Wall Street

For a diverting and entertaining couple of hours I can heartily recommend the film Dumb Money. It tells the real life story of how day traders came together on Reddit forums during the pandemic, turned GameStop (among others) into a “memestock”, and took on hedge funds at their own game. The script is witty, the cast is great.

But as a treatise on the markets it doesn’t really measure up. In order to get the David-and-Goliath theme to work, the writers downplay the losses many retail investors suffered during the wild volatility in GameStop’s share price. They also somewhat over-exaggerate the pain inflicted on hedge funds and the lasting effect the episode had on the markets.

What’s more, it’s already out of date. “Dumb money” is the pejorative term that professional fund managers supposedly use to describe retail investors. But, despite a brief surge in so-called “day trading” when many Americans were flush with Covid benefit payments and had too much time on their hands during lockdowns, these market participants are becoming increasingly rare.

Just after the Second World War, US households owned over 90pc of US stocks compared with just 33pc now, according to Federal Reserve figures. Investment these days is overwhelmingly institutionalised. In time the GameStop saga may be seen as the last hurrah at the end of an era. Which surely means that the markets have become less dumb, right? Not so fast.

Anyone with even a passing interest in the markets can tell you it’s getting awfully frothy out there right now. US indices keep bursting through record highs. And all of the action is concentrated on a tiny handful of companies. Over half of the gains in the S&P 500 so far this year can be ascribed to just three stocks: Microsoft, Meta (aka Facebook) and Nvidia.

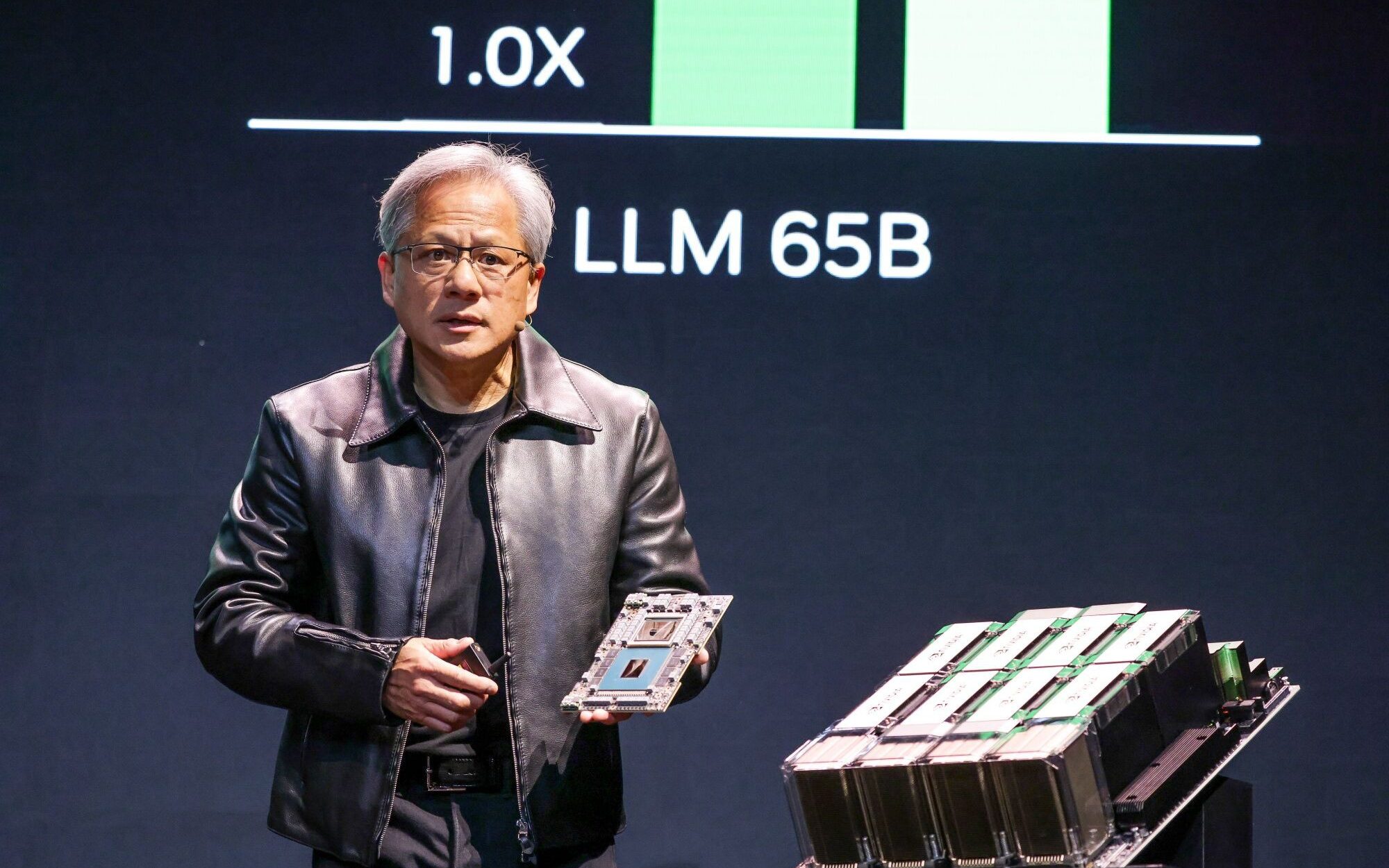

Much of the excitement can be pinned to hype around technological advances and artificial intelligence in particular. The value of shares in Nvidia, which has become a poster child for the AI boom, more than tripled in 2023 and is up nearly 50pc so far this year already.

