A Little Good News for General Motors Investors

Don't look now, but General Motors (NYSE: GM) has quietly had a strong start to 2024 with its stock price jumping over 35% year to date. That compares favorably to its closest competitors Ford Motor Company (NYSE: F), which has remained roughly flat year to date, and Stellantis (NYSE: STLA), which has shed roughly 6% of its stock price.

General Motors' surge looks to continue after the company announced good news in terms of returning value to shareholders this week -- let's dig in.

Share repurchases

General Motors announced earlier this week that its Board of Directors approved a new share repurchase of up to $6 billion of the company's outstanding common stock. This move is in addition to its November 2023 announcement of a $10 billion accelerated share repurchase.

General Motors repurchased $300 million in shares during the first quarter of 2024 and expects to exhaust the remaining $1.1 billion of the prior $10 billion authorization before the end of the second quarter. Paul Jacobson, GM's executive vice president and chief financial officer, said this in a press release:

The investments GM made in its brands and product portfolio over the last several years, and the company's operating discipline, are delivering consistently strong revenue growth, margins and free cash flow...We are very focused on the profitability of our ICE business, we're growing and improving the profitability of our EV business and deploying our capital efficiently. This allows us to continue returning cash to shareholders.

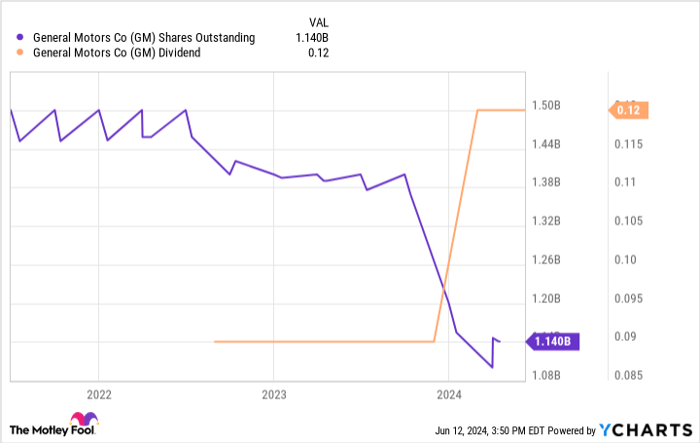

Further, in a separate effort to return value to shareholders, GM increased its common stock dividend by 33% -- from $0.09 per share to $0.12 per share -- during the first quarter.

These aren't just headlines, either, as you can see the impact on shares outstanding that GM's recent repurchase program has made.

GM Shares Outstanding

In fact, put a different way, the difference in value returned to shareholders from 2022 to 2023 was substantial. More specifically, in 2022 GM paid $300 million in dividends and repurchased $2.5 billion, for a total of $2.8 billion returned to shareholders. That number spiked in 2023 to a total of $11.6 billion.

Why it's impressive

General Motors' ability to crank up its repurchase program and start a new authorization is impressive at a time when major automakers are bleeding cash from their electric vehicle (EV) investments. For instance, crosstown rival Ford Motor Company expects to burn roughly $5.5 billion from its model e EV business division. While GM doesn't break out its EV division as Ford does, it's fair to assume GM is losing a pretty penny on its EV business.

That makes it all the more impressive it can raise its dividend and begin a new $6 billion repurchase program at a time EVs are crunching the bottom line.

Another reason the stock continues to climb higher is likely that GM is slowing down its cash-burning EV business. Management once anticipated producing 400,000 EVs by the middle of 2024, but the company now expects production to fall in a range of 200,000 to 250,000 EVs for 2024.

What it all means

Ultimately, this shows the strength of GM's internal combustion engine business, which is printing cash -- enough cash to offset heavy EV losses while still returning ample value to shareholders.

Investors tend to appreciate share buybacks because the reduced share count can increase the earnings per share, making each share owned more valuable. It's just a little good news for long-term GM investors.

Should you invest $1,000 in General Motors right now?

Before you buy stock in General Motors, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Motors wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and Stellantis and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.