Adrian Wisner has found a new hobby in managing his investment portfolio, a pot to which he adds £250 a month – Daniel Jones

Growing vegetables and fruit galore at his Essex allotment, Adrian Wisner, 61, loves the sense of achievement in having home-grown food on his plate.

It is that feeling of success that the former Ford Motor Company services manager is hoping to replicate with his post-retirement investment portfolio which he started building two years ago.

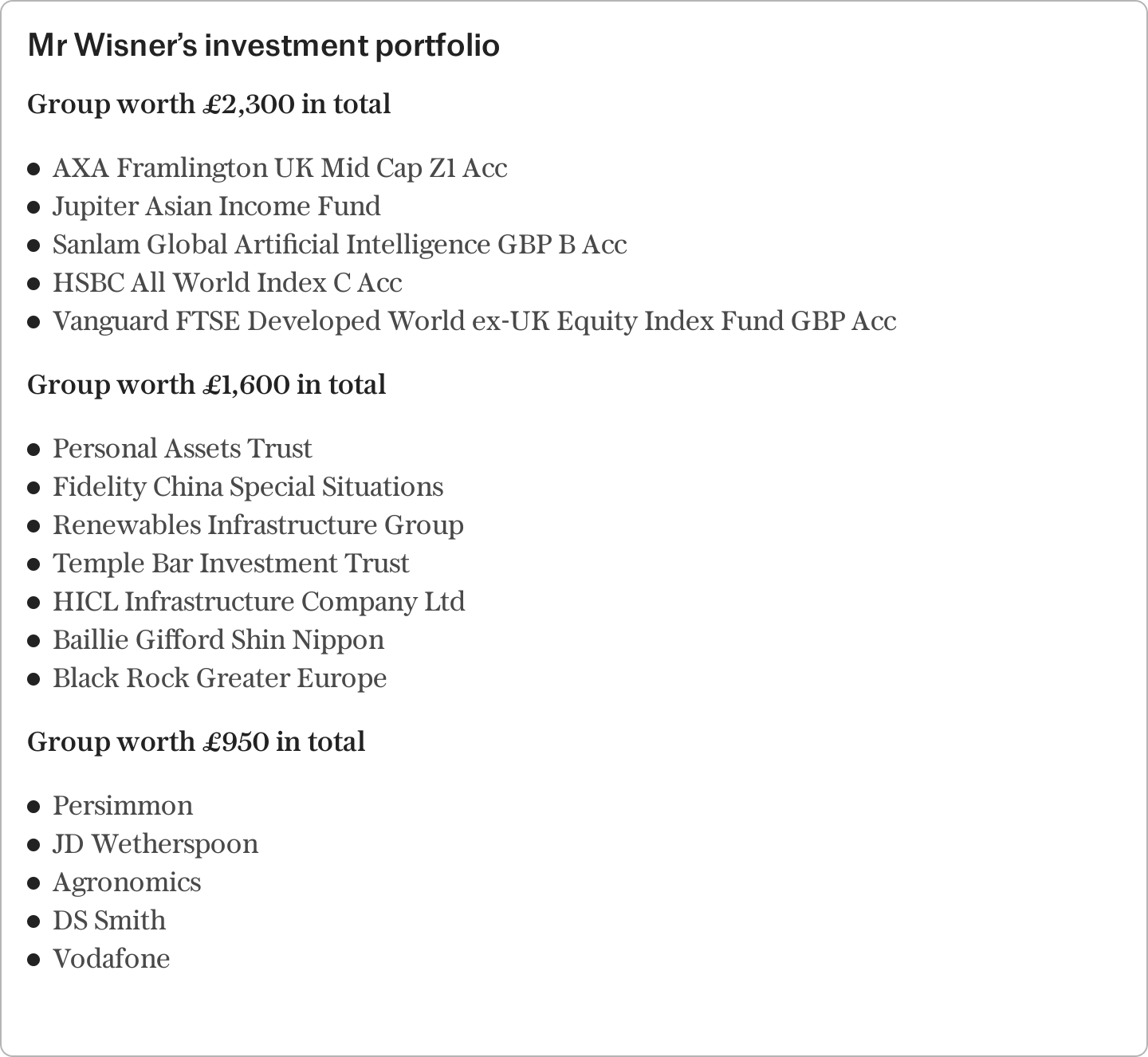

Mr Wisner, who describes himself as an “absolute novice”, trusts investment advisory firm Aviditi with £50,000 of his money. “The intention is to leave that alone and effectively gather dust,” he says. “I’m interested in building a portfolio of my own as it’s become a real hobby.

“I love dabbling in it by investing £250 a month, but I’m only guessing at what I’m doing.”

Mr Wisner – now in his third year of retirement – has paid off the mortgage on a house in Rayleigh, Essex, along with wife Sue, 57, a part-time worker and dance teacher.

Mr Wisner’s main source of his income comes from a gold-plated pension worth £1,500 a month. He will also begin to receive a full state pension in the coming years.

“I think I’m doing the right thing by having a diverse portfolio, but I don’t know,” he said. “I’m in it for the long-term and don’t chop and change.

