Brazil’s Central Bank Faces Self-Inflicted Crisis on Interest Rates and Inflation Forecasts

(Bloomberg) -- Brazil’s central bank is facing an emergency of its own making that threatens to sabotage years of deft policy making and credibility gains.

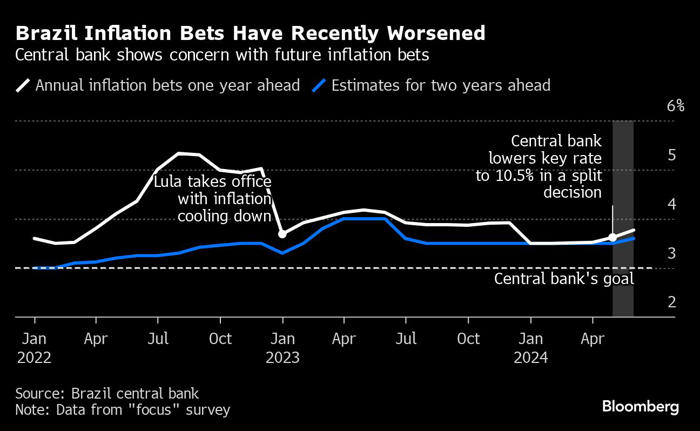

Inflation forecasts are above the 3% target into the foreseeable future and confidence is crumbling as markets question whether the central bank — or the presidency — is commanding monetary policy. It’s a devastating reversal for an institution that was lauded for its fast action against a post-pandemic price surge and subsequent rate cuts that were months ahead of developed economies.

Brazil Inflation Bets Have Recently Worsened | Central bank shows concern with future inflation bets

Investors are now worried about a repeat of the outlook seen under leftist President Dilma Rousseff over a decade ago, when the central bank propelled inflation estimates further above target as it cut rates while public spending took off. The institution risks another vicious cycle especially after Rousseff’s mentor, Luiz Inacio Lula da Silva, gets to nominate a majority of the board this year while he revives his demands for lowering borrowing costs.

The crisis is coming to a head before the June 19 policy decision that’s the most consequential in recent memory. The central bank’s credibility was thrown into question after May’s split vote that pit the majority led by Governor Roberto Campos Neto against directors tapped by Lula who favored a larger rate cut.

“It’s justified to say there’s a confidence crisis,” said former central bank International Affairs Director Tony Volpon. “And the central bank is at fault for it.”

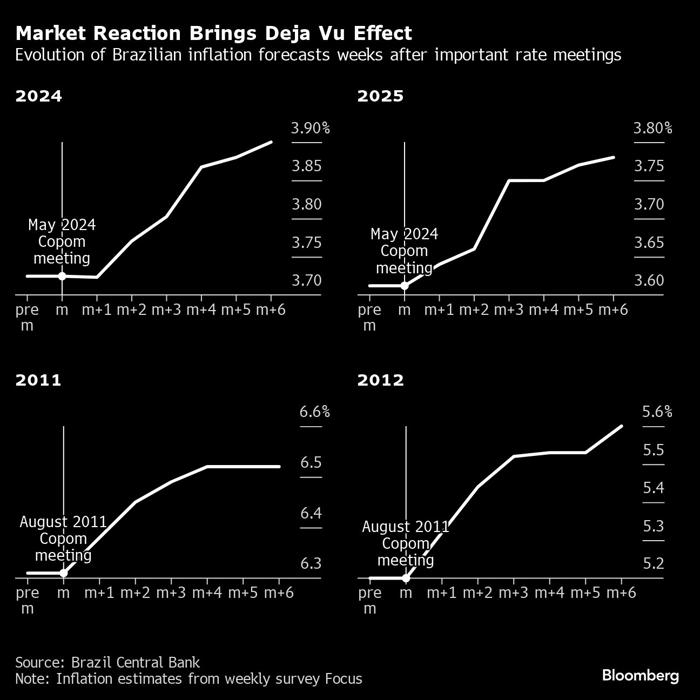

Policymakers tried to defuse concerns of political interference and admitted that a prior change to guidance had not been discussed with the whole board. Still, fears that the institution will be more tolerant of inflation are exacerbating the sense of deja vu in markets, as rising fiscal tensions also mirror a turbulent period starting in 2011.

Labor Unions Protest Ahead Of Central Bank Monetary Policy Committee Meeting

In August 2011, the central bank came under fire by starting an easing cycle when markets expected the Selic to be kept high. Inflation estimates for the following two years leaped by some 30 basis points, and were stoked later by Rousseff’s pressure for lower rates to help the economy.

Policymakers finally capitulated in early 2013, when they kicked off a tightening cycle that raised rates by nearly 4 percentage points before elections the following year, only to tighten even more after the vote. While the current board has given no indication that it plans to lift borrowing costs now, speculation is growing that such a policy shift could become inevitable.

“You can still win this battle without raising interest rates,” said former central bank Monetary Policy Director Reinaldo Le Grazie, underscoring that unanimous rate decisions strengthen monetary policy in the eyes of markets. “But, it’s becoming more difficult to do that.”

