Here’s how HDFC Bank embarked upon a transformative journey after the merger

In the highly integrated banking world, every twist and turn in the domestic as well as global economy poses a new challenge for those at the helm. Sashidhar Jagdishan, or Sashi as he’s called by his peers, has faced his fair share of these in the three and a half years since he became the Managing Director and Chief Executive Officer of HDFC Bank.

For instance, it’s been barely a year since the mega merger of parent company HDFC Ltd with the bank, and Jagdishan already finds himself confronting yet another formidable challenge. This time, it emanates from outside. The adversaries are global short-sellers.

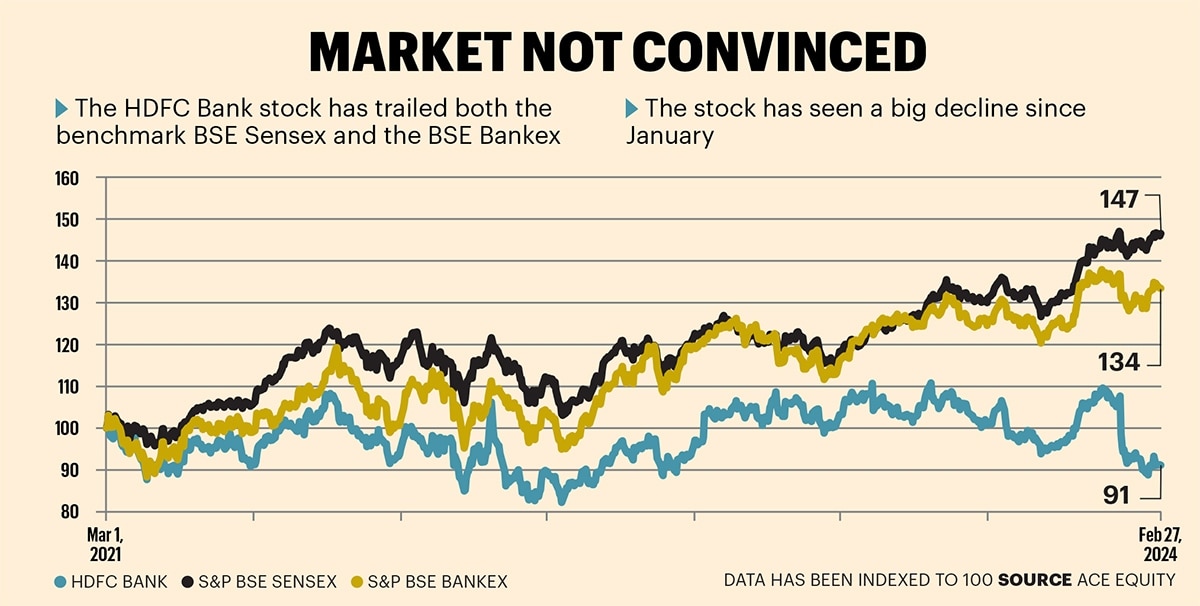

Despite the onslaught of short-sellers—its share prices dipped 17.5% between January 1 and February 29 this year—the 59-year-old Jagdishan remains undaunted. The bank stands firm thanks to its solid management team and consistent track record of growth in assets, loans and advances, and profits. The sustained performance and Jagdishan’s leadership caught the attention of BT-KPMG’s Best Banks & NBFCs jury, which picked the bank as the joint winner in the Bank of the Year category. And, it has again emerged as the winner in the Best Large Indian Bank category in the quantitative study.

Despite lagging in certain parameters such as growth in loans and advances, growth in operating profits, NPA (non-performing assets) coverage, and secured advances to total assets in the BT-KPMG survey, the country’s second-largest bank boasts the best asset quality and profit per employee metrics. Besides, after the merger of mortgage lender HDFC Ltd—effective from the current financial year—the bank has undergone significant transformation. Of course, the merger has brought with it some challenges.

“This is a period of transition we will have to adjust to. So, our anchor is that as a company, for 29 years, we have been consistent on bottom line growth, which you can call earnings per share or whatever that is…,” Jagdishan said at a Goldman Sachs India conference last month.

“Going forward too, we will have that as an anchor. So there are a lot of other metrics you may want to sort of ignore because of the transition, especially the loan growth, and that could be a tad low, but that’s alright,” he added.

The fine print

The bank, whose loan mix was tilted towards retail for a long time, switched to wholesale during Covid-19. But relationships with top-notch corporate houses offer huge potential for cross-selling, again thanks to the merger. Kaizad Bharucha, Deputy MD at HDFC Bank, says the merger has opened up new opportunities for the real estate finance business as the bank would be able to offer this segment a bouquet of banking services.

“We would be able to provide them with cash management, trade, supply chain financing, and the salary account offering, among others,” he says, adding that the merger also enables it to increase lending to infrastructure projects. “It helps us to take a larger share of business in companies and groups where we have appetite in view of the increased capital base of the bank,” adds Bharucha. The bank had a large balance sheet of `24.66 lakh crore as on March 31, 2023, next only to State Bank of India (that had a balance sheet of `55.16 lakh crore).

There are other opportunities it is looking at as well. Last February, the bank raised $300 million through its first ever sustainable finance bonds. The funds raised will be used to lend to emerging sectors like electric vehicles, SMEs, and affordable housing.

