(Bloomberg) — Cathie Wood’s retail army has gone AWOL all year – even in her best-performing exchange-traded fund.

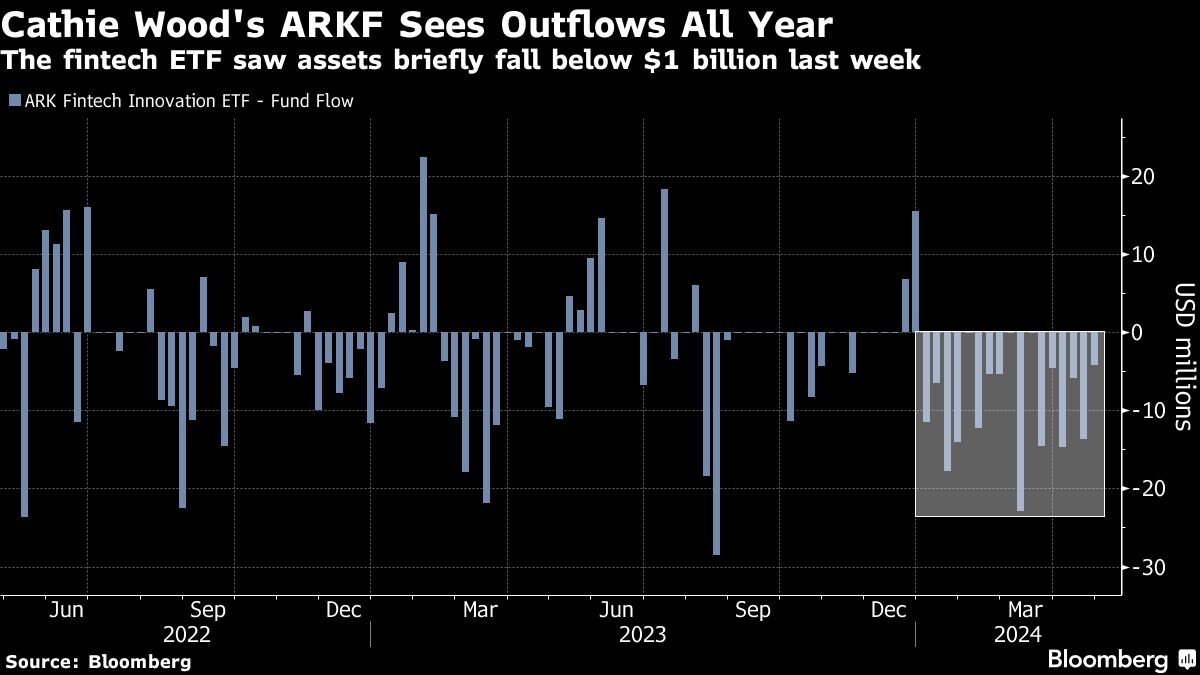

Despite a 27% rally in its biggest holding, Coinbase Global Inc., spurred by the great crypto revival, the ARK Fintech Innovation ETF (ticker ARKF) is flat this year compared to the S&P 500’s 5% gain and the tech-heavy Nasdaq’s 3% rise. In turn, day traders have snubbed the actively-managed fund en masse, with the ETF failing to net any inflows on every single day in 2024, with assets under management plunging below $1 billion after notching nearly $5 billion in 2021.

It’s the last sign that life is getting hard for the famed Wall Street manager known for her eye-catching calls on disruptive technologies of tomorrow.

Combined, the fledging performance and net flows are a stark turnaround for the fintech fund, which surged 93% last year to become the second-best performer among Wood’s suite of funds. Mainly dragging down the fund are its biggest holdings including UiPath Inc., which is down by more than 20%, as well as Block Inc. and Shopify Inc. Offsetting the losses are Coinbase and DraftKings Inc’s 14% rise.

“The fintech industry in general has had a tough time meeting the expectations that were set by the high valuations of the market in 2021,” said George Cipolloni, a portfolio manager at Penn Mutual Asset Management. “That’s very much a typical cycle of a new growth industry; there’s all that excitement, all that money rushes in, but then earnings are coming due and companies have to deliver. If they can’t, you tend to see some of the growth investors exit.”