“I like the reassurance that if every penny I invested disappeared overnight, it wouldn’t really make much difference to my life, but I want to try to beat the market and I’m open to different trends.

“AI seems to be everywhere at the moment and seems like a good opportunity. I don’t want to go down the route of trying one of the Magnificent Seven shares, so where are the different AI opportunities?”

Mr Wisner also wants to improve his knowledge on bonds. “I hear a lot about US bonds and UK government bonds, but I know nothing about them.

“Fractional shares keep popping up too. It’d be great to know in simple terms, whether they are worth pursuing?”

An active retiree, the grandad-of-one is a keen road cyclist. He and Sue – who also has around £50,000 of savings managed by Aviditi – own a holiday home in Essex, which they don’t use for additional income.

They also have a rainy-day fund of £10,000 and Mr Wisner has a couple of hundred pounds in a stocks and shares Isa.

Phil Gillett, client manager at retirement income planners Chancery Lane

Mr Wisner is a novice investor, a great hobby but which can easily lead to losses, which could impact him uncomfortably.

Indications are that he has a defined benefit pension and state pension, so he has some secure retirement income and can take some risk with additional funds. He still needs to ensure he doesn’t over-extend himself.

He believes that dabbling in the market would not impact his lifestyle, though the line between investing and gambling can get blurred.

To get on track, he needs a clear objective for the funds as without a reference point, and it is easy to become distracted by markets and news flow.

A Sipp or an Isa are the obvious contracts to use. Pensions are tax-free on the way in, but taxed on the way out – while Isas are built up from pre-taxed income, but not taxed on the way out.

As Mr Wisner is only investing modest amounts that he wants to control, setting up a Sipp sounds ideal. As he isn’t working, he can still place £2,880 into this which will be grossed up to £3,600 by HM Revenue & Customs – in essence, a free £720 into his pension or a 20pc return before he’s even invested.

On investing, his portfolio doesn’t reflect any clear investment strategy – for example, he has Jupiter Asian Income (seeks income) and Sanlam Artificial Intelligence fund (growth).

AI is a hot theme with myriad investments. Widening the scope through technology funds rather than a single AI stock is a sensible and diversified idea.

Mr Wisner’s risk profile appears undefined. Our recommendation is to decide on key holdings for the longer term, and with his regular contributions buy the more volatile assets to benefit from cost price averaging over time.

He says he is interested in bonds. The global bond market is the largest securities market in the world but can be complex and takes time to understand.

Considering high yielding bond funds instead, such as Invesco Bond Plus yielding 6.8pc may deliver what’s needed. The “Rule of 72” means that in 10.5 years the investment will double.

Mr Wisner mentions he is interested in fractional shares. As the name suggests, these allow you to buy a “fraction” of the share, not the whole. However, Mr Wisner would do better to look at funds or ETFs that offer access to large share prices, as they achieve the same thing and with added diversification.

Emma Deuchars, investment manager at Bestinvest

As an investor drip-feeding funds into his portfolio, which does have its own benefits in terms of pound-cost-averaging, Mr Wisner will need to think further about the shape of his investments should he wish to establish the funds as a well-diversified growth portfolio.

It can be more difficult when you are not investing as a lump sum to plan an asset spread across various asset classes/geographies, but the danger of not doing so is that in the future you will find yourself with a portfolio which is either concentrated within certain areas or under representative of important markets.

While Adrian is cautious regarding over reliance on the Magnificent Seven, I would advise he consider some further US-specific investment.

If he would prefer to look at smaller-cap exposure, funds like the Brown Advisory US Smaller could work within his portfolio.

Asset allocation also brings Mr Wisner’s government bond query to the forefront. Unless the portfolio is intended to be very high risk, I would advise that government-bond exposure is probably a sensible element to hold within the investments.

Government bonds, such as US treasury bonds and UK gilts, have been popular due to tight credit spreads, which means that you do not currently get enough extra return from investing in corporate bonds to make them a good investment versus the ‘risk-free’ government alternatives.

There are tax advantages to holding some gilts directly, however. If you are simply looking for bond exposure, government bond tracker funds such as the Vanguard UK Gilt UCITS ETF and Lyxor Core US TIPS UCITS ETF Hedged can be useful.

It has been prudent to utilise short duration, non-inflation-linked bonds since inflation began to spike.

However, as longer-dated sovereign bonds begin to show more attractive yields and real bonds (inflation-linked) begin to represent reasonably valued insurance against inflation, it would again make sense to utilise some longer-duration and index-linked sovereign bond exposure within portfolios.

As for AI exposure, economists estimate that it will have a transformative effect on world economies over the medium term. If you are looking to add exposure to your portfolio, you can do so via companies that contribute to various elements of the AI process: from the producers of chips (think Nvidia) to those firms using AI to power new services (like Salesforce).

However, if you don’t yet feel comfortable with AI conceptually or don’t want to invest in relatively expensive shares, it may be simpler to stick to your existing route of investing in AI via funds.

That could be an AI specific fund, like your Sanlam Global Artificial Intelligence Fund holding, or a more general technology fund like the Allianz technology trust.

Discover Telegraph Wine Cellar’s new wine club. Enjoy expertly chosen bottles at exclusive member prices. Plus, free delivery on every order.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report