Cover Story: Enegem —edging closer to RE exports

This article first appeared in The Edge Malaysia Weekly on April 22, 2024 – April 28, 2024

THE long-awaited Energy Exchange Malaysia (Enegem) has finally been introduced, along with guidelines on cross-border electricity sales announced by the Ministry of Energy Transition and Water Transformation (Petra) last Monday for exports of green electricity from Malaysia to Singapore and Thailand.

As Malaysia is an oil and gas exporter, the move is seen as a positive development for the country to become an energy hub for the region. This is in line with the National Energy Transition Roadmap (NETR) to transform the nation’s energy sector.

Last week, Petra announced that the maiden export of RE would kick-start with a pilot auction of 100mw to Singapore — that is less than 2% of the nearly 7,000mw installed RE capacity in Peninsular Malaysia — before it is expanded to 300mw.

The pilot project to export at least 100mw of RE to Singapore is one way to test demand while ensuring ample supply to the local market.

Nonetheless, some have raised concerns that the government’s move to export the country’s renewable energy (RE) could lead to Malaysia losing strategic investors to the other countries in the region.

Cover Story: Enegem —edging closer to RE exports

In a written reply to The Edge, Energy Transition and Public Utilities Minister Datuk Seri Fadillah Yusof says the progression from 100mw to 300mw “is intricately tied to the outcomes of the pilot project”.

“This strategic approach ensures a thorough assessment of feasibility and performance before embarking on substantial scaling endeavours,” says Fadillah, who is also deputy prime minister.

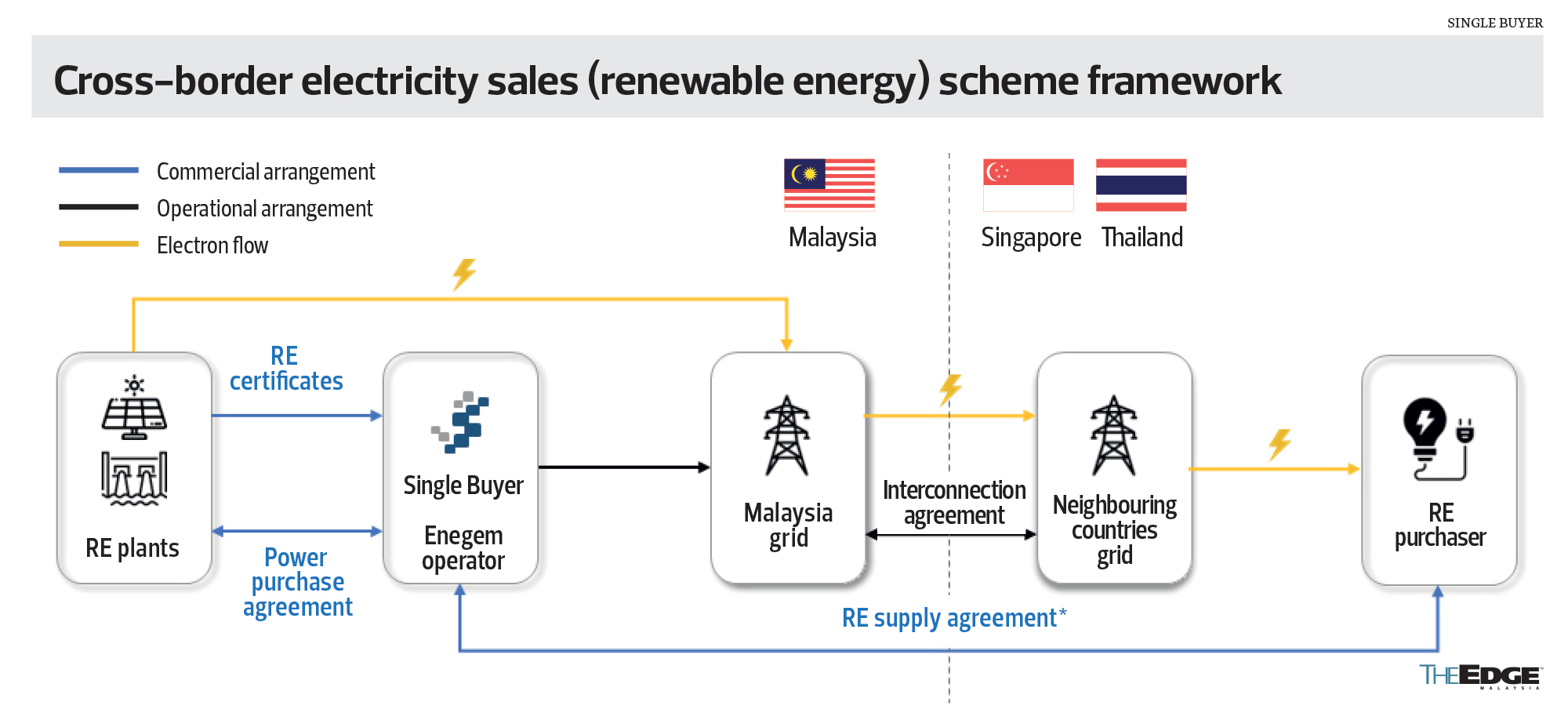

The Guide on Cross-Border Electricity Sales, published by the Energy Commission, confirms that a Single Buyer, the entity responsible for electricity procurement and planning in the country, will be in charge of operating Enegem.

It also confirms that local solar plant owners will sell the RE to be exported at rates agreed upon in power purchase agreements (PPAs) with the Single Buyer. The Single Buyer will then auction the electricity to interested buyers from Singapore or Thailand.

According to a Petra spokesperson, Enegem could start transmitting RE to Singapore as early as September this year.

The RE Supply Agreement, to be signed between the Single Buyer and RE purchasers in Singapore, is estimated to be a one-year contract, the spokesperson says.

How it works

Fadillah explains in his reply that the first 100mw of RE will come from existing installed RE capacity. “The initial phase of Enegem will leverage the available RE supply within the system. There is no designated quota allocated, as it is still a pilot initiative. Our primary focus is on testing feasibility, enhancing performance and securing the stability of our local renewable energy supply.

“Once the pilot phase concludes successfully and the necessary infrastructure is established, we will evaluate the potential for higher export capacity accordingly, taking into account system security and reliability, including consideration on reserve margin.”

The ministry also recently launched 2,000mw of solar capacity quota under the fifth instalment of large scale solar (LSS5) awards.

As for pricing, the value of the export tariff “will be the offered auction price with a minimum reserve price”, which essentially means the RE will be sold to the highest bidders.

The pilot scheme is open to RE bidders that hold an electricity generation and/or retailer licence in Singapore. There are currently 35 entities holding such licences, according to Singapore’s Energy Market Authority (EMA) website.

“This system encourages competition among purchasers while maintaining a baseline price determined by regulatory authorities, facilitating the efficient and transparent exchange of renewable energy between Malaysia and Singapore,” Fadillah says.

He reiterates that net proceeds generated from the exports will fund expansion of RE in the country, which will include “system upgrades, infrastructure modernisation, technology integration and pilot trials for emerging technologies”.

The deputy prime minister has said the proceeds would go to a fund set up by the government and not to RE asset owners nor the Single Buyer.

Meanwhile, Malaysia’s grid system operator (GSO) will sign an interconnection agreement with Singapore’s grid operator to transmit the RE procured by the Singaporean buyers.

An energy exchange committee will be set up to oversee the implementation of the RE exports scheme. The committee will consist of representatives from the ministry, the Energy Commission, the Single Buyer, GSO and other parties as may be required, according to the guidelines.

Uncharted waters

With the 100mw pilot to be conducted using existing capacity, it is unlikely that the government would open up a new tender for a solar farm specifically for Enegem anytime soon.

Commenting on the use of existing capacity for the pilot export programme, an industry observer points to market talk about Singapore’s surging demand for RE, which has yet to be tested.

“Basically, the pilot project will help us understand the market in Singapore in terms of pricing and demand,” she says.

At the moment, local RE supplies contracted to the Single Buyer are taken up by local consumers through the Green Electricity Tariff (GET). Excess from the GET that is not subscribed by the locals can be used for the energy export programme.

Through the GET, customers, whether homeowners or office building owners, can pay an additional tariff on top of the base electricity tariff of 39.95 sen/kWh to obtain the green attributes that offset its carbon emissions.

The GET quota in 2023 was 6,600gwh, with a tariff of 21.8 sen/kWh, up from 3.7 sen/kWh imposed in 2022 when it was introduced. It is understood, however, that the take-up rate fell to 50%, from 100%, following the rate increase.

For 2024, Petra has announced a tiered pricing of 10 sen/kWh for domestic and non-domestic low-voltage users, and 20 sen/kWh for non-domestic medium and high-voltage users. The subscription is open from May 3.

Comparatively, Singapore’s regulated electricity tariff stands at S$0.2979/kWh before GST (RM1.046/kWh) for 1H2024.

Singapore is aiming for its first low-carbon electricity imports of 1.2gw to commence in 2027 — and 4gw by 2035, representing about 30% of electricity supply in the city state by then.

Malaysia is not the only nation eyeing a slice of this growing pie. Parties in Thailand, Indonesia, Cambodia, Laos and even Australia are said to be interested as well.

Given the regional competition, observers say it is appropriate for the government to assess the market’s viability through this pilot project.

The guidelines do not touch on Sarawak’s plans to export its own massive RE supply to Singapore, as the state’s electricity sector — as well as that of Sabah — is regulated independently from the federal government.

Sarawak wants to export up to 1gw of RE to Singapore. In December, it was reported that Premier Tan Sri Abang Johari Tun Openg had confirmed that the state was in talks to develop two dedicated undersea cables — one to Singapore and the other to Peninsular Malaysia.

According to Singapore’s second request for proposals to appoint licensed electricity importers announced in August 2023, the electricity supply is required to have a quarterly load factor of 75% (no disruption for 75% of the time).

This requires 450mw of solar generation capacity with 1,500mw battery storage to ensure consistent supply of 100mw through the day, rough calculations show.

