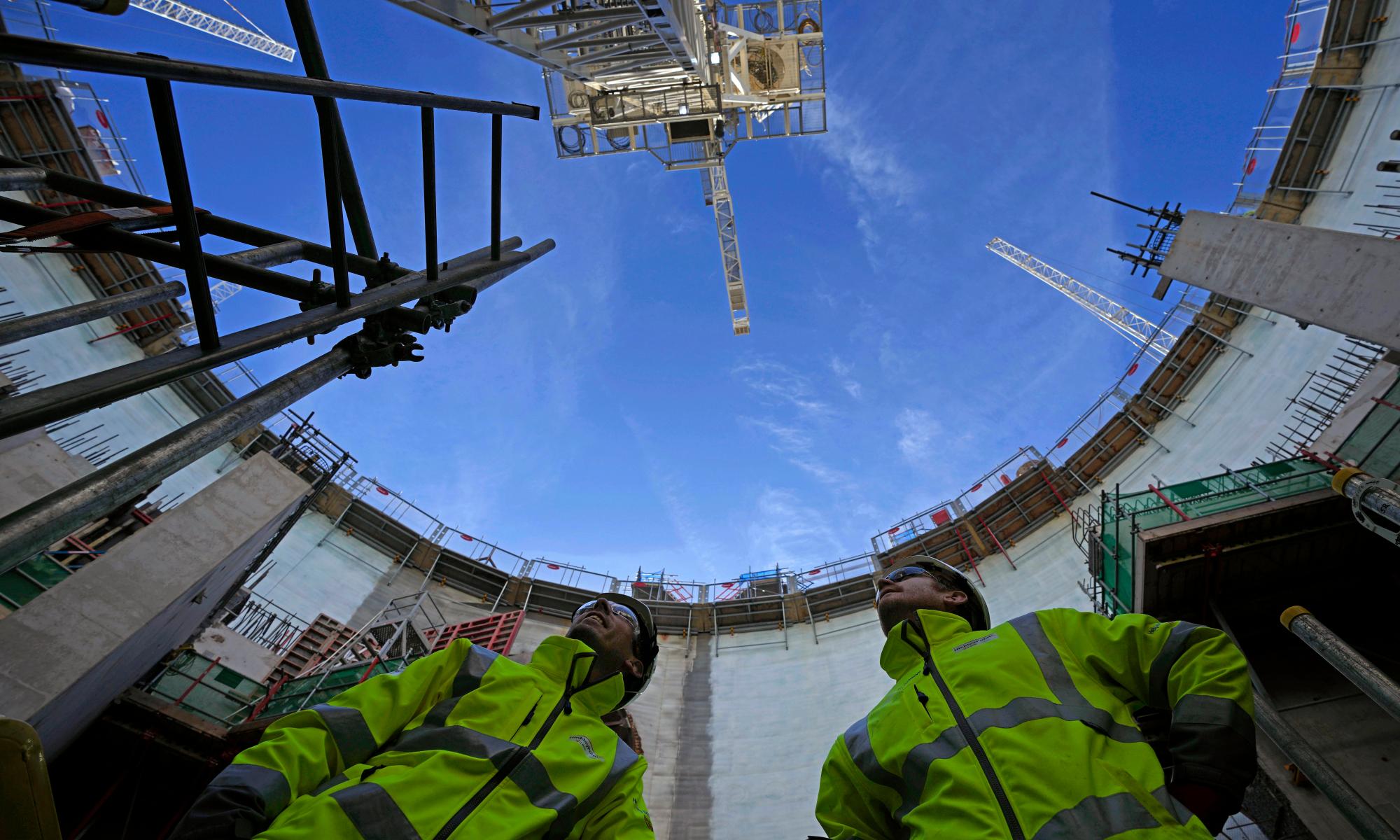

Photograph: Kin Cheung/AP

French trade unions wield significant political clout. But in the summer of 2016 there was little they could do to stop the French government from investing in what would soon become the most expensive power station in the world.

All six trade union representatives on the board of Électricité de France (EDF) voted against a deal to build a nuclear power station in the UK. It was just weeks after its finance chief, Thomas Piquemal, resigned from the company over fears that Hinkley Point C in Somerset was too great a risk. The project was approved by 10 in favour and seven against.

In the last seven years these fears have proved well founded. EDF revealed this week the latest delay to Hinkley, which may not now open until 2031, well beyond its original decade-long schedule. Its costs have climbed to £35bn in 2015 prices, almost double the original forecast of £18bn in 2016. In today’s money Britain’s first new nuclear plant in 30 years could cost £46bn. The spiralling costs were blamed on inflation, Covid and Brexit.

Hinkley was meant to represent a nuclear renaissance on both sides of the Channel, and further the nuclear ambitions of China. It was an opportunity for EDF, once the world’s leading nuclear developer, to secure a future for its reactor designs in a low-carbon world.

