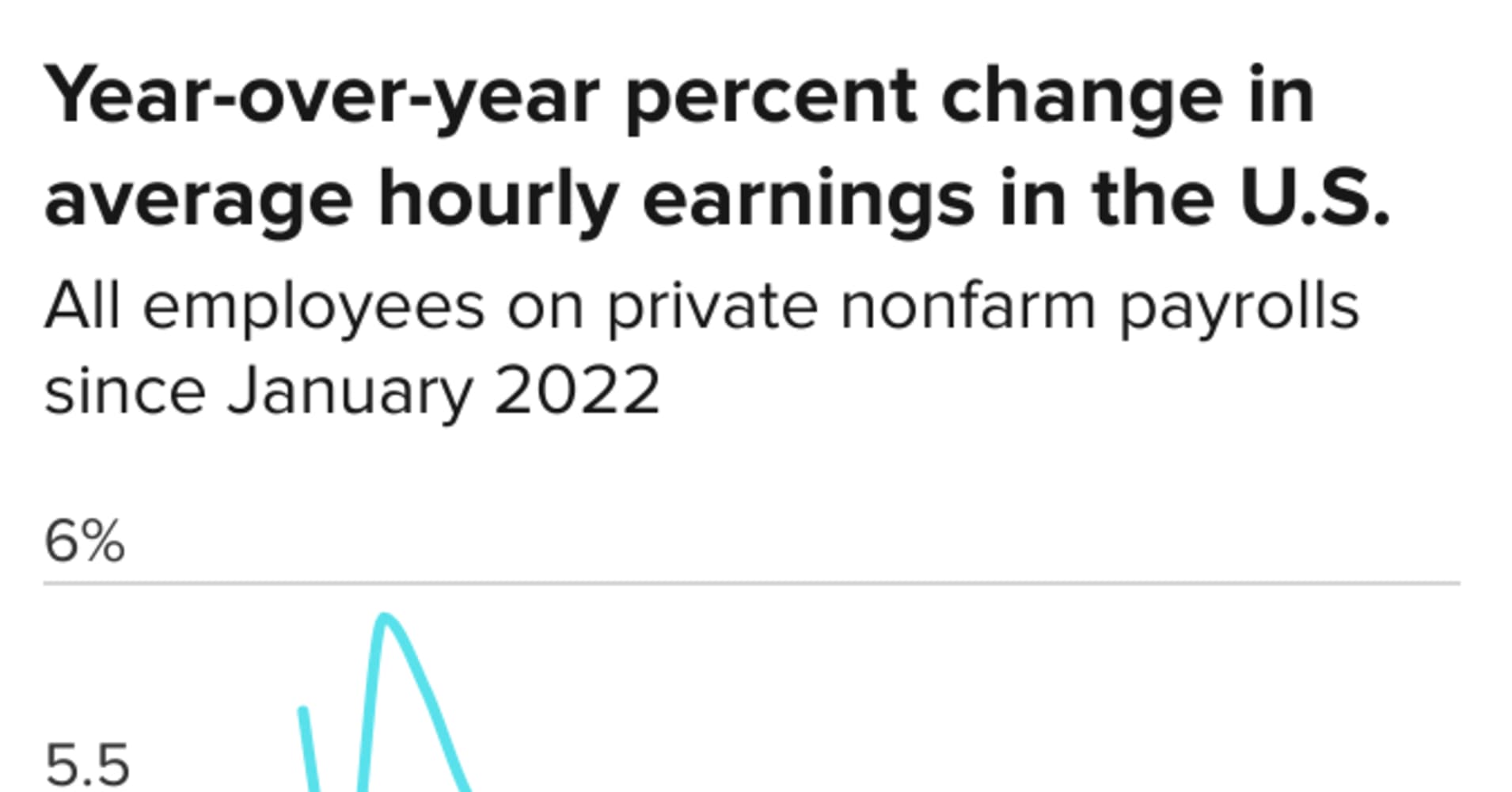

Average hourly earnings rose 0.2% from the previous month and 3.9% from a year ago, both below consensus estimates and an encouraging sign for inflation.

The jobless rate tied for the highest level since January 2022. A more encompassing rate that includes discouraged workers and those holding part-time jobs for economic reasons also edged up, to 7.4%, its highest level since November 2021. The labor force participation rate, or those actively looking for work, was unchanged at 62.7%.

Wall Street already had been poised for a higher open, and futures tied to major stock market averages added to gains following the report. Treasury yields tumbled after being little changed prior to the release. The report raised the prospect of a “Goldilocks” climate where growth continues but not at such a rapid pace to force the Fed to tighten policy further.

“With this report, the porridge was just about right,” said Dan North, senior economist at Allianz Trade. “What would you like at this point the cycle? We’ve had interest rates jacked up pretty high, so you would expect to see the labor market slow down a little. But we’re still at pretty high levels.”

Consistent with recent trends, health care led job creation, with a 56,000 increase.

