This article first appeared in The Edge Malaysia Weekly on February 5, 2024 – February 11, 2024

FOR a person whose name doesn’t surface as a shareholder, the list of 14 privately held companies listed on Tun Daim Zainuddin’s charge sheet has been nothing short of intriguing.

The former finance minister, whom some would describe as a crafty businessman, has been charged with not declaring a substantial number of assets to the Malaysian Anti-Corruption Commission (MACC).

He has pleaded not guilty to the charge of not declaring one Amanah Saham bank account, seven vehicles, 38 companies and 25 properties, some of which are linked to the companies that he owns. Daim did not respond to the question by The Edge on whether he was asked to declare his assets or that of his wife and children.

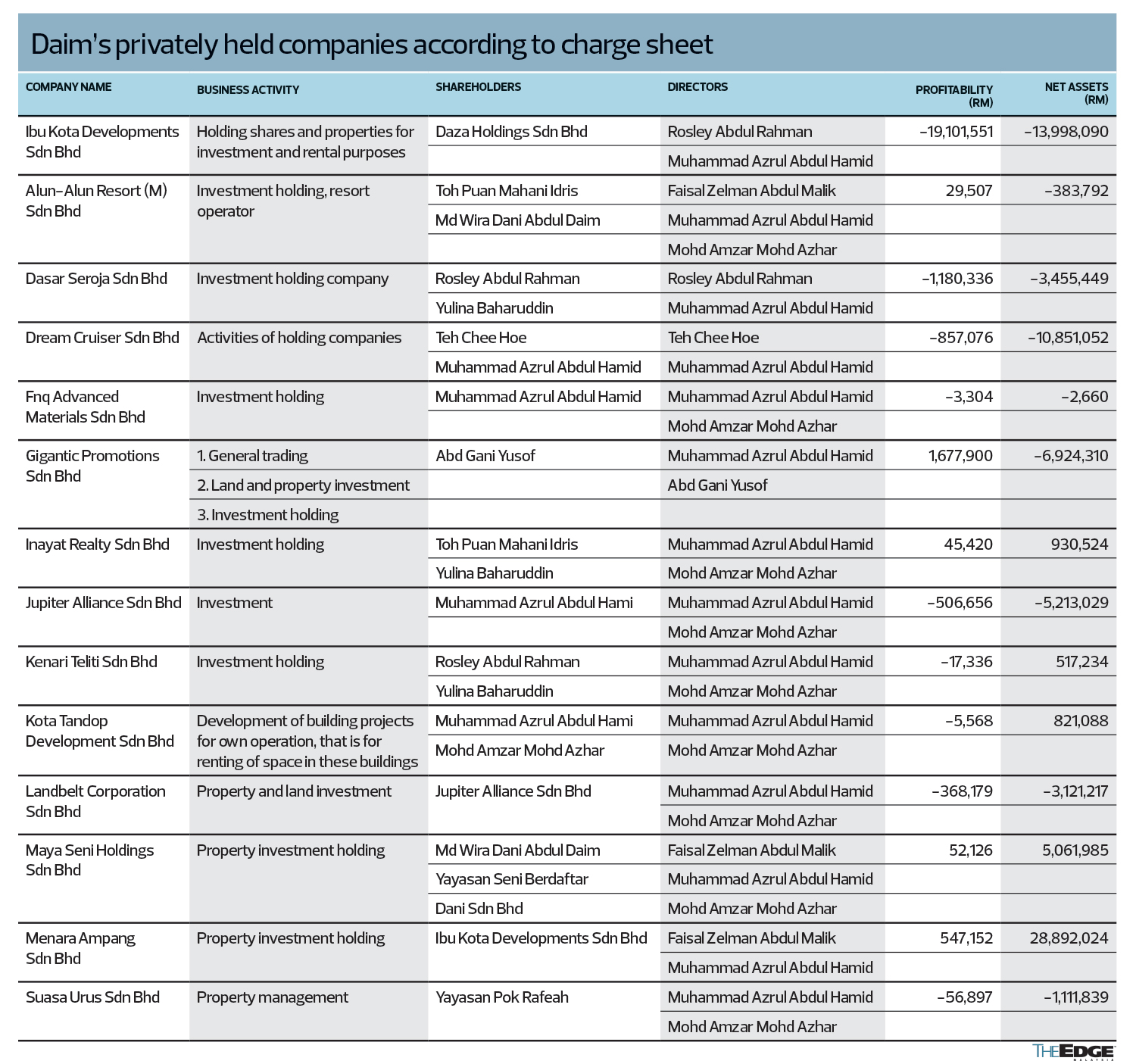

Company searches done on the 14 privately held companies show that most are in the business of investment holding or property investment holding. However, only five of them have reported a net profit in their most recent filings with the Companies Commission of Malaysia (CCM). The rest are loss-making (refer to accompanying table).

