E-INVOICE TO ENHANCE TAX EFFICIENCY

Malaysia joins countries worldwide in introducing e-invoice for national taxation system

TO improve the efficiency of Malaysia’s tax administration, the Inland Revenue Board of Malaysia (IRBM) is set to implement the e-Invoice initiative in stages – in support of the growth of the digital economy and in line with the 12th Malaysia Plan.

The IRBM e-Invoice is among the government’s initiatives to improve efficiency, transparency and, tax and finance management control.

An e-invoice is a digital representation of transactions between seller and buyer, to replace the use of paper for electronic documents in PDF, JPEG or doc formats.

It contains the same essential information as traditional documents which includes buyer’s details, item description, quantity, taxes, price excluding taxes, and total amounts that record transaction data for daily business operations.

Advent of e-invoice

Since 2001, e-invoice has been introduced in several countries including Chile, Brazil, Mexico, Denmark, Italy, France, Saudi Arabia, Egypt, South Korea, Singapore and China, to name a few.

Tax administrators around the world are moving towards digital invoicing in line with digitalisation shifts, especially in regards to the centralised clearance model which is the continuous transaction control model, since the validity of invoice data is verified before it is issued to the buyer.

It is expected that more than 13 countries – including Belgium, Germany, Denmark, Bahrain and Oman – will introduce the centralised clearance model by 2027.

E-invoice in Malaysia

The implementation of e-invoice in Malaysia will involve the issuance of invoices for business transactions conducted between business to business, business to government, and business to client – for international and local transactions.

The IRBM has provided updated guidance and reference for taxpayers, in the form of the e-Invoice Guideline Version 2.1 and e-Invoice Specific Guideline Version 1.1:

> e-Invoice Guideline (Version 2.1): Contains general information on the IRBM e-Invoice.

> e-Invoice Specific Guideline (Version 1.1): Describes certain transactions such as transactions with buyers, periodic statements or bills, disbursement and reimbursement, employment perquisites and benefits. Explains certain expenses incurred by employees on behalf of the employer, self-billed e-invoices, and transactions that involve payments in monetary form to agents, dealers or distributors. Contains information on cross-border transactions, profit distribution, foreign income, currency exchange rate, application programming interface (API) overview, and cybersecurity.

These guidelines can be accessed and downloaded at hasil.gov.my/e-invois/ .

The implementation of e-invoicing can help to:

> Improve efficiency and streamline taxpayer business operations.

> Increase the level of tax compliance.

> Reduce manual processes and errors.

> Simplify submission of return forms.

> Improve operational efficiency.

> Digitalise taxation and financial reporting.

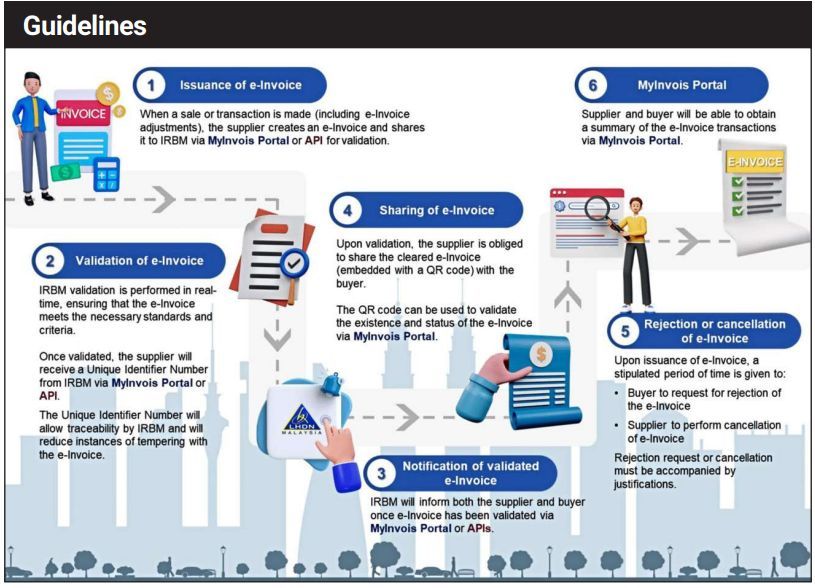

Taxpayers can choose the most appropriate mechanism to transmit e-invoices to IRBM, such as the MyInvoice portal or API, based on their business needs and specific circumstances.

The MyInvoice portal is a platform hosted by IRBM, which taxpayers can access at no cost, when API connection is not available.

API is a set of programming codes that enables direct transmission of data between a taxpayer’s system and MyInvoice. This is ideal for large taxpayers or businesses with high volumes of transactions as it requires an initial investment in technology and an extension to existing systems.

Implementation timeline

The IRBM e-Invoice will be implemented in three phases from August 2024 to July 2025.

The turnover or revenue thresholds have been considered during this detailed planning of implementation, to ensure that taxpayers have sufficient time to prepare for and adapt to the implementation of e-invoicing.

IRBM is actively working with taxation practitioners and professional bodies to provide comprehensive information on the implementation of e-invoicing in Malaysia.

It also conducts engagement sessions with media practitioners, media influencers and industry players to gain feedback on marketing strategies that can be implemented to raise awareness of e-invoice in national taxation affairs.

IRBM has signed a memorandum of understanding with the Malaysian Digital Economy Corporation (MDEC) as a sign of strategic cooperation on the implementation of the national e-invoice initiative.

Through this MoU, MDEC and IRBM will coordinate the implementation of the e-invoice in the nationwide tax compliance model.

For more info on the IRBM e-Invoice, click here or email [email protected]