Failing to remortgage in time could cost typical homeowner £278 a month

A typical homeowner could face unnecessary costs of £278 per month if they forgot to renew their mortgage deal in time, new research has shown.

Almost a third of homeowners have let their mortgage slip onto their lender’s standard variable rate for at least a month after their fixed rate deal ended, according to a study by the personal finance website, Finder.

The standard variable rate (SVR) is a bank or building society’s more expensive ‘default’ rate that borrowers revert to once their initial fixed deal ends, if they don’t immediately remortgage.

Don’t be caught out: If homeowners don’t remortgage immediately at the end of the initial fixed term, the interest rate will revert to their lender’s higher standard variable rate

Many people coming to the end of their five-year, three-year or two year fixed rate mortgage today will be on a rate of 2 per cent or less.

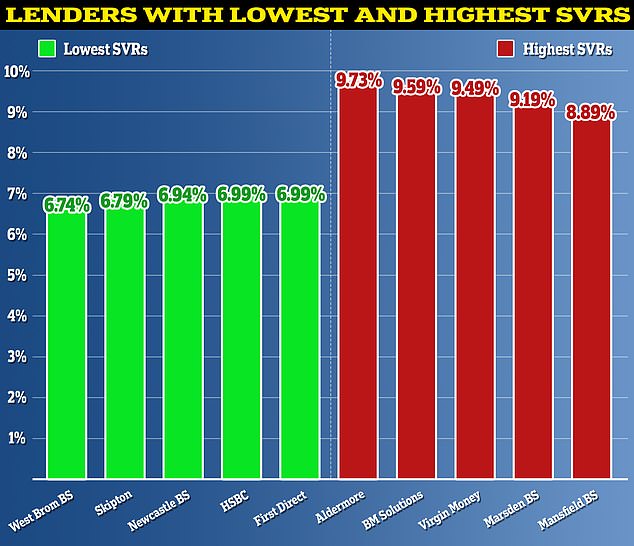

If they fail to remortgage in time and fall onto their lender’s SVR, they could drop on to a rate as high as 9.73 per cent, depending on the lender.

> Read: Which lenders have hiked SVR mortgage rates up to nearly 10%?

The average amount on a fixed rate mortgage is currently £164,000, according to UK Finance data.

Nicholas Mendes, mortgage technical manager at John Charcol said: ‘For borrowers, sticking with or switching back to a SVR is generally not advisable unless the mortgage amount is very small, or a property sale is imminent.

‘This is because SVRs are usually 3 or 4 per cent higher than fixed rates. There will likely be alternative deals with the existing lender which would be more cost effective.’

The best and the worst: The standard variable rate is set at each lender’s discretion and they therefore vary widely

How much could slipping on to an SVR cost you?

The average SVR is currently 8.18 per cent, according to Moneyfacts. The highest SVR on the market is 9.73 per cent.

Someone with a £164,000 mortgage being repaid over 25 years on a 2 per cent rate will be paying £695 a month.

If they were to revert onto the average SVR, their monthly payments would rise to £1,285 a month – a £590 monthly jump.

The average five-year fix is currently 5.5 per cent, according to Moneyfacts.

On a £164,000 mortgage being repaid over 25 years that would cost £1,007 a month. That equates to a £278 monthly saving, if the homeowner had remortgaged in time instead of dropping on to the SVR.

If they had 40 per cent equity in their home, they might have secured an even lower five-year rate of 4.5 per cent, or around 4.8 per cent if they fixed for two years.

Switching a £164,000 mortgage to a 4.5 per cent rate would see someone paying £912 a month, which equates to a £373 monthly saving when compared to the average SVR.

> What next for mortgage rates in 2024 – and how long should you fix for?

How long do people spend on SVRs?

Over the course of their mortgage term, the average person will spend 10 months on an SVR, according to Finder’s study.

It found that 11 per cent of mortgage holders have paid a higher SVR for more than one year, with 3 per cent admitting they’d paid an SVR for over five years.

Ultimately, borrowers have plenty of time to avoid falling onto their lender’s SVR.

Most mortgage offers last for six months, which means homeowners can lock in a new mortgage deal six months ahead of their current deal ending.

Sometimes life gets in the way and people will end up arranging their new mortgage closer to the deadline, but it’s worth bearing in mind that the application itself will often take a number of weeks.

According to the mortgage broker Habito, the average mortgage application takes between four and six weeks.

> Read about one lender that claims to offer most of its mortgages within 24 hours

Liz Edwards, mortgage expert at the personal finance comparison site finder said: ‘It’s easy to let renewals slide for a while and even if you remember to renew your mortgage, if you leave it too late then you may need to wait a month or two for the rate on your new deal to kick in. For mortgages this can have a huge impact on the amount you pay.

‘The extra monthly cost is shocking in itself but as an illustrative point, if someone paid off a 30-year mortgage using the current average revert rate versus the current average three-year rate, they’d pay an extra £180,000 in needless interest.

‘So, set a calendar reminder and make sure you find a new deal in plenty of time before your fixed-deal expires.’