Among the 14 companies, the most profitable is Gigantic Promotion Sdn Bhd, albeit reporting a net profit of a mere RM1.68 million for the financial year ended Dec 31, 2021. It is involved in general trading, apart from land and property investment as well as investment holding.

Only five companies have positive net assets, with Menara Ampang Sdn Bhd — a property investment company — boasting the largest net assets amounting to RM28.89 million as at Dec 31, 2021. It made a net profit of RM547,152 in the same year, but it was 40% less than the year before.

Menara Ampang is wholly owned by Ibu Kota Developments Sdn Bhd, which in turn is wholly owned by Daza Holdings Sdn Bhd — a company linked to Daim’s family.

Interestingly, the privately held companies are all audited by the same firm — TF Lee Lum Associates — except for Suasa Urus Sdn Bhd.

TF Lee Lum is located at Menara Mutiara Bangsar, at Suite 8-13-7, which is just a unit away from the registered address and business address used by the majority of Daim’s family companies, that being Suite 8-13-6.

The other business address that has been used for some of the companies is that of a condominium unit in Cinta Condominium, located off Jalan U Thant in Ampang Hilir, Kuala Lumpur.

Searches on the web revealed that TF Lee Lum provides taxation consultancy, accounting and payroll as well as company secretarial and consultant services.

One Cho Wai Loon appears in 13 of the privately held companies as the company secretary. Other names on the directors’ lists that appear frequently in the 14 companies are Muhammad Azrul Abdul Hami, Mohd Amzar Mohd Azhar, Faisal Zelman Abdul Malik and Rosley Abdul Rhaman.

Azrul and Rosley have also appeared on several occasions as shareholders of the private companies in question.

Notably, Daim’s name does not appear as a shareholder on any of the private companies listed in the charge sheet but his late wife Toh Puan Mahani Idris is listed as a shareholder on Alun-Alun Resort (M) Sdn Bhd and Inayat Realty Sdn Bhd.

Alun-Alun is a resort operator and is also in the business of investment holding. For the financial year ended Dec 31, 2020, the company recorded a profit of RM29,507 but its net liability amounted to RM383,792.

As for Inayat Realty, an investment holding company, it recorded a net profit of RM45,420 for the financial year ended Dec 31, 2021; its net assets stood at RM930,524.

In Alun-Alun, the other shareholder that emerged is Daim’s son Datuk Md Wira Dani Abdul Daim. Wira Dani is also a shareholder of Maya Seni Holdings Sdn Bhd, a property investment company, which is profitable, recording a net profit of RM52,126 for the financial year ended Dec 31, 2021. It also has net assets amounting to RM5.06 million.

Wira Dani is also the largest shareholder of publicly listed company Avillion Bhd through a 21.82% stake held via Ibu Kota and Daza Holdings. He has been the group’s substantial shareholder since April 2016, back when it was known as Reliance Pacific Bhd.

Loss-making but asset-rich Avillion

Avillion Bhd, formerly known as Reliance Pacific Bhd, has come under the spotlight recently, thanks to its link to Daim. The company, which is involved in the property, hotel and travel business, is known as Avillion Hotel Group — a chain of luxury hotels and resorts located in Port Dickson, Negeri Sembilan; Pangkor, Perak; and Cameron Highlands, Pahang. It also has villas in Bali, Indonesia.

However, the group has been loss-making over the last eight years, from FY2016 to FY2023. In its financial year ended March 31, 2023, the group recorded a net loss amounting to RM4.76 million. For the cumulative six months ended Sept 30, 2023, Avillion’s net loss widened to RM3 million from RM2.37 million the year before.

The jewel in the crown for Avillion is in the assets that it owns. According to the 2023 annual report, it has a total of RM158.04 million in buildings, RM7.65 million in freehold land and RM350,000 in condominiums. The group also has leasehold land valued at RM49.24 million and investment properties amounting to RM2.71 million. The group’s list of top 12 properties listed in the annual report has a net book value of RM285.92 million.

Apart from Avillion Hotel and Admiral Cove Premier Integrated Marina Resort, which are located in Port Dickson, and its villas in Bali — with a combined net book value of RM214.79 million — the other properties have not been revalued in recent years.

Other properties that have not been revalued are leasehold land for development at Admiral Cove, measuring 1,779,063 sq ft and freehold land in Port Dickson amounting to 227,203 sq ft. Avillion also have several parcels of freehold land for development in Setapak, Kuala Lumpur, which measures 325,286 sq ft .

As at Sept 30, 2023, Avillion’s net asset per share amounted to 17.99 sen — more than three times the group’s share price of 5.5 sen at the close last Friday, which values the company at RM62 million.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport