Time to Buy the Dip on Super Micro Computer Stock?

Super Micro Computer (NASDAQ: SMCI) has emerged as one of the big winners amid the artificial intelligence (AI) technology boom.

The company is capturing strong demand for specialized computer systems as a plug-and-play data center service. On the other hand, the stock has cooled following a spectacular rally at the start of the year. Shares are up 170% in 2024, but also down 37% from their 52-week high set in early March.

With the tailwind of operating and financial momentum expected to continue, could Super Micro Computer be ready to power up again? I believe so, and here's why.

A critical player in the AI ecosystem

Running the latest GPU-based AI chips from Nvidia or Advanced Micro Devices for high-performance computing requires extensive hardware infrastructure.

Enter Super Micro Computer, whose rack-scale systems integrate all the necessary power, storage, cooling, and software components that make it all work.

By this measure, the company is benefiting from the explosive growth in complex data processing needs. Supermicro is recognized as building Nvidia-certified GPU server systems, including those that incorporate the newest Blackwell superchips and the B200 Tensor Core GPUs.

Sales for the last reported fiscal third quarter reached $3.9 billion, up 200% over the past year. Earnings per share (EPS) of $6.65 grew even faster, climbing 308% from $1.63 in the prior-year quarter.

All indications are that there is more upside for growth as customers invest heavily in accelerated computing applications including AI and machine learning. Management is guiding for Q4 revenue between $5.1 billion and $5.5 billion, representing a 143% midpoint year-over-year increase.

A person analyzing information from a computer.

The bullish case for investing in Supermicro

Supermicro is moving forward with expanding manufacturing capabilities across its global footprint, including at its facility in San Jose, California, along with operations in Taiwan and Malaysia. The metric that stands out is a planned capacity to produce 5,000 racks per month this year, which marks a major increase from 4,000 at the end of last year, or 3,000 in 2022.

The company sees room to reach $25 billion in annual sales over the next several years compared to the 2024 guidance range between $14.7 billion and $15.1 billion.

The driver here is not only a shift toward higher-value opportunities including AI-focused data center products, but also leveraging the installed hardware base into its "5S Strategy" covering software, services, switches, storage, and security as a total IT system provider.

One area of optimism is the opportunity to integrate liquid cooling across the product portfolio, which helps make the power-intensive computer systems run more efficiently.

For the next generation of AI chips and applications, direct liquid cooling (DLC) is seen as a requirement that allows Supermicro to stand out as a differentiated supplier compared to the traditional general computing server manufacturing market.

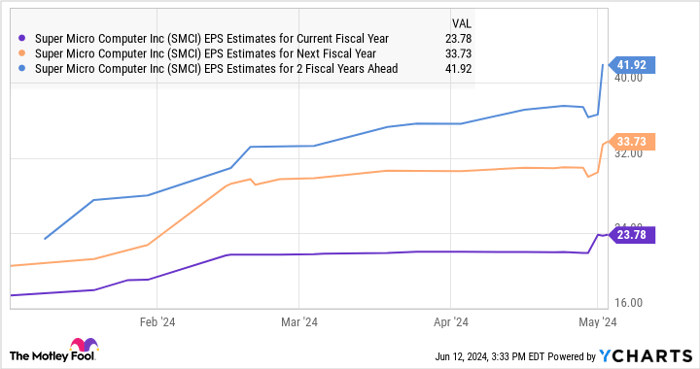

That effort can be positive for margins and earnings, which is evident by current Wall Street analyst estimates. Consensus EPS for the rest of fiscal 2024 and the next two years have been trending higher in recent months, indicating confidence in the outlook for Supermicro. The market sees EPS of $23.78 this year, increasing by 42% in fiscal 2025 to $33.73, and again by 24% for fiscal 2026 to $41.92 .

In my view, shares of Supermicro trading at 23 times next year's consensus earnings offer good value within the tech arena given its growth and earnings momentum.

SMCI EPS Estimates for Current Fiscal Year

Final thoughts

Despite the share price weakness from Supermicro in recent months, there's a case to be made that its outlook is as strong as ever. The company's solid fundamentals and ability to consolidate its leadership in increasingly high-tech data center infrastructure add to the appeal of the stock as a compelling investment. It likely won't be a straight line higher, but I see more upside for shares moving forward.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.