AirAsia X-Capital A merger set to transform air travel again, says Fernandes

This article first appeared in The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

AFTER more than two years since Capital A Bhd fell into the Practice Note 17 (PN17) category — Bursa Malaysia’s classification for companies in financial distress — there appears to be hope for the aviation group that it will finally emerge from this category by leveraging the clean balance sheet of its sister company AirAsia X Bhd (AAX).

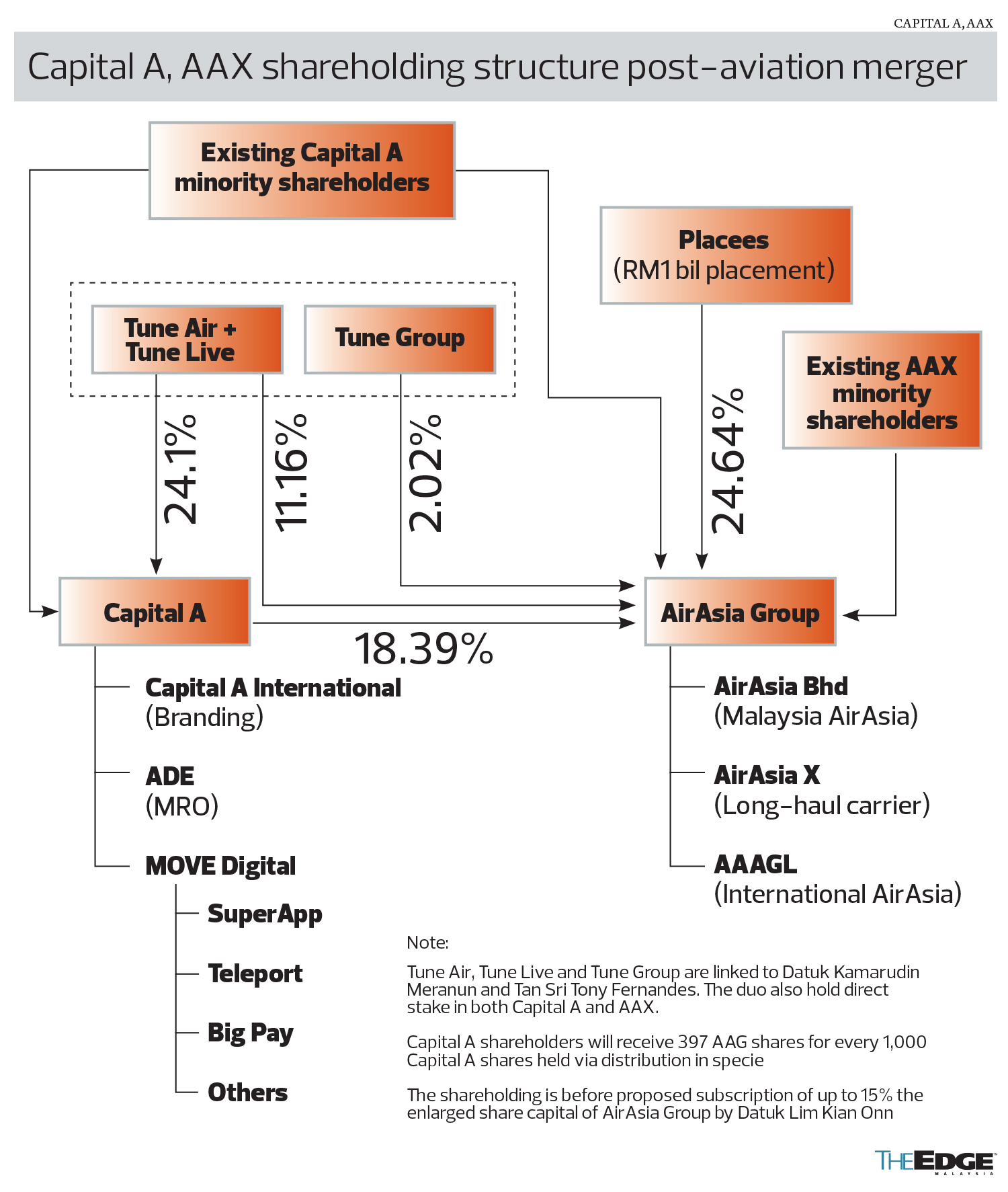

The restructuring plan, which was unveiled last Thursday (April 26), will see Capital A divesting its short-haul airline to AAX in a RM6.8 billion deal. In a nutshell, the merger will see both the short- and medium-to-long-haul airlines’ business under one roof, bringing the combined fleet size to 249 aircraft this year that are projected to fly 76.6 million passengers.