There’s a lot of breathless talk about “the transformative power of AI” from people who don’t appear to have a firm understanding of what AI actually is. Sure, the new technology may enhance productivity, reshape entire industries and even create a few new ones. But as yet, that’s an unproven thesis at best.

However, there are also growing worries that extra air is also being pumped into an already over-inflated bubble by the amount of money invested in passive strategies, which merely track market indices rather than stocks picked by fund managers. As more money flows into passive funds, a greater portion automatically gets allocated to the largest stocks, pushing their valuations yet higher.

Whereas active investors try to outperform a given benchmark, passive investors simply accept the market return. There’s a compelling case, backed up by tonnes of research, for this approach. Given that a stock market index is, by definition, the product of the returns achieved by the owners of those shares, it stands to reason that investors will in aggregate be unable to beat it.

Add in the high fees charged by active managers and most will underperform the market. A study conducted by S&P Dow Jones in 2020 found that, over the previous 15 years, 91.6pc of large-cap managers, 92.7pc of mid-cap managers, and 96.7pc of small-cap managers had failed to outperform their benchmarks on a relative basis

John Bogle, the founder of Vanguard, who is often described as the “Godfather of Index Investing”, once wrote: “No matter where we look, the message of history is clear: selecting funds that will significantly exceed market returns, a search in which hope springs eternal and in which past performance has proven of virtually no predictive value, is a loser’s game.”

He’s not wrong. The trouble is that this logic is so compelling that we may be risking a tragedy of the commons. An investment strategy that makes sense for any one person comes close to a form of collective madness when employed by everyone. The tail is quite possibly starting to wag the dog.

Companies like Jensen Huang’s Nvidia have enjoyed soaring valuations amid optimism over AI’s transformative potential – I-Hwa Cheng/Bloomberg

This is not a new concern. In 2016, analysts at the US fund firm Alliance Bernstein wrote a controversial paper entitled “The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism,” in which they argued the rise of passive asset management threatens to fundamentally undermine market mechanisms and, ultimately, the entire system of capitalism.

Such warnings have been lent added urgency by the news that the US markets reached an inflection point at the turn of the year with the majority of funds now passively managed, according to Morningstar. In a recent interview, the respected US hedge fund manager David Einhorn (most famous for betting against Lehman Brothers before it went bust) said: “I view the markets as fundamentally broken.”

However, there’s reason to hope some of these more gloomy prognostications may be a touch hyperbolic. For starters, many analysts argue that active managers don’t need to be in the majority in order to preserve price discovery and that, even if the vast weight of passive money creates distortions, they will only be temporary. Fingers crossed on that one.

Secondly, the investment industry in its infinite inventiveness is alive to the issue and has started dreaming up so-called “smart beta” and “equal weight” products that don’t just funnel money straight into the largest stocks (for which most of the good news is already priced in).

Thirdly, public markets are no longer the be-all-and-end-all. If they are misallocating capital, it means there are almost certainly opportunities for other players to come in and make a killing. This is very plausibly what is happening right now with private equity companies picking off untechie, unloved and therefore undervalued British companies.

The public markets might be getting dumber but, as Jeff Goldblum almost said in another entertaining but overly-simplistic film: “Capitalism finds a way.”

%n

Sign up to the Front Page newsletter for free: Your essential guide to the day’s agenda from The Telegraph – direct to your inbox seven days a week.

News Related-

The best Walmart Cyber Monday deals 2023

-

Jordan Poole took time to showboat and got his shot blocked into the stratosphere

-

The Top Canadian REITs to Buy in November 2023

-

OpenAI’s board might have been dysfunctional–but they made the right choice. Their defeat shows that in the battle between AI profits and ethics, it’s no contest

-

Russia-Ukraine Drone Warfare Rages With Dozens Headed for Moscow, Amid Deadly Winter Storm

-

Trump tells appeals court that threats to judge and clerk in NY civil fraud trial do not justify gag order

-

Can Anyone Take Paxlovid for Covid? Doctors Explain.

-

Google this week will begin deleting inactive accounts. Here's how to save yours.

-

How John Tortorella's Culture Extends from the Philadelphia Flyers to the AHL Phantoms

-

Tri-Cities' hatcheries report best Coho return in years

-

Wild release Dean Evason of head coaching duties

-

Air New Zealand’s Cyber Monday Sale Has the 'Lowest Fares of 2023' to Auckland, Sydney, and More

-

NDP tells Liberals to sweeten the deal if pharmacare legislation is delayed

-

'1,000 contacts with a club': Tiger Woods breaks down his typical tournament prep to college kids in fascinating video