The local RE supply has an edge when it comes to the “quality” of energy to be exported — some companies do not consider large hydro as green energy because of the impact on river ecology, displacement of residents or emission of greenhouse gases from the decomposition of flooded forests.

On that note, Enegem’s energy mix in the pilot will include at least 30% solar generated power, which is the minimum criterion of RE mix for some multinational companies seeking green energy to reduce their carbon emissions.

In the case of the Laos-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP), its 100mw hydro-generated electricity exports to Singapore, which will last until 2024 under the current terms of agreement, exclude renewable energy certificates (RECs), unlike the RE that will be sold from Enegem. The Single Buyer will also act as the verifier and issuer of RECs associated with the RE export.

Single Buyer carve-out ongoing

On the carving out of the Single Buyer from Tenaga Nasional Bhd (it is currently a ring-fenced entity within the listed utility company), Fadillah explains the process is ongoing and the goal is for it to achieve independence “as soon as possible”.

“This transition is complex, however, and may take some time. It involves amending the Electricity Supply Act 1990 and requires collaboration across various government ministries,” he says.

“The transition process shall be pragmatic and implemented in phases, taking into account the needs of the electricity supply industry in Malaysia.”

Of note is the roughly RM70 billion PPA liabilities sitting on Tenaga’s books, comprising 6.08% of federal government debt of RM1.15 trillion as at August 2023. It will be interesting to see how the restructuring will be done, to facilitate the carving out of the Single Buyer without burdening the government’s financial position. It is understood that, in the meantime, the pilot export can still proceed.

The government’s step-by-step approach means that local RE players would not directly benefit from the higher prices to be gained from the exports — for now. Having said that, instances of RE capacity curtailment in other markets due to oversupply and grid bottlenecks, such as those in the UK and Vietnam, are lessons worth noting.

“The accelerated deployment of local RE supply in Malaysia will be implemented in line with the national energy transition aspiration of 70% RE installed capacity or an additional RE capacity of about 40gw in 2050 compared to the existing 26%,” says Fadillah, referring to the progress of Malaysia’s RE capacity growth.

“This is also in tandem with the strategic intent of the NETR to transform and decarbonise Malaysia’s energy landscape.”

Market players weigh in on latest developments in solar rollout and RE exports

From the rooftop solar quota and incentives to tiered large-scale solar (LSS) bids, and now the energy exchange, The Edge speaks to industry players to gauge their response to these developments

CHOW PUI HEE, CEO, SAMAIDEN GROUP BHD

Undertook engineering, procurement, construction and commissioning works for over 300mwp capacity

To meet Singapore’s demand requirement (75% load factor), battery storage surely will come. And the installed capacity will be much bigger [to feed to Singapore and charge the battery in the daytime].

While requirements for exports will certainly be more stringent [than local LSS requirements], we would like to be at the forefront. We look forward to future bids for LSS that will cater for cross-border sale; it will not be low power purchase agreement (PPA) rates [as seen in the past].

The message from the government is consistent, where Enegem (Energy Exchange Malaysia) is the single liaison party with Singapore. The question is whether the Single Buyer will be carved out of Tenaga Nasional Bhd.

LEE CHOO BOO, MANAGING DIRECTOR, ITRAMAS CORP

200mw solar capacity in operation, 1.5gw under development (including 1gw in a joint venture with UEM Group announced in the National Energy Transition Roadmap)

The announcement on the renewable energy (RE) export initiative is long overdue and certainly a good step in the right direction. The initial 100mw base load is a small start. We hope more quotas will be allocated in the near future.

We are ready [to execute the 1gw project via the corporate PPA model]; land, funding, preliminary engineering, offtakers, and so on. The only thing left is the wheeling charges. The investment from our side is more than US$1 billion. The funds are ready to be deployed. We want to bring this FDI into Malaysia as soon as possible.

DATUK GUNTOR TOBENG, MANAGING DIRECTOR, GADING KENCANA SDN BHD

45mw solar capacity in operation, 81mw under development

It’s very exciting. The guideline is quite clear. The government is moving very fast. My team has to engage more engineers and business development officials.

With the recent announcements, seasoned players can begin looking into RE exports, as well as the potential new market of RECs (renewable energy certificates) as a new industry. Newer players can look into rooftop solar installations under the Net Energy Metering scheme and smaller LSS awards.

AMI MORIS, EXECUTIVE CHAIR, CYPARK RESOURCES BHD

270mw solar capacity in development

Quality scale matters. With a potential of up to 4gw of low-carbon electricity export to Singapore by 2035, Malaysia and its established RE players are in an ideal position to take advantage of this new revenue source due to construction and asset management expertise.

In an industry undergoing commoditisation, the establishment of an exchange platform is a necessary step to ensure sustainable growth for industry players. The energy exchange plays a crucial role in underpinning the long-term viability and sustainability of our RE business by driving scale, facilitating the establishment of long-term contracts, and promoting market transparency and efficiency.

By providing opportunities for increased scale among established and experienced RE players, these platforms create an environment conducive to innovation and research and development.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.