For Capital A CEO Tan Sri Tony Fernandes, the restructuring is not just about lifting the company out of PN17 status, but also charting the growth trajectory of AAX over the next five years to eventually increase the entity’s fleet to 377 aircraft, harnessing the synergies of the enlarged aviation group.

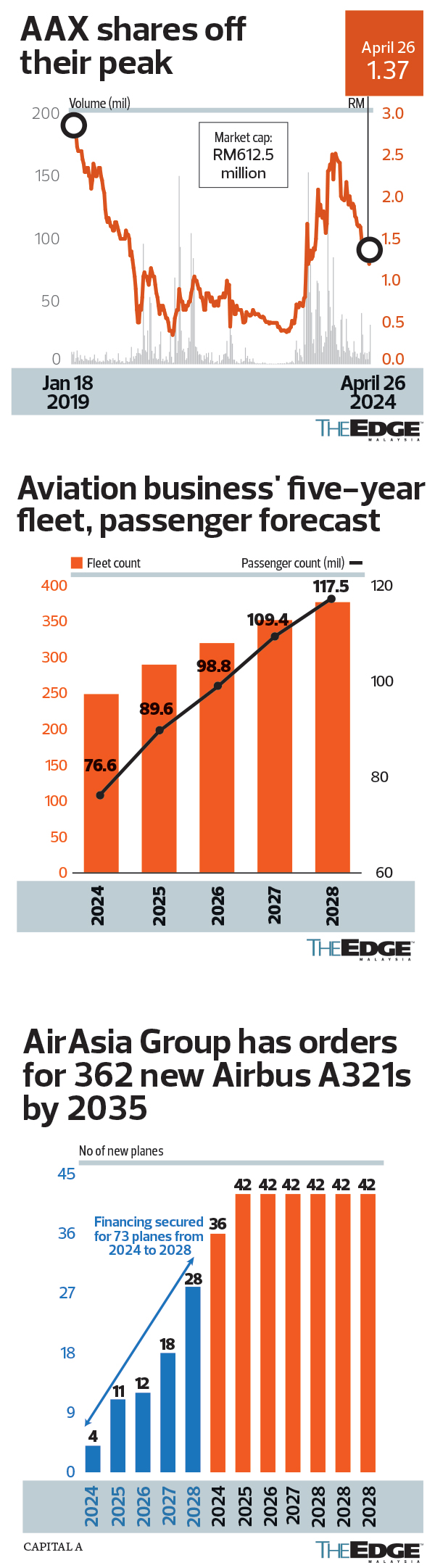

At a briefing last Friday, Fernandes forecast that the merged entity — to be known as AirAsia Group Bhd (AAG) — will fly 117.5 million passengers by 2028, translating into a compound annual growth rate of 11.3% over a five-year period.

“We didn’t think we could do it within the AirAsia model, so we created AirAsia X, but they were always sub-optimal — AirAsia could do four-hour [flights], AAX did four hours and above. But now, with the advent of these [longer flight narrowbody] aircraft, the advent of technology, we are able to put this one-plus-one airline and make it five,” he told the media.

“Second, by doing this, Capital A’s balance sheet [will have] positive equity, which will enable us to get out of the situation we are in. I won’t talk today about the strength of the four companies. We have phenomenally strong businesses that analysts and the market have not looked at because, rightly so, they have been preoccupied with whether AirAsia can survive,” he adds.

By merging its short-haul airline and novating debts into AAX, Capital A is able to reverse a big part of its negative equity and is left with four businesses: logistics, aviation services, travel fintech and a branding company set to be listed in the US via a special purpose acquisition company (SPAC).