Two-year breakeven rates have jumped 48 basis points to 5.03% since the May 8 interest rate decision. Economists in a weekly central bank survey raised their 2024 inflation forecasts for the sixth straight week and their 2025 estimates for the seventh, according to data published on Monday. Traders are penciling in at least a half point in borrowing cost hikes by the end of this year, with those bets influenced partly by risk premium.

“It will probably be necessary to raise interest rates so that long-term expectations get anchored again,” said former central bank Economic Policy Director Fabio Kanczuk.

Market Reaction Brings Deja Vu Effect | Evolution of Brazilian inflation forecasts weeks after important rate meetings

Brazil’s central bank declined to comment on this story. In a June 10 speech, Campos Neto said consumer prices are converging as expected toward target, even though inflation forecasts continue to become unanchored. This phenomenon “hasn’t happened many times in the past,” he said.

Premature Comparison

For Volpon, who joined the monetary authority in 2015, Brazil is still far from rate hikes, a view that’s shared by most economists. Still, he urged policymakers to heed the lessons learned about the high price of losing credibility.

“It was horrible. We raised rates, and inflation expectations were still unanchored,” he said. “At the end of the day, after you lose credibility, gaining it back requires a more orthodox, austere and restrictive monetary policy.”

What Bloomberg Economics Says

“The comparison with the 2011-2014 period is premature for several reasons. First, although the fiscal situation is far from ideal, there is much more transparency both in terms of the policy and the fiscal data than at that time. Second, the level of scrutiny from the market is much higher now, given the condition of global and domestic liquidity, than it was in 2011. Third — and not the least important — a vote of dissent that’s technically justifiable is not enough to reach conclusions about the profile of board members.”

— Adriana Dupita, Brazil and Argentina economist

Investors fear the central bank will become more lenient toward consumer prices once Lula — who has also argued for a higher inflation target — nominates a new governor and two new directors later this year.

Indeed, those tensions will make it more difficult for the leftist head of state to decide on a successor to Campos Neto, Le Grazie said.

For Volpon, the current board will have a crucial chance to calm the waters by voting in unison, and thus bucking political pressure, in this week’s decision.

“There has to be unanimity,” he said. “The bank’s credibility is at stake.”

Difficult to Regain Control

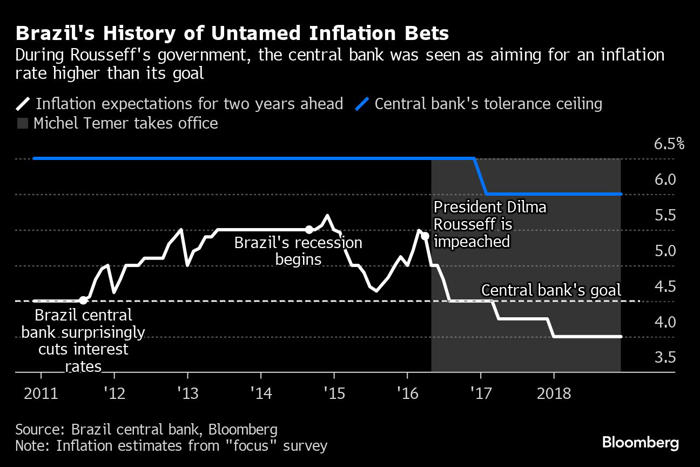

The loss of control of inflation expectations starting in 2011 stemmed from policymakers’ laxness on consumer prices, according to a study published this year by former central bank Economic Policy Director Carlos Viana, among others. Their work concluded that the re-anchoring process was complex and gradual, with estimates only coming under control again in 2016.

Brazil's History of Untamed Inflation Bets | During Rousseff's government, the central bank was seen as aiming for an inflation rate higher than its goal

Going forward, public spending will be key to whether Brazil inflation forecasts go back down. Investors were disillusioned by the announcement in April that the government will seek a balanced primary budget next year, not a surplus.

More recently, Finance Minister Fernando Haddad expressed concern about Brazil’s fiscal outlook during a meeting with investors this month, causing assets to tank in a stark reminder of market sensitivity to the issue.

Brazilian central bankers also aren’t getting any help from the Federal Reserve, which has signaled it will wait longer before starting its own easing cycle.

Read More on Brazil’s Economy

| Brazil Finance Chief Remarks Fuel Fiscal Worries, Roiling Assets |

| Brazil Central Bank Chief Says Inflation Forecasts Will Improve |

| Under Lula, Doves Are Rapidly Gaining Power in the Central Bank |

Still, Brazilian policymakers’ biggest challenges are coming from within, according to former central bank International Affairs Director Alexandre Schwartsman.

“The hypothesis is that there will be a new central bank board with a weaker commitment to the inflation target,” he said. “There’s a direct questioning of the central bank’s credibility.”

--With assistance from Giovanna Serafim.

(Updates market moves and economist survey data in 10th paragraph)

Most Read from Bloomberg

©2024 Bloomberg L.P.