Other sectors showing significant increases included social assistance (31,000), transportation and warehousing (22,000) and retail (20,000). Construction added 9,000 positions while government, which had shown solid gains in recent months, was up just 8,000 after averaging 55,000 over the previous 12 months.

Revisions to previous months took the March gain to 315,000, or 12,000 from the initial estimate, and February to 236,000, a decline of 34,000.

Household employment, which is used to calculate the unemployment rate, increased by just 25,000 on the month. Workers holding full-time jobs soared by 949,000 on the month, while those hold part-time jobs slumped by 914,000.

The report comes two days after the Fed again voted to hold borrowing costs steady, keeping its benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%, the highest in more than 20 years.

Following the decision, Chair Jerome Powell characterized the jobs market as “strong” but noted that inflation is “too high” and this year’s economic data have indicated “a lack of further progress” in getting inflation back to the Fed’s 2% target.

Though inflation has come well off its highs in mid-2022, it is still considerably above the central bank’s comfort zone. Most reports this year have shown inflation around 3% annually; the Fed’s own preferred measure, the core personal consumption expenditures price index, most recently was at 2.8%.

Higher prices have been putting upward pressure on wages, part of an inflation picture that has kept the Fed on the sidelines despite widespread market expectations that the central bank would be cutting interest rates aggressively this year.

Most Fed officials in fact had been mentioning the likelihood of reductions in their public comments. However, Powell at his post-meeting news conference Wednesday made no mention of the likelihood that rates would be lowered at some point this year, as he had in the past.

In turn, markets have pushed out pricing of the first cut until September, with no more than two quarter-percentage-point reductions by the end of the year seen as likely, according to the CME Group’s measure of futures pricing.

This is breaking news. Please check back here for updates.

News Related

-

Window opens for Zahid to ride off into the sunset – but at Anwar’s cost Sources within Umno have not ruled out strong speculation since last month about a so-called “exit plan” for Ahmad Zahid Hamidi, a move that could pave the way for his political retirement having survived more ...

See Details:

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Brianna Ghey died after she was found with fatal stab wounds in a park Two teenagers accused of murdering Brianna Ghey showed a “preoccupation” with “violence, torture and death”, a court has heard. The body of Brianna, 16, who was transgender, was discovered by dog walkers in a park in ...

See Details:

Murder-accused teens 'had preoccupation with torture'

-

ISLAMIC REVOLUTIONARY Guard Corps Commander-in-Cheif Major General Hossein Salami speaks at an anti-Israel protest in Tehran on Saturday. The IRGC trained Hezbollah to use human shields, say the writers. The conflict in Gaza has raised a deeply troubling issue: Reports suggest that Hamas is deliberately using civilians as shields, a ...

See Details:

A plea for Islamic voices against using human shields - opinion

-

Photo for illustration purposes only. – BERNAMA FILE PIX SHAH ALAM – The government needs to strengthen the Malaysia My Second Home (MM2H) programme, especially with the exemption of visas for Chinese and Indian citizens visiting the country starting Dec 1. Universiti Tun Abdul Razak economic expert Emeritus Professor Dr ...

See Details:

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill KUALA LUMPUR: The generational end-game (GEG) element has been removed from the revised Control of Smoking Products for Public Health 2023 Bill tabled for the first reading in the Dewan Rakyat on Tuesday (Nov 28). This is as the Health Ministry tries for the ...

See Details:

GEG element removed from anti-smoking Bill

-

-

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Malaysia Airlines launches year-end sale

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Dr M accuses govt of bribery over allocations

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Malaysia to check if the Netherlands still keen to send flood experts

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Appeals court to rule in Isa’s graft case on Jan 31

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Elephants Trample On Axia With Family Of Three Inside

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Sirul fitted with monitoring device

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Nigerian airliner lands at wrong airport

OTHER NEWS

THOSE looking for fresh produce may find themselves spoilt for choice at the biggest wet market in Klang, but visitors to the place say the condition of the facilities and ...

Read more »

Olive Grove is the first-ever gated-and-guarded development in Bercham, Ipoh with 24-hour security. IPOH: YTL Land and Development Bhd announced that Phase 1 of Olive Grove is fully sold while ...

Read more »

Screenshots of a video showing a teenager pointing a knife at an elderly e-hailing driver. PETALING JAYA: Police have arrested a 13-year-old boy for holding an elderly e-hailing driver at ...

Read more »

Sprint Highway’s Semantan To KL Slip Road Fully Closed Until Dec 31 If you’re a regular user of the Sprint expressway, you’ll need to do some planning for your trips ...

Read more »

Genshin Impact Version 4.3 Leak Showcases Update to Domains New leaks reveals a quality-of-life update to Domains in Genshin Impact, making it easier for players to repeat and farm resources. ...

Read more »

CG Computers will host the Urban Republic (UR) Warehouse Clearance from 30 November to 3 December at the Atria Shopping Gallery in Petaling Jaya. During the event, visitor can get ...

Read more »

Photo for illustrative purposes only – 123RF KUALA LUMPUR – Hyperinflation has never happened in Malaysia and the government hopes it will never happen, according to the Economy Ministry. It ...

Read more »