Question: I read with interest your recent article in DM168 regarding retirement options.

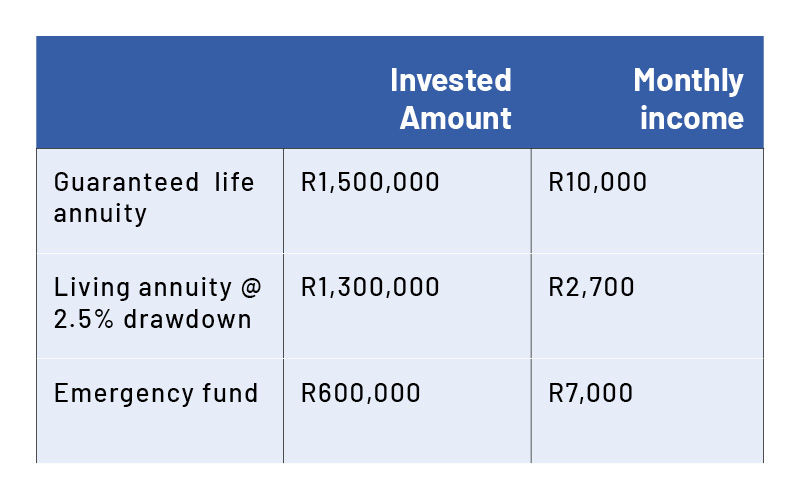

I retired three years ago and have the following retirement income sources:

retirement

I need about R20,000 a month to cover my costs and have noticed that the capital in my emergency fund is decreasing every month.

Does it make sense to convert the sum in the living annuity to the life annuity in an attempt to avoid or reduce drawing from the emergency fund, as it was not intended as income?

Your advice is much appreciated, as my financial adviser is very scarce these days.

Answer: You need about R4.8-million to get an income of R20,000 a month. Your current investments are worth R3.4-million, which is why you are starting to run into trouble.

The good news is that you spotted the problem early and we can still do something about it. You have two main options:

- Increase the drawdown of the living annuity; or

- Convert the living annuity into a guaranteed life annuity.

Increase the drawdown of the living annuity

A sustainable drawdown rate for a living annuity is 5% and you are only drawing down 2.5%, so there is scope to increase the drawdown rate.

If we do so, we will have the following:

You will still need to use R4,600 a month from your emergency fund to meet your needs of R20,000 a month. This equates to a drawdown of 9% a year, so you will deplete this fund.

Convert the living annuity to a life annuity

Life annuity rates are good at the moment and the R1.3-million will give you a life annuity of R10,300 a month, increasing by 5% a year, for the rest of your life. This looks like a good solution, as you will not be making any regular withdrawals from your emergency fund.

You must bear in mind that tax will have to be paid on these annuities. This will work out to about R1,400 a month.

I would recommend that you try to manage your budget to accommodate the tax rather than make regular withdrawals from the emergency fund.

It is important that you invest the funds in the emergency fund cleverly, as there will come a time when you will need to access some of these funds to live on. Pensioner inflation will be higher than your 5% annual annuity increase, and you will start to feel the pinch in years to come. DM

Kenny Meiring is an independent financial adviser. Contact him on 082 856 0348 or at financialwellnesscoach.co.za. Send your questions to [email protected].

This story first appeared in our weekly Daily Maverick 168 newspaper, which is available countrywide for R35.

News Related

-

1024x768_france-antoine-dupont-and-fabian-galthie-oct-2023-jpg Fabien Galthie’s men went into the global tournament as one of the favourites but they were ousted in the last-eight. Les Bleus suffered a 29-28 defeat to the Springboks as they were eliminated at their home World Cup by the eventual champions. It was a similar story to 2019, ...

See Details:

Antoine Dupont still hurt by 'injustice' of World Cup loss to Springboks

-

China’s New Aircraft Carrier Begins Catapult Testing Testing of the catapults on the Chinese aircraft carrier Fujian has begun. This is an important step forward in the construction of this ship, which is set to be the first carrier in the People’s Liberation Army Navy, or PLAN, that launches aircraft ...

