'Mortgage rise means I can't afford to live here anymore'

Nadine McKenna said she had no choice but to sell her home

When Nadine McKenna checked her phone notifications in February, she never imagined she would end up having to sell her home.

Ms McKenna’s banking app broke the news that her mortgage was set to increase by £240 per month.

“My first reaction was fear,” the single mother from Lisburn told BBC News NI.

“How am I going to manage this? Where’s the money going to come from? And how am I going to keep a roof over my head and my son’s head?

“And then I had to start thinking: ‘I can’t afford to live here. What are my next options?’”

'Heartbreaking'

The number of people in Northern Ireland at serious risk of having their homes repossessed has risen by nearly 25% in the first three months of the year.

Between January and March, 285 homeowners faced court proceedings after defaulting on their mortgage payments, according to Department of Justice data.

This is the largest number of new cases since early 2020 but remains below pre-pandemic levels.

To avoid the threat of repossession, Ms McKenna had no choice but to sell the home where she has lived for 13 years.

“That was my first house I ever bought. I bought it on my own. I’ve put all my money into it. I’ve put my heart and soul into it,” she said.

“It’s heartbreaking.”

Already paying more than £1,000 a month in childcare on top of her household bills, Ms McKenna was forced to ask her family for financial support.

Her sister agreed to help purchase a smaller home in Lurgan for Ms McKenna and her young son.

“I’m 38. I never thought I would have to rely on my baby sister to help me get a mortgage,” Ms McKenna said.

“I can’t believe this is actually happening.”

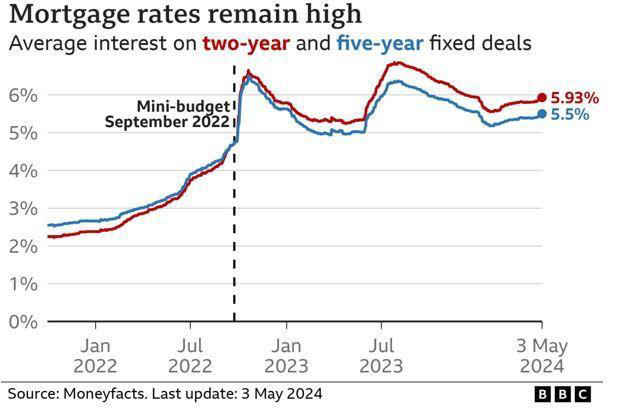

Homeowners across the UK have felt the pressure of increasing mortgage payments as interest rates have risen to their highest levels in 16 years.

The latest Northern Ireland figures show that 78 final orders for repossession were issued in the first three months of this year.

A manager for the charity Housing Rights, which provides free legal advice and emergency court representation to people facing repossession, said the process can be harrowing.

“We never find that somebody just doesn’t pay their mortgage, there are always reasons behind it," Aisling Cunningham said.

"It can involve illness, bereavement, relationship breakdown – anything.

“Some of the stories that people tell you are very difficult.”

Ms Cunningham said that because homeowners are in debt they are unlikely to receive legal aid or be able to afford a solicitor – meaning charities like Housing Rights are their only hope.

“Due to the huge increases in private rents and the lack of social housing, there are fewer options for those people,” she said.

“So these situations are getting more fraught.”

Research recently released by Housing Rights shows that those with a disability, those on lower incomes and older homeowners are particularly vulnerable to repossession.

The data indicates that many of those struggling to pay are on interest-only or variable rate mortgages, deals which have been particularly impacted as the Bank of England has hiked interest rates 14 times in three years.

Nadine McKenna is one of tens of thousands of Northern Ireland homeowners expected to remortgage this year as their fixed-rate deals expire – a situation described as a “mortgage timebomb” by a property expert from Ulster University.

Dr Michael McCord said those remortgaging will have to accept far higher rates than in the deals they secured during the pandemic, when interest rates were historically low.

The average new homeowner in Northern Ireland is now paying almost £3,000 more for their mortgage every year than in 2021, according to the property website Zoopla.

“In the short-term, this will undoubtedly cause a lot of pain for quite a lot of existing homeowners and place significant financial stress on them,” Dr McCord said.

“This has not been helped by the escalating rental market prices which may leave some struggling with nowhere to go.”

The Bank of England kept interest rates at 5.25% in May, but experts expect to see cuts this autumn.

“That should filter into the mortgage market which will see more competitive deals moving forward,” Dr McCord said.

“But any changes to interest rates will be protracted, so in the immediate future there will continue to be financial pressure facing those homeowners remortgaging.”

You can see how your mortgage may be affected by changing interest rates using our calculator.