Alibaba Stock: Buy, Sell, or Hold?

If you're leery of taking a swing on shares of China's e-commerce powerhouse Alibaba (NYSE: BABA) at this time, the sentiment is certainly understandable. The stock's been a subpar performer since 2021, dogged by a myriad of challenges, including a brutal regulatory crackdown and lingering economic weakness within its core market. The stock's still within sight of its multiyear low hit in late 2022.

But have you considered that too many investors may be so fixated on Alibaba's disappointing past and haven't noticed that the future looks much brighter? If that's true, does that make Alibaba stock a full-blown buy?

Challenges galore for Alibaba

If you're reading this, then you're likely already familiar with the company. Alibaba is of course parent to China-focused e-commerce platforms Taobao and Tmall. It also operates a logistics business called Cainiao, along with a cloud computing enterprise, and owns a handful of digital entertainment businesses. Its core source of revenue, however, is its e-commerce offerings.

So what went wrong beginning in 2021? As noted, Beijing's heavy-handed pressure didn't help. The swell of online shopping seen in 2020 was a tough act to follow as well.

China also kept its coronavirus lockdowns in place for a little too long, doing more longer-lived damage to its economy than other parts of the world suffered. The nation's GDP growth of only 5.2% last year was -- except for the earliest days of the pandemic -- the weakest economic growth China's seen in years.

It would also be amiss, however, not to mention that Alibaba has been suffering something of an identity and operational crisis since founder Jack Ma stepped down as chairman in 2019. The company's made some major management moves a couple of different times since then and has twice now canceled plans to spin off major divisions. The most recent of these is March's decision to hold on to its logistics arm, and instead revamp it in a way that bolsters its e-commerce operation.

These may ultimately be the right moves, but the indecision doesn't inspire confidence.

This company, as well as the economic environment it's operating in, however, both may have finally turned the corner. And the struggling stock could soon do the same, given its valuation of less than 10 times its trailing and projected per-share profits.

The Alibaba --and the backdrop -- we've all been waiting for

Don't misread the message: There's still plenty of risk here, to be sure. But the potential reward is also underestimated for a couple of reasons.

The first of these reasons is China's current and projected economic growth. While still down from last year's subpar progress, the International Monetary Fund recently raised its full-year growth outlook for the country from 4.6% to a healthy 5%. While the nation's industrial outfits did most of that heavy lifting, China's consumers are willing and able to do their part. The nation's retail spending has been up year over year every single month since January 2023.

And this tailwind is blowing at a time when the company's finally being led by a team that knows what they want Alibaba to be.

Although the cancellation of plans to spin off Cainiao as well as its cloud computing arm point to an alarming degree of indecision, CEO Eddie Wu appears to have hit the ground running with a compelling vision after taking the helm in September. As chairman Joe Tsai (a role he was given also in September) commented at the time, "Eddie's leadership of both Alibaba Cloud and TTG [Taobao and Tmall Group] will ensure total focus on, and significant and sustained investment in, our two core businesses of cloud computing and e-commerce, as well as enabling TTG to transform through technology innovation."

Read between the lines. This is the company and the leadership team most in-the-know parties have been waiting on. For instance, Wu's decision to keep its logistics arm in-house will create challenges, but it's a challenge that will pay big dividends if it can make Tmall and Taobao more marketable. Alibaba is holding on to its cloud business in the hopes it will be able to capitalize on the strong growth of the artificial intelligence industry.

Connecting the dots

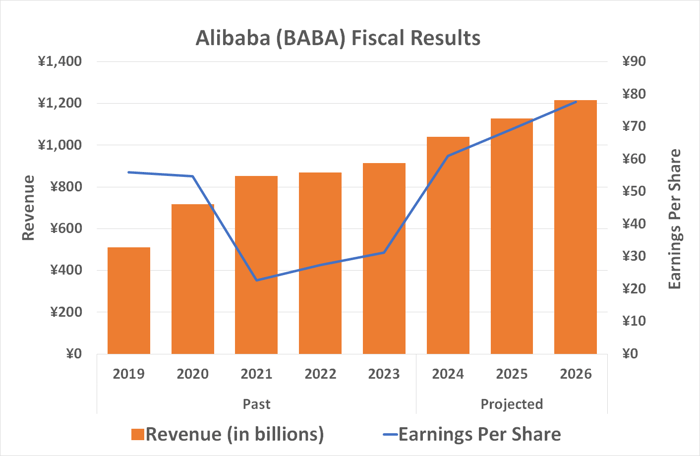

The grand irony is, the stock's still underperforming mostly because investors don't see what analysts expect. That's solid revenue growth through 2026, paired with even better per-share earnings growth.

Data source: StockAnalysis.com. Figures are in Chinese yuan.

Analysts also collectively say the ADR (American depository receipt) version of this stock is worth 40% more than its present price. The fact that shares are priced at less than 10 times their expected 2024 earnings may have a little something to do with that.

So why then are shares struggling so much?

As was already noted, this looks like one of those not-entirely rare instances where the market is so accustomed to a company facing problems that it's difficult to believe that organization could ever overcome them. But, they do, and Alibaba likely has. It's just going to take a few more quarters of success to prove it to enough people to light a fire under the stock. Once that happens, don't be surprised to see sizable, prolonged gains take shape.

This might help: Billionaire investor David Tepper's Appaloosa Management scooped up 6.9 million shares of Alibaba stock during the first quarter of the year, more than doubling the position's size to make it the fund's single-biggest holding. It's not a bad bet that he knows or sees something a bunch of other people are just missing about Alibaba right now.

Connect the dots. Yes, Alibaba stock is a buy here.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.