See Details:

China's New Aircraft Carrier Begins Catapult Testing

-

Aircraft Downed Inside Russia By Patriot System: Ukrainian Air Force The Ukrainian Air Force has now confirmed that a number of Russian aircraft shot down back in May over their own territory were indeed destroyed by a foreign-supplied Patriot air defense system. The possibility that Ukraine’s newly acquired Patriots may ...

See Details:

Aircraft Downed Inside Russia By Patriot System: Ukrainian Air Force

-

-

Exiled Mayor of Melitopol Ivan Fedorov delivers a speech during a meeting of the Foreign Affairs Committee of the European Parliament on April 20, 2022 in Brussels. Fedorov on Monday said Ukrainian partisans blew up a car with pro-Russian fighters inside over the weekend. A car with Chechen soldiers fighting ...

See Details:

Car With Pro-Russian Fighters Blown Up by Resistance: Exiled Mayor

-

-

Springbok lock opts not to renew contract with URC team Rugby World Cup-winning lock RG Snyman has opted not to extend his stay at Munster beyond the current season. This week, it was revealed by Munster that Snyman would seek new horizons once his deal with the Irish Province expires. ...

See Details:

Springbok lock opts not to renew contract with URC team

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future In the corridors of power, where decisions shape the destiny of nations, one man has emerged as front runner for the dubious honour of being the architect of South Africa’s economic chaos – Minister of Public Enterprises Pravin Gordhan, at ...

See Details:

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future In the corridors of power, where decisions shape the destiny of nations, one man has emerged as front runner for the dubious honour of being the architect of South Africa’s economic chaos – Minister of Public Enterprises Pravin Gordhan, at ...

See Details:

Antoine Dupont STILL hurt by ‘injustice’ of Rugby World Cup loss to Springboks

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future In the corridors of power, where decisions shape the destiny of nations, one man has emerged as front runner for the dubious honour of being the architect of South Africa’s economic chaos – Minister of Public Enterprises Pravin Gordhan, at ...

See Details:

Rubber stamping NHI Bill will have damaging consequences for SA for generations

-

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future In the corridors of power, where decisions shape the destiny of nations, one man has emerged as front runner for the dubious honour of being the architect of South Africa’s economic chaos – Minister of Public Enterprises Pravin Gordhan, at ...

See Details:

After the Bell: SA’s NHI healthcare disaster starts right here

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future In the corridors of power, where decisions shape the destiny of nations, one man has emerged as front runner for the dubious honour of being the architect of South Africa’s economic chaos – Minister of Public Enterprises Pravin Gordhan, at ...

See Details:

Gupta-linked development land for sale

-

OTHER NEWS

A senior Volkswagen executive involved in a global cost-cutting strategy said on Friday, 24 November, he was “very worried” about the future of the company’s operations in South Africa, which ...

Read more »

Photograph: Toby Melville/Reuters Liz Truss, the shortest-serving prime minister in British history, who was famously shown to have a shorter shelf life than a lettuce, has effectively backed Donald Trump ...

Read more »

Standard Bank treasonous? We're literally helping to keep the lights on says CEO Bruce Whitfield speaks to Lungisa Fuzile, Standard Bank SA CEO. Standard Bank is one of 28 banks ...

Read more »

Israel, Hamas agree to extend truce for two days; Musk ‘would like to help rebuild Gaza’ The UN said many people in Gaza still had no food or cooking fuel ...

Read more »

Mamelodi Sundowns’ former coach, Pitso Mosimane, dismissed the African Football League Jingles shared his opinion and compared it to the CAF league and said that it was a mere tournament ...

Read more »

Take note of these N3 road works between Westville and Paradise Valley The N3 between the Westville viaduct and Paradise Valley interchange will be partially closed to traffic for the ...

Read more »

UKZN medical student bags 2023 Health Excellence Rising Star Award Durban — One of the country’s most progressive young minds in the medical field, fifth-year University of KwaZulu-Natal (UKZN) medical ...

Read more »