For the UK, the first new nuclear power plant in a generation marked the start of the government’s campaign to replace its ageing fleet of reactors. And China saw it as a way to showcase its nuclear expertise, furthering its ultimate aim of building its homegrown HPR1000 nuclear reactors at Bradwell in Essex.

The deal was struck in 2016 just weeks after the Brexit vote, making Hinkley an opportunity to forge fresh ties between old friends – and create opportunities for new economic alliances too. China General Nuclear Power Group (CGN), a state-run energy company, agreed to take on a third of the project as the first step in a plan to roll out a string of nuclear plants in the UK built with its own reactor design.

The chancellor at the time, George Osborne, argued that Britain should “run towards China” to help boost the UK economy. Within months of the Hinkley deal the French president, Emmanuel Macron, and his Chinese counterpart, Xi Jinping, began talks on strengthening ties between the two nations. These led to trade deals worth about $15bn (£11.8bn) and an order from Beijing for 300 aircraft from Airbus worth tens of billions of euros.

But the rationale for all three nations now looks precarious. Hinkley’s costs have climbed as diplomatic relations between China and the west have soured. By the time the former UK prime minister Boris Johnson vowed to purge China’s Huawei from the UK’s telecoms network over security fears, the notion of Chinese-built nuclear reactors powering British homes had become politically unthinkable. CGN has ruled out any further investment in Hinkley – leaving French taxpayers to pick up the tab.

Two former EDF executives told the Guardian the odds were stacked against Hinkley from the start. “I would have bet at the time that we would see the costs we have today. And I think they’ll climb higher too,” said one.

Philippe Huet, a former head of EDF’s internal auditing in Paris, said the deal was based on political strategy rather than a commercial rationale. The British government offered EDF a contract that would guarantee payment of £92.50 for every megawatt hour of electricity generated by the nuclear plant. It was criticised for being both eye-wateringly expensive for UK bill payers but not nearly enough to cover the risks of constructing the project.

“At the time that it was agreed it was already known that EDF’s estimates understated the cost and schedule of the project. Key decision-makers chose to ignore this because it was too important strategically. As they would say, if a project cannot be profitable it must at least be strategic,” Huet said.

Hinkley is one of many costs facing the French taxpayer after the government renationalised EDF last year. The company’s future investments – in maintaining its existing fleet of nuclear reactors, building new ones, and investing in renewable energy – could exceed €20bn (£17bn) a year, according to Agnès Pannier-Runacher, the country’s energy transition minister.

The French government is reportedly calling on the UK government to provide financial help for both Hinkley and the next planned plant, Sizewell in Suffolk, to keep the struggling nuclear revival afloat. The UK government has been quick to quash any suggestion that Hinkley’s financial fallout will be borne by UK taxpayers. A spokesperson said the government “plays no part in the financing or operation of Hinkley Point C”, which was a matter for EDF and its shareholders.

Huet has predicted that EDF may even try to renegotiate its contract with the government. He estimates it could seek to raise how much it charges per megawatt hour of electricity produced by about 15% to make Hinkley a worthwhile venture.

“I believe that Hinkley Point C is now a loss-making project for EDF. Its costs have climbed, of course, but also the assumptions for the plant’s running rate were too optimistic from the start,” Huet said. “Writing EDF a blank cheque will not help. And the UK government should be concerned about plans for new EPRs [reactors] at Sizewell. What assurances are there that the project will deliver on current promises?”

But if the French state can bear the burden of further costs it may just pay off, according to one nuclear industry source.

“There are many conflicting views on whether Hinkley is a good deal but it often depends on the timeframe you’re using,” the source said. Once the power plant is ready to begin generating electricity, and the risk of further construction costs are in the past, investors could view Hinkley quite differently. Then, its cost overruns can be balanced against its guaranteed revenue for every megawatt hour of electricity it generates over the next 35 years.

“There will be opportunities for EDF to refinance the project when infrastructure investors decide they are interested in taking a stake in a stable, long-term investment,” the source said. “It’s also important to remember that this piece of infrastructure will last at least 60 years, perhaps even as long as 80 years. Once the costs of construction have been covered it becomes a potentially very lucrative asset.”

Tom Greatrex, the chief executive of the Nuclear Industry Association, said Hinkley would still prove to be good value to Britain’s energy users by cutting its dependency on imported gas, which has surged in cost since Russia’s invasion of Ukraine. There are wider economic benefits too, he said. “Hinkley Point C will be a vital part of our fight against climate and our energy security through 2100 and beyond,” Greatrex said.

But many in the energy industry believe Britain may have to wait well into the 2030s before Hinkley is generating power, raising serious questions over EDF’s finances and the UK’s supply of low-carbon electricity.

“I’m sure there are some at EDF who would say hand on heart that their latest cost forecasts are accurate,” Huet said. “But it would take a brave person to say today that Hinkley Point has reached rock bottom.”

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report