Broadcom Just Announced a Stock Split. Time to Buy?

The artificial intelligence (AI) boom has been a boon to technology companies and those who invest in them in recent times. Players that develop tools or equipment to power AI projects have climbed the most, often in the triple or quadruple digits over the period of a few years. That's because AI customers have flocked to these companies, driving their earnings higher too.

Broadcom (NASDAQ: AVGO) is one of these AI stars. The semiconductor and infrastructure software company saw earnings take off as AI development gathered momentum, and that movement has continued. In the most recent quarter, revenue soared in the double digits, and the company predicted full-year revenue of $51 billion -- that's 42% higher than last year.

Broadcom's shares have reflected this success, soaring nearly 500% in five years, and as of late last year, they surpassed $1,000 and continued advancing. But the per-share price won't be so high for long. Following the move of fellow AI giant Nvidia, Broadcom this week announced a 10-for-1 stock split, scheduled for next month.

Is now a good time to buy the stock? Let's find out.

An investor types something on a laptop in an office.

How Broadcom's stock split will unfold

First, a little bit about stock splits in general and how the Broadcom operation will unfold. Stock splits lower the price of each individual share through the issuance of more shares to current holders. But these operations don't change the market value of the company or the value of your holding -- so they don't change anything fundamental, and instead are more of a mechanical operation.

Companies generally launch these operations after they've done well and their stock price has climbed considerably -- and the move is meant to make their stock more accessible to a broader range of investors. Broadcom even cited this as the reason for its decision, saying the split will help employees and investors more easily buy the stock.

As mentioned, Broadcom is launching a 10-for-1 split, meaning if you own one share as of the July 11 market close, you'll be issued nine additional shares after the July 12 market close. The stock will begin trading on a split-adjusted basis when the market opens on July 15. Using today's price of $1,678 as a guide, the new price after market open would be around $167.

Investors welcomed Broadcom's stock split announcement, pushing the shares to a 12% gain in one trading session. The market generally likes stock splits for two reasons: They suggest a company is confident about the future, and as noted, these operations make it easier for more people to invest in the stock.

Is Broadcom a buy right now?

Now let's get back to our question: Following this news, is it time to buy Broadcom shares? Since stock splits are mechanical moves, not catalysts for stock performance, you shouldn't buy Broadcom just because it's planning a stock split.

But here's why you should consider buying shares of the company. Broadcom has been one of the winners of the AI boom so far, and there's reason to believe this will continue. The company makes thousands of products used everywhere from data centers to your smartphone -- more than 99% of Internet traffic passes through a Broadcom product or service.

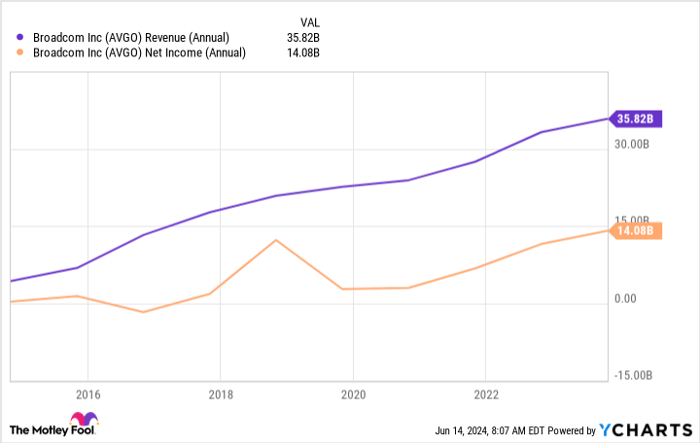

Broadcom has a solid earnings track record, with revenue and profit rising over the past decade.

AVGO Revenue (Annual)

And today, Broadcom's acquisition of VMware, a cloud software company, and AI demand are adding significantly to growth. Including VMware's contribution, revenue soared 43% in the most recent quarter to $12.5 billion.

And excluding WMware, revenue climbed 12% thanks to AI demand. AI customers flocked to Broadcom for AI networking and custom accelerators, and AI revenue soared 280% year over year to $3.1 billion. Right now, seven of the eight biggest AI clusters out there are using Broadcom Ethernet systems, and Broadcom predicts that next year all large-scale projects will be on Ethernet.

It's also important to remember we're in the early days of the AI growth story, with analysts predicting an AI market of more than $1 trillion by 2030. A leader like Broadcom clearly stands to benefit as demand continues, and that's why the shares look very reasonably priced at 34x forward earnings estimates.

All of this means you don't have to wait for the stock split to get in on this exciting long-term AI growth story: Broadcom makes a fantastic buy right now.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.