Market reacts positively to merger deal

Investors and analysts generally reacted positively to the merger, with the share price of both AAX and Capital A closing higher last Friday (April 26) after the plan was unveiled the day before. AAX’s share price rose 16 sen or 13% to close at RM1.37, valuing the company at RM612.49 million, while Capital A gained 3.5 sen or 5% to settle at 73.5 sen, for a market capitalisation of RM3.13 billion.

“I have always been a proponent of merging the airline businesses and thought the separate structure was inefficient and created artificial impediments such as the four-hour rule,” says Brendan Sobie, founder of Singapore-based independent aviation consulting firm Sobie Aviation and a former chief analyst at the Centre for Asia Pacific Aviation.

Endau Analytics founder Shukor Yusof, however, thinks that the low-cost, medium-to-long-haul airline remains challenging to operate and there is a risk that AAX’s incumbent operations may weigh on the short-haul business.

“The most successful low-cost carriers — Southwest Airlines Co and Ryanair Holdings plc — stick to short-haul flights under four hours. AAX may drag AirAsia down,” he tells The Edge when contacted.

As for Capital A, Shukor is of the view that “it is tough to replace the airline business with those which Capital A is hoping to capitalise on and expect to be consistently profitable”.

After acquiring the airline business of Capital A, AAX’s total borrowings and lease liabilities will balloon to RM23.27 billion, from RM1.51 billion as at Dec 31, 2023 (FY2023) and RM1.06 billion in FY2022. Nonetheless, the enlarged liabilities will still be lower than the total debt of RM63.5 billion for which AAX managed to get creditors to agree to a 99.5% haircut in its debt restructuring scheme back in 2022.

“We have had a tough time with refunds and all these other issues. We dealt with it. I think very soon we will be at a press conference to tell everyone where we are at with the refunds, basically everyone has been paid back,” Fernandes said last Friday.

The merger between Capital A and AAX is also said to bode well for the latter as according to him, it has a smaller order book after the restructuring and had given up some of its airport slots.

“[AAX] doesn’t have enough aircraft to grow, and it doesn’t have enough destinations to grow. But it has very valuable traffic rights and very valuable brand recognition in the countries that it and AirAsia have in common,” he said.

Minimal capital outlay for fleet expansion

Currently, AAX has an order book of 15 A330neo and 20 A321XLR with Airbus, compared with the 362 aircraft ordered by Capital A’s short-haul airline business.

Fernandes said 73 of these aircraft deliveries have their financing secured and he expects the capital outlay to be minimal due to the group’s sale-and-leaseback model.

“[The model] may change in the future, depending on the interest rate regime. Interest rates now, obviously it is better to go to lease aircraft. In the early days, we owned all our aircraft. Then, we changed to a leasing model,” he added.

Note that prior to acquiring the airline from Capital A, the new entity AAG will be created to take over AAX’s listing status through a one-to-one share swap with existing shareholders, and subsequently undertake a RM1 billion private placement to third-party investors, whom Fernandes said have yet to be identified.

Under the merger deal, AAG will issue RM3 billion worth of new shares at RM1.30 apiece to Capital A for the acquisition of AirAsia Aviation Group Ltd, the unit that houses mainly Capital A’s short-haul airlines overseas, like its 40.71% stake in Thai-listed Asia Aviation pcl, 100% stake in the Philippines AirAsia Inc and 46.25% stake in PT AirAsia Indonesia Tbk.

Upon completion of the deal, Capital A is expected to hold the single-largest direct stake of 18.4%, while Fernandes, his long-time business partner Datuk Kamarudin Meranun, as well as their private vehicles Tune Group Sdn Bhd, Tune Live Sdn Bhd and Tune Air Sdn Bhd collectively own 14.54% equity interest.

The share issuance through the RM1 billion private placement will be equivalent to a 24.64% stake in AAG’s enlarged share capital, while the remaining 42.42% are those of minority shareholders.

Fernandes told The Edge in an earlier interview this year that apart from the private placement, AAG could issue a “revenue bond” of about US$200 million to settle some lease obligations under the aviation businesses.

The next few months will be crucial to see if he and his team can garner enough support from the authorities and shareholders, as the merger is expected to be completed by September.

As he finished his presentation last Friday, Fernandes described the merger as “the beginning of a new road for [Kamarudin] and me to transform air travel once again”.

See also ‘More work lies ahead for PN17 Capital A, say analysts’ on Page 62

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.