Cathie Wood’s ARKF Sees Outflows All Year | The fintech ETF saw assets briefly fall below $1 billion last week

A representative from Ark did not immediately respond to a request for comment.

It’s been in shift in fortune for Wood, who catapulted to fame during the height of the pandemic for her bold calls over pandemic darlings like Tesla Inc., Zoom Video Communications Inc. and Roku Inc. Retail traders embraced her views, pushing the funds to more than $60 billion in assets at their peak in early 2021. ARKF enjoyed a stellar 2023 due to the very same cohort of holdings, with Coinbase — then, also the biggest — advancing almost 400% and DraftKings rising more than 200%.

But companies at the intersection of fintech — the very ones Wood bets big on — typically need investors willing to shell out higher valuations on the hopes of explosive future growth. That worked well when rock-bottom interest rates in the past years spurred a speculative frenzy in high-priced companies that promised to deliver earnings over the long haul.

Now elevated rates – a broad drag on valuations for those very same growth stocks, since they rely on future profits – and misfiring bets on high-conviction holdings are causing woes for Wood’s portfolios. Similar funds such as the $315 million Global X FinTech ETF (FINX) — which considers PayPal Holdings Inc., Fidelity National Information Services Inc. and Fiserv Inc. as its biggest holdings — is seeing consistent outflows while the $143 million Fidelity Disruptive Technology ETF (FDTX) is seeing inflows. Its main holdings are Nvidia Corp., Taiwan Semiconductor Manufacturing Co. and Salesforce Inc.

“The ever improving economic environment, plus sticky inflation concerns, are inevitably creating challenging circumstances for growth stocks,” said Seema Shah, chief global strategist at Principal Asset Management. “Although a slight downshift in growth is likely as the year progresses, the still very solid backdrop means investors will increasingly look for other opportunities that can generate more impressive returns than those on offer from companies with already lofty valuations.”

That ARKF is already Wood’s best performing fund from her line-up of six actively-managed ETFs is noteworthy. Her flagship $6.4 billion Ark Innovation ETF (ARKK) has been hit by losses this year, seeing five months of consecutive outflows and is down by 18% this year. Investors in total have yanked out around $2.2 billion from her cohort of six active funds this year.

“There are opportunities elsewhere where you can get 5% yields under cash with companies like Nvidia or Microsoft in the AI space that have taken attention away,” said Todd Sohn, an ETF strategist at Strategas. “Even though ARKF had a good year last year, I think the flow shows that there’s just this real lukewarm appetite for this type of high beta growth strategy right now.”

Read more:

| Cathie Wood’s ARKK Hits Five-Month Low as Tesla Fuels Losing Run |

| Cathie Wood Muscles Into ChatGPT Boom With New OpenAI Stake |

| Cathie Wood’s Ark Buys Its Own Bitcoin ETF as Arms Race Heats Up |

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

AWS and Clarity AI to use generative AI to boost sustainable investments

-

Ref Watch: 'Enough' of a foul to disallow Man City goal vs Liverpool

-

Day in the Life: Ex-England rugby star on organising this year's Emirates Dubai Sevens

-

Pandya returns to MI, Green goes to RCB

-

Snowstorm kills eight in Ukraine and Moldova, hundreds of towns lose power

-

‘This is why fewer Sikhs visiting gurdwaras abroad’: BJP after Indian envoy heckled in Long Island

-

Inside a Dubai home with upcycled furniture and zero waste

-

Captain Turner aims for Pitch 1 return as JESS bid to retain Dubai Sevens U19 crown

-

No Antoine Dupont but Dubai still set to launch new era for sevens

-

Why ESG investors are concerned about AI

-

Your campsite can harm the environment

-

Mubadala, Saudi Fund deals on US radar for potential China angle

-

Abu Dhabi T10 season seven to kick off with thrilling double-header

-

Eight climate fiction, or cli-fi, books to consider before Cop28