The Merger

But there are some challenges that the bank confronts. The merger has brought with it high-cost borrowing. After the deal, the share of borrowing in total liabilities has risen from 8% pre-merger to 21% post-merger. Investors have expressed concerns about this since interest rates have gone up and liquidity has tightened. “What we acquired after the merger was a well-matched asset and liability book. Accordingly, the borrowings were long tenor funds aligned to the long tenor mortgage loans. These borrowings are not callable earlier than the stated dates. As HDFC’s borrowings mature over time, these will get replaced with lower-cost granular retail funds of the bank,” explains Srinivasan Vaidyanathan, Chief Financial Officer of the bank.

Of course, tightened liquidity conditions don’t just impact HDFC Bank. It has led to a general scramble for deposits. As of December 31, 2023, the bank had sequentially grown its CASA (current account and savings account) deposits by 2.2% (or 21.6% YoY). Its CASA ratio—or the share of CASA deposits in a bank’s overall deposits—was almost flat between September and December 2023, at 37.7%. But its CASA ratio was 44% pre-merger.

To boost its relationship with customers, the bank is also revamping other parts of its operations. It has launched Customer First— a priority for the CEO—that aims to enhance customer experience by bringing in primary banking and providing the bedrock of low-cost funding. With the sudden surge in interest rates to contain inflation, the cost of funds has also increased. “The elevated credit-to-deposit ratio added pressure on the bank’s NIM (net interest margin), which was apparent in Q3FY24,” says Omkar Kamtekar, Analyst at brokerage Bonanza Portfolio.

The management has said the CD ratio will reduce in the coming quarters, but this remains a major pain point, Kamtekar adds.

“The RBI is expected to take cues from its global peers and lower rates as well; this would be a welcome sign as the cost of funds would decrease, thereby enhancing the NIM. Also, as the new branches mature, the growth outlook will improve. Considering these factors… NIM could reach and surpass the pre-merger level in the medium term,” says Kamtekar.

Jagdishan assures investors that the return on assets (ROA) is intact. If one looks at the long-term trajectory of over two decades, the bank has maintained an ROA of 1.8-2%. Even when the business mix changed during the Covid-19 pandemic and the bank’s margins declined, the ROA was maintained. This will continue, he asserts.

Bundling Opportunities

HDFC’s mortgage business is a good fit with the banking component because of the low-cost funds and the diversified product basket. While the yields are low in the mortgage business, the bank is bundling other services with it. Arvind Kapil, Group Head-Mortgage Banking Business, HDFC Bank, says the home loan business has become both an asset and liability generator and is growing significantly. This leads to a higher stickiness quotient and stronger customer connection for a longer duration, enabling cross-selling. “The bank has already commenced cross-selling its products and services through the service centres of the erstwhile HDFC Ltd from February 1, 2024,” says Kapil.

As part of this strategy, the bank’s home loan customers will be able to avail of a wide range of products and services like consumer durables loans, credit cards, wealth advisory, unsecured loans, and home refurbishment loans. “The mortgage team that now serves as relationship managers is expected to cross-sell at no incremental acquisition cost thanks to digital journeys,” adds Kapil.

By mid-March, the bank plans to launch a straight-through journey for home refurbishment loans. Similarly, by April, it is lining up a home saver product, a liability product for existing and prospective home buyers.

After the merger, the share of unsecured loans on its books declined from 30% to nearly 22%. This has opened a huge window to get into high-yield unsecured loans. But the Reserve Bank of India’s decision to raise risk weights in the unsecured segment has slowed down the growth here. In fact, investors were banking on a higher share of unsecured debt to push up the NIM. The bank, however, has always gone against the current. It is not pushing unsecured loans since there is overleveraging in the system.

Considering this, the question remains: Why are investors cautious when the bank appears to be on such a strong wicket? Kamtekar of Bonanza Portfolio says one of the primary reasons for the underperformance of the stock is the uncertainty surrounding the operations of the merged entity. “The growth rate of the combined entity was expected to be slower. Initially, the bank witnessed a sell-off from FIIs due to a change in the weighting in the various global indices. This led to the stock becoming range-bound over the last two years,” says Kamtekar.

In the last two to three years, it looks like short-sellers may have made more money than long-term investors. Some would argue that the short-sellers are playing with fire, and as the pain points associated with the merger dissipate, the stock will reflect its true potential.

For Jagdishan, the focus remains solely on delivering on his promise.

@anandadhikari

Watch Live TV in English

Watch Live TV in Hindi

News Related-

Recall Just Announced For Popular Cookies Featured In Holiday Gift Baskets

-

Eagles rally past Bills in overtime as Chiefs win

-

Reality bites the green energy agenda

-

Sandigan orders Marcos Sr. pal to pay workers

-

DSWD: Shear line, LPA affect 1.2 million people; over 18,000 families evacuated

-

The mayor of Paris is making a loud exit from X, calling the platform a 'gigantic global sewer'

-

Rain showers, thunderstorms over Luzon, including Metro Manila — Pagasa

-

'Naruto' live-action film adaptation is in the works

-

NASA Highlights Stingray Nebula

-

Manila's Lagusnilad underpass opens

-

China probes debt-ridden financial giant

-

China's VUCA situation

-

Unraveling the mystery that is diabetes

-

Bangladesh's nuke plant is not going to steal PH investments