A tax-cutting Spring Budget was trailed just a couple of weeks ago, as the Chancellor prepared for a General Election.

But now the rumour mill suggests Jeremy Hunt lacks the ‘fiscal headroom’ and instead of a bonfire of the taxes we will get a damp squib.

The kite-flying rumours had included cuts to income tax, national insurance and even abolishing inheritance tax or stamp duty.

Yet, it seems unlikely from the noises just a week ahead of next Wednesday’s Budget that we will get a spectacular blowout.

And maybe that’s not even what we need.

Instead, I’d argue it would be better for Mr Hunt to lay out a radical but coherent plan to fix the illogical mess our tax system has got into.

What’s in the box? Jeremy Hunt could deliver a tax-cutting Budget or a damp squib

A set of clearly laid out changes that remove tax traps and quirks, make the system fairer and rebuild some of the trust in it that has ebbed away over recent years.

This would be no Truss-Kwarteng sugar rush but the kind of common-sense changes that it would be hard to lambast – or for a new party in charge to reverse.

Here’s my hitlist:

The 60% tax trap

The income tax-free personal allowance is removed at a rate of £1 for every £2 earned above £100,000.

This bakes a 60 per cent marginal income tax rate into the system between £100,000 and £125,140, when it is all gone.

That means that our tax rates really go 20 per cent, 40 per cent, 60 per cent, 45 per cent, which is clearly stupid.

People earning £105,000 are paid a lot of money, but they shouldn’t pay a higher tax rate on their next pound earned than someone earning £150,000.

If the £100,000 threshold had risen with inflation since it was announced in 2009, it would now be £153,000.

Mr Hunt should kill off this terrible bit of the tax system altogether and stop the removal of the personal allowance.

> Our real top rate of income tax is 60% – and it’s not the highest earners who pay it

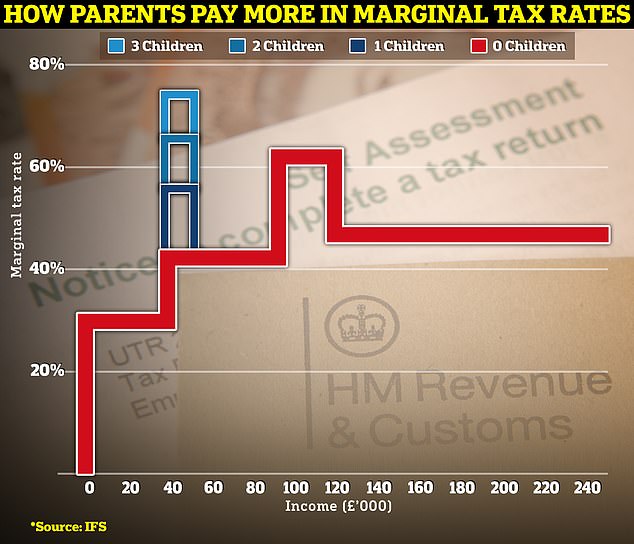

Tax traps: The chart above shows marginal tax rates for income tax and national insurance on the red line, with a rise to 62% between £100k to £125k due to the removal of the personal allowance. The blue lines show the effect of child benefit removal between £50k and £60k

Child benefit

The child benefit high income charge was badly designed when George Osborne conjured it up – and it has only got worse since.

It removes child benefit if one parent’s earnings go above £50,000 but both could earn £49,999 each and still get the payments.

Removing child benefit creates marginal income tax rates between £50,000 and £60,000 of 52% for a parent with one child, 61 per cent with two children and 69 per cent with three children.

The threshold hasn’t risen in the 11 years since the taper was introduced, if it had risen with inflation it would be £67,000.

Ideally, Mr Hunt would axe the policy altogether and go back to the old universal benefit principle.

If he is unwilling to do that, he should raise the removal threshold to start at least as high as £75,000 and be spread over a broader bracket to £100,000.

> The child benefit removal tax trap explained

Stamp duty

We definitely do not need a stamp duty holiday. These time-limited cuts are daft and cause more problems.

Stamp duty should be cut though, or ideally abolished.

Getting rid of it completely sounds crazy until you remember that until Gordon Brown started tinkering with it, stamp duty was a flat 1 per cent above £60,000.

If we survived until 1997 with that rate, we could probably get by on it now – or axe it completely.

Stamp duty is another bad tax as it inhibits movement and economic activity.

If the Chancellor won’t axe it, he should make it a flat 1 per cent above £250,000.

> Stamp duty calculator: How much would you pay to move home

Student loans

Student loans are a mess and require more room than I have here to go into properly.

What we definitely shouldn’t do is charge interest based on RPI, which hasn’t been an official inflation figure for years.

We should also go back to the principle of there being no real interest rate and peg all existing loans to official CPI inflation.

As pensioners look likely to get the state pension triple lock again, I’d give students a similar promise.

Why should students suffer because the government and Bank of England can’t get a grip on inflation?

The student loan double lock would guarantee the interest rate would be the lower of CPI inflation or 2.5 per cent.

> My student loan has increased by 25% in six years… even though I’m paying it off

Tax thresholds

The freeze on tax thresholds is costing us all dear and needs to stop. We have pulled more people into tax, a huge number into higher rate tax, and dramatically swollen the number of 45p taxpayers.

Without tax thresholds rising in line with the cost of living, people get poorer even if their wage or pension increase matches inflation.

The Chancellor should commit to tax thresholds rising at least by inflation and create a rule to embed this in the system. This should start from April.

Ideally, we’d also see a renewed commitment to pulling those on the lowest incomes out of tax – an ambition to get the basic rate threshold up to £20,000, for example.

> Stealth tax threshold freezes are hitting our savings, investments and income

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report